DBS Dividends - Your Complete Guide to DBS Group Holdings Ltd's (SGX: D05)

Sudhan P

Sudhan P●

Singapore’s largest bank DBS Group Holdings Ltd (SGX: D05) is widely popular among dividend-hungry investors as it pays really chunky dividends.

For Q2 2023, DBS has announced a record-high profit and a sweet (33 per cent increase) interim dividend of S$0.48 per share! For DBS stockholders, you can expect your dividend payment on 24th August 2023.

Let’s dive into DBS’ dividend yield, dividend history, and more importantly…

… its dividend sustainability to understand if the bank can continue paying growing dividends.

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any stock. The writer doesn’t own shares in any companies mentioned.

TL;DR: DBS Group Holdings Ltd’s (SGX: D05) Dividends

Jump to:

- Dividend Yield

- Dividend Amount and Payout Periods

- Scrip Dividend Scheme

- Dividend History

- Dividend Policy

- Dividend Sustainability

Dividend Yield

DBS shares are currently at S$34.34 each on 7 August 2023, 3.26pm.

At that price, the bank’s trailing dividend yield stood at 4.89%.

For context, the SPDR STI ETF (SGX: ES3) had a lower distribution yield of 3.69% on the same day.

The SPDR STI ETF is an exchange-traded fund (ETF) that tracks the fundamentals of Singapore’s Straits Times Index (STI).

DBS is part of the STI and is its largest component at around 20%.

Dividend Amount and Payout Periods

For its financial year ended 31 December 2022, DBS dished out a total dividend of S$2 per share.

DBS is the only bank that pays a quarterly dividend currently. That means it declares a dividend every quarter (or three months) each year.

In 2022, DBS dished out 36 cents per share for its first three quarters and 42 cents each for the final quarter. Along with the special dividend of 50 cents per share, this brings the total to S$2 per share for the year.

| 2022 DBS Dividend | Amount Per Share (Singapore Cents) |

|---|---|

| 1Q interim dividend | 36 |

| 2Q interim dividend | 36 |

| 3Q interim dividend | 36 |

| 4Q interim dividend | 42 |

| Special dividend | 50 |

| Total dividend | 200 |

For the first half of 2023, DBS has given an interim dividend of S$0.42 in Q1 and will be giving an interim dividend of $0.48 in Q2.

Scrip Dividend Scheme

The DBS scrip dividend scheme provides shareholders with the option of receiving their dividends in the form of shares instead of cash.

The last time DBS offered a scrip dividend was for its 2021 first-quarter dividend.

For its 2021 second-quarter, DBS ceased the scrip dividend scheme.

Dividend History

The following table showcases DBS’ dividends from 2001 to 2023, broken down into payout periods:

| DBS Dividend for Year | Dividend Period | Dividend Per Share (Singapore Cents) | Total Dividend for the Year (Excluding Special Dividend) | 5-Year Compound Annual Growth Rate (CAGR) |

|---|---|---|---|---|

| 2001 | First-half (1H) interim dividend | 12 | 26 | 17.2% |

| Final dividend | 14 | |||

| 2002 | 1H interim dividend | 12 | 26 | |

| Final dividend | 14 | |||

| 2003 | 1H interim dividend | 12 | 26 | |

| Final dividend | 14 | |||

| 2004 | 1H interim dividend | 15 | 34 | |

| Final dividend | 19 | |||

| 2005 | First quarter (1Q) interim dividend | 9 | 49 | |

| 2Q interim dividend | 13 | |||

| 3Q interim dividend | 13 | |||

| Final dividend | 14 | |||

| 2006 | 1Q interim dividend | 14 | 59 | -1.3% |

| 2Q interim dividend | 14 | |||

| 3Q interim dividend | 14 | |||

| Final dividend | 17 | |||

| Special dividend | 4 | |||

| 2007 | 1Q interim dividend | 17 | 68 | |

| 2Q interim dividend | 17 | |||

| 3Q interim dividend | 17 | |||

| Final dividend | 17 | |||

| 2008 | 1Q interim dividend | 17 | 65 | |

| 2Q interim dividend | 17 | |||

| 3Q interim dividend | 17 | |||

| Final dividend | 14 | |||

| 2009 | 1Q interim dividend | 14 | 56 | |

| 2Q interim dividend | 14 | |||

| 3Q interim dividend | 14 | |||

| Final dividend | 14 | |||

| 2010 | 1Q interim dividend | 14 | 56 | |

| 2Q interim dividend | 14 | |||

| Final dividend | 28 | |||

| 2011 | 1H interim dividend | 28 | 56 | 1.7% |

| Final dividend | 28 | |||

| 2012 | 1H interim dividend | 28 | 56 | |

| Final dividend | 28 | |||

| 2013 | 1H interim dividend | 28 | 58 | |

| Final dividend | 30 | |||

| 2014 | 1H interim dividend | 28 | 58 | |

| Final dividend | 30 | |||

| 2015 | 1H interim dividend | 30 | 60 | |

| Final dividend | 30 | |||

| 2016 | 1H interim dividend | 30 | 60 | 9.7% |

| Final dividend | 30 | |||

| 2017 | 1H interim dividend | 33 | 93 | |

| Final dividend | 60 | |||

| Special dividend | 50 | |||

| 2018 | 1H interim dividend | 60 | 120 | |

| Final dividend | 60 | |||

| 2019 | 1Q interim dividend | 30 | 123 | |

| 2Q interim dividend | 30 | |||

| 3Q interim dividend | 30 | |||

| Final dividend | 33 | |||

| 2020 | 1Q interim dividend | 33 | 87 | |

| 2Q interim dividend | 18 | |||

| 3Q interim dividend | 18 | |||

| Final dividend | 18 | |||

| 2021 | 1Q interim dividend | 18 | 120 | N/A |

| 2Q interim dividend | 33 | |||

| 3Q interim dividend | 33 | |||

| Final dividend | 36 | |||

| 2022 | 1Q interim dividend | 36 | 200 | |

| 2Q interim dividend | 36 | |||

| 3Q interim dividend | 36 | |||

| Final dividend | 42 | |||

| Special dividend | 50 | |||

| 2023 | 1Q interim dividend | 42 | 90 | |

| 2Q interim dividend | 48 |

(Note: Total yearly dividend has been adjusted for the rights issue announced in December 2008.)

Overall, we can see that DBS has been paying increasing dividends, less any unforeseen circumstances such as 2007-2009 global financial crisis and the coronavirus-driven economic slowdown in 2020.

In July 2020, DBS and the other local banks had to curb their dividend payout after the Monetary Authority of Singapore (MAS) called on the financial institutions to cap their total dividends per share for 2020 at 60% of 2019’s dividends.

If not for the cap, DBS could have paid out a total dividend of 132 cents per share for 2020 (or 33 cents each quarter).

That would bring its five-year dividend CAGR from 2016 to 2020 to around 22%, the highest five-year annualised growth rate over the past 20 years.

The MAS dividend cap was lifted in July this year, and DBS has resumed its dividend payout of 33 cents per share for its 2021 second-quarter.

Dividend Policy

DBS has a dividend policy of paying “sustainable dividends that grow progressively with earnings”.

But it doesn’t have a specific dividend payout ratio, unlike some other listed companies.

Dividend Sustainability

The dividend payout ratio gives investors clues about a company’s dividend sustainability.

The dividend sustainability of a company is more important than its dividend yield as the yield is about the past while the sustainability portion revolves around the future.

Companies that pay less than 100% of their earnings leave some room for dividend increases in the future, even if their earnings were to stall.

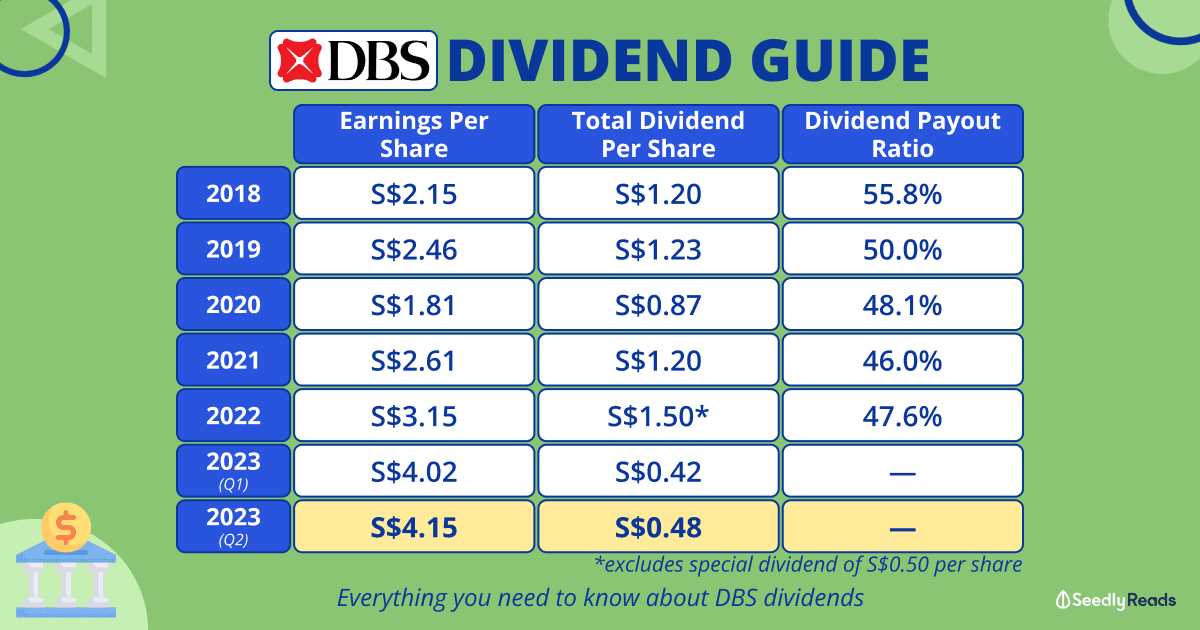

As for DBS, here’s a table showing its dividend payout ratios from 2018 to 2022:

| 2018 | 2019 | 2020 | 2021 | 2022 | |

|---|---|---|---|---|---|

| Earnings Per Share (S$) | 2.15 | 2.46 | 1.81 | 2.61 | 3.15 |

| Dividend Per Share, Excluding Special Dividend (S$) | 1.20 | 1.23 | 0.87 | 1.20 | 1.50 |

| Dividend Payout Ratio | 55.8% | 50.0% | 48.1% | 46.0% | 47.6% |

We can see that DBS has paid out below 60% of its earnings as dividends over the last five years.

This shows that the bank’s dividends are well-covered by its earnings and that they are sustainable.

As long as the bank continues growing its earnings, its current dividends will become “safer”, giving ample room for dividend increase over time.

Related Articles

Advertisement