The DBS Multiplier Account has always been one of the more popular savings accounts around.

But with every revision to the interest rates and qualifying transactions announced.

It may not be as attractive as before…

Wondering if the DBS Multiplier is still the savings account for you?

Here are the latest changes to the DBS Multiplier account which will take effect from 1 January 2021.

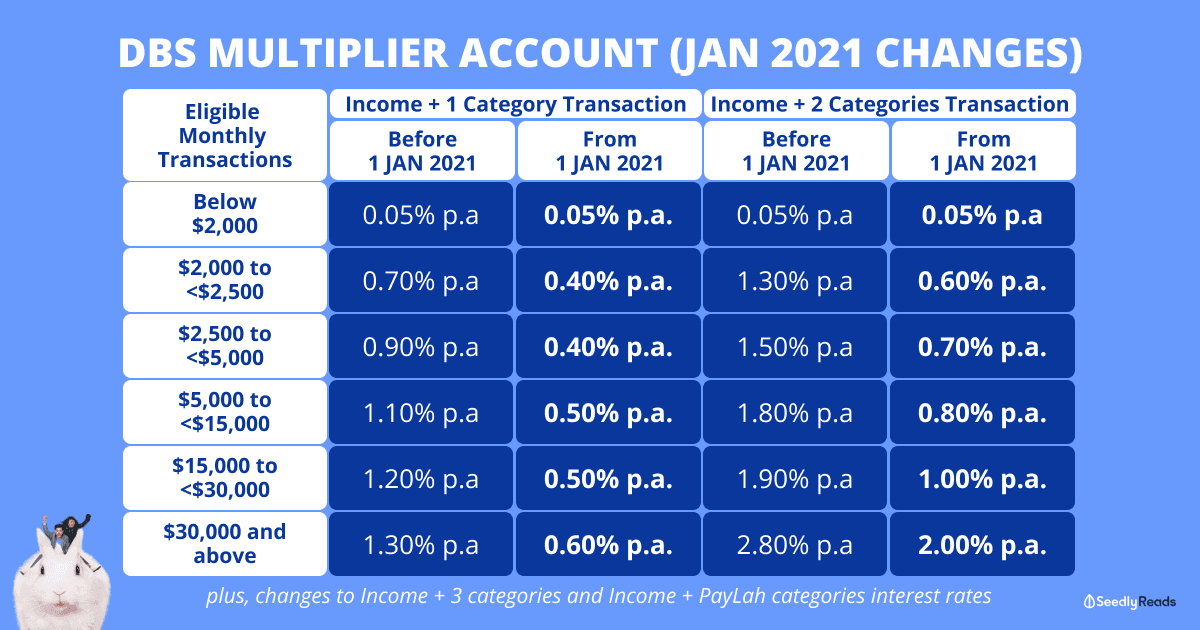

TL;DR: Changes to DBS Multiplier Interest Rates From 1 January 2021

Latest Revision of DBS Multiplier Account Interest Rates

Effective 1 January 2021, there will be two revisions:

- Changes in interest rates for Income + transactions in 1, 2 and 3 categories

- Changes to Income and/or PayLah! retail spend

1. Changes in DBS Multiplier Interest Rates

| First $25,000 Income + transactions in 1 category | First $50,000 Income + transactions in 2 categories | Next $50,000 Income + transactions in 3 categories |

|||||||

|---|---|---|---|---|---|---|---|---|---|

| Total eligible transactions per month | Before 1 Jan 2021 (per annum) | From 1 Jan 2021 (per annum) | Changes in interest rate (percentage point) | Before 1 Jan 2021 (per annum) | From 1 Jan 2021 (per annum) | Changes in interest rate (percentage point) | Before 1 Jan 2021 (per annum) | From 1 Jan 2021 (per annum) | Changes in interest rate (percentage point) |

| Below $2,000 | 0.05% | 0.05% | No change | 0.05% | 0.05% | No change | 0.05% | 0.05% | No change |

| $2,000 to <$2,500 | 0.70% | 0.40% | -0.30% | 1.30% | 0.60% | -0.70% | 2.00% | 1.20% | -0.80% |

| $2,500 to <$5,000 | 0.90% | 0.40% | -0.50% | 1.50% | 0.70% | -0.80% | 2.20% | 1.40% | -0.80% |

| $5,000 to <$15,000 | 1.10% | 0.50% | -0.60% | 1.80% | 0.80% | -1.00% | 2.40% | 1.60% | -0.80% |

| $15,000 to <$30,000 | 1.20% | 0.50% | -0.70% | 1.90% | 1.00% | -0.90% | 2.50% | 1.70% | -0.80% |

| $30,000 and above | 1.30% | 0.60% | -0.70% | 2.80% | 2.00% | -0.80% | 3.80% | 3.00% | -0.80% |

2. Changes to Income and/or PayLah! Retail Spend Categories Interest Rate

| - | First S$10,000 PayLah! Retail Spend only (29 years old and below) | First S$10,000 Income + PayLah! Retail Spend only |

||

|---|---|---|---|---|

| Total eligible transactions per month | Before 1 January 2021 | From 1 January 2021 | Before 1 January 2021 | From 1 January 2021 |

| $0 - $499 | 0.30% p.a. | 0.30% p.a (no change) | 0.05% p.a. | 0.05% p.a. |

| ≥S$500 | 0.50% p.a. | 0.40% p.a. | ||

There will be no changes to the PayLah retail spend option for those who are 29 years and below with no eligible income.

You will have to simply make PayLah retail transactions worth any amount to qualify for the bonus 0.30% p.a. interest straight away.

But for the salary credit and/or dividends + PayLah! retail transactions option, the bonus interest rate will drop to 0.40% from 1 Jan 2021.

To qualify for this category, the total transaction amount needs to be at least $500.

You will also need to make payments using PayLah in order to qualify for the bonus interest.

But no, you cannot PayLah your friends, as money transfers are not considered eligible transactions.

All other qualifying conditions for the DBS Multiplier Account remain unchanged.

If you’d rather pore through the actual terms & conditions governing the DBS Multiplier account for more details, you’ll want to zoom in on Section M of the document.

What Does The “Income + Transactions in 1 Category” Mean for DBS Multiplier?

It means, you are crediting your salary and/or your dividends PLUS performing one of these transactions with DBS:

- Spend using your credit card

- Buy an eligible insurance policy

- Invest in an eligible investment

- Get a home loan from DBS

For two categories, it simply means you are doing any two of the above four.

There’s no minimum amount needed for any category (including Income).

As long as your monthly total eligible transactions total $2,000 or more, you will qualify for the interest.

January 2021 Update: How Does It Affect Current DBS Multiplier Account Holders?

With the US Fed cutting its interest rates to near zero, the lowering of interest rates for the DBS Multiplier Account was expected.

Other bank accounts to change interest rates include OCBC 360, Standard Chartered JumpStart, and CIMB FastSaver.

As for the DBS Multiplier account, the change directly impacts account holders with the first $25,000 or the first $50,000 account balance, and the next $50,000 account balance they have in their account.

There will be a drop in the interest rate of 0.3 percentage point (p.p) to 1 p.p, depending on which bracket you fall into.

For example, if you satisfy the salary credit criterion and have 2 more categories of transactions, the amount of interest you can earn is now much lesser.

Note: this applies to people with $50,000 or less in their account

Assuming Alex, a DBS Multiplier Account holder has:

- A total of $30,000 savings parked in his DBS Multiplier Account

- He gets $3,000 worth of salary credited monthly into his Multiplier Account each month

- His monthly spend on his credit card amount to $300 per month

- He spends an additional $500 servicing his DBS home loan each month

His overall eligible transaction will be $3,000 + $300 + $500 for a total of $3,800 per month.

He will be eligible for a 1.5% p.a. on his first $30,000 in savings around $450 in interest a year (assuming his balance and expenses stay the same throughout the year).

From January 2021 onwards, this interest rate will drop to 0.70% p.a. on his first $30,000 worth of savings.

The difference will be 0.8% p.a. or $240 worth of interest.

That’s about 38 Pumpkin Spiced Lattes from Starbucks foregone!

A Quick Recap of Changes to DBS Multiplier Over 2020

The latest January 2021 revision will be the fourth time DBS is making changes to the DBS Multiplier account since the start of 2020.

This will also be the third time DBS is cutting interest rates on the multiplier account since the start of 2020 as well.

Changes to the DBS Multiplier Account on February 2020

The first revision took effect from 1 February 2020.

Before 1 February 2020 From 1 February 2020

Salary Credit Must be credited via GIRO, with transaction reference code

'SAL or PAY' Will be renamed to income category instead, and will be made up of:

1) Salary Credit: Must be credited via GIRO, with transaction reference codes SAL or PAY.

2) Dividends: Must be credited via GIRO, fromCentral Depository Pte Ltd (CDP)

Dividend Credit Qualify under Investment Category Will be qualified under Income Category instead

Balance cap for Salary Credit + transactions in 1 category Higher interest is applied for balances up to $50,000 only Higher interest will be applied on balances up to $25,000 only.

Changes to the DBS Multiplier Account on May 2020

The next revision kicked in from 1 May 2020.

Income + transactions in 1 category

(for the first $25,000)

Total eligible transactions

per monthBefore 1 May 2020 From 1 May 2020 Changes in interest rate (percentage point)

Below $2,000 0.05% per annum 0.05% per annum No change

$2,000 to <$2,500 1.55% per annum 1.40% per annum -0.15

$2,500 to <$5,000 1.85% per annum 1.60% per annum -0.15

$5,000 to <$15,000 1.90% per annum 1.80% per annum -0.10

$15,000 to <$30,000 2.00% per annum 1.90% per annum -0.10

$30,000 and above 2.08% per annum 2.00% per annum -0.08

Changes to the DBS Multiplier Account on August 2020

On 1 August 2020, the interest rates were revised again:

Income + transactions in 1 category

(for the first $25,000)Income + transactions in 2 categories

(for the first $50,000)

Total eligible transactions

per monthBefore 1 Aug 2020 (per annum) From 1 Aug 2020 (per annum) Changes in interest rate (percentage point) Before 1 Aug 2020 From 1 Aug 2020 Changes in interest rate (percentage point)

Below $2,000 0.05% 0.05% No change 0.05% 0.05% No change

$2,000 to <$2,500 1.40% 0.70% -0.7 1.80% 1.30% -0.5

$2,500 to <$5,000 1.60% 0.90% -0.7 2.00% 1.50% -0.5

$5,000 to <$15,000 1.80% 1.10% -0.7 2.20% 1.80% -0.4

$15,000 to <$30,000 1.90% 1.20% -0.7 2.30% 1.90% -0.4

$30,000 and above 2.00% 1.30% -0.7 3.50% 2.80% -0.7

But it’s not all bad news…

There’s also a small change to the Income category which now takes into account dividend crediting.

| Before 1 August 2020 | From 1 August 2020 (changes in bold) |

|---|---|

| Eligible dividends included are from: (1) Central Depository Pte Ltd (CDP) (2) DBS Vickers (SGX only) (3) DBS Online Equity Trading (SGX only) | Eligible dividends included are from: (1) Central Depository Pte Ltd (CDP) (2) DBS Vickers (all markets) (3) DBS Online Equity Trading (all markets) (4) DBS Unit Trusts (5) DBS Online Funds Investing (6) DBS Invest-Saver |

| Dividends must be credited into: (1) Personal or joint DBS/POSB savings/current accounts | Dividends must be credited into: (1) Personal or joint DBS/POSB savings/current accounts (2) Supplementary Retirement Scheme (SRS) account (3) CPF Investment Account (CPFIA) |

For example, previously, dividends from say… the Hong Kong market which was credited into your DBS account don’t count towards any transactions or categories.

But with the expanded definition, dividends from your Hong Kong stocks are now eligible under the Income category!

So… Is It Still Worth Opening A DBS Multiplier Account?

The latest reduction in interest rate is… disappointing.

However, it is expected.

Given the low-interest-rate environment, we’re currently in, it’s inevitable that the banks will cut their interest rates on their high-interest savings account.

I mean, why would the bank be giving out free money for no reason right?

That being said.

If you’re currently with DBS Multiplier, it might not be the wisest to switch to another high-interest savings account.

Because who’s to say that the next bank you switch to won’t revise their interest rates too?

But if you’re looking for other options which could possibly give you a better rate of return.

You might want to consider an insurance savings plan.

If you’re still convinced that you should switch to another high-interest savings account which can do the same (or better) for you.

Why not use our FREE Savings Account Calculator and see for yourself?

It’ll only take you less than a minute.

Advertisement