DBS, OCBC and UOB: Comparison of Their Scrip Dividend Schemes for 2020 Interim Dividend

Sudhan P

Sudhan P●

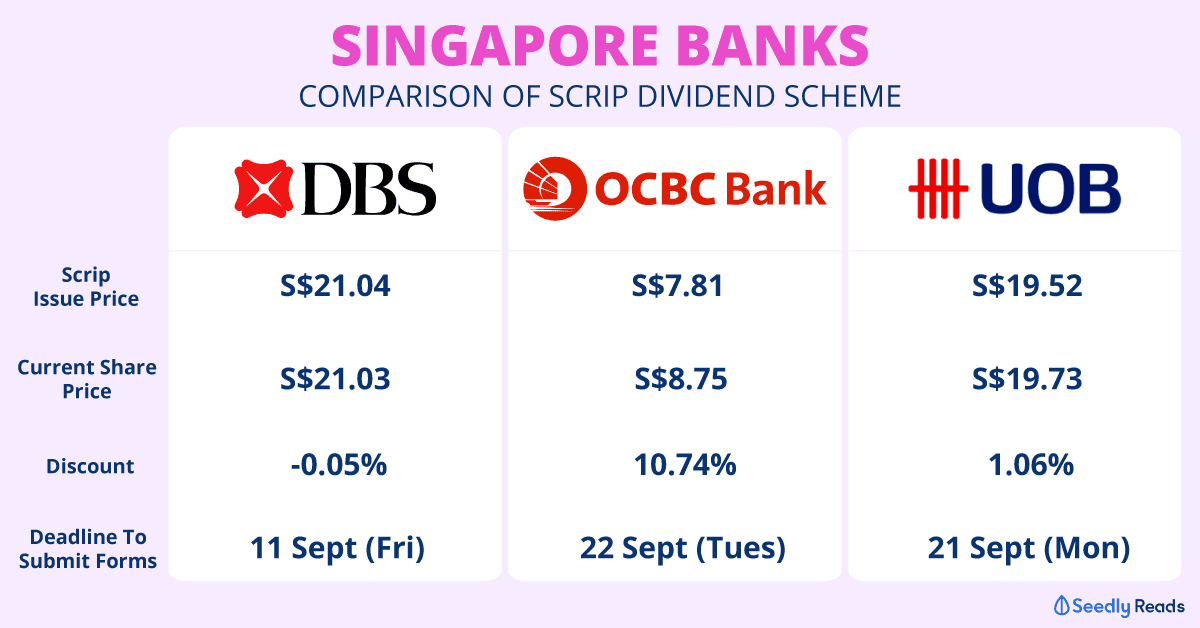

Singapore’s three listed banks — DBS Group Holdings Ltd (SGX: D05), Oversea-Chinese Banking Corporation Limited (SGX: O39) (OCBC) and United Overseas Bank Ltd (SGX: U11) (UOB) — have announced the details for their scrip dividend schemes.

If you have shares in more than one bank, it could be cumbersome to keep track of the key details.

To make your life simpler, here’s a summary of important aspects of the banks’ scrip dividend schemes!

TL;DR: Scrip Dividend Schemes for DBS, OCBC, and UOB

| DBS | OCBC | UOB | |

|---|---|---|---|

| Scrip Price Comparison | |||

| Scrip issue price | S$21.04 | S$7.81 | S$19.52 |

| Share price (at time of writing) | S$21.03 | S$8.75 | S$19.73 |

| Discount | -0.05% | 10.74% | 1.06% |

| Election for New Shares and Cash | |||

| Can shareholders get both new shares and cash? | Yes | No | Yes |

| Fractional Entitlements | |||

| If fraction is 0.5 or more | Rounded up to the nearest whole number | Rounded up to the nearest whole number | Rounded up to the nearest whole number |

| If fraction is less than 0.5 | Rounded down to the nearest whole number; fraction will be disregarded (no cash will be paid) | Rounded up to the nearest whole number | Rounded down to the nearest whole number; fraction will be disregarded (no cash will be paid) |

| Deadline to Note | |||

| When Notices of Election and Scrip Dividend Entitlement Advices will be dispatched to eligible shareholders | On or about 27 August 2020 (Thursday) | On or about 3 September 2020 (Thursday) | On or about 8 September 2020 (Tuesday) |

| Last day to submit Notices of Election and Notices of Cancellation | 11 September 2020 (Friday) | 22 September 2020 (Tuesday) | 21 September 2020 (Monday) |

Why Are Banks Offering Scrip Dividend?

When a company offers scrip dividend, the dividend is paid in the form of the firm’s shares.

Shareholders may choose to accept scrip or cash for their dividends, or both in some cases.

As for the banks, they are issuing scrip dividend in line with the guidance from the Monetary Authority of Singapore (MAS).

Recently, the MAS called on local banks to cap their total dividends per share for 2020 at 60% of last year’s dividends and to offer shareholders the option of receiving their 2020 dividends in scrip instead of cash.

What Are the Issue Prices for New Scrip Shares?

Let’s compare the prices at which each new share will be given to shareholders:

| DBS | OCBC | UOB | |

|---|---|---|---|

| Scrip issue price | S$21.04 | S$7.81 | S$19.52 |

| Share price (at time of writing) | S$21.03 | S$8.75 | S$19.73 |

| Discount | -0.05% | 10.74% | 1.06% |

OCBC is the only bank that is giving a discount for its scrip dividend.

The issue price of S$7.81 is based on a 10% discount to the average of the volume-weighted average prices of OCBC shares on 21 August 2020 and 24 August 2020, which was S$8.67.

On the other hand, DBS’ and UOB’s scrip issue prices are based on the average of the closing share prices of certain trading days.

Can Shareholders Choose to Receive Both Cash and New Shares?

Both DBS and UOB allow shareholders the option to receive scrip dividends either for all or part of their shares in the banks.

If they wish to get both cash and scrip as dividends, they can choose as such in the election forms.

As for OCBC shareholders, they are allowed to either receive their dividends in the form of cash or new shares, but not both.

| DBS | OCBC | UOB | |

|---|---|---|---|

| Cash | Yes | Yes | Yes |

| New shares | Yes | Yes | Yes |

| Both new shares and cash | Yes | No | Yes |

How Are Fractional Shares Dealt With?

It is highly likely that you will add up with fractional shares when you choose to accept scrip dividends.

To determine how many new shares you will receive, you can use the formula shown below:

New shares entitled = (Dividend per share x Number of shares owned) / Scrip issue price

Let’s look at how each bank deals with fractional entitlements:

| DBS | OCBC | UOB | |

|---|---|---|---|

| If fraction is 0.5 or more | Rounded up to the nearest whole number | Rounded up to the nearest whole number | Rounded up to the nearest whole number |

| If fraction is less than 0.5 | Rounded down to the nearest whole number; fraction will be disregarded (no cash will be paid) | Rounded up to the nearest whole number | Rounded down to the nearest whole number; fraction will be disregarded (no cash will be paid) |

It looks like OCBC shareholders get the best deal since even though their fractional shares may fall below 0.5, it will be rounded up to the nearest whole share.

UOB is the only bank which said that if the shareholder is entitled to less than one new share, the shareholder will not receive any new share but will receive the dividend in cash instead.

This is regardless of whether the person has elected to receive new shares or made a permanent election previously.

When Shareholders Have to Elect for Scrip Dividends By?

There’s a deadline to meet for shareholders to elect to receive their scrip dividends if they have not done a permanent election before.

| DBS | OCBC | UOB | |

|---|---|---|---|

| When Notices of Election and Scrip Dividend Entitlement Advices will be dispatched to eligible shareholders | On or about 27 August 2020 (Thursday) | On or about 3 September 2020 (Thursday) | On or about 8 September 2020 (Tuesday) |

| Last day to submit Notices of Election and Notices of Cancellation | 11 September 2020 (Friday) | 22 September 2020 (Tuesday) | 21 September 2020 (Monday) |

The Notices of Election and Scrip Dividend Entitlement Advices will contain the information on how to go about applying for the scrip dividend.

Please refer to the instructions on the forms on how to go about choosing your scrip entitlements.

Shareholders who wish to receive the banks’ 2020 interim dividend in cash do not need to do anything, provided they have not previously made permanent elections to receive new shares.

Have Burning Questions Surrounding The Stock Market?

Why not check out the SeedlyCommunity and participate in the lively discussion regarding stocks!

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any stock. The writer owns shares in OCBC.

Advertisement