A Singaporean’s Guide to Affordable Dimensional Funds Investing

●

What a time to be alive for the passive investor.

FYI: Passive investing largely refers to a long term buy-and-hold investment strategy where the investor does a minimal amount of active management of their portfolio.,

Not too long ago, the investment options available to passive investors in Singapore were scarce as exchange-traded funds (ETFs) were not prevalent and there was no such thing as

Robo-advisors.

Nowadays, you are spoilt for choice as you can invest in ETFs, Robo-advisors or engage a human financial advisor who will do the legwork.

An important thing to remember is that although you might be investing passively, your advisor (the fund manager managing the ETF, Robo-advisor or human financial advisor) is working hard in the background.

They are actively managing your portfolio to varying degrees, by trading to take advantage of short term trends and adjusting to economic events.

One of the more compelling options to invest passively is putting your money in a unit trust like the Dimensional Fund Advisors (DFA) Fund which is sold to investors via Endowus, MoneyOwl or financial advisors.

Generally, the consensus is that Dimensional investing outperforms its competitors. But is this really the case?

TL;DR: Cheapest Way to Invest in Dimensional Fund Advisor (DFA) Funds For Singaporeans

As such, we will be breaking down Dimensional funds, comparing them to Vanguard funds, evaluating their performance over the years and informing you of the cheapest way to invest in them in Singapore.

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any stock.

What Are Dimensional Fund Advisor Funds?

Before we begin, it is important for you to know all about Dimensional funds to determine if it aligns with your investing goals.

Who are Dimensional Fund Advisors?

Dimensional Funds are offered by Dimensional Fund Advisors (DFA), a private investment firm with its headquarters in Austin, Texas.

The company was founded back in 1981 by Rex Sinquefield and David Booth who graduated University of Chicago’s School of Business. The university has been since renamed as the Booth School of Business after David Booth.

At first, their investment philosophy revolved around evidence-based research and a focus on small-capitalisation (cap) companies.

Over the years, their investment philosophy evolved, with the addition of Nobel laureates Eugene Fama and Kenneth French to the DFA team as directors.

The duo were renowned for developing the Fama and French Three-Factor Model framework in 1992.

As of 31 Mar 2020, DFA has US$454 billion (S$630 billion) in firmwide assets under management globally, offering over 100 equity and fixed income mutual funds.

For DFA, their core investment philosophy revolves around translating evidence-based financial science research into practical real-world investment solutions expose market exposures to the drivers of expected return aka Dimensions.

Their core strategy employed to structure their broadly diversified portfolios is backed by economic theory built on the foundation of the groundbreaking research done by Fama and French and the work of other Nobel laureates, Robert Merton and Myron Scholes.

Their research has shown that stocks of small-cap companies, as well as undervalued companies (value investing strategy) and companies with higher than average profitability, will deliver higher expected returns over a long investment horizon.

This is incorporated in its the ‘Smart Beta’ strategy approach to constructing their portfolios.

An important thing to note is that Dimensional funds are not index funds. Rather, the funds are passively managed funds that have their own specific set of criteria on how the fund is structured and what companies to include.

Compared to ETFs that track indexes, Dimensional funds are not based on market capitalisation and tend to more diversified than a similar index-tracking ETF as these funds hold 7000 to almost 11000 securities, not just 500.

Also unlike ETFs that track indexes that are forced to adopt companies that have been included the index, Dimensional fund managers can pick and choose.

When it comes to implementation, DFA focuses on lowering investing costs with efficient trading and low turnover in its portfolios.

One way to determine the costs of an investment strategy is to evaluate its annual turnover ratio. A 100% annual turnover ratio indicates that the fund manager has refreshed the whole portfolio in one year which is a rather active approach.

Investors who have purchased these funds would likely to have incurred higher tax liabilities and other costs compared to passively managed funds like Dimensional funds.

According to Index Fund Advisors, The average turnover ratios for equity and bond funds from Dimensional were 11.92% and 57.80%, respectively.

In other words, Dimensoial equity funds have an average holding period of 8.39 years while their bond counterparts are held for about 20.76 months. This higher turnover for bond funds is due to a good portion of them being short-term in nature with variable-terms and associated credit strategies employed.

As a result, Dimensional equity funds have a 0.41% expense ratio on average while Dimensional bond funds have a 0.20% expense ratio on average.

Overall, DFA has been honing its investment philosophy and trading infrastructure for close to forty years, taking an adaptable and patient trading approach. Its expense ratios are also comparatively lower than the industry average.

Dimensional Funds vs Vanguard Funds And Performance Over the Years

Now that you have gained a better understanding of DFA funds, I think you’ll be interested in knowing more about how it compares to its closest competitor, Vanguard funds.

On average, Dimensional Funds charge about 0.15% more annually than comparable Vanguard Funds.

Vanguard’s market capitalization-weighted funds have lower expense ratios and do an excellent job at catching equity market returns.

Dimensional funds, on the other hand, are geared towards small-cap and value stocks to attempt to capture higher long-run expected returns

But are the Dimensional Funds worth their extra fees?

Jared Kizer the Chief Investment Officer for Buckingham Wealth Partners says yes.

In a paper written for the Hill Investment Group, Kizer compared Dimensional funds and Vanguard funds by crafting three equally weighted portfolios covering U.S. Equity, International Equity and Emerging Markets Equity.

The U.S. portfolio consists of the following Dimensional funds:

• 25% DFA U.S. Large Company fund (DFUSX)

• 25% DFA U.S. Large-Cap Value III fund (DFUVX)

• 25% DFA U.S. Micro-Cap fund (DFSCX)

• 25% DFA U.S. Small-Cap Value fund (DFSVX).

This portfolio is pitted against the Vanguard Total Stock Market Index fund (VTSMX and VTSAX)

The international portfolio is composed of the following funds:

• 25% DFA International Large-Cap fund (DFALX)

• 25% DFA International Large-Cap Value III fund (DFVIX)

• 25% DFA International Small Company fund (DFISX)

• 25% DFA International Small-Cap Value fund (DISVX)

This portfolio is pitted against the Vanguard Developed Markets Index fund (VTMGX)

The emerging markets portfolio is composed of the following funds:

33% DFA Emerging Markets fund (DFEMX)

• 33% DFA Emerging Markets Small-Cap fund (DEMSX)

• 33% DFA Emerging Markets Value fund (DFEVX)

This portfolio is pitted against the Vanguard Emerging Markets Index fund (VEIEX and VEMAX).

Vanguard vs Dimensional Equity Performance Comparison (Oct 1999 – Jun 2018)

| Portfolio | DFA U.S. | Vanguard U.S. | DFA International | Vanguard International | DFA Emerging Markets | Vanguard EM Emerging Markets |

|---|---|---|---|---|---|---|

| Compound Return (%) | 9.5 | 6.7 | 7.3 | 4.2 | 9.9 | 7.2 |

| Volatility Ratio | 16.9 | 14.9 | 16.8 | 16.8 | 23.4 | 23.4 |

| Sharpe Ratio | 0.53 | 0.40 | 0.41 | 0.23 | 0.44 | 0.34 |

Source: Hill Investment Groups

Overall, the Dimensional Fund portfolios have produced both higher compound returns and risk-adjusted returns compared to the Vanguard market-capitalization-weighted portfolios over the years.

More specifically, the international and emerging market Dimensional funds have performed more consistently compared to the U.S. funds. However, there have been some time periods where the Vanguard portfolios outperformed the DFA portfolios.

Another thing to note is that the performance in any particular timeframe can be quite big.

The Cheapest Way to Invest in Dimensional Funds in Singapore

I would say that Dimensional Funds has an interesting marketing strategy as they limit access to their funds.

In Singapore, you can invest in Dimensional funds via qualified financial advisors or brokers who will have to get trained and certified by DFA before they can sell the funds.

The fees between the FA and clients are typically negotiable and done on instruction only without advice required.

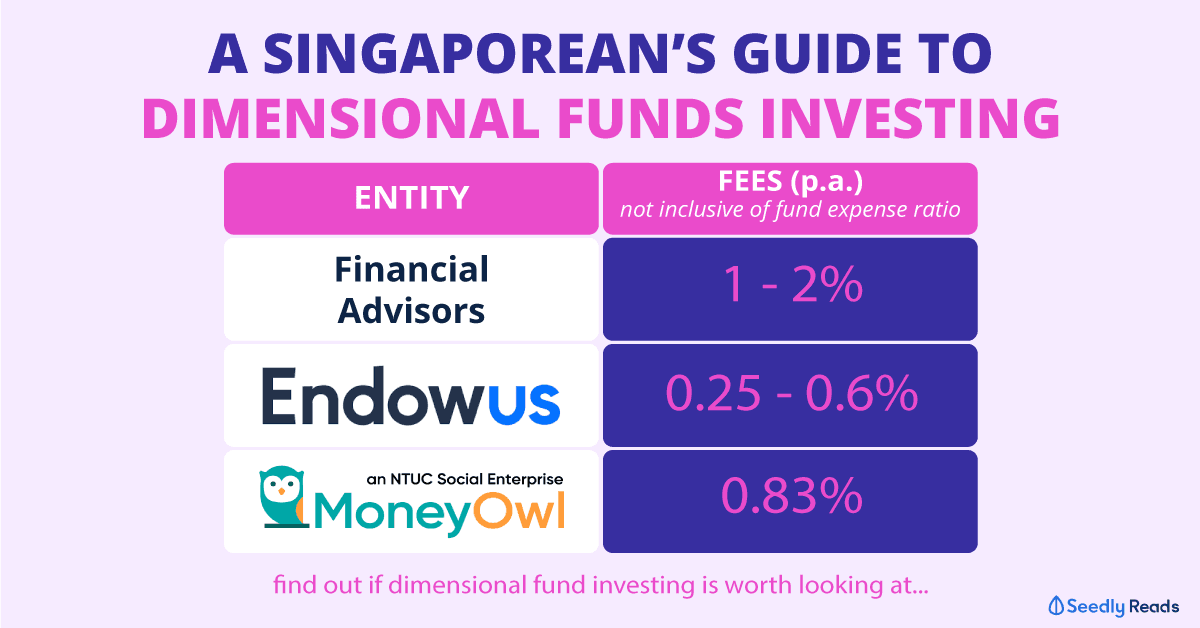

FAs and wealth advisors like Providend, typically charge wrap or managed account fees between 1% to 2% p.a. This is on top of the fund manager fee (fund expense ratio), for investment advice, portfolio creation and rebalancing and more.

Otherwise, you can engage financial advisory firms like Endowus, and MoneyOwl.

The main difference between Endowus and MoneyOwl is this: Endowus uses PIMCO Investment Management for the bonds allocation of their portfolios. PIMCO is an active bond manager

Endowus Dimensional Funds Fee

First up we have Endowus.

Endowus has partnered with DFA to offer these funds via the Cash/SRS Portfolios:

- Dimensional Global Core Equity Fund — Total Expense ratio: 0.30% p.a.

- Dimensional Emerging Market Large Caps Core Equity Fund — Total Expense ratio: 0.44% p.a.

- Dimensional Pacific Basin Small Companies Fund — Total Expense ratio: 0.64% p.a.

- Dimensional Global Core Fixed Income Fund — Total Expense ratio: 0.28% p.a.

Endowus charges an Access Fee on top of the fund manager fee (fund expense ratio), for investment advice, portfolio creation and rebalancing, brokerage, and transfers. They require a minimal investment of S$10,000

Access Fee per annum based on assets under advice (AUA) for Cash:

- 0.60% S$200,000 and below

- 0.50% S$200,001 to S$1,000,000

- 0.35% S$1,000,001 to S$5,000,000

- 0.25% S$5,000,001 and above

*tiered not stacked

Access Fee per annum based on assets under advice (AUA) for SRS:

- 0.40% flat fee across any amount

MoneyOwl Dimensional Funds Fee

Next, we have MoneyOwl.

MoneyOwl has partnered with DFA to offer these funds:

- Dimensional Global Core Equity Fund — Total Expense ratio: 0.30% p.a.

- Dimensional Emerging Market Large Caps Core Equity Fund — Total Expense ratio: 0.44% p.a.

- Dimensional Global Short Fixed Income Fund — Total Expense ratio: 0.29% p.a.

MoneyOwl charges an advisory/wrap fee, and custody platform fee. These fees are in addition to the fund manager fee (fund expense ratio), for investment advice, portfolio creation and rebalancing, brokerage, and transfers.

Fees per annum based on assets under advice (AUA):

- 0.65% advisory/wrap fee.

- 0.18% custody/ platform fee.

All in all, this adds up to about 0.83% p.a. in fees.

Unfortunately, retail investors have limited access to Dimensional funds in Singapore. Endowus only offers three Dimensional funds for their equities fund and one dimensional fund for bond funds. As for MoneyOwl, they have two Dimensional equity funds and one Dimensional bond fund among its offerings.

Got Any Questions About Dimensional Funds?

Why not join the discussion over at our friendly Seedly where you can ask questions and clear your doubts about investments!

Advertisement