Dirty Things Shops Do: Pricing Tactics To 'Trick' You Into Buying More Than You Should

Here at Seedly, we’re all about making smarter personal finance choices.

Today, we’re going to show you 5 dirty pricing tactics that we unknowingly (and sometimes also willingly) fall for.

Yep.

No matter how smart you think you are, you might be an unconscious victim of these psychological pricing tactics.

There’s nothing illegal or unscrupulous about it.

They’re just tactics that are commonly used to target a consumer emotionally rather than logically, with the main aim of making you think that you’re spending less than what you really are.

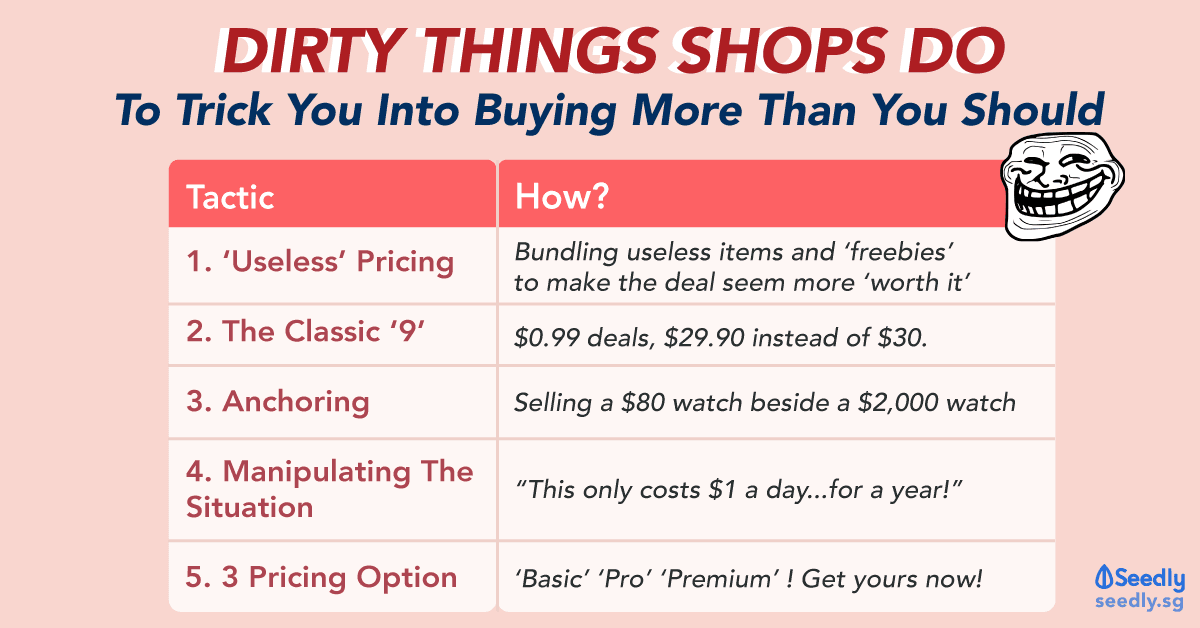

TL;DR: Here Are Some Ways Where Shops Make You Pay More Than You Should!

Even the smartest of you might have fallen for one of these tricks:

| Tactic | How? |

|---|---|

| 1. Useless Pricing | Bundling useless items and freebies to make the deal seem more 'worth it'. |

| 2. The Classic 9 | $0.99 deals, $29.90 instead of $30. |

| 3. Anchoring | Selling a $80 watch beside a $2,000 watch |

| 4. Manipulating the Situation | "It only costs $1 a day.... for a year!" |

| 5. 3 Pricing Option | "Basic" "Pro" and "Premium" versions. |

1. “Useless” Pricing

Ever noticed the prices of medium-sized fries vs large-sized fries at McDonald’s?

| Size of Fries | Price of Fries (S$) |

|---|---|

| Small | 2.15 |

| Medium | 3.75 |

| Large | 4.00 |

Would anyone buy the medium-sized fries? Definitely not, especially if you are only getting fries!

This happens very often in bundle deals at IT fairs, where they show you the price of a laptop on its own.

And they’ll show you another (higher) price which consists of the laptop plus freebies such as extra RAM, a mouse, a laptop case, and etc.

The latter always seems like a better deal since you only need to pay a little more to get more stuff.

But if you step back and not let the inner-auntie in you buy what you believe is the best deal.

You’ll realise that you only need to purchase what you need.

Especially if you already have a working mouse and laptop case at home.

2. The Classic Nine – 9

Most commonly found in shops EVERYWHERE.

You’ll most likely be greeted with price tags that end with a ‘9’.

Buy a T-shirt for $30? That’s too expensive.

Buy the same T-shirt for $29.99. Hey… It’s still under $30.

OR IS IT?!

Since we still tell ourselves, “Aiya, it’s okay. It’s still within the $20 range…” (Yes, even I am guilty of falling for this.)

3. Anchoring

How do shops make you buy a $2,000 watch? Place it next to a $20,000 watch.

How do spas make you commit to a $99 facial package? Advertise it next to a seemingly “more attractive” $399 package that they never intended to sell!

This is called anchoring.

It refers to how we, as humans, rely on any available information provided when making your purchase.

This is a pretty common tactic used by most stores.

Especially during flash sales.

Where a much higher “original” price is being replaced by a “discounted price”.

When in reality, the product was never intended to be sold at the “original price” to begin with!

4. Manipulating The Situation

Honestly, we hear this a lot during sales pitches.

I once went for a trial facial session, and the salesperson told me how important it is to take care of my skin and that it would only cost me about $1 a day.

Notice how she made ‘$1 a day’ sound more reasonable than signing a year-long package that costs $380?

(In case you’re wondering, I didn’t sign up for the package.)

Some stores will even “create” a new category or product name to entice you into buying something you exotic.

Like how Americano is actually Kopi O (black coffee)? (Okay, coffee purists will hate me for this. But they’re both quite similar aren’t they?!)

By changing the name of a product, a consumers’ point of reference is shifted.

Throw in branding and marketing and…

Suddenly Americano costs $5.00 at Starbucks whereas Kopi O costs $1.00 at your neighbourhood kopitiam.

5. 3 Pricing Options To Choose From

Whenever I am met with a range of pricing options, based on the size of the drinks.

I am more inclined to pick the “safer” option which is the middle option.

It is a common practice for shops to add a super-premium product to get you to choose the option which they want you to: the middle option.

In actual fact, the middle option is already premium-priced.

Advertisement