Dividend Stocks vs Growth Stocks vs Value Stocks: Which Is the Best Investment Strategy for You?

●

When it comes to investing in stocks, I would think that majority of investors are looking to fulfil two main objectives:

- Buy stock and sell it at a higher price for capital gains

- Buy stock for the dividends yield to create a source of investment income.

Needless to say, there are some stocks that can fulfil both objectives up to a point.

However, most of the stocks can be classified into three main categories: dividend, value stocks and growth stocks.

If I would describe it, these categories of stocks are like different types of fire.

For dividend stocks, what you get is a strong steady fire, as you are investing in mature companies that provide you with a stable source of dividends.

P.S. Dividend stocks are also known as income stocks.

For value stocks, you are getting a smouldering fire, as you are investing in companies that have seen better days. The fundamentals of the company are still sound, but it is trading below what they are worth.

In theory, this will provide good returns in the future when the company rebounds.

For growth stocks, you are getting an explosive fire that has the potential to ignite.

These companies have substantial potential for explosive growth in the future with a growth rate that typically beats the overall market.

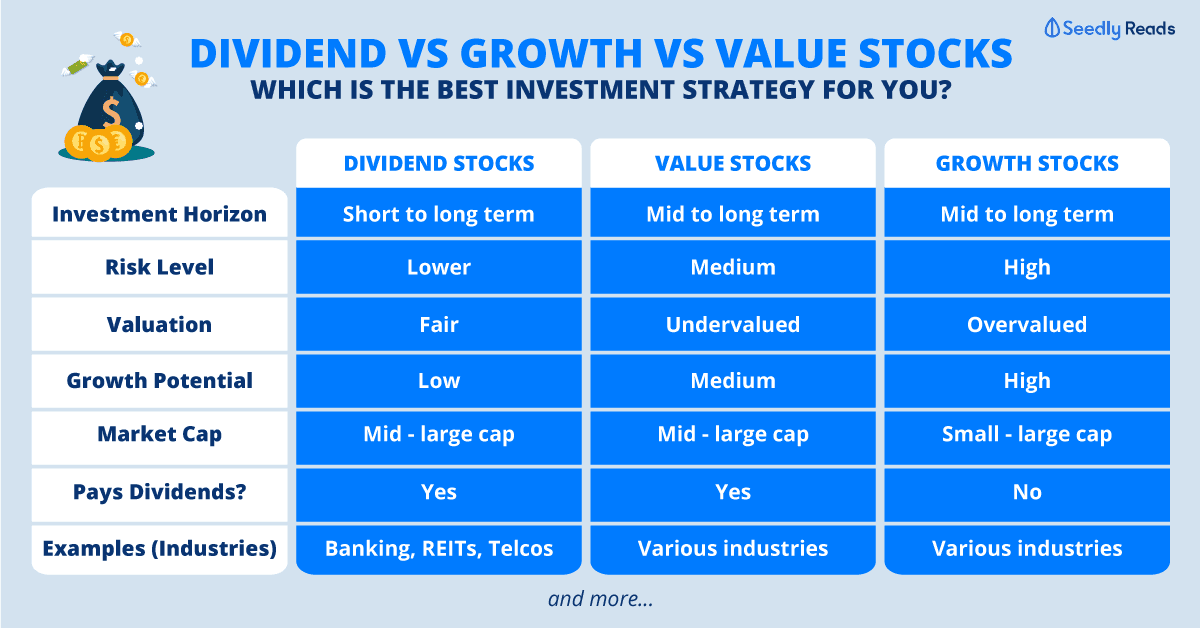

TL;DR: Dividend vs Value vs Growth Stocks: Which Is the Best Investment Strategy for You?

Understanding the individual characteristics of each category of stock will make you a better investor as you can use this knowledge to create a more effective personal investment portfolio.

Here is a summary of the characteristics of each stock.

| Dividend Stocks | Value Stocks | Growth Stocks | |

|---|---|---|---|

| Investment Horizon | Short to long term | Mid to long term | Mid to long term |

| Risk Level | Lower | Medium | High |

| Valuation | Fair | Undervalued | Overvalued |

| Growth | Low potential for growth | Medium potential for growth | High potential for growth |

| Market Cap | Mid - large cap | Mid - large cap | Small - large cap |

| Pays Dividends? | Yes | Yes | No |

| Examples (Industries) | Banks, REITs, telcos and utilities | Various industries | Various industries but majority in technology, biotechnology and clean energy |

Dividend Stock Investing

First off, we have dividend stocks.

Although they are not as exciting as their growth or value peers when it comes to large stock price gains; they can provide you with stable long-term returns that will generally do better than the larger market.

Are Stocks With Dividends a Good Investment?

If you are an investor who is looking draw a regular investment income, dividend stock investing is the way to go.

Dividend-paying stocks have good financials, a good track record of dividend payouts, a higher payout ratio, a low price to book ratio and are often fairly valued.

These sorts of companies are usually more mature companies with a high dividend yield.

Yes, high-growth stocks have the potential to experience HUGE share-price gains which translates to high returns – on paper anyways until you decide to sell the stock.

But dividend investing offers investors a way to draw an income from their investments as well as enjoy the fuzzy feeling one gets when you see your share prices go up (gradually).

Here are the characteristics of a good dividend stock:

Investment Horizon: In terms of personal investment horizons, dividend stocks are the most flexible amongst the three. As the company is more mature, there will typically not be any large fluctuations in the share price.

Thus, you can typically hold on to dividends in the short term (anything below three years), mid-term (three to 10 years) and long term (above 10 years).

Risk Level: In comparison to growth stocks and value stocks, dividend stocks are generally less risky as they have good enough financials to pay you regular dividends.

These companies are typically more stable in terms of share price.

However as with investing there is always a risk. Even though dividend stocks might be less risky than value or growth stocks, they are still subject to the volatility of the market.

Valuation: Comparatively, dividend stocks tend to be more expensive than growth or value stocks as you are buying into mature companies that are valued fairly.

Growth Potential: This is a downside to dividend stock paying companies. As they are more mature, they have a lower potential for growth.

Another factor for their low growth potential is that unlike their peers; they usually would not be reinvesting their profits into their business as they are using the money for dividend payments.

Company Size: Dividend stock companies are usually larger and more mature companies with mid to large-cap.

Pays Dividends: Yes. Dividend stock companies will distribute to you a portion of their companies earnings which are paid out on a yearly, quarterly, or monthly basis. Or even randomly without a fixed schedule.

When the company is doing well, you can expect dividend growth where the companies will pay you more dividends per share.

It’s also a common misconception that a dividend-paying stock will ALWAYS pay you dividends. Newsflash: dividends are not compulsory.

Examples: Banks, utilities, supermarkets, telecommunication companies (telcos) and Real Estate Investment Trusts (REITs)

One upside to dividend stocks is that these companies usually pay out dividends regularly.

But, you have to be careful when interest rates rise as this will negatively affect the share price.

Another important thing to consider is this. Will the companies be able to manage their financials well and sustain their growth so that they will continue to pay dividends in the future?

If dividend investing interests you, check out our dividend stock investing guide!

Value Stock Investing

Alternatively, you can consider value stocks.

When you buy value stocks the primary objective you want to achieve is to buy the stock and sell it at a higher price to turn a profit.

Value Investing is the process of finding underpriced stocks, buying them, and holding them for the long-term until the market sees the value in the company and what it does.

Such stocks are usually smaller companies as they have a greater potential to see a large increase in their share prices.

These companies usually have a relatively low price-to-earnings (P/E) ratios, below book value (P/B), or even below cash value.

Sometimes, stocks are undervalued because the company may have run into financial difficulties towards the end of the fiscal year. Either that or public perception of the company may have suffered due to public scandals. It is also important to check that these troubles do not affect the operations of the company too much.

Here are the characteristics of a good value stock:

Investment Horizon: In terms of personal investment horizons, value stocks require you to have a longer investment horizon.

You will need the patience and discipline to hold on to the stocks for the mid-term (three to 10 years) to long term (above 10 years). This is so as the problems that plague the stock will need time to be resolved and the value of the stock to be restored.

Risk Level: In comparison to dividend stock, value stocks are generally riskier but less risky than growth stocks.

This is because you do not know if the company can solve its problems and restore its value.

In other words, you will need to see if the wound is just a scratch or something that is life-threatening.

You will also need to study the company’s underlying business and fundamentals to see if it still remains sound.

Valuation: Comparatively, value stocks are relatively less expensive than dividend or growth stocks as you are buying into a company that is undervalued.

Growth Potential: If you do your homework well, value stocks have quite a bit of potential for growth, but not much as growth stocks as value stock companies tend to be more mature.

Company Size: Value stock companies are usually large well-established companies with a mid to large-cap.

Pays Dividends: Yes. Most value stock companies pay dividends and may even have high dividend payout ratios. However, if the company is undervalued because of financial difficulties, dividends may be cut.

Examples: Value stock companies can come from any industry.

A good example of this would be the companies that Berkshire Hathaway acquires. Warren Buffett, founder of Berkshire Hathaway is one of the most renowned value investors who has done very well with this strategy.

At the end of the day when value stocks, you will need to examine the fundamentals of the company and determine if the company can recover from them.

If value investing interests you, check out our value investing guide!

Growth Stock Investing

Last but not least we have growth stocks.

When you buy growth stocks the primary objective you want to achieve is to buy the stock and sell it at a higher price to turn a profit.

But unlike value stocks, you are looking to invest in companies that are not undervalued but rather companies that have the potential for huge share price gains in the future.

Growth stock companies tend to be growing at a rate faster than the broader market.

Instead of paying dividends like dividend stock companies and value stock companies, they usually reinvest their revenue back in their business for growth.

Typically growth stock companies produce innovative products that have the potential to disrupt the market in the future, but there are exceptions.

Growth stock companies can be highly effective companies with great business models that are able to effectively capture the demand for their products.

Here are the characteristics of a good growth stock:

Investment Horizon: In terms of personal investment horizons, you will need to commit to a growth stock for mid-term (three to 10 years) to long term (above 10 years).

This is so that you will be able to stick around to see the fruits of a company’s business expansion plans.

Risk Level: In comparison to dividend stock and value growth stocks are generally the riskiest.

However, there are a few things you can take note of to reduce this risk:

- Read what analysts are saying about the company’s potential earnings per share in the near future.

- See if the company has positive free cash flow for their expansion plans. If not this will affect their financial health.

- Check the company’s current ratio. Have they been able to repay their financial obligations?

- Look at their return on equity (ROE). Is the company making good use of shareholder’s money to generate profits?

Valuation: Growth stocks can be just as expensive as dividend stocks or just as affordable as value stocks.

However, there is a tendency for the stocks of these companies to appear overvalued because of their generally high price to earnings (P/E) ratios.

Growth Potential: For growth stock companies, the sky is the limit. For example, if you bought Amazon stock four years ago you could have made a 401% gain.

However, with this potential for growth comes risk and volatility. Growth stock companies are very reliant on growth and events such as recessions will disrupt their expansion plans more than other companies.

Company Size: Growth stock companies can be small-cap, medium cap or big-cap companies.

For example, small growing companies like Zuora and big companies like Amazon are considered growth stock companies due to their huge potential for growth.

Pays Dividends: No. Typically, growth stock companies do not pay dividends as they tend to reinvest their profits into their business on their expansion plans.

Examples: There are growth stock companies in almost any industry. However, some industries like technology, alternative energy and biotechnology have a higher concentration of growth stock companies.

You can take a look at our detailed growth investing and dividend investing comparison if you would like to learn more about growth stocks.

Stocks can provide a return on your investment with income from dividends, undervalued bargains or future growth returns.

Plenty of stocks (e.g. 3M) have qualities from all three qualities.

Also, no one is stopping you from owning dividend, growth and value stocks. Each category has its own perks and having exposure to all three can diversify your portfolio.

On the other hand, it’s okay if one investing style resonates more with you.

Depending on your investment goals, you may find that focusing on either dividend stocks, growth stocks or value stocks might fit your overall financial strategy better.

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any stock.

Advertisement