What Is Your Returns If You Dollar Cost Averaged Into The Straits Times Index Exchanged Traded Fund (STI ETF) For The Past 8 Years

” Invest into the STI ETF they say. It is good, they say.”

That was exactly what I did upon graduation.

The reason behind it was simple back then.

- Most of the financial blogs were recommending STI ETF

- Most of my friends were Dollar-cost averaging into the STI ETF

(that was the only thing we know to invest in) - I am not really the best at handling peer pressure, so I invested too.

With time totally not on my side, I can finally write this article on the returns if you invest in the STI ETF over the past 8 years.

What is STI ETF?

To do a quick recap, the STI ETF stands for Straits Times Index Exchange Traded Fund.

- It is designed for passive investors who are just getting started.

- The STI basically tracks the top 30 companies in the Singapore market. Hence, it is made up of companies we are all familiar with, such as DBS or Singtel.

- It is diversified across various industry verticals, which helps spread the risk of investors.

Step-by-step guide to STI ETF investing

Returns if you dollar-cost average into the STI ETF over the past 8 years

There are 2 methods to invest in the STI ETF, be it using

- Dollar-cost averaging

- Lump-sum averaging

The dollar-cost averaging method goes well with most beginner investors simply because:

- It requires less time to monitor the price movement

- One can start investing with as little as S$100 per month through a regular savings plan

- The dollar-cost averaging method helps an investor buy more shares when the price is low and lesser shares when the price is high.

Read more: Dollar-cost averaging vs Lump sum investing

Further Reading: S$100 per month investment, over 8 years into the STI ETF

“Brace yourself for some crazy numbers!”

Assuming, an investor

- Invests S$100 per month into the STI ETF

- He has been doing this for the past 10 years

- He invests using a Regular Savings Plan that charges him 1% of the total investment amount

(Since that is the cheapest in the market for his investment amount) - Because of the Regular Savings Plan, he is on, his money is invested into the Nikko AM Singapore STI ETF

To determine the total gains of this investor’s Dollar-cost averaging strategy into the STI ETF over the years, we will be running two sets of numbers:

- Changes in the price of the STI ETF over the years

- Total dividends collected over the years

For convenience, we use the monthly closing price in the illustration.

Read also: Which Regular Savings Plan Is The Cheapest?

Changes in the price of STI ETF (G3B.SI) over the years

Below, we calculate the returns over the years in terms of price and also, to find out the number of stocks he bought over the 8 years.

Changes in the price of STI ETF (G3B.SI) in the year 2010

| Date | Price of STI ETF (G3B.SI) | Lots Purchased | Costs (Including Fees) |

|---|---|---|---|

| Jan 2010 | 2.77 | 35 | S$97.92 |

| Feb 2010 | 2.79 | 35 | S$98.63 |

| Mar 2010 | 2.93 | 33 | S$97.66 |

| Apr 2010 | 3.00 | 33 | S$99.99 |

| May 2010 | 2.81 | 35 | S$99.33 |

| Jun 2010 | 2.83 | 34 | S$97.18 |

| Jul 2010 | 3.02 | 32 | S$97.61 |

| Aug 2010 | 3.00 | 33 | S$99.99 |

| Sep 2010 | 3.15 | 31 | S$98.63 |

| Oct 2010 | 3.18 | 31 | S$99.57 |

| Nov 2010 | 3.18 | 31 | S$99.57 |

| Dec 2010 | 3.26 | 30 | S$98.78 |

| Total | - | 393 | S$1,184.86 |

- In the year 2010, one would have invested S$1,184.86 on 393 units of STI ETF.

Changes in the price of STI ETF (G3B.SI) in the year 2011

| Date | Price of STI ETF (G3B.SI) | Lots Purchased | Costs (Including Fees) |

|---|---|---|---|

| Jan 2011 | 3.24 | 30 | S$98.18 |

| Feb 2011 | 3.05 | 32 | S$98.58 |

| Mar 2011 | 3.14 | 31 | S$98.31 |

| Apr 2011 | 3.22 | 30 | S$97.57 |

| May 2011 | 3.20 | 30 | S$96.96 |

| Jun 2011 | 3.16 | 31 | S$98.94 |

| Jul 2011 | 3.22 | 30 | S$97.57 |

| Aug 2011 | 2.94 | 33 | S$97.99 |

| Sep 2011 | 2.72 | 36 | S$98.90 |

| Oct 2011 | 2.89 | 34 | S$99.24 |

| Nov 2011 | 2.73 | 36 | S$99.27 |

| Dec 2011 | 2.68 | 36 | S$97.45 |

| Total | - | 389 | S$1,178.96 |

- In the year 2011, one would have invested S$1,178.96 on 389 units of STI ETF.

Changes in the price of STI ETF (G3B.SI) in the year 2012

| Date | Price of STI ETF (G3B.SI) | Lots Purchased | Costs (Including Fees) |

|---|---|---|---|

| Jan 2012 | 2.93 | 33 | S$97.66 |

| Feb 2012 | 3.02 | 32 | S$97.61 |

| Mar 2012 | 3.05 | 32 | S$98.58 |

| Apr 2012 | 3.02 | 32 | S$97.61 |

| May 2012 | 2.83 | 34 | S$97.19 |

| Jun 2012 | 2.93 | 33 | S$97.66 |

| Jul 2012 | 3.08 | 32 | S$99.55 |

| Aug 2012 | 3.08 | 32 | S$99.55 |

| Sep 2012 | 3.15 | 31 | S$98.63 |

| Oct 2012 | 3.09 | 32 | S$99.87 |

| Nov 2012 | 3.12 | 31 | S$97.69 |

| Dec 2012 | 3.22 | 30 | S$97.57 |

| Total | - | 384 | S$1,179.17 |

- In the year 2012, one would have invested S$1,179.17 on 384 units of STI ETF.

Changes in the price of STI ETF (G3B.SI) in the year 2013

| Date | Price of STI ETF (G3B.SI) | Lots Purchased | Costs (Including Fees) |

|---|---|---|---|

| Jan 2013 | 3.33 | 29 | S$97.54 |

| Feb 2013 | 3.33 | 29 | S$97.54 |

| Mar 2013 | 3.37 | 29 | S$98.71 |

| Apr 2013 | 3.39 | 29 | S$99.30 |

| May 2013 | 3.37 | 29 | S$98.71 |

| Jun 2013 | 3.21 | 30 | S$97.27 |

| Jul 2013 | 3.29 | 30 | S$99.69 |

| Aug 2013 | 3.11 | 31 | S$97.38 |

| Sep 2013 | 3.27 | 30 | S$99.09 |

| Oct 2013 | 3.25 | 30 | S$98.48 |

| Nov 2013 | 3.22 | 30 | S$97.57 |

| Dec 2013 | 3.21 | 30 | S$97.27 |

| Total | - | 357 | S$1,178.55 |

- In the year 2013, one would have invested S$1,178.55 on 356 units of STI ETF.

Changes in the price of STI ETF (G3B.SI) in the year 2014

| Date | Price of STI ETF (G3B.SI) | Lots Purchased | Costs (Including Fees) |

|---|---|---|---|

| Jan 2014 | 3.06 | 32 | S$98.90 |

| Feb 2014 | 3.16 | 31 | S$98.94 |

| Mar 2014 | 3.26 | 30 | S$98.78 |

| Apr 2014 | 3.35 | 29 | S$98.13 |

| May 2014 | 3.4 | 29 | S$99.59 |

| Jun 2014 | 3.35 | 29 | S$98.13 |

| Jul 2014 | 3.43 | 28 | S$97.01 |

| Aug 2014 | 3.42 | 28 | S$96.72 |

| Sep 2014 | 3.36 | 29 | S$98.42 |

| Oct 2014 | 3.36 | 29 | S$98.42 |

| Nov 2014 | 3.46 | 28 | S$97.85 |

| Dec 2014 | 3.45 | 28 | S$97.57 |

| Total | - | 350 | S$1,178.46 |

- In the year 2014, one would have invested S$1,178.46 on 350 units of STI ETF.

Changes in the price of STI ETF (G3B.SI) in the year 2015

| Date | Price of STI ETF (G3B.SI) | Lots Purchased | Costs (Including Fees) |

|---|---|---|---|

| Jan 2015 | 3.45 | 28 | S$97.57 |

| Feb 2015 | 3.46 | 28 | S$97.85 |

| Mar 2015 | 3.50 | 28 | S$98.98 |

| Apr 2015 | 3.57 | 27 | S$97.36 |

| May 2015 | 3.48 | 28 | S$98.42 |

| Jun 2015 | 3.42 | 28 | S$96.72 |

| Jul 2015 | 3.26 | 30 | S$98.78 |

| Aug 2015 | 3.42 | 28 | S$96.72 |

| Sep 2015 | 3.02 | 32 | S$97.61 |

| Oct 2015 | 3.09 | 32 | S$99.87 |

| Nov 2015 | 2.97 | 33 | S$99.00 |

| Dec 2015 | 2.99 | 33 | S$99.66 |

| Total | - | 355 | S$1,178.54 |

- In the year 2015, one would have invested S$1,178.54 on 355 units of STI ETF.

Changes in the price of STI ETF (G3B.SI) in the year 2016

| Date | Price of STI ETF (G3B.SI) | Lots Purchased | Costs (Including Fees) |

|---|---|---|---|

| Jan 2016 | 2.68 | 36 | S$97.45 |

| Feb 2016 | 2.72 | 36 | S$98.90 |

| Mar 2016 | 2.91 | 34 | S$99.93 |

| Apr 2016 | 2.92 | 33 | S$97.33 |

| May 2016 | 3.48 | 28 | S$98.42 |

| Jun 2016 | 2.93 | 33 | S$97.66 |

| Jul 2016 | 2.93 | 33 | S$97.66 |

| Aug 2016 | 2.93 | 33 | S$97.66 |

| Sep 2016 | 2.97 | 33 | S$99.00 |

| Oct 2016 | 2.92 | 33 | S$97.33 |

| Nov 2016 | 3.02 | 32 | S$97.61 |

| Dec 2016 | 3.00 | 33 | S$99.99 |

| Total | - | 397 | S$1,178.94 |

- In the year 2016, one would have invested S$1,178.94 on 397 units of STI ETF.

Changes in the price of STI ETF (G3B.SI) in the year 2017

| Date | Price of STI ETF (G3B.SI) | Lots Purchased | Costs (Including Fees) |

|---|---|---|---|

| Jan 2017 | 3.10 | 31 | S$97.07 |

| Feb 2017 | 3.16 | 31 | S$98.94 |

| Mar 2017 | 3.25 | 30 | S$98.48 |

| Apr 2017 | 3.26 | 30 | S$98.78 |

| May 2017 | 3.31 | 29 | S$96.95 |

| Jun 2017 | 3.34 | 29 | S$97.83 |

| Jul 2017 | 3.42 | 28 | S$96.72 |

| Aug 2017 | 3.41 | 29 | S$99.88 |

| Sep 2017 | 3.35 | 29 | S$98.13 |

| Oct 2017 | 3.51 | 28 | S$99.27 |

| Nov 2017 | 3.56 | 27 | S$97.09 |

| Dec 2017 | 3.54 | 27 | S$96.54 |

| Total | - | 348 | S$1,175.68 |

- In the year 2017, one would have invested S$1,175.68 on 348 units of STI ETF.

Dividends of STI ETF year 2010 to 2017

Of course, it does not simply end here. The STI ETF gives out dividends twice annually.

The amount of dividends are one received depends on how many units one has during the exercise date and the amount dictated.

The history of dividends given out by NIKKO AM STI ETF looks like this:

source: SGX

In the above example, where one dollar cost averaged in the STI ETF at S$100 per month, this is the total amount of dividends he would have received:

| Date | Amount of units accumulated | Dividends per share | Total Dividends received |

|---|---|---|---|

| 29 Apr 2010 | 136 | S$0.02 | S$2.72 |

| 30 Sep 2010 | 301 | S$0.03 | S$9.03 |

| 29 Apr 2011 | 516 | S$0.03 | S$15.48 |

| 13 Oct 2011 | 676 | S$0.035 | S$23.66 |

| 27 Apr 2012 | 911 | S$0.03 | S$27.33 |

| 11 Oct 2012 | 1,105 | S$0.035 | S$38.68 |

| 29 Apr 2013 | 1,282 | S$0.035 | S$44.87 |

| 10 Oct 2013 | 1,462 | S$0.045 | S$65.79 |

| 1 Jul 2014 | 1,730 | S$0.0465 | S$80.45 |

| 2 Jan 2015 | 1,900 | S$0.0495 | S$94.05 |

| 1 Jul 2015 | 2,069 | S$0.0482 | S$99.73 |

| 4 Jan 2016 | 2,263 | S$0.0452 | S$102.29 |

| 1 Jul 2016 | 2,460 | S$0.0344 | S$84.62 |

| 3 Jan 2017 | 2,655 | S$0.0604 | S$160.36 |

| 3 Jul 2017 | 2,832 | S$0.0231 | S$65.42 |

| Total | - | - | S$914.70 |

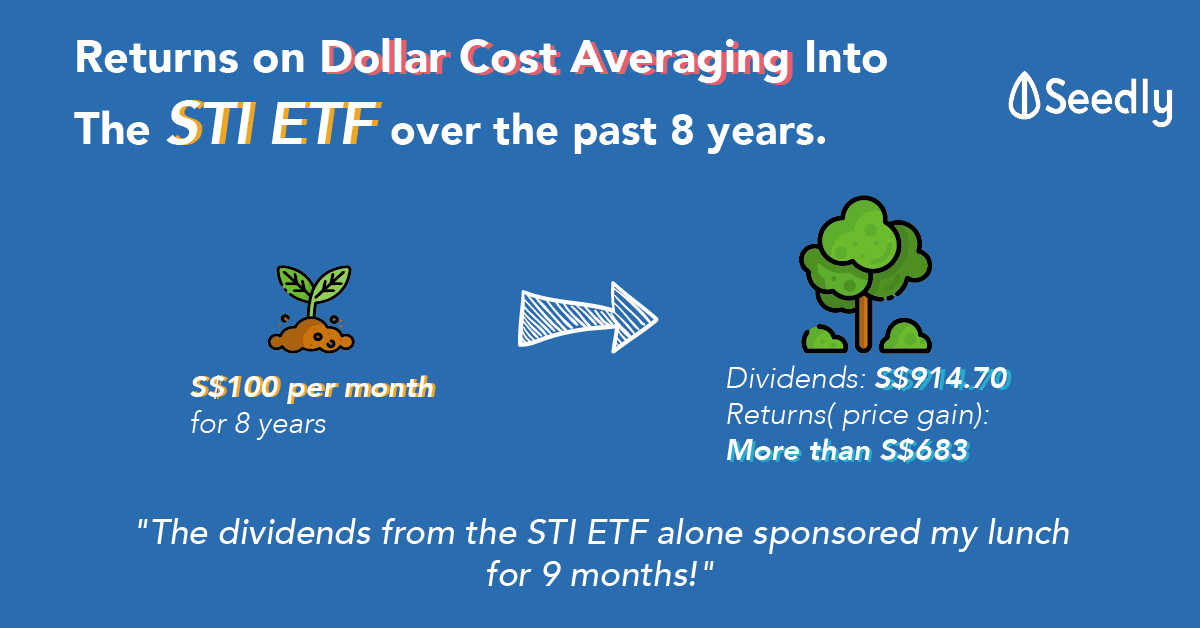

- The investor would have accumulated total dividends of S$914.70 by the end of 2017.

Average Price of STI ETF using Dollar Cost Averaging Method from the year 2010 to 2017

Based on the above calculating, using Dollar Cost Averaging Method, an investor would have invested a total of S$9,433.16 on 2,972 units of STI ETF.

This works out to be an average price of S$3.17 per unit.

We cross-reference that to the latest price:

chart plotted using: sg.finance.yahoo

- The current price since the start of the year 2018 has been above 3.40.

- To be modest and taking 3.40 as the benchmark, each unit would have gained a share price of 0.23.

- This makes a total gain of S$683.56 based on share price.

Dividends of STI ETF bought him lunch for 9 months

Assuming an investor survive on his favourite fried rice for lunch at work every day.

- He purchases 5 plates of fried rice per week, one for each weekday.

- This delicious (and addictive) fried rice costs him S$5.

- He decides to pay his lunch using dividends he collected over the years from the STI ETF

- It allows him to purchase 183 plates of fried rice.

- The dividends he collected paid for his lunch for 9 months.

- This is excluding the face value gain of the units he purchased.

Advertisement