Effective today, HDB just rolled out a new grant, Enhanced Central Provident Fund (CPF) Housing Grant and increased the income ceiling for HDB buyers.

Wondering how this affects you?

As always fam, I gotchu.

TL;DR: Higher Income Ceilings And Enhanced CPF Housing Grant

- HDB income ceilings will be raised to $14,000 for families and $7,000 for singles

- A new Enhanced CPF Housing Grant will replace the existing Additional and Special CPF Housing Grants

- Eligible first-timers stand to benefit with higher subsidies that are applicable to new and resale flats regardless of flat type and location

- For a refresher course on all things CPF

Note: the EHG will not be retrospectively applied to flat applications received before 11 September 2019

Higher Income Ceilings For HDB Buyers

Here’s what the new income ceilings (effective 11 September 2019) look like:

| Flat Type | Previous Income Ceiling (Average Gross Monthly Household Income) | Current Income Ceiling (Average Gross Monthly Household Income) |

| 4-room flat or bigger | - $12,000 - $18,000 if purchasing with extended or multi-generation family | - $14,000 - $21,000 if purchasing with extended or multi-generation family |

| 3-room flat | $6,000 or $12,000 depending on project | $7,000 or $14,000 depending on project |

The higher income ceiling is great news for all HDB buyers but at the same time, it also means that competition for popular HDB flats and BTO launches will only get stiffer now that more people are eligible to apply.

Enhanced CPF Housing Grant

If you’ve ever thought about buying an HDB flat, or have already bought one, understanding the grants that you’re eligible for is a mind-boggling process.

Like seriously, “Want to give me money to buy HDB flat JUST GIVE LAH… Why must make until so cheem?!”

But with the introduction of the Enhanced CPF Housing Grant (EHG) to replace the Additional and Special CPF Housing Grant, all this convoluted math will be a thing of the past.

Plus, it’s pretty sweet that with the change in eligibility conditions and restructuring of the grants, you might end up qualifying for more subsidies than before.

For those who’re interested (who isn’t?) here’s what the EHG looks like:

Eligibility For EHG

To be eligible for the Enhanced CPF Housing Grant, applicants or their spouses must have been employed continuously for at least 12 months. This is in line with other HDB schemes and grants.

More importantly, applicants must buy flats that they can call home until they reach the age of 95.

For flats which fail to meet this condition, the EHG will be pro-rated based on the extent that the remaining lease will cover them till that age.

So… What Does This All Mean?

All of the abovementioned sound great.

But to make it easier for you to understand what it all means, here’re a couple of scenarios which you might find yourself in:

For First-Timers Buying A BTO HDB Flat

Before 11 September

You can receive up to $80,000 in grants:

- $40,000 under Additional CPF Housing Grant (AHG) for household incomes $5,000 or below

- $40,000 under Special CPF Housing Grant (SHG) for household incomes not exceeding $8,500, if buying a 4-room or smaller HDB flat in a non-mature estate

11 September onwards

You can receive up to $80,000 in grants:

- Up to $80,000 under Enhanced CPF Housing Grant (EHG) for household incomes not exceeding $9,000, for any new flat of any type in any estate

Looks The Same, But How Much Subsidy Will I Get?

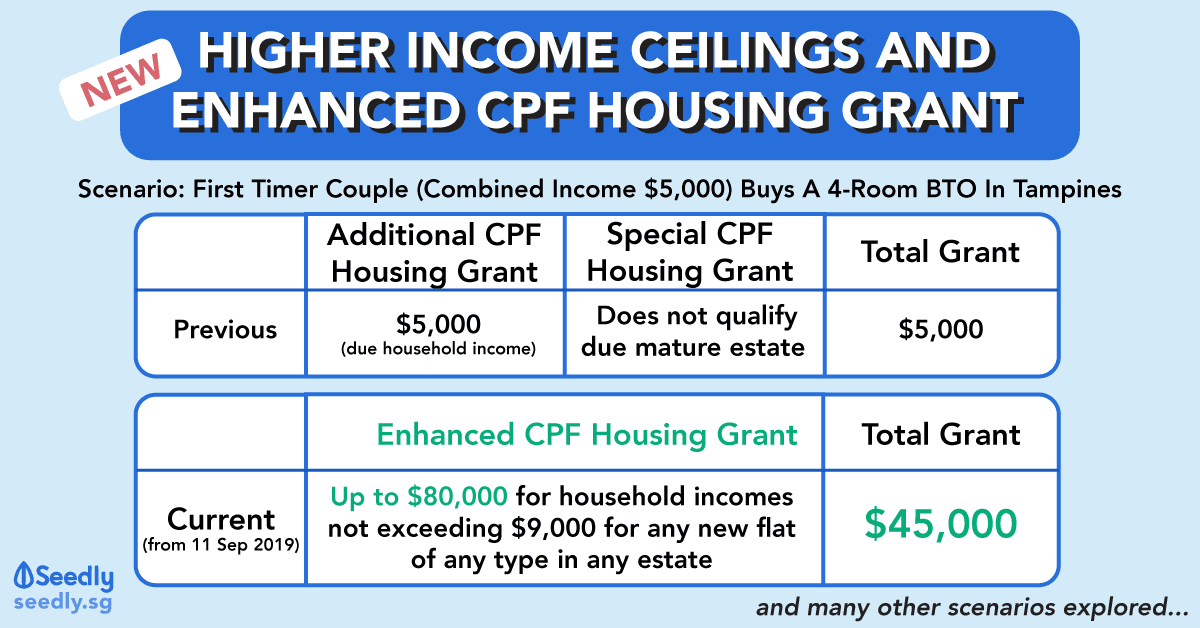

Under the previous grant conditions, a couple with a household income of $5,000 looking to get a 4-room BTO in Tampines (a mature estate) will only get $5,000 under AHG.

Now, the same couple will get $45,000 under EHG.

For First-Timers Buying A Resale HDB Flat

Before 11 September

You can receive up to $120,000 in grants:

- $50,000 under CPF Housing Grant for household incomes not exceeding $12,000

- $40,000 under AHG for household incomes $5,000 or below

- $30,000 under Proximity Housing Grant (PHG) if you live with or near your parents

11 September Onwards

You can receive up to $160,000 in grants:

- $50,000 under CPF Housing Grant for household incomes not exceeding $̶1̶2̶,̶0̶0̶0̶ $14,000

- Up to $80,000 under EHG for household incomes not exceeding $9,000, for any flat of any type in any estate

- $30,000 under PHG if you live with or near your parents

Seems Higher, But How Much Subsidy Will I Get?

Under the previous grant conditions, the same couple (both 30 years old) with a household income of $5,000 looking to get a 4-room HDB Resale in Tampines (70 years left on the lease) will get $55,000 ($50,000 under CPF Housing Grant + $5,000 under AHG).

Note: This is assuming their parents live in the West, so they do not qualify for the PHG.

Now, the same couple will get $95,000 ($50,000 under CPF Housing Grant + $45,000 under EHG).

For First-Timer Singles Buying A BTO HDB Flat

Before 11 September

You can receive up to $40,000 in grants:

- $20,000 under AHG for household incomes not exceeding $2,500

- $20,000 under SHG for household incomes up to $4,250

11 September Onwards

You can receive up to $40,000 in grants:

- Up to $40,000 under EHG for household incomes not exceeding $4,500, for a 2-Room Flexi BTO HDB flat

Looks The Same, But How Much Subsidy Will I Get?

Under the previous grant conditions, a single applicant (35 years old) with a household income exceeding $6,000 would not be able to apply for a 2-Room Flexi BTO HDB flat (99-year lease).

But a single applicant (35 years old) with a household income of $2,500 looking to get a 2-Room Flexi BTO HDB flat (99-year lease) will get $22,500 ($2,500 under AHG + $20,000 under SHG).

Now, the same single applicant (35 years old) with a household income of $2,500 looking to get a 2-Room Flexi BTO HDB (99-year lease) will get $22,500 under EHG.

The subsidy is the same then.

And here’s a little bit of good news: if your monthly income is, say… $6,500 and you couldn’t apply for a 2-Room Flexi BTO HDB flat (99-year lease) because of the income cap, you can apply now as the household income ceiling has been raised to $7,000.

For First-Timer Singles Buying A Resale HDB Flat

Before 11 September

You can receive up to $60,000 in grants:

- Up to $25,000 under CPF Housing Grant (Singles) for household incomes not exceeding $6,000

- $20,000 under AHG for household incomes not exceeding $2,500

- $15,000 under PHG if you live with or near your parents

11 September Onwards

You can receive up to $80,000 in grants:

- Up to $25,000 under CPF Housing Grant (Singles) for household incomes not exceeding $̶6̶,̶0̶0̶0̶ $7,000

- Up to $40,000 under EHG for household incomes not exceeding $4,500, for any flat of any type in any estate

- $15,000 under PHG if you live with or near your parents

Seems Higher, But How Much Subsidy Will I Get?

Under the previous grant conditions, a single applicant (35 years old) with a household income of $2,500 looking to get a 3-Room HDB Resale in Tampines (70 years left on the lease) will get $30,000 ($25,000 under Singles Grant + $5,000 under AHG).

Note: This is assuming his or her parents live in the West, so the single applicant does not qualify for the PHG.

Now, the same single applicant (35 years old) with a household income of $2,500 looking to get a 3-Room HDB Resale in Tampines (70 years left on the lease) will get $47,500 ($25,000 under Singles Grant + $22,500 under EHG).

Making HDB Flats Affordable

The increase in income ceiling and introduction of the EHG are all right steps in continuing to make HDB housing affordable for the masses.

Overall, it seems like the changes introduced are to encourage people to buy resale flats.

With the caveat being, it has to cover you till you hit 95 years old, of course.

Looking at the scenarios I just painted, I believe that these are the following groups of people who will enjoy an increase in subsidies IF they’re looking to purchase a resale flat:

- First-timer Families

- First-timer Singles (under Joint Singles Scheme)

- First-timer Singles (under Single Singapore Citizen Scheme)

But obviously, this will largely depend on your income ceiling and prevailing market conditions.

“Am I Eligible For EHG If I Already BTO And Am Waiting To Collect My Keys?”

I’m sure that a lot of you have questions like:

- “What if I only pay downpayment? Am I still eligible for EHG?”

- “I already BTO but am waiting to collect my keys… Will I be put on the EHG?”

- “I’m still in queue and waiting for my BTO…”

And etc.

I managed to get an answer from HDB regarding these types of questions and the bottom line is: EHG will not be retrospectively applied to flat applications before 11 September.

But if you meet the eligibility conditions, you will still qualify for the AHG and SHG.

Advertisement