Investing is fun, but only when you make money, or even beat the market if you’re that competitive.

However, there are countless bumps on the journey to get there. It takes half a century for Warren Buffett to be known as the Oracle of Ohama (where he lives) and decades of experience for Peter Lynch to be a legendary mutual fund manager who averaged 29.2% returns annually (wow!).

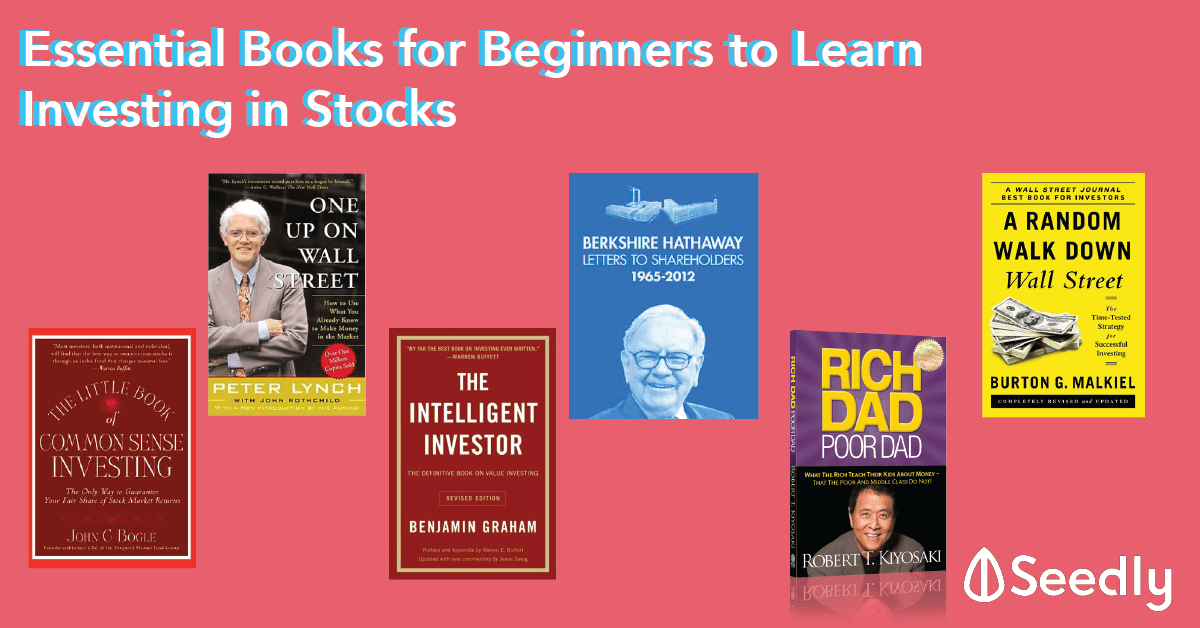

Reading up blogs, news and taking online courses can only get one so far. To be able to achieve results, any beginner needs to understand the thought process of previously successful investors to develop their own fundamentals and improve with experience in the future. Books allow you to do just that.

In this article, I will be recommending books according to one’s level of interest in the stock market.

Why should I even be investing in the stocks market?

Book: Rich Dad Poor Dad

Author: Robert T. Kiyosaki

If you are already interested in making money in the market, you can skip this one.

If you are financially clueless, reading Rich Dad Poor Dad by Robert T. Kiyosaki helps. In his book, he explains the philosophy of money and by the end of it, you will be coming back to Seedly to learn more about investing, I promise you.

How do I go about learning this stock thing?

Book: A Random Walk Down Wall Street

Author: Burton G. Malkiel

If you are very much like myself who enjoys researching about everything involving the stock market before your hands on, this is the book for you.

Think of it like the fairy tales, with stocks involved. It sums up all the major events on Wall Street over the last 50 years, from the Asian Financial Crisis, Internet Bubble, all the way to the Housing Crisis which occurs just years ago.

As an investor, one will have to find out about all of this sooner or later, why not find out everything there is?

Interestingly enough, this book also covers both technical and fundamental investing styles. Personally, I know nothing about technical analysis existed until 6 months into investing. It is important that one understands the pros and cons of each. Coupled that with the chapter Behavioural Finance, one will understand how the stock market works.

Book: One Up On Wall Street

Author: Peter Lynch

” Not going to lie, I am a huge fan of Peter.”

This guy bags an average 29.2% annual return for 13 consecutive years as a Fidelity fund manager. That is a total of 2,800% return throughout his whole career. He is a fundamental investor, very much like Warren Buffett as well as many others, and hopefully you.

Peter Lynch argues that retail investor, like an average Singaporean, can perform the same way he does simply by using what we already know. His book will also walk you through the process of picking a great stock.

I want to outperform the market!

Book: The Intelligent Investor

Author: Benjamin Graham

Honestly, you can beat the market, but it is going to take a lot of work and experience to do so. The books below are at the advanced level, requiring basic knowledge to understand. Reading (and following) these will give you lots of advantages over other investors (who don’t).

I have read this book 3 times. Each time I read it again, I learn so much more. Anyone who’s in the stock market has read or heard of this book. Understandably, Warren Buffett has one copy of his own.

This book goes in-depth into fundamental investing. However, it was written a long time ago and behaviour of investors has changed so much since. Nevertheless, the core philosophy applies today. It’s a must read if you want to outperform others. If you give it a try, read Chapter 8 carefully, memorise everything. I promise you it will serve you well.

Book: Berkshire Hathaway Letters to Shareholders

Author: Warren Buffett

Finally, a book by the legend himself.

Warren Buffett personally writes letters to update his shareholders every year. Not only does he deliver spectacular returns to his investors, he’s also a visionary leader. This book is for anyone who wishes to understand what makes a great CEO like Warren Buffett to trust with your investment.

Book: The Little Books Of Common Sense Investing

Author: John C. Bogle

This book is mainly for choosing investment funds.

There are funds that can outperform the market significantly. What do you need to pick the right one? Founding The Vanguard Group, John C. Bogle is one of the most reliable men you can seek advice from when choosing a fund.

The task of picking stocks can be extremely time-consuming. For each stock you invest in, you’ll probably have looked at ten, inside out. If finance is not your profession, you may want to consider investing in a fund. Believe it or not, I’m actually in marketing. I currently only have one fund in my portfolio because I enjoy picking stocks.

Closing Thought: Books help deliver results over time

Reading all the books I mentioned above won’t make you a billionaire overnight. It is through consistency, that will deliver results over time. Be prepared to make many mistakes along the way, so much so that you can write a book to document all of it.

However, you can void the costly ones and learn to pick the winners by following the successful investors. Lastly, investing is so much fun when you win.

Seedly Contributor: Edward Nguyen

Edward Nguyen hopes that his humble advice as an investor who has made a ton of mistakes can benefit many Singaporeans embarking on their investing journey.

Editor’s note: The above is a really insightful article by Edward Nguyen who is a part of our Seedly community. For readers who are interested in the investing aspect of personal finance, check out Seedly’s content on Investing!

Advertisement