COE Price Singapore (8 Nov 2023): Here's How Much a Car Costs in Singapore

Despite losing its top spot of being the number one most expensive city in the world, Singapore does not fall too far with second place.

And it’s largely due to the cost of buying and running a car.

In fact, we worked out in another article that if you should be earning at least S$8,729 to buy a car:

Yes.

It’s that siao.

This round, COE prices have gone through the roof, with three categories (B, D and E) reaching new records.

TL;DR: Cost of Owning a Car in Singapore? Costs of Cars in Singapore Explained

Singapore is physically small.

This means that the number of cars allowed on Singapore’s roads has to be properly controlled.

To do this effectively, the government decided to push up the price of car ownership through the levying of various fees and taxes, such as:

- Certificate of Entitlement (COE)

- Open Market Value (OMV)

- Additional Registration Fee (ARF)

- Excise Duty

- Goods and Services Tax (GST)

- Registration Fee

- Vehicular Emissions Scheme (VES)

- Other Charges (road tax, IU fee, car plate fee, dealer’s commission, etc.).

Apart from the OMV of a vehicle, the biggest single fee levied on car owners is probably the COE.

This is also not considering car insurance, which is another cost to concern yourself with.

Without it, you wouldn’t be able to own, much less drive, the car you bought at the dealership.

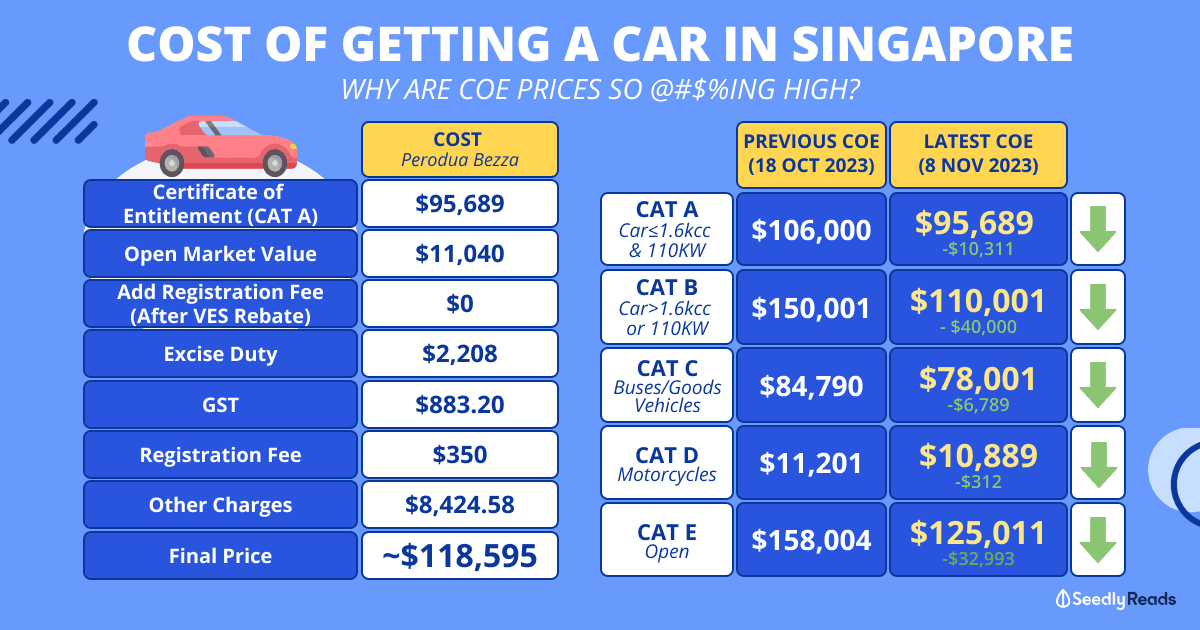

Here’s the current COE price as of 8 Nov 2023, 4pm:

| Category | Latest COE Price (Oct 2nd Bidding) (Wed, 18 Oct 2023, 4pm) | Latest COE Price (Nov 1st Bidding) (Wed, 8 Nov 2023, 4pm) | Quota | Bids Received |

|---|---|---|---|

| A (Cars up to 1,600cc & 110KW) | $106,000 | $95,689 (-$10,311) | 924 | 1,165 |

| B (Cars above 1,600cc or 110KW) | $150,001 | $110,001 (-$40,000) | 636 | 830 |

| C (Goods vehicles and buses) | $84,790 | $78,001 (-$6,789) | 190 | 281 |

| D (Motorcycles) | $11,201 | $10,889 (-$312) | 520 | 630 |

| E (Open - All Except Motorcycles) | $158,004 | $125,011 (-$32,993) | 141 | 227 |

Latest COE Price Singapore

![]()

Whether you drive or not.

The term Certificate of Entitlement (COE) is something that all Singaporeans know.

It’s basically a certificate that gives car owners the legal right to register, own, and use a vehicle in Singapore for a period of 10 years.

A typical COE for a sensible sedan car will cost over $100,000.

But as you can see from the wide range, the prices are determined by supply and demand.

So if supply is low and demand is high… then siao liao.

The COE is also the BIGGEST reason cars in Singapore are so #$%&ing expensive.

What Is the Current COE (Car, Motorcycle) Price?

There are five categories of COE available to bid for:

- Category A: Car up to 1,600cc and 110KW

- Category B: Car above 1,600cc or 110KW

- Category C: Goods vehicles and buses

- Category D: Motorcycles

- Category E: Open (all except for motorcycles)

Here are the latest COE prices:

| Category | Latest COE Price (Oct 2nd Bidding) (Wed, 18 Oct 2023, 4pm) | Latest COE Price (Nov 1st Bidding) (Wed, 8 Nov 2023, 4pm) | Quota | Bids Received |

|---|---|---|---|

| A (Cars up to 1,600cc & 110KW) | $106,000 | $95,689 (-$10,311) | 924 | 1,165 |

| B (Cars above 1,600cc or 110KW) | $150,001 | $110,001 (-$40,000) | 636 | 830 |

| C (Goods vehicles and buses) | $84,790 | $78,001 (-$6,789) | 190 | 281 |

| D (Motorcycles) | $11,201 | $10,889 (-$312) | 520 | 630 |

| E (Open - All Except Motorcycles) | $158,004 | $125,011 (-$32,993) | 141 | 227 |

Source: LTA/OneMotoring

When Is the Next COE Bidding Exercise?

There are usually two COE bidding exercises conducted by LTA every month.

The next COE bidding exercise will start on Monday, 20 Nov 2023, 12pm, and the exercise will end on Wednesday, 22 Nov 2023, at 4pm.

What If I Bid for the COE Myself? Will It Be Cheaper?

The COE is not something that only car dealers can get.

You can bid for the COE yourself too.

And it’s pretty simple, actually.

But whether it’ll be cheaper doing it yourself is a little iffy.

Assuming everyone cooperates and bids low. Maybe $1.

Then you can probably get your COE for a low price.

But knowing how kiasu Singaporeans are and the fact that so many affluent Singaporean drivers can throw money to get their COE, it’s unlikely that you can get your COE for $1.

How to Bid for COE?

Before the start of the COE bid, LTA will announce how many COEs are available for bidding and what were the previous COE prices.

Note: the previous COE price does not directly influence how the COE prices for the next bidding will turn out — most will use it as a gauge.

To bid for the COE as an individual, you can use a DBS or POSB ATM.

Just select “Electronic COE Bidding” and follow the instructions.

You’ll also have to enter your reserve price, which is the amount you are willing to pay for your COE.

The minimum amount for this is a mere $1 (imagine if everyone in the COE bid only bid $1…).

If your bid is accepted, you’ll get a 6-digit Acknowledgement Code which you can use to submit or revise your bid via the LTA Open Bidding site.

FYI: your Bidder ID will be your NRIC or FIN number.

When the COE bidding starts, you’ll need to revise your bid in order to qualify for one of the available COEs.

Also, you won’t know what the dealers or other independent car owners are bidding on.

BUT.

You will always know what the lowest bid is.

So if you want your bid to qualify, you have to at least beat the lowest bid.

The bidding will last for three working days.

Once the bidding is closed, the bank will deduct the non-refundable administrative fee of $2 to $10 from your account.

If you were successful in your bid, the bank would also deduct the bid deposit:

| COE Category | COE Bid Deposit |

|---|---|

| A, B, C, and E | $10,000 |

| D | $200 |

Congratulations!

Open Market Value

The Open Market Value (OMV) of a vehicle is determined by Singapore Customs.

It is based on the actual price paid or payable for the vehicle.

The OMV includes:

- purchase price

- freight fees

- insurance, as well as

- other charges incurred

during the sale and delivery of the car to Singapore.

Additional Registration Fee

![]()

The Additional Registration Fee (ARF) is a form of tax that is imposed upon the registration of a new car.

This tax is calculated based on a percentage of the OMV of a vehicle.

| OMV of Vehicle | Additional Registration Fee (ARF) Rate |

|---|---|

| First $20,000 | 100% of OMV |

| Next $20,001 to $50,000 | 140% of Incremental OMV |

| Next $50,001 to $80,000 | 180% of Incremental OMV |

| Above $80,000 | 220% of Incremental OMV |

VES rebates (if any) will be subtracted from the above-listed values.

Excise Duty and GST

![]()

Excise Duty is another form of tax imposed by Singapore Customs.

This tax is 20 per cent of the vehicle’s OMV.

Furthermore, an additional eight per cent GST will be charged from the sum of the vehicle’s OMV and Excise Duty.

Let’s take the cost of a Perodua Bezza 1.3 Premium X (A), for example.

The car has an OMV of $11,040 (via sgcarmart) and will incur an Excise Duty of $2,208 (20% of $11,040) and an additional GST of $883.20 (8% of $11,040 + $2,867).

No discounts and no buts.

Vehicular Emissions Scheme (VES) Surcharge

![]()

The Vehicular Emissions Scheme (VES) is a taxation scheme that was implemented to encourage buyers to choose vehicles that are more environmentally friendly and reduce carbon emissions and pollutants like:

- hydrocarbons

- carbon monoxide

- nitrogen oxide

- particulate matter

Depending on the date of registration of your vehicle and the band which it falls under based on the emission scheme, you will enjoy a rebate or pay a surcharge.

As of Jan 2021, the VES was adjusted and released under the new Enhanced Vehicular Emissions Scheme with higher rebates and higher surcharges.

Assuming your vehicle is registered from 1 Jan 2021 to 31 Dec 2023:

| Band | CO2 (g/km) | HC (g/km) | CO (g/km) | NOx (g/km) | PM* (mg/km) | Rebate** | Surcharge |

|---|---|---|---|---|---|---|---|

| A1 | A1 ≤ 90 | A1 ≤ 0.020 | A1 ≤ 0.150 | A1 ≤ 0.007 | A1 = 0.0 | $25,000 | N.A. |

| A2 | 90 < A2 ≤125 | 0.020 < A2 ≤ 0.036 | 0.150 < A2 ≤ 0.190 | 0.007 < A2 ≤0.013 | 0.0 < A2 ≤0.3 | $15,000 | N.A. |

| B | 125 < B ≤160 | 0.036 < B ≤ 0.052 | 0.190 < B ≤ 0.270 | 0.013 < B ≤ 0.024 | 0.3 < B ≤0.5 | N.A. | N.A. |

| C1 | 160 < C1 ≤185 | 0.052 < C1 ≤ 0.075 | 0.270 < C1 ≤ 0.350 | 0.024 < C1 ≤ 0.030 | 0.5 < C1 ≤2.0 | N.A. | $15,000 |

| C2 | C2 > 185 | C2 > 0.075 | C2 > 0.350 | C2 > 0.030 | C2 > 2.0 | N.A. | $25,000 |

*Subject to a minimum payment of $5,000 for ARF

**Applicable to cars/taxis registered from 1 July 2021 (date inclusive).

Registration Fee

According to the Land Transport Authority (LTA), a Registration Fee of $350 is levied upon registering a new car.

Other Charges

As though you haven’t paid enough, there’s also other stuff to pay, like:

- Insurance premiums

- Road Tax

- IU fee

- Number plates

- Dealer’s commission.

This is about 7 per cent of the car’s basic price.

Do you see how owning a car in Singapore can be expensive?

Car Price in Singapore: How Much Does It Cost to Own a Car?

Now that you understand the various fees and taxes involved in buying and owning a car.

Since one of the cheapest cars on the market now is the Perodua Bezza 1.3 Premium X (A):

We’ll be using that to compare the costs of owning a car in Singapore.

Let’s look at how a $11,040 Perodua Bezza 1.3 Premium X (A) costs a whopping ~$118,465 once it gets to Singapore:

| Factors Affecting Car Prices | Costs |

|---|---|

| Certificate of Entitlement (Category A COE) | $95,689 |

| Open Market Value (OMV) | $11,040 |

| Excise Duty (20% of OMV) | $2,208 |

| 8% GST | $883.20 |

| Registration Fee | $350 |

| Additional Registration Fee (ARF) After VES Rebate | $0 [-$15,000 (A2)] |

| Vehicle Emissions Scheme (VES) Rebate | (-$15,000) |

| Total Basic Cost | $110,170.20 |

| Other Charges ~7% (Insurance premium, number plates, road tax, IU, dealer's commission, and all other overheads) | $8,424.58 |

| Final Price | ~$118,595 |

Should I Renew COE or Buy a New Car?

It seems like a lot of money to be paying for a COE.

So once it’s near the 10-year mark, a lot of car owners will wonder if it’s worth renewing it.

Or does it make more (financial) sense to just buy a new car and get a brand new COE?

We took to Seedly to understand what people’s views are with regard to this dilemma.

- Ken Tan

Bought a new car and sort of regretted it. I should have gotten a resale instead.

- Sau Yee Fong

My car has less than 2 years’ worth of COE, and I intend to renew the COE for another 10 years. Just to share with you my thought process, hope it will be helpful to you. My car has low mileage (75K as of now) and hence I am betting that there will be less wear and tear. My car, if bought in today’s context, would be classified under CAT B. But I get to renew my COE under CAT A since it was under CAT A eight years ago. So I get to enjoy CAT B power by paying CAT A COE. With the introduction of VES, I would expect COE premiums stay relatively constant at the current level. An old car that renews COE is not subjected to VES but a new car is.

- Bea Tang

Renewed COE (cash only) last year at a 10-year low (but still 4x of the value it was when I first got the car). Depreciation for the next 10 years works out to $5k+ per annum (including loss of PARF but excluding higher road tax), which is far lower than a new car of similar capacity (2000cc). Having said that, my mileage was low (<70k), and the car was in good condition. I did, however, stock up on some parts as Honda no longer manufacture that model, and I was already facing difficulty getting parts.

- William Seah

How well does your car run? If maintenance is cheap and the car works, then sure, renewing is a good idea. Having said that, most cars will need a certain degree of higher maintenance cost as it gets older due to lack of spare parts or even wear and tear of parts (gearboxes, for example, are designed to run for possibly 200k km, give or take, which after ten years is a possibility) so some repairs won’t show up till after you renewed. In my case, I renewed my COE. After that, I also renewed my transmission, clutch, and Aircon, and I will have to renew my suspension soon. Such wonderful opportunities for renewal only came after I bought a COE back in 2016. So beware!

- Lucas AI

Take your car’s scrap value into consideration. (Scrap value + renewed COE price) divided by the number of years renewed = depreciation per year. Hence, smaller or cheaper b&b cars are usually more worth renewing as they have lower OMV. With that in mind, a new car does not necessarily mean high depreciation. A brand new small Toyota can have a depreciation of about 8-9k. This is similar to a Toyota with renewed COE for 5 years. The difference lies in the financial outlay. Furthermore, do note that a renewed COE Car has road tax that will increase year on year till it is 50% more. So then again, it’s more expensive to renew a bigger capacity car.

Related Articles

- Ultimate Driver’s Guide to the Best Car Insurance in Singapore

- What Should You Do When You Get Into A Car Accident?

- Best Credit Cards for Insurance Premiums in Singapore 2022

- Top 6 Ways You’re Spending Way Too Much On Your Car

- Sell Car Singapore Guide: Can You Actually Sell Your Car for a Profit Now?

- Budget 2023 Singapore Summary

- Best Credit Card in Singapore

- Best Travel Insurance in Singapore

Advertisement