10 Things I Learned From Warren Buffett’s 2019 Letter to Berkshire Shareholders

This the most coveted letter that investors look forward to each year.

Having read them over the years, Warren Buffett’s investment principles grew on me over time and have started to stick.

It’s these four investment tenets that Buffett highlights: invest in a business you understand, that has a wide economic moat, is run by honest and able managers, and don’t overpay for the business.

So if you don’t have the time to go through all 14 pages of his latest letter, here are 10 things I learned from Warren Buffett’s 2019 annual letter to Berkshire Hathaway shareholders:

1) How to Make Sense of the New GAAP Rule to Recognise Unrealised Gains and Loses in the Income Statement

The new Generally Accepted Accounting Principles (GAAP) rule to recognise unrealised gains and losses in the income statement is not a good reflection of the earning power of the business.

Buffett has reiterated this for the past couple of years.

With a portfolio size of close to a quarter-trillion dollars, fluctuations in the stock market may cause Berkshire’s earnings to swing wildly from year to year.

For example, in 2018 (a down year in the stock market) unrealised losses of US$20.6 billion caused Berkshire to report earnings of US$4 billion.

In 2019 (a good year in the stock market), unrealized gains of US$53.7 billion boosted the earnings of the company to US$81.4 billion.

2) Buffett Expects the Power of Retained Earnings From Its Portfolio to Deliver ‘Major Gains’ Over Time.

Stocks that reinvest their earnings fare better in absolute returns compared to dividend stocks and bonds.

Retained earnings can be compounded contributing to the growth of the intrinsic value of the business in the long run.

That’s the strategy renowned industrialists like Andrew Carnegie, John D. Rockefeller, and Henry Ford used to build their wealth.

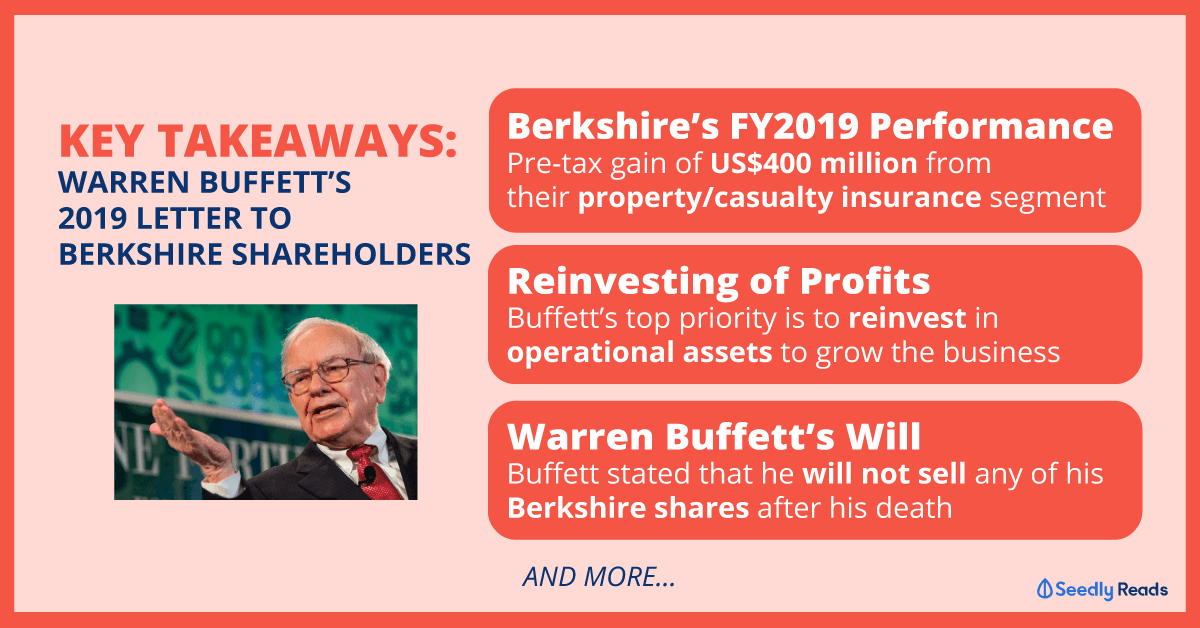

3) Buffett Plans to Create Value for Shareholders by Reinvesting Their Profits Wisely

His top priority is to reinvest in operational assets to grow the business. Berkshire will also make either partial or full acquisitions of businesses.

Purchases of businesses must fulfil Buffett’s three criteria of what constitutes a good buy.

Firstly, the business must earn good returns on net tangible capital.

Secondly, it needs to be run by honest and capable managers.

Third, the business must be available at sensible prices to be included in Berkshire’s stable of companies.

4) Berkshire Hathaway’s Fiscal Year 2019 Performance

In the fiscal year 2019, Berkshire reported a pre-tax gain of US$400 million from their property/casualty insurance segment.

Disciplined risk evaluation led to underwriting profits in 16 of the last 17 years.

The only loss that they experienced was in 2017, a pre-tax loss of US$3.2 billion.

Berkshire’s insurance float increased from US$123 billion in 2018 to US$129 billion in 2019. Net income from Berkshire’s non-insurance businesses increased by 3% to 17.7 billion; the bulk of earnings came from BNSF railroad and Berkshire Hathaway Energy.

5) Praise for Guard Insurance Group

Berkshire acquired GUARD Insurance Group for US$221 million in 2012, and this investment is paying off handsomely.

Buffett praised GUARD CEO, Sy Foguel, for his wonderful performance, growing the company’s premium volume by 379% to US$1.9 billion in 2019.

6) Berkshire Hathaway Energy’s Lower Electricity Rate Costs

Berkshire Hathaway Energy charges 70% less in electricity rates compared to its competitors in Iowa due to their investments in wind energy.

By 2021, Berkshire Hathaway Energy will generate 25.2 million megawatt-hours (MWh) of energy through wind, more than enough to meet Iowa customers’ demand of 24.6 million MWh.

7) Fire at Lubrizol

On 26 September 2019, one of the plants at Lubrizol, an Ohio-based company that produces and markets oil additives was damaged by a fire originating at a small next-door operation.

Both the company’s property loss and business-interruption loss will be mitigated by substantial insurance recoveries.

8) Warren Buffett Reassures Shareholders

Buffett reassured shareholders that Berkshire will continue to do well after his departure.

Firstly, Berkshire owns businesses that earn attractive returns on capital.

Secondly, these businesses have wide economic moats.

Thirdly, Berkshire is managed to withstand extreme shocks to its financial position.

Fourthly, they have talented managers who are driven by a passion to run their subsidiaries.

And finally, there are directors in place to ensure that the managers act in accordance to shareholders’ interests.

9) Berkshire Hathaway’s Promise to Shareholders

Berkshire will continue to look for and fill its board with business-savvy directors who are shareholder-oriented.

They will represent shareholders’ interests, seek managers who strive to make their customers happy, cherish their associates, and be outstanding citizens of both their communities and their countries.

10) Warren Buffett’s Will Information

Buffett stated in his will that he will not sell any of his Berkshire shares after his death.

Each year, the executors will convert a portion of his A shares into B shares and distribute the B shares to various foundations.

He estimates that it will take approximately 12 to 15 years for all his shares to re-enter the market after his death.

Bonus: Watch a Livestream of Berkshire’s Annual Meeting

Berkshire’s annual meeting will once again be available live on Yahoo.

To view the event, go to this link at 4am Singapore Time (GMT+8) on Sunday, 3 May 2020.

This article first appeared on The Fifth Person and is part of a content syndication agreement between The Fifth Person and Seedly.

For our Stocks Investing and Stocks Analysis articles, the Seedly team worked closely with The Fifth Person, who is an expert in the field to curate unbiased, non-sponsored content to add value back to our readers.

The Fifth Person believes in spreading a message – that sound investment knowledge, financial literacy and intelligent money habits can help millions of people around the world achieve financial security, freedom, and lead better lives for themselves and their loved ones.

Inspired by Warren Buffett? Take action today and start discussing stock ideas with the friendly SeedlyCommunity!

Advertisement