I’m so fortunate to be born in Singapore!

It’s such an incredibly modern city with so many amenities for me to enjoy!

I get to stay connected with fast wifi or mobile data almost everywhere I go.

Best of all, with our public transport networks constantly developing, I can quickly go from place to place in Singapore in an hour or two!

Yet, every day I hear about everyone complaining that it’s bad to stay here in Singapore.

Expensive taxes, fines everywhere, and many, many, more.

Sometimes, we do not notice how good we have it until everything is taken from us.

Let’s look at these financial privileges so we can be thankful for what we have and not brood over what we do not!

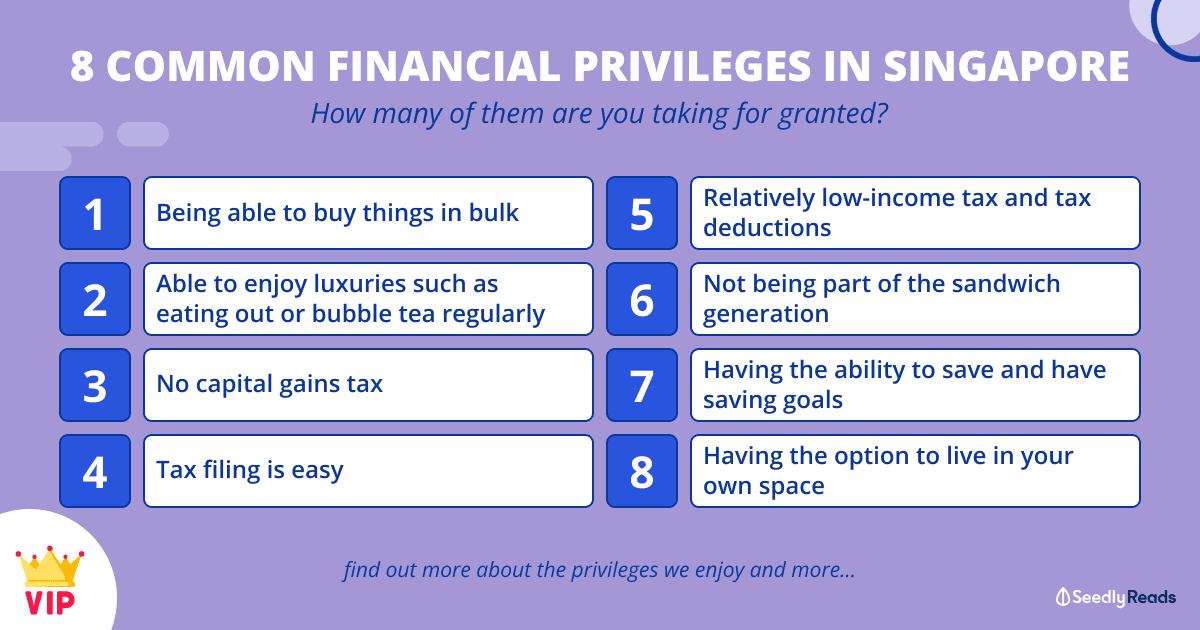

TL;DR: Common Financial Privileges in Singapore We Take For Granted

Being Able to Buy Things in Bulk

Picture this.

You’re out getting your groceries, and every shelf in the supermarkets you go are filled to the brim with food and daily necessities.

Singapore’s food security is robust compared to other countries; hence we can constantly enjoy having supplies like this without fear of them running out.

Although it is a privilege we enjoy, it goes by unseen easily.

Just take the panic buying scare we had when COVID-19 started as an example.

We enjoy having all these supplies every day, but we immediately went nuts the first time these supplies seemed threatened.

Able to Enjoy Luxuries Such As Eating Out or Bubble Tea Regularly

Enjoying your delicious HaiDiLao hotpot? Can’t go a day without your favourite brown sugar milk tea with extra pearls?

Here in Singapore, we enjoy expensive luxuries most other countries don’t.

You see all the atas cafes constantly packed with people, bubble tea and HaiDiLao outlets with queues extending to other shops.

Even as I scroll my social media, I see people complaining that they don’t have any money even though they show off all the expensive food and drinks they have daily.

Sometimes, we can just be so spoiled…

No Capital Gains Tax

That’s right, you own all the money you get from selling your investments.

Funny enough, not many of us Singaporeans have a habit of investing despite this fact.

While we still do not have a capital gains tax, we can potentially earn a lot from investing if we make the right choices or are just very, very lucky.

Now that you know this think it’s time to start your own investment portfolio?

Tax Filing is Easy

Compared to so many places, the process of filing taxes is highly simplified in Singapore.

Just hop on over to the tax authority’s website, fill in a few forms, and you’re done!

Unlike some other countries out there, which require complicated processes like hiring an accountant to help you file your taxes, we have it a lot easier.

Furthermore, the process of filling out your tax information is so streamlined it doesn’t take much effort at all!

Relatively Low-Income Tax and Tax Deductions

On the topic of taxes in Singapore, did you know that our tax rates aren’t that high?

The maximum tax rate for personal income tax in Singapore is 24%, and that’s comparing it with countries out there with a maximum tax rate of 40% – 50%.

Let’s not forget deductions.

Surprisingly, it’s not something easily declared in some countries I’ve been to. We have deductions for education, some insurance, living with parents, etc.

There are just so many ways we can reduce our taxes.

Furthermore, contributing money to our CPF ensures that the money we deduct from our income tax goes into our own pockets.

Even though we can only withdraw it after retirement, it doesn’t change the fact that the money still comes back to us.

We also have SRS, which I think is really great especially once you reach the higher tax brackets.

Not Being Part of the Sandwich Generation

With how well we take care of our citizen’s healthcare, a lot of the older generation can still work even past their retirement age.

Hence, a lot of middle-aged workers don’t find themselves caught between caring for their parents and their children financially.

Especially with how hard the older generation works to put food on the table, many from the young generation have everything ready for them, money for education, a comfortable home, and three square meals a day.

Even as they progress into the working world, most of the money they make tends to go into their own expenses.

In some developing countries, children don’t even have access to proper education and have to work at a wee age.

Still hate your schooling days after hearing this?

Having the Ability To Save and Have Saving Goals

One of the things even I forget, is that our financial systems are so strong and reliable!

Like the older generation always preaches, having our money stored in our bank savings accounts is safe. We won’t have to worry about losing our money or the banks collapsing.

Furthermore, if we’re worried about losing our money due to inflation, we can always invest them!

As our assets and those of the brokers are separated, we won’t lose our money even if the brokers go bankrupt.

Even the money we park in an insurance savings plan is safe!

Rest assured unlike in other countries, the insurance companies here won’t go out of their way just to deny your claims.

With so many options to help us save and/or grow our cash without any worry, this is something that shouldn’t go unsaid.

Having the Option To Live In Your Own Space

Staying apart from your family?

I’ve seen many cases of people who immediately rent a place outside not long after they start working.

As a matter of fact, I happen to have a friend who is doing that right now.

The amount of money we are earning is considerably higher than what others are earning in other countries.

To the point where moving out can be a viable option for some of us!

Still Think We Have It Hard in Singapore?

Thinking back, staying in Singapore isn’t so bad after all.

Thanks to our strong complaint culture, we are constantly unsatisfied despite all of these privileges we are enjoying.

Honestly, aside from all the benefits, living every day safely without having to worry about food or housing is enough to remind us to count our blessings.

Are you still unhappy that you’re born here in Singapore?

Advertisement