Freelancers seem like they have it great: unlike the rigid 9-5 workers who’d have to squeeze in jam-packed MRTs and buses every day, being a freelancer seems to entail late mornings in minimalistic cafe joints with a cup of latte and a sleek Macbook Pro.

While this may be stereotypically true for some, a freelancer’s job shouldn’t be viewed through rose-tinted lenses.

More often than not, freelancers have to deal with the mental load of an irregular schedule, keeping track on their finances, dealing with late payments and low-balling clients.

Freelancers don’t always have it easy, and to top it off, they are not covered by full-time employee benefits when shit happens to them. So to make their lives a little easier, here’s an insurance guide for freelancers in Singapore, so that they can get paid even when they’re feeling under the weather.

TL;DR: Everything You Need To Know About Insurance For Freelancers

In General: What Insurance Do I Need As A Self-Employed Person?

Since you don’t have medical benefits from your company, insurance is essential to protect you and your source of income. Your needs will differ from a salaried staff.

A quick summary from the list of insurance a working adult needs:

| Insurance | Level of Importance | Why should you get it? |

|---|---|---|

| Health Insurance | High | • To protect your savings from the expensive healthcare |

| Life Insurance | High | • If you have dependants (parents, siblings, children etc.) that relies on you and your income for a living. |

| Critical Illness | Mid | • If anything, you would not be able to work, thus, this is for you and your family to cope by while you recover from with your illness. |

| Disability | Mid | • To still provide a source of income to your family/dependants through your recovery. |

| Personal Accident | Mid | • If your job requires you to move around a lot • To compensate you to seek aid for your injury • To compensate for the days you are unable to work due to your injury |

Got a better idea on what to get? Here are some recommended coverages for each type of insurance you can consider:

| Rank | Type | Why | Recommended Coverage |

|---|---|---|---|

| 1 | Health (Hospitalisation & Surgical) | Hospital and Surgical bills & outpatient care | Private Hospital Or Public A |

| 2 | Term Or Whole Life | In case of death, your family gets the sum assured | 5 x your yearly income Or based on liabilities |

| 3 | Critical Illness | Paid out a sum assured when discovered Critical Illness | Payout tied to life insurance |

| 4 | Disability | A monthly payout for income loss if unable to work | >$3000 a month or based on existing income |

| 5 | Personal Accident (PA) | Covers outpatient accidental medical expenses | Payout based on expenses occured |

These insurance are however generic and applicable to the masses. However, as freelancers or self-employed individuals, you don’t have the luxury of paid medical leave, or reimbursements when it comes to medical consultation fees.

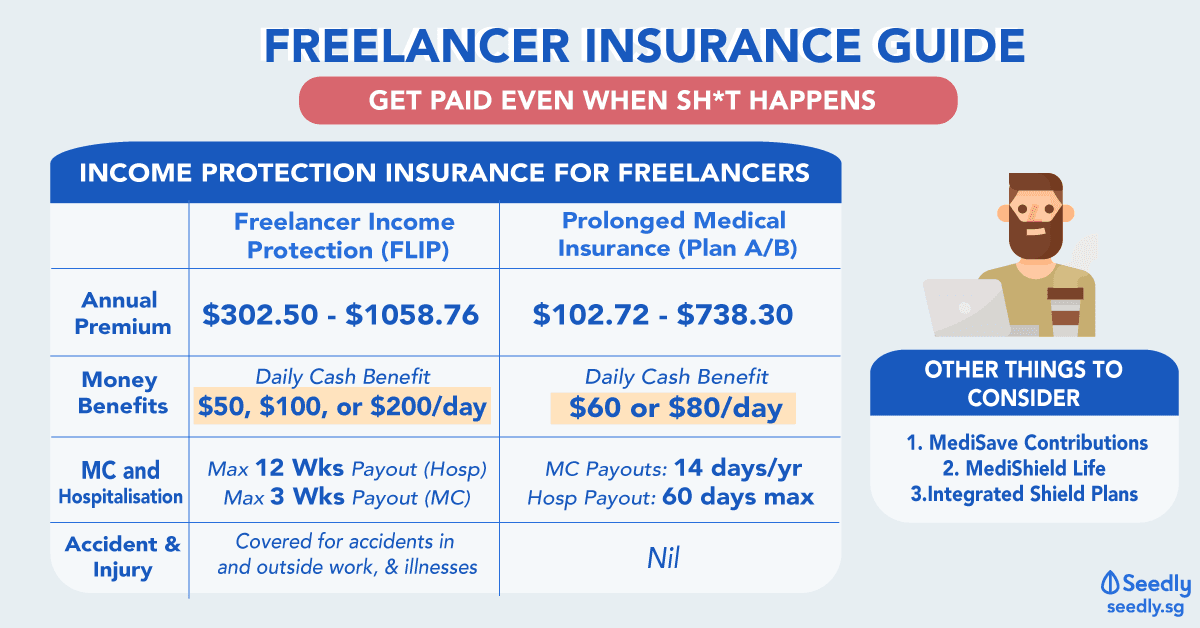

If you want such benefits, it’s important to make some provisions for yourself! Here’s a comparison of insurances that are specifically catered for freelancers, so that you can choose the one that’s best for you.

A Comparison Of Freelance Insurances In SG

Income Protection Insurance

| FREELANCER INCOME PROTECTION (FLIP) GigaCover (underwriter: Etiqa Insurance) | PROLONGED MEDICAL INSURANCE (PML) NTUC Income PLAN A | PROLONGED MEDICAL INSURANCE (PML) NTUC Income PLAN B |

|

|---|---|---|---|

| Annual Premium | $302.50-$1058.76 | $102.72-$555.33 | $136.96- $738.30 |

| Money Benefits | Daily cash benefit of $50, $100 or $200/day for 12 weeks if you are unable to work due to accident or illness. Change or stop coverage anytime without penalty | Daily cash benefit of $60. | Daily cash benefit of $80. |

| Hospitalisation and Medical Leave | After 1st 3 days up to 12 weeks of payout for Hospitalisation After 1st 5 days and 3 weeks max payout for MC. | Medical Leave payouts 14 days per policy year. Hospitalisation leave payouts 60 days per policy year. | Medical Leave payouts 14 days per policy year. Hospitalisation leave payouts 60 days per policy year. |

| Accident or Injury | Covered for accidents at work, outside work and illnesses. | NIL | NIL |

| Remarks | - | Covers for pre-existing conditions. Will be insured after 12 months of being continuously covered under this policy. | Covers for pre-existing conditions. Will be insured after 12 months of being continuously covered under this policy. |

Are these coverages enough?

For Income Payouts, maximum coverage for FLIP is capped at $16,800 ($200/day x 7 days/week x 12 weeks) while PML covers a maximum of $4,800 ($80/day x 60 days).

You will have to work out given your current take-home amount each month if this is enough coverage for you. Also, only buy the insurance that you need and can afford!

Other Important Health-Related Matters and Insurances You Should Take Note Of:

As a freelancer, you will also have to know a little about your CPF contribution as a self-employed person, as well as the different schemes that will be useful to you.

Let me be clear: your Income Protection Insurance is used to protect your income (i.e they compensate you an amount per day when you are not able to work due to illness or hospitalisation), it does not pay for your hospitalisation bills etc.

In contrast, health insurance iwill be the one that helps you cover your medical expenses.

For those who have no clue on the difference between MediSave and MediShield Life, Medisave is essentially a personal savings account for all Singaporeans to help tackle heavy medical expenses should the need arise in the future. In contrast, MediShield Life is a low-cost medical insurance initiative to help Singaporeans pay for larger B2/C class wards hospitalisation bills.

All clear? Now let’s delve into it:

1. MediSave Contributions

You may assume that it is automatic for freelancers to contribute to their MediSave, but as it turns out, around one in four freelancers fail to make the necessary MediSave contributions!

Here’s a real quick overview on how you can pay for your CPF MediSave, you can click the picture to find out more about your CPF contribution as a freelancer!

2. MediShield Life

MediShielf Life includes coverage for class B2/C-type hospital wards in public hospitals. If you are looking to stay at more expensive wards in private hospitals, you will have to top up from your own pocket as payouts from MediShield Life will only cover a portion of your medical bill.

Also, MediShield Life only covers selected costly outpatient treatments such as dialysis and chemotherapy for cancer. So for example, if you require outpatient treatment for more minor medical conditions like a flu, you will not be covered by MediShield Life.

3. Integrated Shield Plans

For those who want an upgrade from their basic insurance coverage from MediShield Life, you’d get the Integrated Shield Plan, which provides greater coverage than MediShielf Life. These are provided by a list of private insurers.

I will not delve into it here, but you can take a look at the Ministry Of Health’s website for a better understanding.

Do note that certain integrated shield plans may have riders that you can add to increase coverage. Some of these give extras like cash benefits for each day you’re hospitalised. So if you’re well covered in that aspect, you may not need to opt for Freelancer-specific insurances.

Insurance For Freelancers in Singapore

There are many ways you can protect yourself and your income as a freelancer, either by opting for an income-protection freelance insurance scheme or by upgrading your current medical and hospitalisation plan to include a more robust coverage.

Whatever the situation, do remember to choose wisely and within your means. Freelancers who have expensive equipment can also consider equipment insurance, and those who are extra cautious can consider getting professional indemnity insurance!

For those who are on an existing health insurance policy, we’d love to hear what’s the best health insurance provider out there. Do share with the community by leaving a review here!

Advertisement