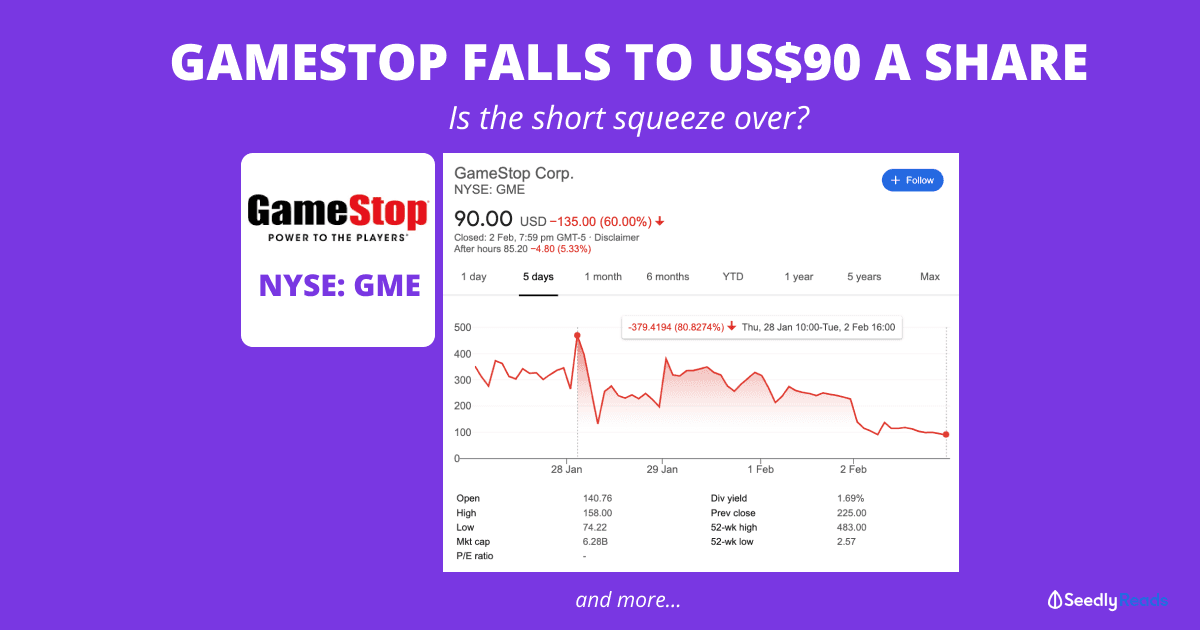

Gamestop (NYSE:GME) Falls From US$472 to US$90 in 6 Days: Is the Short Squeeze Over?

●

Unfortunately, for those who bought GameStop Corp (NYSE: GME) stocks, yesterday (2 Feb 2021) was not a good day.

As of Tuesday’s close, GameStop’s stock price stands at US$90: a 60 per cent drop that shaved $135 from its opening price.

This also means that GameStop’s stock price has fallen about 81 per cent from its US$472 high on Thursday (28 Jan 2021).

The huge drop makes it appear that the whole GameStop short squeeze and the trading frenzy driven by the popular online Reddit community(subreddit) r/WallStreetBets is over – at least for now.

P.S. I would recommend that you read my explanation of the whole situation here: GameStop’s Short Squeeze Madness: 3 Things You Can Learn From GameStop’s Stock Going up 345% in 3 Weeks first before coming back to this article.

But this drop begs a few questions. Have the Hedge Funds shorting GameStop won? Are the retail investors left holding the bag? How will this all play out?

As there’s a lot of noise and misinformation being thrown around, I will try my best to explain things with the facts and answer the above questions so you get a better understanding of the situation.

I’ll answer these questions and more in this article.

GameStop Short Squeeze Summary

If you don’t have time to read up on the whole GameStop short squeeze situation here is a quick Too Long Didn’t Read (TL;DR) version.

Basically, a group of Wall Street Hedge Funds like Melvin Capital and Steven Cohen’s Point72 Asset Management have bet billions that GameStop will go the way of the dinosaur and fail.

The Hedge Funds were so greedy that they shorted 138 per cent of GameStop’s stocks. At one point, it was one of the most shorted stocks in America. Depending on the way this is done, this practice might also be illegal

For context, this short interest is extremely high considering that Singapore Airlines Ltd (SGX: C6L) which was the most shorted stock in Singapore last year only had a 15.5 per cent short interest in May 2020.

Also, if you are wondering how traders can short more than 100% of a company’s stock available on the market, it is because traders can borrow stocks from other investors, and those stocks can be borrowed more than once.

So what happened was that Keith Gill (u/DeepF*******Value on Reddit/Roaring Kitty on YouTube) posted about his investment thesis on GameStop and why he invested in the company.

In short, he was investing in GameStop as he believed in the company as well as it being a stock play that might trigger a short squeeze.

FYI: A short squeeze happens when a stock’s price unexpectedly rises at a rapid rate. Investors who hold a short position in the stock are ‘squeezed’ as they have to cover their positions and buy up more of the stocks. This in turn increases the stock’s price even further. Subsequently, this may even trigger additional margin calls and short covering for investors shorting the stock, further driving up the price in a brutal feedback loop.

All this momentum started building in the r/WallStreetBets community, which has about 8.3 million subscribers (at time of writing) and GameStop was turned into a meme stock as investors continue pouring money in.

This has played a part in triggering the company’s meteoric rise in price despite its fundamentals not improving much.

Clearly, the current share price and valuation levels are quite detached from the company’s fundamentals. This means that the stock is more than likely to drop to a much lower normal/fair valuation driven by its fundamentals.

But again, I would like to remind you about the dangers of trading GameStop stocks.

Do Not Blindly Buy GameStop And Other Speculative Stocks

The steep decline in GameStop’s stock price demonstrates the dangers of buying GameStop’s stocks and other speculative investments.

At this point in time, the retail investors are the ones who are holding the bag, staring at huge unrealised losses depending on the price they bought GameStop stocks at.

When you boil it down, most investors who were buying into GameStop stocks initially were making a stock bet and speculating on a potential short squeeze.

If you ignored our previous warnings about GameStop Corp (NYSE: GME), please listen to this.

Unlike what mainstream media would like you to believe, there are sophisticated traders on r/WallStreetBets who know the difference between delta and theta, understand what role a clearing house performs and how options work.

There are very good reasons why they have bought GameStop stocks.

These group of Redditors on WallStreetBets understand what they are getting into, know the risks involved and threw in money they could lose.

There are also groups of Redditors that are just buying GameStop stocks to stick it to the Hedge Funds shorting GameStop.

Many of them have also gotten in way earlier when GameStop was trading at between US$4 – US$20 which reduced the risk they were taking tremendously.

If these things don’t describe you. Stay far far away and don’t let this stock bet ruin you.

There are much safer and better ways to invest over the long term. Here’s a good place to start:

And as Paul Samuelson, the first American to win the Nobel Memorial Prize in Economic Sciences would attest:

“Investing should be like watching paint dry or watching grass grow”.

Although you might disagree, this is still one of the tried and tested approaches to create wealth.

With that out of the way, let’s see how this GameStop situation might play out.

Aiming For The Moon

I’m oversimplifying things a little but if enough investors bought and held the stock, it will trigger a short squeeze.

But what kind of short squeeze you say?

For this, we will have to look at the infinity short squeeze that happened with Volkswagen (VW) back in October 2008 right in the midst of the Great Financial Crisis.

For just one glorious day, Volkswagen became the biggest company in the world as per this recounting of the event by Jamie Powell of the Financial Times.

Unfortunately for Volkswagen, the company was undergoing a takeover attempt by Porsche. Its ordinary shares (with voting rights) had skyrocketed in comparison to its preference shares (with no voting rights).

The hedge funds saw an opportunity as it could short the ordinary shares and hedge by going long on the preference shares.

However, they were blindsided by Porsche increasing its stake in Volkswagen using cash-settled options and reducing the shares available on the open market to just 6 per cent.

Powell noted that it was:

“It was mathematically impossible for every short-seller to buy a share, and therefore close their position. In other words, half the room were going to be left in a burning building with no way out. A panicked dash for the exit began.”

Volkswagen share price went up to €210 just before the squeeze. When the squeeze hit, Volkswagen’s stock price went up to as high as €1,000 intraday.

This was when the group of hedge funds that shorted Volkswagen eventually exited the market at around the €300-€400 mark. However, they were bled dry as they lost about US$30 billion betting against Volkswagen.

This is the outcome that r/WallStreetBets and the investors who bought GameStop’s stock are aiming for.

You might be thinking.

Can’t short sellers wait out the whole situation and hope for GameStop’s share price to fall before covering their short positions?

Well, there are two reasons they can’t exit this way.

First, short-sellers have to pay interest on the GameStop’s stocks that they borrowed to short.

According to Investopedia, due to a shortage in stock borrowing supply, the hedge funds that are shorting GameStop earlier are paying about 31 per cent in stock borrowing fees. Whereas the new hedge funds that are shorting the stock are paying over 80 per cent.

In other words, these hedge funds are bleeding money so long as they hold on to their short positions.

Secondly, if the stock price goes up exponentially like what GameStop’s stock did, brokers will generally invoke margin calls and force the hedge funds to close their short positions and reduce losses to manageable levels.

This is because if the hedge funds go bankrupt, the brokers will become liable for the losses.

But what happened with Volkswagen is not too relevant as there are many more factors at play this time around.

And also, past performance is not indicative of future returns.

There is no telling how this will play out.

Factors Affecting GameStop’s Stock Price in The Near Term

But here are some factors affecting the price of GameStop’s stock in the near term.

Fundamentals

As covered by my colleague Sudhan, GameStop’s fundamentals aren’t all that great.

In addition, if you are looking at a valuation for GameStop, you can look at NYU finance professor Aswath Damodaran who is respected for his meticulous approach to valuation.

He published an article on SeekingAlpha valuing the company at $47 a share.

Professor Damodaran added that this valuation is also rather optimistic and assumes that GameStop is able to adapt to a post COVID-19 world and continue to increase its online growth revenue and digitise better.

However, this is not too relevant now.

Momentum

Arguably, this is the main factor why GameStop was able to hit a 52 week high of US$483 and is still up 421 per cent year to date despite the stock price plummeting to US$90.

The growing global coverage of the GameStop short squeeze situation enticed retail investors and even other hedge funds and institutional investors to get on board.

However, this momentum can change directions upwards or downwards easily and is subject to manipulation as we have seen.

Gamma Squeeze

GameStop’s stock price movements can also be attributed to a gamma squeeze.

A gamma squeeze is when rapid price movements that forces investors (in this case hedge funds), to buy up more stock due to open options positions on the underlying stock.

Price Manipulation

A lot of this is speculation but I shall only comment on the more concrete examples.

Brokers Halting Trading of GameStop For Retail Investors

Last Thursday (28 Feb 2021), Robinhood and Webull stopped its customers from buying GameStop stock and other meme stocks like AMC and Koss corporation.

These brokers allowed their customers to sell but not open new positions in GameStop but have seen reduced restrictions somewhat.

In addition, other brokers like Charles Schwab and TD Ameritrade halted certain options trades and prevented their customers from buying GameStop shares on margin.

This can be attributed to liquidity issues as it was revealed by Robinhood that the Depository Trust and Clearing Corporation (DTCC) required Robinhood to put up US$3 billion in cash as collateral due to the unprecedented trading conditions.

There have also been some unsubstantiated reports of retail brokers cancelling orders, restricting limit prices and enforcing unwanted stop losses as well.

The Short Squeeze

Earlier, I talked about the short squeeze and the high short interest in GameStop that will drive up its share price.

But for that to happen, the hedge fund sellers will have to close their positions at a huge loss and buy up shares in bulk.

But, you have to remember that these short sellers have deep pockets and can wait out or hedge against their short positions.

It is unlikely that these hedge funds were margin called. Even if they exited like Melvin Capital, they received a $2.75 billion bailout from Citadel LLC. and their short positions were possibly bought up.

Has The Squeeze Been Squoze?

There is some evidence the squeeze has been squoze or is being squeezed now.

Here’s something to think about.

GameStop’s shares went up from US$40 to $483 in five trading sessions. In addition, this US$40 is already up from about US$4 back in August 2020.

That is a stock that went up about 8,200 per cent in just six months.

In comparison, Volkswagen’s short squeeze took almost a year and only went up only about 1,000 per cent from €100 to €1,000 at its peak.

But then again what is happening with GameStop is unprecedented and past performances do not indicate future returns.

Short Interest Has Fallen or is Trending Downwards

As of 3 February 2021, short interest is trending downwards.

According to data from S3 Partners, short interest has fallen from about 140 per cent last month to 51.13 per cent of the float (26.09 million shares).

In addition, ORTEX is reporting that the amount of floated shares has fallen to 52.88 per cent of the float (27.04 million shares).

MarketBeat is a lot more optimistic as it claims that 88.8 per cent of the float (61.78 million shares) is being shorted.

However, there is some speculation about how the data is being presented as there are tactics which can be used to manipulate disclosed short interest.

But on balance, hedge funds could have been buying up shares from actual sellers who are spooked by GME’s fall in price.

Will There be a Short Squeeze Part 2?

This is looking less likely as the time passes but there is still hope for those holding GameStop shares.

The short float is still high, and the trading volume has been steadily decreasing.

This may indicate that the hedge funds are not covering their positions as much as well.

The stock is still incredibly volatile, which means that any big movements in demand can drastically impact the price.

This means that if the retail investors and those institutional investors continue to hold and buy more GameStop shares, and people don’t sell. The hedge funds are not out of the woods just yet.

The short squeeze might still happen but it is looking less likely.

In addition, Billionaire investor Mark Cuban went on r/WallStreetBets to do an Ask Me Anything (AMA).

At the AMA, Mark Cuban told investors *(via Bloomberg):

“If you can afford to hold the stock, you hold. I don’t own it, but that’s what I would do,”

For more context, you might want to head over to the AMA.

Want to Learn More About Investing And More Articles Like This?

You can actually personalise your feed on Seedly to follow topics like investing, CPF and much much more…

Do check it out!

Advertisement