Managing your personal finances is already tough as it is.

And as a financial minimalist myself who values simplicity, automatic payment systems such as GIRO are a godsend.

I mean, who wouldn’t want to have automated bill payments so we can just “set and forget”?

Plus, with GIRO payment, we can eliminate the hassle of paying all our bills one by one while making sure that we don’t miss a payment (which will result in late fees).

But, as much as I love the advantages of GIRO payment and other forms of autopay, there are just some things that you shouldn’t leave unchecked.

In some cases, these bill payments could be a leaking bucket in your finances and could cost you a huge sum in the long run.

So here are five bills that you shouldn’t put on GIRO payment or autopay.

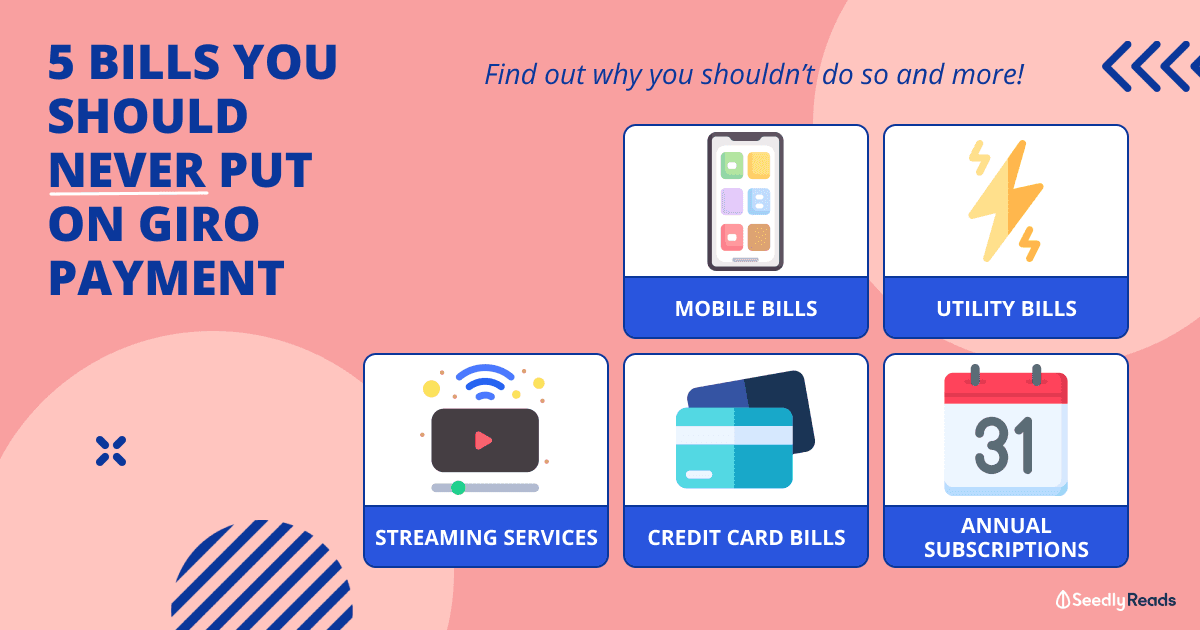

TL;DR: GIRO Payment — 5 Bills You Should Never Put on Automated Payment

Keeping track of your expenses and regularly reviewing your budget form the core of personal finance. But while there are useful features such as GIRO payments that help us simplify and automate our personal finances, not everything in our financial lives should be put on autopilot.

Here are five bills that you should not put on automated payment:

- Streaming services

- Mobile bills

- Utility bills

- Credit card bills

- Annual subscriptions

Read more:

- Expense Tracking Apps You Should Use: How to Budget Like a Boss

- The Seedly Money Framework: The Complete Guide to Winning Your Finances in 2022 & Beyond

1. Streaming Services

Since the era of “Netflix and Chill” with all the amazing shows from Squid Game and Stranger Things to The Mandalorian and The Expanse, streaming services that brought video entertainment on-demand are things most of us can’t live without.

And even as a geek myself with access to almost all of these streaming services, I still wouldn’t recommend putting any of them on GIRO payments.

Why?

The answer is simple.

If you get used to putting Netflix on GIRO payment, for example, you might become numb to them, even when you don’t really need these services.

Unless you watch at least one show/movie every month from a particular service, most of us would essentially be throwing money down the long kang (Malay: Drain) since we aren’t taking full advantage of the streaming service.

Moreover, with Netflix increasing their subscription prices last year, you really don’t want to miss out on a bill payment increase and then get a shock later on when you realised that you’ve paid hundreds extra for nothing.

Read more:

- Best Streaming Services for 2022: Netflix vs Disney Plus vs Amazon Prime vs HBO vs Viu & More

- Here’s How To Enjoy Discounts For Your Netflix & Spotify Subscriptions

2. Mobile Bills

Unless you have an unlimited data plan and your mobile bill never varies, it is a good idea to pay for your mobile plans manually.

Doing so helps you verify any billing errors you may encounter from telcos.

Moreover, being reminded of how much you are paying would spur you to keep up to date with the most bang-for-buck mobile plans out there to cut down on recurring costs.

3. Utility Bills

It’s no secret that utility bills have skyrocketed over the years thanks to inflation and the Russia-Ukraine war.

And while there are fixed plans available that charge for the amount of electricity used, how much we use varies from month to month.

By doing manual payments, you’re encouraging yourself to review your statements monthly.

This way, you can identify any unusual increases in usage, or even spot things like water leakages which can cause damage to your home and wallet in the long run.

4. Credit Card Bills

If you’ve been keeping up with the news lately, you would’ve heard of the Singaporean who found himself with a $20,000 credit card bill, courtesy of his daughter who went on a Genshin Impact pulling spree. Luckily, he was able to recover some of his losses from the credit card issuer out of goodwill.

While this is a rather extreme case where the transaction amount is hard to miss, smaller charges that accrue over time may be overlooked if we simply put our credit card bills on GIRO payment.

Thus, it is good practice to check your statements regularly in order to dispute any fraudulent charges.

5. Annual Subscriptions

Do you have an annual subscription? If you do, these infrequent bills may catch you off guard if you happen to forget about them.

When put on a GIRO payment, any one of these bills may hit your account when your balance is low, resulting in an overdraft and additional fees.

And like subscription services on autopay, you may also be underutilising or wasting your hard-earned money without you realising it.

Hence, it is a good habit to keep track of your annual subscriptions and avoid having too many of them.

Related Articles:

Advertisement