Global Pension Index 2022 Pension Scheme Study: CPF Got a B Grade Again — Why Didn’t It Get an A?

The Central Provident Fund (CPF) Scored a B Again

Like almost everything in Singapore, everything has to be graded. Even the Central Provident Fund (CPF) retirement system is not immune as it is assessed every year.

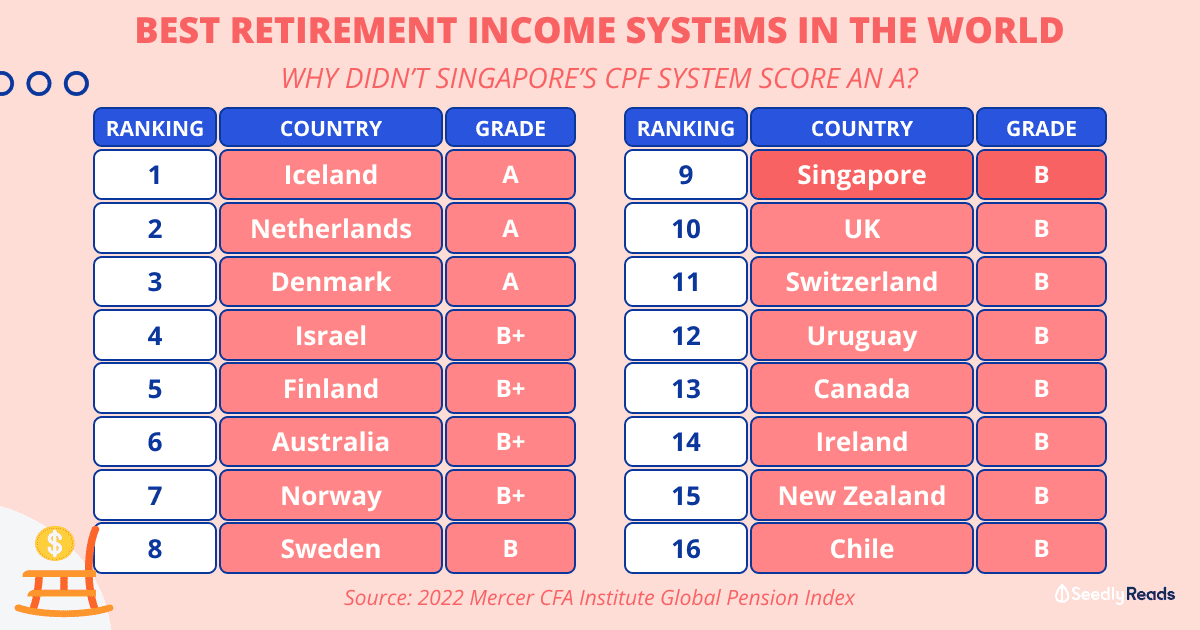

This year, CPF was given a B grade by Mercer in their latest 2022 Mercer CFA Institute Global Pension Index (MCGPI) study — the same grade since 2019.

“How can dis b allow?”

But memes aside, this score indicates that CPF is structurally sound and has many good features. After all, Singapore’s retirement income system is ranked ninth in the world and is the best in Asia, followed by Hong Kong SAR and Malaysia

However, there are also some areas for improvement that differentiate it from an A-grade system.

This puts us on the same grade as the pension systems of:

- Sweden

- UK

- Switzerland

- Uruguay

- Canada

- Ireland

- New Zealand

- Chile

- Germany

- Belgium.

Iceland, Netherlands and Denmark’s pension systems topped the class once again with an A grade, indicating that they have a first-class and robust retirement income system.

Very much like how we constantly strive for an A grade in school, we take a look at what caused CPF to lose points against the rest of the retirement income systems.

TL;DR: Global Pension Index 2022 Pension Scheme Study — Why Did CPF Get a B Again?

Click to Teleport

- How Is the Mercer CFA Institute Global Pension Index Determined?

- What Does the Grading Mean for Pension Funds?

- Mercer CPF Score

- Which Pension Scheme Is Best? Which Country Has the Best Pensions?

- Will There Ever Be a Perfect National Pension Scheme? What Can We Do?

How Is the Mercer CFA Institute Global Pension Index Determined?

But before we get to that, we will break down the MCGPI.

Like any other examination, you will need to know the syllabus (and do lots of ten-year series), before you can do well.

What Are Pensions? Pensions Meaning Explained

Here’s how the the ‘examiner’ Mercer grades retirement income systems:

The MCGPI is a comprehensive study of 44 global pension systems, accounting for 65 per cent of the world’s population.

It benchmarks retirement income systems around the world, highlighting some shortcomings in each system, and suggests possible areas of reform that would help provide more adequate and sustainable retirement benefits.

More specifically, these are the factors that will affect the grading of retirement income systems:

| Adequacy | Sustainability | Integrity | |

|---|---|---|---|

| Indicators | -Benefits -System design -Savings -Government support -Home ownership -Growth Assets | -Pension coverage -Total assets -Demography -Government debt -Economic growth | -Regulation -Governance -Protection -Communication -Operating costs |

| Weightage | 40% | 35% | 25% |

| Overall Value | 100% | ||

What Does the Grading Mean for Pension Funds?

For every score, a country’s pension system will be given a grade as follows:

| Grade | Score | What does it mean? |

|---|---|---|

| A | More than 80 | First class and robust retirement income system that delivers good benefits, is sustainable, with high level of integrity. |

| B+ | 75 to 80 | A system with sound structure and many good features. There are some areas for improvement that differentiates it from an A-grade system. |

| B | 65 to 75 | |

| C+ | 60 to 65 | A system with some good features, but has major risks and/or shortcomings that need to be addressed. Failure to address these shortcomings can hurt the effectiveness or long-term sustainability of the pension system. |

| C | 50 to 60 | |

| D | 35 to 50 | System with some desirable features, but also major weakness and/pr omissions that need to be addressed. Its efficacy and sustainability will be in doubt without these improvements. |

| E | Less than 35 | Poor system that may be in early stages of development or non-existent. |

Mercer CPF Score

While Singapore (74.1) saw a slight dip in its overall index value in 2021, it bounced back this year due mainly to the revised scoring matrix and an increase in net replacement rates.

Most retirement income systems in Asia saw overall improvements except for Mainland China (54.5), Indonesia (49.2) and the Philippines (42).

With the criteria stated above, Singapore’s pension system received a total score of 74.1. This can be broken down into:

- 77.3 for Adequacy

- 65.4 for Sustainability

- 81.0 for Integrity

For context, Singapore’s retirement income sysytem system scored 70.8 in the year 2018.

Pension Scheme Singapore: Why Did We Not Score an A?

For Singapore’s retirement income system to achieve a better score, here’s what the experts at Mercer believe we should be doing:

- Reducing the barriers to establishing tax-approved group corporate retirement plans

- Opening up CPF to non-residents (who make up a significant percentage of

the labor force) - Increasing the age at which CPF members can access their savings set aside for retirement as life expectancies rise

- Improving the level of communication provided to CPF members.

Of the four suggestions, increasing the age to withdraw CPF is definitely something that will be unpopular amongst Singaporeans having worked for almost all their life.

Which Pension Scheme Is Best? Which Country Has the Best Pensions?

Curious about what contributes to Iceland, the Netherlands and Denmark having a first-class pension system?

Let’s take a look and see if there is anything we can possibly learn from them!

The Iceland Pension System

The Dutch Pension System

The Denmark Pension System

Will There Ever Be a Perfect National Pension Scheme?

Despite all the findings, it is important that we acknowledge that there is no one size fits all solution for every country’s pension system. Each country has its own economic, historical, social and cultural circumstances to take into account.

What Are the Different Types of Pensions?

On top of that, there are just simply too many permutations to have a blanket solution to everyone’s retirement plan.

For example according to the Organisation for Economic Co-operation and Development (OECD):

All OECD countries have safety nets in place that aim to prevent poverty of the elderly. These schemes, called “first-tier, redistributive schemes” here, can be of four different types: social assistance, separate targeted retirement-income programmes, basic pension schemes and minimum pensions within earnings-related plans. All of these are provided by the public sector and are mandatory.

The second tier in this typology of pension schemes plays an “insurance” role. It aims to ensure that retired people have an adequate replacement rate (retirement income) relative to earnings before retirement) and not just a poverty-preventing absolute standard of living. Like the first tier, it is mandatory. Only Ireland and New Zealand do not have some form of mandatory, second-tier provision.

What Can We Do?

In Singapore, we once compiled a minimum amount required for Singaporeans to meet their basic needs upon retiring.

| Demographic of household | How much you need for basic needs |

|---|---|

| Single elderly household | $1,379 per month |

| Coupled elderly household | $2,351 per month |

| Single person (aged 55 - 64 years old) | $1,721 per month |

Also, despite Singaporeans living longer, studies have shown that they will have good health until an average of 73 years old. This may lead to additional healthcare costs which we need to factor in for our planning.

The mindset around retirement is that, while the CPF system is ranked ninth in the world, it will be really risky for us to rely on it solely for retirement.

In fact, if we take a look at the payouts for CPF Life, it’ll probably amount to a fraction of your last drawn salary at that stage:

Some of the suggestions that Mercer brought up include:

- Increasing the average retirement age

- Increasing the savings rate.

These changes may be necessary from a holistic point of view for every pension system, but they may be undesirable for an individual.

One possible way Singapore can do better is if employers and government can work together to push out a more coordinated policy or message about saving up for retirement early.

Ultimately, it all boils down to each and every Singaporean. It is extremely important that we plan ahead for our retirement, on top of our reliance on our pension system.

The best time to do this is now!

Read More

- Should You Top-Up Your CPF MA or CPF SA First?

- Ultimate Guide to CPF Interest Rates: Latest Rates, Calculation Methodology & Additional CPF Interest Explained

- CPF LIFE VS Retirement Sum Scheme (RSS): Which One Are You On? What’s the Difference?

- CPF Calculator 2022 Guide: Use This Tool to Forecast Your CPF Retirement Payout & More

Advertisement