In our Seedly Personal Finance Community, the topic of CPF has been a heavily debated one. Everyone has a different opinion on whether CPF is a good thing or a bad thing. However, the answer to this question isn’t that relevant for most people since making CPF contribution is an unchangeable fact of life for Singaporeans and PRs, at least as for now.

What ways can we use our CPF?

Rather, what is worth pondering on is how we can best use the fund that is sitting in our CPF accounts since this is something we can actually decide and act on. However, there is also a plethora of opinion online on how to do this well: Here, we discuss the good, neutral and bad ways of using your CPF money in an attempt to shine some clarity on this topic. (This is in our own opinion only and based on research from sources)

It’s all about Cost VS Benefit analysis

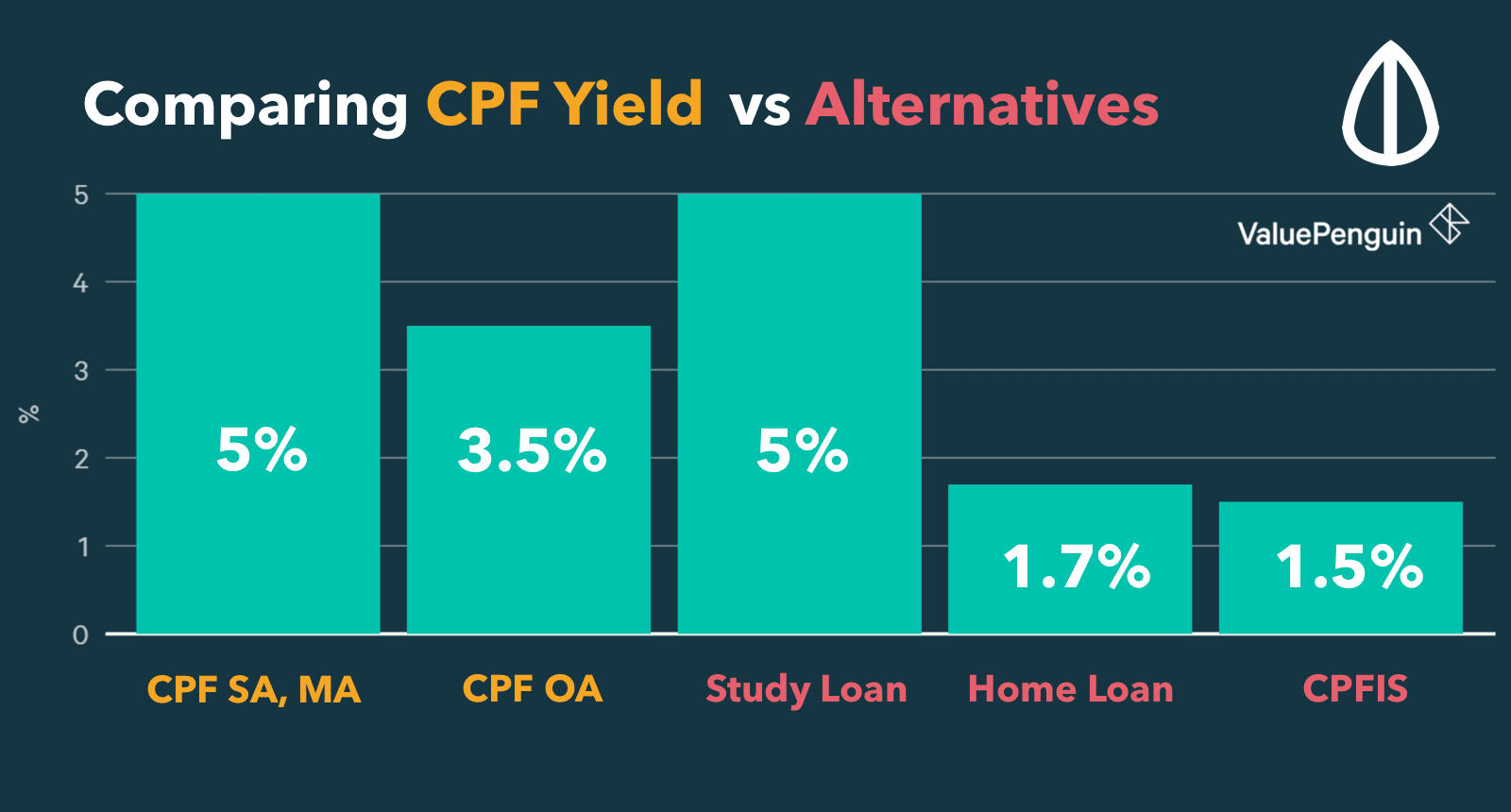

When judging which are the good and bad ways of utilising CPF, you must always consider how the benefit compare against the cost of drawing down on your CPF account. The cost side of the math is actually quite simple: by withdrawing funds from your CPF account to pay for things, you are forgoing the 2.5% to 5% yield that is guaranteed by the government. Therefore, the economic gain you can achieve from using your CPF money elsewhere has to outweigh this cost to justify your withdrawal of your CPF money.

Paying for your home & home mortgage: Bad/Neutral

Ministry of Manpower’s website lists a number of ways that your CPF can be utilised. However, there are a few that aren’t all that ideal. Paying for your home and/or your home loan is one of them. The reason for this quite simple. Since the best home loans in Singapore cost you 1.5%-1.7% per year, it’s just not worth forgoing your guaranteed return of 2.5%-5% to replace your home loan payment. Worse, you have to “pay back” the amount that you withdraw from your CPF accounts that increases at 2.5% per year when you sell your home. Although some may argue that this isn’t a real cost since your CPF account is still your money, this is still a cost in the sense that you are shifting the responsibility of growing your retirement fund from the government to yourself.

However, note that there are much pros and cons when it comes to choosing between whether you should take up a CPF or Bank loan for your home. A snippet can be seen here:

HDB Loan | Bank Loan |

|

|---|---|---|

| Interest Rate | Currently 2.6% (0.1% above the CPF Ordinary Account interest rate) | Currently 3.25% - 4.70% (Depends on the bank and benchmark, interest rates fluctuates) |

| Downpayment | 20% in CPF or Cash | At least 5% in cash+ 20% in cash or using CPF OA savings |

| Maximum Loan | New flats: 80% of the purchase price Resale flats: 80% of the resale price or market valuation, whichever is lower | 75% of the purchase price |

| Minimum Loan | None | Usually $100,000 |

| Late Payment Penalty | Currently 7.5% per annum | Depends on individual banks. Usually less lenient than HDB. |

| Eligibility | Income + citizenship requirements | No restrictions, although a bad credit score might hinder your application |

Paying for your education: Good

In contrast, using one’s CPF to pay for his education can actually be a worthwhile exercise. Even the study loans in Singapore come with an interest rate of around 5% per year, so forgoing the 2.5% that you earn in your CPF Ordinary account is actually a much cheaper way of financing your post-secondary degree if you don’t have sufficient amount of cash on hand. However, you have to take this with a grain of salt mainly because of two reasons.

First, you have to repay the full amount of CPF savings withdrawn for education along with the interest accrued (i.e. 2.5%), as with home loans. While this may not be so difficult with a home loan, since you are receiving a large chunk of money when you sell your property, the only thing you get from a university or a polytech is your diploma, which you can’t sell for a large sum.

Secondly, you have to consider what your return on investment will be post-graduation. While it is true that university graduates and polytechnics graduates make 18% to 50% more than those who only have a secondary degree, this can vary heavily depending on your major as well as the institution you attend. In some cases, attending some of these institutions may not help you make more money compared to what others make with just a secondary degree.

In general, however, we believe achieving higher education is generally a great idea for one’s long-term prospects. Despite the caveats mentioned above, paying 2.5% of opportunity cost for a reasonable chance of increasing your income by at least 20-50% forever (which would mean difference of tens of thousands of dollars) is definitely a good transaction. Of course, this would only apply to those who can’t pay out of pocket for their education expenditures.

CPF Investment Scheme (CPFIS): Bad/Neutral

Another popular way of utilising one’s CPF account is to invest it in stocks, bonds, ETFs, and funds. However, this is generally a bad idea for most people. According to the government’s own study, more than 80% of people who invested their CPF money through CPF Investment Scheme would have been better off leaving their money in their CPF Ordinary Account. This means that they made less than the guaranteed 2.5% by actively seeking out better returns on their own.

This phenomenon is quite illustrative of what psychologists refer to as “better than average bias.” To put it simply, most people think in the world they are above average, which can’t be factually true because “average” by default refers to most people. By believing their ability to produce superior returns to be true, most people make the mistake of foregoing the guaranteed 2.5% yield and end up making less. Unless you are willing and able to put in a lot of effort in studying and evaluating your investment opportunities, you are more likely to be better-off by not participating in CPF Investment Scheme and leaving your money in CPF Ordinary account.

Increasing yield on your CPF accounts: Good

There are other ways you can increase the yield on your CPF money that are safer and more economically sound. For one, allocating your capital to CPF Special Account and Medisave Account can boost your yield from 2.5% to 4%. Not only that, these rates can go up by an additional 1% for the first $60,000 of a member’s combined balances (with up to $20,000 from the OA), and another 1% on the first $30,000 of their combined balances (with up to $20,000 from the OA) for people who are aged 55 and above. This means that people aged 55 and above can earn up to 6% of interest on their retirement balances guaranteed.

Of course, CPF’s study showed that 15% of people who used CPF Investment Scheme generated profit in excess of the 2.5% guaranteed rate that they could’ve earned in their CPFOA. If you are one of these people, you may have a legitimate reason to allocate less money in CPF Special Account account that can grow at 5-6% per year. Otherwise, actively utilising these instruments are great, steady ways to grow your wealth over a long period of time without much risk or effort on your part.

What do you think? Leave your comments below or do chat with our community of savvy Singaporeans here in our Personal Finance community (SG).

This article first appeared on Value Penguin, a guest contributor on The Seedly Personal Finance blog. Edits were made by the Seedly editor to reflect some key pointers which we feel could value add and bring forward a complete picture to our readers.

Advertisement