Good Class Bungalow (GCB) Prices in Singapore: How Much Do You Need To Earn To Afford One?

●

We’ve seen how much we need to earn to afford a freehold condo in Singapore.

But for some, getting a freehold condo might not cut it.

They might be looking at landed properties with multi-million dollar price tags.

But for a select few, the ‘regular’ landed property won’t do.

Enter the Good Class Bungalow (GCB), an exclusive class of property that only the richest of the rich in Singapore can afford.

How expensive, you say?

According to Edgeprop Singapore, the GCB at Queen Astrid park is being rented out to a Chinese national for $200,000 a month or $2.4 MILLION a year!

Cue Crazy Rich Asians Music

So you might wonder how much you would need to earn to afford one of these?

Let’s find out.

TL;DR: Good Class Bungalow in Singapore — How Much Do You Need to Earn to Afford a GCB Singapore

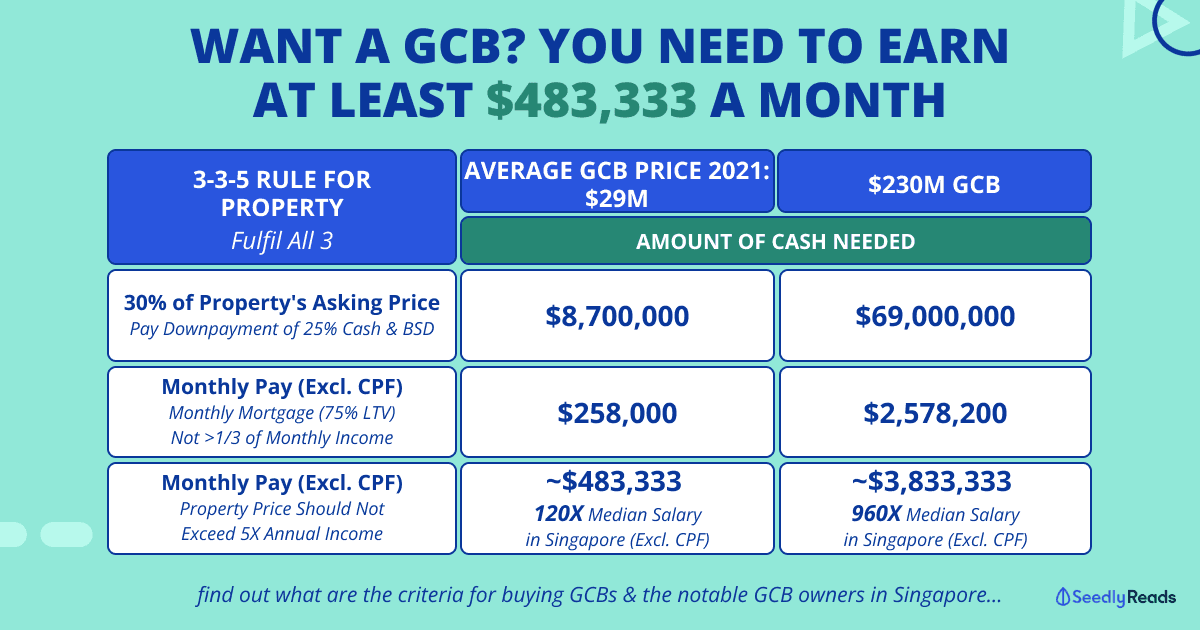

| 3-3-5 Rule For Property Guideline (Fulfil All 3) | Average $29M GCB in 2021 | $230M GCB |

|---|---|---|

| Amount of Cash Needed | ||

| 30% of Property's Asking Price (Pay Downpayment of 25% Cash & BSD) | $8,700,000 | $69,000,000 |

| Total Take Home Pay (Monthly Mortgage (75% LTV) Not >1/3 of Monthly Income) | $258,000 | $2,578,200 |

| Monthly Take Home Pay (Property Price Should Not Exceed 5X Annual Income) | ~$483,333 [120X Median Salary in Singapore (Excl. CPF)*] | ~$3,833,333 [960X Median Salary in Singapore (Excl. CPF)*] |

*According to the Ministry of Manpower (MOM), the median gross income from work in Singapore in 2021 was $4,000 per month (or $48,000 per year).

What is a Good Class Bungalow (GCB)? Is GCB a Freehold?

Good Class Bungalows (GCBs) are the crème de la crème (best of the best) of freehold Singapore properties.

They are also usually the most expensive bungalows in Singapore.

But not all bungalows are Good Class Bungalows.

They have to meet certain criteria.

GCB Meaning: What Does Good Class Bungalow Mean? GCB Meaning

To be classified as a GCB by URA, the bungalow must fulfil the following criteria:

- GCBs cannot be more than two storeys high (excludes attic and basement)

- GCBs need to have a minimum plot size of 1,400 sq m (~15,070 sq ft)

- The living area cannot exceed more than 40 per cent of the plot area

- The other 60 per cent of the plot area is usually dedicated to greenery and landscaping.

List of GCB Areas: What Are the Good Class Bungalow Area?

Also, a GCB must be situated within the 39 areas gazetted by the Urban Redevelopment Authority (URA).

| Belmont Park | Cornwall Gardens | Leedon Park |

| Bin Tong Park | Dalvey Estate | Maryland Estate |

| Binjai Park | Eng Neo Avenue | Nassim Road |

| Brizay Park | Ewart Park | Oei Tiong Ham Park |

| Bukit Sedap | First/Third Avenue | Queen Astrid Park |

| Bukit Tunggal | Ford Avenue | Raffles Park |

| Caldecott Hill Estate | Fourth/Sixth Avenue | Rebecca Park |

| Camden Park | Gallop Road/Woollerton Park | Ridley Park |

| Chatsworth Park | Garlick Avenue | Ridout Park |

| Chee Hoon Avenue | Holland Park | Swiss Club Road |

| Chestnut Avenue | Holland Rise | Victoria Park |

| Cluny Hill | Kilburn Estate | Windsor Park |

| Cluny Park | King Albert Park | White House Park |

Not to mention that many of these areas are large forested areas to ensure that there is sufficient greenery surrounding these properties.

As such, GCBs can command higher prices as compared to other types of landed property due to their exclusivity.

Who Can Buy a GCB? Can Foreigners Own GCB?

Not to mention that typically only Singaporean Citizens can buy them.

But, there are exceptions. Under the Global Investor Programme (GIP), Permanent Residents that have proved to have made exceptional economic contributions to Singapore have been allowed to buy GCBs. The caveat is that they can only personally occupy the GCBs.

Who could forget James Dyson’s $45 million purchase of a GCB on Cluny Road back in 2019.

Good Class Bungalow Price: How Much Does a Good Class Bungalow Cost?

Before looking at how much you need to earn to be able to afford one, let’s take a look at how much GCBs usually cost.

For the whole of 2021, PropNex (SGX: OYY) noted that there were 88 GCB transactions with a total transaction value of about $2.55 billion.

In other words, the average price of a GCB sold in 2021 was about $28.95 million or about $1,685 psf.

We’ll be rounding it up to $29 million for simplicity’s sake.

Some of these properties are owned by well-known businessmen with details spread all over the internet.

Here are some of the most notable GCB purchases in 2021:

| Name | Address | Price |

|---|---|---|

| Zhang Hanzhi, son of Haidilao CEO Zhang Yong | Gallop Road | $27 million |

| Ian Ang, Secretlab CEO | Caldecott Hill | $36 million |

| Chloe Tong, wife of Grab CEO Anthony Tan | Bin Tong Park | $40 million |

| Tan Min Liang, Razer CEO | Third Avenue | $52.8 million |

| Tommy Ong, Stamped.io CEO | Cluny Hill | $63.7 million |

| Chew Shou Zi, TikTok CEO | Queen Astrid Park | $86 million |

| Jin Xiao Qun, wife of Nanofilm Technologies CEO Shi Xu | Nassim Road | $128.8 million |

How Much Do I Need To Earn To Afford an Average Good Class Bungalow

To determine how much you need to earn, you can look at the widely accepted 3-3-5 Rule originated from Vina Ip of PropertySoul.com and endorsed by the Central Provident Fund (CPF) board:

How Much Cash Do You Need for a $29 Million GCB?

First off some assumptions:

- You are a 30 years old single buying their first property

- You have no existing home loans

- You took up a bank mortgage loan and would like to pay off your GCB over 30 years – the maximum period allowed to enjoy the full 75% Loan-to-value (LTV) limit

- You are paying an interest rate of about 2.5 per cent per annum (p.a.) over the loan tenure

- ~$86,000 a month mortgage payment using the home loan calculator from PropertyGuru:

-

Source: PropertyGuru

-

- You are paying for the entire GCB in cash because you have the money and want to set aside your CPF for retirement since you are making such an extravagant purchase

- Monthly income is take-home pay for the same reason.

| 3-3-5 Rule For Property Guideline (Fulfil All 3) | $29M GCB Amount (Cash) |

| 30% of Property’s Asking Price (Used To Pay Off Downpayment of 25% Cash & BSD) | $8,700,000 |

| Total Take Home Pay (Monthly Mortgage Payment Only 1/3 Monthly Income) | $258,000 |

| Monthly Take Home Pay (Property Price Should Not Exceed 5X Annual Income) | ~$483,333 ($5,800,000/12) |

Based on the fulfilment of all three criteria for the 3-3-5 guideline, you will need to be earning at least $483,333 a month (excluding CPF) or $5,800,000 a year to afford your $29 million property comfortably.

According to the Ministry of Manpower (MOM), the median gross income from work in Singapore in 2021 was $4,000 per month (or $48,000 per year).

That’s more than 120 times the salary of an average salaryman in Singapore.

Yes, don’t forget your Buyer’s Stamp Duty (BSD), which gets progressively more expensive as the price tag of your house increases.

| Purchase Price/Market Value of Property | BSD Rates (Residential Properties) |

| First $180,000 | 1% |

| Next $180,000 | 2% |

| Next $640,000 | 3% |

| Remaining Amount | 4% |

Based on the rates above, the BSD for a $29 million property is about $1.14 million. 🤯

This is also based on the assumption that this is your first property.

Otherwise, there’s also Additional Buyers Stamp Duty (ABSD) to take note of.

We can all agree – you need a LOT of spare cash to be lying around to afford one of these opulent homes.

How Much Do You Need for a $230M GCB Then?

Now, aren’t you curious how much you would need to afford the $230 million jewel nestled at 33 Nassim Road that was sold in 2019?

Let’s do some quick math using similar assumptions:

- You are a 30 years old single buying their first property

- You have no existing home loans

- You took up a bank mortgage loan and would like to pay off your GCB over 30 years – the maximum period allowed to enjoy the full 75% Loan-to-value (LTV) limit

- You are paying an interest rate of about 2.5 per cent per annum (p.a.) over the loan tenure

- ~$859,400 a month mortgage payment using the home loan calculator from MoneySense:

-

Source: PropertyGuru

-

- You are paying for the entire GCB in cash because you have the money and want to set aside your CPF for retirement since you are making such an extravagant purchase

- Monthly income is take-home pay for the same reason.

| 3-3-5 Rule For Property Guideline (Fulfil All 3) | $230M GCB Amount (Cash) |

| 30% of Property’s Asking Price (Used To Pay Off Downpayment of 25% Cash & BSD) | $69,000,000 |

| Total Take Home Pay (Monthly Mortgage Payment Only 1/3 Monthly Income) | $2,578,200 |

| Monthly Take Home Pay (Property Price Should Not Exceed 5X Annual Income) | ~$3,833,333 ($46,000,000/12) |

Along with the assumptions made earlier, you would need a $3.8 million monthly salary (excluding CPF) or a $46 million annual salary to pay for this place comfortably.

That’s about 960 times the monthly pay of an average salaryman in Singapore.

This translates to a $46 million annual salary.

Whoa.

Not even our prime minister has such a salary.

Based on the rates above, the BSD for a $230 million property is about $9.19 million. 🤯

Other Things to Take Into Account

The high costs of owning a GCB do not stop at its upfront costs.

Besides having to fork out high monthly repayments, having such an ample space would mean more enormous bills to pay too.

This includes:

- Higher property taxes

- Costly home insurance

- A much larger renovation bill

- More expensive furnishings, utility bills…

You get my drift.

Are Good Class Bungalows Achievable Then?

Now that we’ve seen the intimidating numbers, does it mean that GCBs are unattainable then?

Well, apparently not.

Since there are 2,800 plots around Singapore, thousands of people can actually afford them. 🤔

Also, we can imagine that the fabulously wealthy would have enough money to pay for such houses in cash.

So perhaps they don’t need that high of a salary to sustain a monthly repayment but clear these payments in a quick, billionaire-ish way instead.

Are Good Class Bungalows Worth the Money?

While it seems like these properties come at an unimaginable, out-of-the-world price tag, they might be just another money-making tool for the elite.

You know, through flipping properties and all that jazz.

I guess that’s how the rich get richer too.

It kinda amazes (and intrigues) me that here we are trying to make smarter personal finance decisions and fretting over which HDB BTO project to get while the ultra-rich in Singapore are just playing a totally different ball game altogether.

If you’re a peasant like me interested in having your burning property questions answered, hop on over to our Seedly Community!

Advertisement