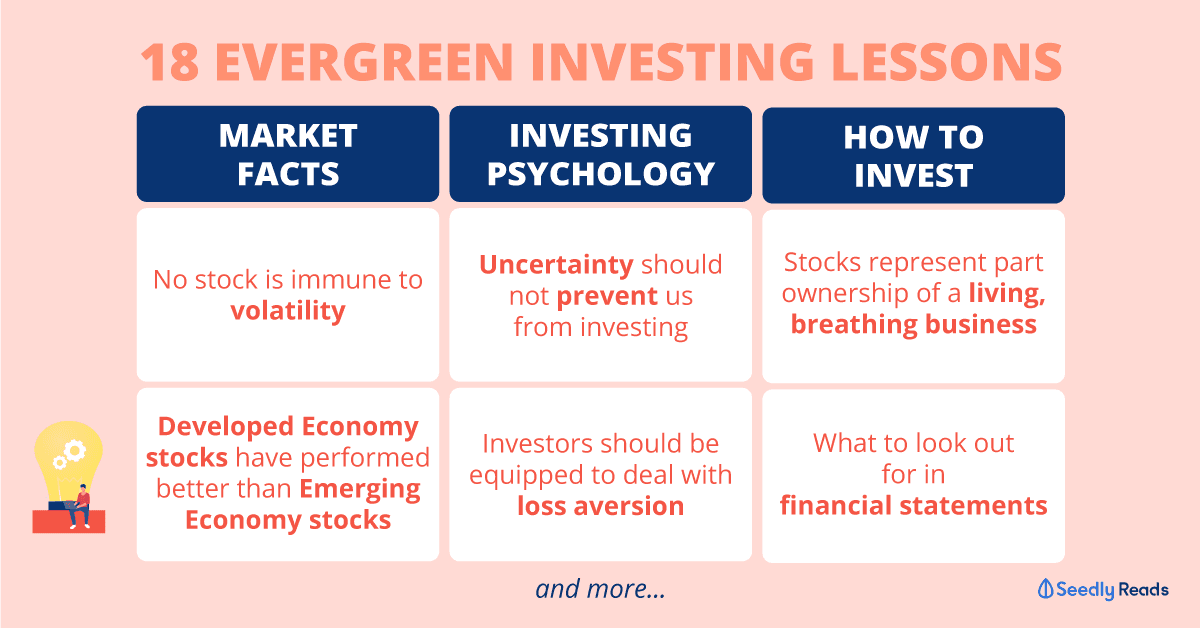

18 Evergreen Investing Lessons Every Investor Should Know

I started investing in October 2010 and have learnt a lot along the way.

Here are 18 evergreen lessons so that you, dear reader, can become a better investor.

I will be splitting the lessons into three broad categories:

- Market Facts

- Investing Psychology

- How to Invest.

Market Facts

1. Keep Your Eyes Open

There are many hucksters out there.

When learning about investing from someone, always ask about their track record.

How many “students” they have, how long they have been in the business, or much money they are managing does not matter. The key is this: how have they done over a long period of time (five years and more)?

2. Stocks Represent an Ownership Stake in the Company

Stocks represent part ownership of a living, breathing business.

3. Stock Price Is Tied to the Business Performance Over the Long Run

If a business does well over time, its stock price will do well too eventually; if a business does poorly, so too will its stock price.

4. Developed Economy Stocks Have Performed Better Than Emerging Economy Stocks

According to the Credit Suisse Global Investment Returns Yearbook 2019 report, Developed economy stocks have climbed by 8.2% per year from 1900 to 2018 – this turns $1,000 into $10.9 million.

Emerging economy stocks have climbed by 7.2% per year from 1900 to 2018 – this turns $1,000 into $3.7 million.

5. No Stock Is Immune to Volatility

Stocks have been volatile over the short run – it happens to even the best of stocks.

6. Stocks With Fantastic Long-Term Returns Can Be Agonising to Own Over the Short-Term

From 1997 to 2018, the peak-to-trough decline for Amazon.com’s share price in each year ranged from 12.6% to 83.0%, meaning to say that Amazon’s share price had experienced a double-digit peak-to-trough fall every year.

Over the same period, Amazon has seen its stock price climb from $1.96 to $1,501.97, for an astonishing gain of over 76,000%.

7. It is ‘Natural’ for Stocks to Be Volatile

It makes sense for stocks to be volatile. If stocks went up 8% per year like clockwork without volatility, investors will feel safe.

In a world where stocks are guaranteed to give 8% per year, the logical response from investors would be to keep buying them, till the point where stocks simply become too expensive to continue returning 8%, or where the system becomes too fragile with debt to handle shocks.

Thing is, there are no guarantees in the world. Bad things happen from time to time. And when stocks are priced for perfection, any whiff of bad news will lead to tumbling prices.

8. Stock Investing Allow You to Be a Silent Partner

Investing in stocks allows you to be a silent partner to some of the best businessmen and investors on the planet.

Investing Psychology

9. Uncertainty Should Not Prevent Us From Investing

There are always things to worry about and the future is always uncertain. But that does not mean we shouldn’t invest.

The past 53 years from 1965 to 2018 included the Vietnam War, the Black Monday stock market crash (when US stocks fell by more than 22% in a day), the “breaking” of the Bank of England (when the UK was forced to allow the pound to have a floating exchange rate), the Asian Financial Crisis, the bursting of the Dotcom Bubble, the Great Financial Crisis, Brexit, and the US-China trade war.

But in those 53 years, the book value of Warren Buffett’s Berkshire Hathaway grew by 18.7% per year while its stock price increased by 20.5% per year.

An 18.7% input has still led to a 20.5% output despite all these things to worry about.

10. Investors Should Be Equipped to Deal With Loss Aversion

Loss aversion is a psychological bias most people have where a loss feels twice as painful as an equivalent gain.

Put in place systems to help you deal with the psychological pain when stocks fall from time to time.

The most important organ for investing is not the brain, but the stomach. We must not be scared off by short-term declines.

How to Invest

11. Investment Philosophies Should Be Built on the Idea That Stocks Represent Part Ownership of a Business

The most sensible investment philosophy should be built on the idea that stocks represent part ownership of a living, breathing business.

And there are times when a stock has a price that’s significantly lower than the value of its underlying business – investing is about identifying these instances!

There are many different ways to invest with the philosophy above. The three broad categories are:

- Stocks that are cheap based on their financial statements

- Stocks that are cheap based on their financial statements and appraisal of their current business conditions

- Stocks that are cheap based on how well their businesses may do in the future.

12. Financial Statements 101

There are three financial statements every listed company must report:

13. Income Statement 101

The income statement measures how much sales a company makes, and how much profit the company makes; the balance sheet tells us what a company owns, and what it owes; the cash flow statement tells us how much cash a company brings in. It’s important to have basic accounting knowledge so you can track the progress of a company. Each financial statement has many important things to look at, but there are a few that are critical.

Here are the critical things to look out for in a company’s income statement:

- Revenue (how much sales a company makes)

- Gross profit margin

- Operating profit margin

- Net profit margin

- Net profit (what’s left from sales after deduction of all expenses)

- We typically want fat gross margins, fat operating margins, and fat net profit margins.

14. Balance Sheet 101

Here are the critical things to look out for in a company’s balance sheet:

- Level of cash and level of debt; we typically want cash to be significantly higher than debt

- Slightly less important things are total assets (what the company owns), total liabilities (what the company owes), and total equity (total assets minus total liabilities).

15. Cash Flow Statement 101

Here are the critical things to look out for in a company’s cash flow statement:

- Operating cash flow (the cash flow generated from the company’s normal business operations)

- Capital expenditure (what the company has spent to maintain its business at the current state)

- We typically want high operating cash flow and low capital expenditure; the difference between operating cash flow and capital expenditure is free cash flow – the higher the better.

The next points will cover some iinvestment strategies that build off the idea that stocks represent part ownership of a living, breathing business

16. Finding Stocks That Are Cheap Based on Their Financial Statements

This investment strategy focuses on finding a large group of stocks with share prices that are low in relation to their net profit and/or their total equity and buying an entire basket of them.

This basket is typically held for anywhere from a quarter to two-years, and the search-and-investing process is then repeated.

17. Finding Stocks That Are Cheap Based on Their Financial Statements and Appraisal of Their Current Business Conditions

This investment strategy focuses on the analysis of a company’s business and financials to determine its underlying intrinsic value (nearly always how much cash it can generate from now to eternity, discounted back to the present), and then buying only a small handful of stocks with share prices that are much lower than their underlying intrinsic values.

18. Finding Stocks That Are Cheap Based on How Well Their Businesses May Do in the Future

This investment strategy is where I have found the most success in, and find the most intellectually stimulating.

To do well in this area requires two very important things:

- Patience, because share prices need time to reflect the strengths of the business, and because compounding takes time, and

- A strong stomach to withstand volatility.

To find these types of stocks, I use the following set of criteria to identify them:

- Revenues that are small in relation to a large and/or growing market, or revenues that are large in a fast-growing market

- Strong balance sheets with minimal or reasonable levels of debt

- Management teams with integrity, capability, and an innovative mindset

- Revenue streams that are recurring in nature, either through contracts or customer-behaviour

- A proven ability to grow

- A high likelihood of generating a strong and growing stream of free cash flow in the future.

For a more thorough take on the six criteria, check out our investment framework!

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any stock.

This article first appeared on The Good Investors and is part of a content syndication agreement between The Good Investors and Seedly.

The Good Investors is the personal investing blog of two simple guys, Chong Ser Jing and Jeremy Chia, who are passionate about educating Singaporeans about stock market investing.

If you have any questions about this stock and other stocks in general, why not head over to the SeedlyCommunity to discuss them with like-minded individuals?

Advertisement