Ever wanted to start a business but don’t know how?

From formulating an idea to getting funds, the process of starting up a business is never easy. Especially so if you are unable to find the right support and community to help validate ideas, and navigate through the entrepreneurship landscape!

For aspiring entrepreneurs and early-stage start-ups, here are some of the start-up grants and resources available at your disposal, to turn your idea into reality!

Disclaimer: This is NOT a sponsored post, we wrote this to help you, big dreamers!

Start-Up Grants Available For Early Stage Start-Ups

Being one of the best places in the world to start a business, there are many available government schemes in Singapore to help new businesses with funding, the main conditions for the entrepreneur to fulfill to be eligible for such fundings is:

- Singaporean/PR

- The company has to be based in Singapore

- Have a minimum of 30% local shareholding

Of course, these preconditions may vary for different grants providers. Here are some interesting grants you can try out for!

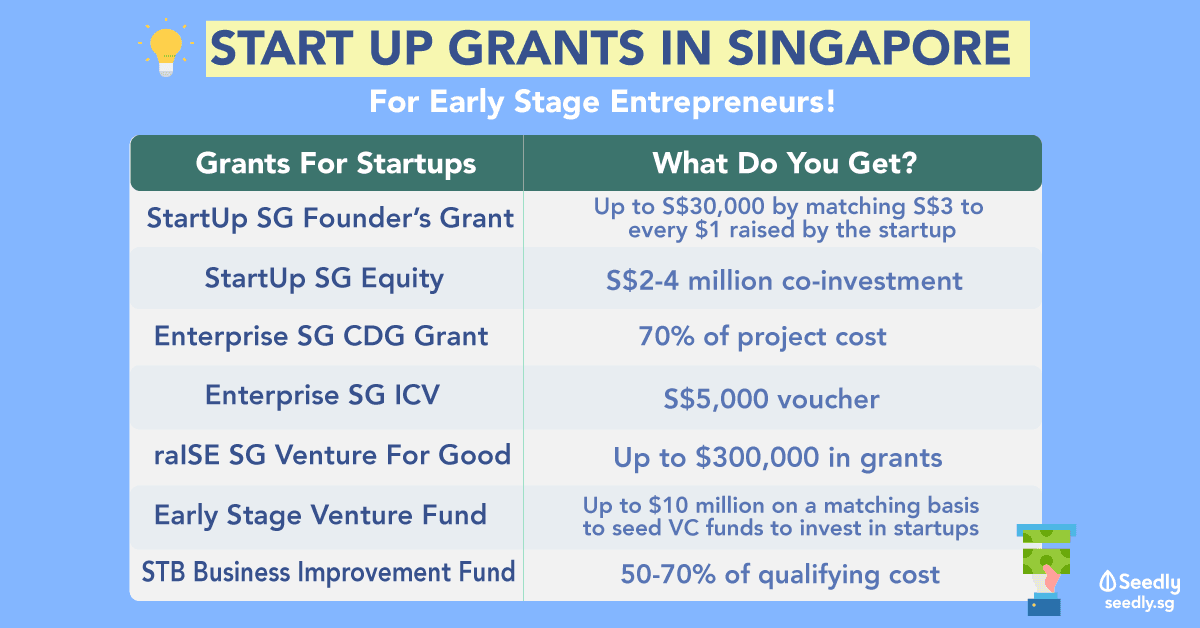

TL;DR: Start-Up Grants And Resources For Early Stage Entrepreneurs

| Grants For Start Ups | What Do You Get? |

|---|---|

| 1. StartupSG Founder Grant | Grant: Up to S$30,000 by matching S$3 to every $1 raised by the startup This is mainly for people who are starting their own businesses for the first time. |

| 2. StartupSG Equity | Private Sector + Government investments Up to $2 million for general tech companies, $4 million for deep tech companies. |

| 3. StartupSG Tech | Companies will receive funding for both Proof-of-Concept (POC) and Proof-of-Viability (POV) projects POC project - funding up to S$250,000 POV project - funding up to S$500,000 |

| 4. Capabilities Development Grant (CDG) by Enterprise Singapore | Grant defrays up to 70% of qualifying project costs |

| 5. Innovation and Capability Voucher (ICV) by Enterprise Singapore | S$5,000 voucher for you to develop your business capabilities |

| 6. raISE SG VentureForGood Grant | apply for up to $300,000 in grants |

| 7. National Research Foundation (NRF) – Early Stage Venture Fund (ESVF) | Through ESVF, NRF invests $10 million on a matching basis, to seed corporate venture capital (VC) funds to invest in startups. |

| 8. Singapore Tourism Board – Business Improvement Fund (BIF) | SME applicants: up to 70% of qualifying costs Non-SME applicants: up to 50% of qualifying costs |

1. Grants From ACE: Action Community For Entrepreneurship

Startup SG Founder

Grant: Up to S$30,000 by matching S$3 to every $1 raised by the startup

This is mainly for people who are starting their own businesses for the first time.

- Mentorship and business guidance from Singapore-based incubators.

- Apply through an Accredited Mentorship Partner (AMP).

| Terms and Conditions | |

|---|---|

| On Applicant | Main applicant(s) must: Be a first-time entrepreneur & Singaporean Citizen / PR Hold more than 30% equity Be a key decision maker and commit full time to the company upon acceptance of grant |

| On Company | In addition, the Startup Company must: Be operating within six (6) months of incorporation at the point of application Have minimum 51% Singaporean Citizen/ PR shareholding Have business activities conducted wholly or mainly in Singapore Have not received funding for the proposed business idea from another government organisation Not be in areas such as cafes, nightclubs, lounges, bars, foot reflexology, massage parlours, beauty salons, gambling, prostitution, social escort, etc. |

How To Apply?

- Attend ACE’s grant briefing that’s conducted on the 1st Friday of every month.

- Apply for BACECAMP

- Go through the program

- Successful start-ups will be recommended to Enterprise Singapore for the appropriate funding.

2. Startup SG Grants

Startup SG Equity

As part of the Startup SG Equity scheme, the government will co-invest with independent, qualified 3rd party investors into eligible startups. This scheme aims to stimulate private-sector investments into innovative, Singapore-based technology startups with intellectual property and global market potential.

Grant:

| General Tech | Deep Tech | |

|---|---|---|

| Investment Cap for each startup | $2M | $4M |

| Co-investment ratio | 7:3 up to $250K, 1:1 thereafter up to $2M (only for SC’s investments) | 7:3 up to $500K, 1:1 thereafter up to $4M (only for SC's investments) |

- The Singapore government will provide 70% of the funding in an initial investment round of S$250K (S$500K for “deep tech” startups).

- Thereafter, the Singapore government will invest S$1 for every S$1 invested by private investors up to a cap of S$2 million (S$4 million for “deep tech” startups).

This is mainly for startups that are improving existing technologies, that require exorbitant capital and may take longer to succeed commercially.

You can find out more about the eligibility for start-ups or third-party investors, and apply for the Startup SG Equity at their website.

Startup SG Tech

- Companies will receive funding for both Proof-of-Concept (POC) and Proof-of-Viability (POV) projects

- POC project – funding up to S$250,000

- POV project – funding up to S$500,000

Criteria:

- Annual revenue must be less than S$100 million or the company must employ fewer than 200 people

There are six pillars of support, the rest are Startup SG Accelerator, Startup SG Loan, and Startup SG Talent, which focuses on other aspects of building your business.

3. Grants From Enterprise Singapore

Capabilities Development Grant (CDG) by Enterprise Singapore

- The grant defrays up to 70% of qualifying project costs such as consultancy, training, certification and equipment expenses.

- The application requirements for smaller scale projects (grant support of S$30,000 or less) has also been simplified. Look forward to an easier application process with more streamlined forms and documentation requirements.

Criteria:

- Group annual sales turnover of S$100 million or less, or group employment of up to 200 employees.

Innovation and Capability Voucher (ICV) by Enterprise Singapore

- S$5,000 voucher for you to develop your business capabilities

- Such as upgrading and strengthening their core business operations

- Entitled to a maximum of eight vouchers, and the duration of each project should not exceed six months.

Criteria:

- Group annual sales turnover of S$100 million or less, or group employment of up to 200 employees.

- Purchase/lease/subscription of the IT solutions or equipment must be used in Singapore.

4. raISE SG: VentureForGood Grant

The VentureForGood (VFG) grant is a funding scheme under raiSE to support social enterprises in various stages of their business. New and existing social enterprises who are starting up or expanding their operations can apply for up to $300,000 in grants.

Who can apply for the VentureForGood Grant?

The raiSE Grant is open to all new and existing locally-based social enterprises that are registered/ intend to register under the Companies Act or Co-operative Societies Act.

For applicants who have not incorporated their business at the point of application and are in the process of prototyping, a partnership with a relevant Social Service Agency (SSA) and/or validations with intended beneficiary groups should be illustrated.

The company should be incorporated and be registered as a raiSE member at the point of grant disbursement.

The social enterprise should be addressing a local social gap/need through one or more of the following outcome areas to be eligible:

| Details | |

|---|---|

| Beneficiary-focused | - Provision of employment opportunities. - Provision of good and services, in the areas of (i) education, (ii) skills development, (iii) basic human needs, (iv) economic tools and services and (v) health care / social care. |

| Non-beneficiary focused | - Capacity building for organisations in the social sector - A social gap (identified by a public sector agency) that is not specifically targeted at beneficiary groups, but delivering impact to build resilient communities. Examples include mental health & well-being, ageing, caregiving and also emerging needs such as food and water security. |

To find out more and apply for the VentureForGood fund, you can head over to raISE’s website for more details.

5. National Research Foundation (NRF) – Early Stage Venture Fund (ESVF)

- Invest in Singapore-based early-stage technology start-ups.

- Through ESVF, NRF invests $10 million on a matching basis, to seed corporate venture capital (VC) funds to invest in startups.

Criteria for these aren’t explicitly mentioned but you may check out their website to find out more.

Except that it would like the startup to source for innovative technologies and business models as part of their overall corporate strategy, and in the process improve their innovation capacity.

6. Singapore Tourism Board – Business Improvement Fund (BIF)

- SME applicants: up to 70% of qualifying costs

- Non-SME applicants: up to 50% of qualifying costs

Criteria:

- Tourism companies taking on capability development initiatives

- Technology companies that create innovative technology products and services for tourism businesses.

Other Funding Alternatives: Loans

Apart from the available grants that I have listed above (not exhaustive), other ways you can fund your business would be by taking up a loan.

But never take up a loan to only land yourself up in more loans which will reflect negatively on your debt to equity ratio.

SME Micro Loans

- Companies with 10 or fewer employees that have products or services on the market may access working capital financing of up to S$100,000 to support their day-to-day business operations.

SME Venture Loan

- Innovative, high-growth companies that have products or services on the market may access alternative financing of up to S$5,000,000 for the purpose of business expansion.

There are many ways you could fund your dreams, some other alternatives could be pitching your business models to angel investors or venture capitalists.

Starting A Business In SG: Join Our Comunity Of Entrepreneurs!

In collaboration with Enactus Singapore, ACE, and Young Sustainable Impact SEA, Seedly aims to contribute to the start-up ecosystem by providing a QnA platform for entrepreneurs to ask and answer finance-related questions on Entrepreneurship in Singapore.

If you’re an aspiring entrepreneur, don’t forget to head over to our Seedly QnA to ask any entrepreneurship-related questions!

We will have experts, grant providers, and start-up founders to start a discussion that will help grow your ideas into viable businesses.

Advertisement