GST on Imported Goods: You Need To Pay for Items Above $500 When You Travel More Than 48 Hours

Have you ever spotted your friend, colleague or relative carrying a new Louis Vuitton, Christian Dior or Chanel bag and wallet when they are back from an overseas trip, especially in Europe?

Or, are you the one who tends or plans to splurge when you’re overseas?

Now, before you go on a luxury shopping spree online or overseas, if you don’t already know, there’s actually Goods and Services Tax (GST) to be paid.

Yup, we aren’t joking. GST is applicable for overseas purchases too.

If you’re jumping out of your skin, don’t worry. There are actually criteria on what would be taxed.

You don’t have to pay for every luxury or branded item, so read on to find out what and how much you need to pay!

TL;DR: GST on Imported Goods, How To Declare and Pay GST and if Branded Goods Are Cheaper Overseas

Click here to jump:

- GST on imported goods and overseas purchases, online purchases and gifts

- How to pay the taxes and make declarations

- Are luxury goods really cheaper overseas?

- How to save more for trips?

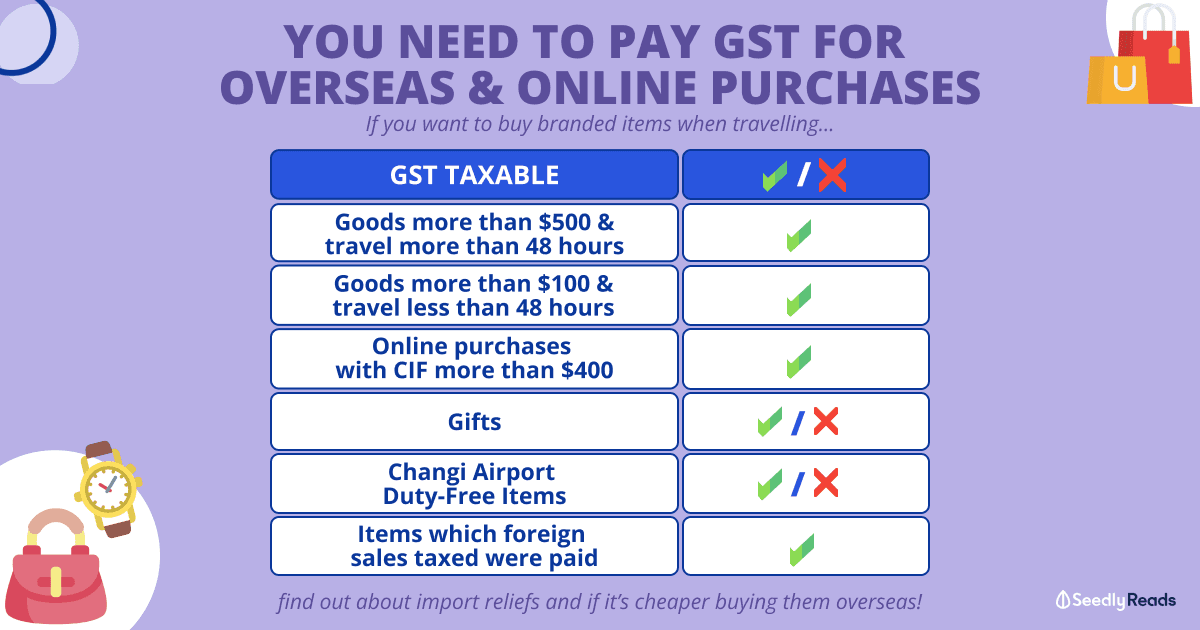

GST Taxable Goods

Currently, GST is at 7% and is expected to increase to 8% in 2023, and 9% in 2024.

By definition, GST is the tax levied on the value of imported goods, which may include the cost, insurance and freight (CIF) and other chargeable costs and the duty payable (if applicable), regardless of whether they are imported through commercial shipments or hand-carried by travellers for personal use and consumption.

According to Customs Singapore:

Arriving travellers are required to declare and pay the duty and Goods and Services Tax (GST) to bring in dutiable and taxable goods exceeding their duty-free concession and GST relief.

This means that travellers, including Singaporeans returning from overseas, will have to pay GST on the value of goods that exceeds the GST relief.

I know how you’re feeling…but there are actually concessions.

1. What Is GST Import Relief And How to Calculate It?

Travellers are granted GST import relief on goods (excluding liquor and tobacco) that are purchased overseas and brought into Singapore.

The relief is available for all travellers except those who are on a work pass, student pass, dependent pass or long-term pass issued by the Singapore Government and crew members.

For your information, this is the relief amount:

| Time Away From Singapore | Value of Goods Granted GST Relief (SGD) |

|---|---|

| ≥ 48 hours | $500 |

| < 48 hours | $100 |

In essence, if the value of the item purchased exceeds the amount of GST import relief granted, travellers are required to pay GST, which will be applied to the excess amount.

To illustrate, we will use two examples:

- Scenario 1: You’ve spent more than 48 hours travelling in Malaysia and have purchased an item that is $600.

The GST import relief granted is $500 and you will need to pay GST that is applicable on the remaining $100.

So, the 7% is applied to the remaining $100, which is $7.

- Scenario 2: You’ve made a day trip to Malaysia and purchased an item for $600.

The GST import relief granted is $100, and you will need to pay GST for the remaining $500. Therefore, the GST you should be paying would be $35.

Based on the examples above, it makes more sense to purchase an expensive item when you’re going to spend more than 48 hours abroad.

If you haven’t noticed by now, the higher the price of your item, the more tax you’ll be paying.

A woman was actually arrested for failing to pay her GST of more than $11,000 when she bought luxury goods overseas.

There have also been other cases such as a man being fined $4 million for evading $1,252,100.18 of GST.

If you don’t want to run into issues with the law, make sure you declare your items and pay the taxes accordingly.

2. What About GST on Online Purchases and What is GST Exempt in Singapore?

All imported goods via post or air are exempt from GST if their total CIF value is less than $400, except alcoholic beverages and tobacco.

There is no GST relief if the value exceeds $400 and GST is payable on the total value of the shipment.

GST relief is also not granted for goods imported by other transport modes such as sea freight and land.

3. What if the Item Was Received as a Gift?

Here comes the tricky part – since it’s a gift, you would likely not have the receipt.

In such cases, the value of the item will be assessed based on the values of identical or similar goods when computing the GST payable.

I know it’s hard, but do yourself a favour to check with the gifter if they have paid the GST.

4. What if You’ve Paid the Sales Tax When You’re Overseas?

GST is payable regardless of whether foreign sales taxes were paid.

This means that even when you’ve made your purchase at a Tax-Free shop when overseas (regardless of whether you claimed tax rebates), you would still be required to pay GST.

5. What if You’ve Purchased From A Duty-Free Shop in Changi Airport Before Travelling?

Similarly, even when you’ve purchased an item from a duty-free shop, the item is subject to GST if it exceeds the GST relief amount.

How To Pay GST for Your Branded Purchases

1. Declare Your Purchases at the Red Channel

The Red and Green Channels system is used in Singapore as the main entry point for travellers.

After immigration clearance, the arrival hall has Red and Green Channel indicators above the examination desks.

Before passing through immigration, inform the inspecting officer at the Red Channel or at the Customs Examination Area if you are carrying any dutiable, taxable, regulated, or prohibited products.

You will need to present a valid Customs import permit for clearance if you are carrying these:

| Items That Require a Customs Import Permit (Non-Exhaustive) |

|---|

| More than 0.4kg of cigarettes or other tobacco products |

| More than 10 litres of liquor products |

| More than 10 litres of motor fuel in a spare container of a motor vehicle |

| More than 0.5kg of investment precious metals for personal use |

| Goods for trade, commercial or business purposes, in which the GST payable exceeds S$300 |

| Goods marked as trade samples with value exceeding SGD400 (excluding liquor and tobacco products) |

2. Make Payment Online

Similar to paying your income tax, you can also make your GST payment online.

You can do so using credit cards (Visa or Master credit cards on the Customs@SG Web Application and American Express), mobile wallets, NETS and Cashcard at the Singapore Customs Tax Payment Office.

3. What if I Failed To Declare the Goods?

For failing to declare products you bought overseas that are worth more than the amount of GST relief you are eligible for, the overdue GST will be collected from you from Singapore Customs.

Furthermore, if you fail to declare the value of your purchase, you may be fined up to $10,000 or jailed for up to 12 months, or both.

Are Branded or Luxury Goods Really Cheaper Overseas?

This begs the question – are these items really cheaper?

If you’re travelling to Europe and the United States, probably.

In Europe, foreign travellers (non-European Union) can claim a Value-Added Tax (VAT) refund on eligible purchases. The VAT is akin to our GST, fluctuates from 7 to 25%, and is usually included in the market price of the item.

The policies governing VAT vary across Europe and most countries usually require you to meet a minimum spend.

There are numerous high-end fashion houses in Paris, including well-known brands like Chanel, Louis Vuitton, Givenchy, Hermes, Chloe, YSL, and Celine, to name a few.

Currently, the VAT refund criterion in Paris is to spend 100EUROS within 3 days in the same departmental store to receive a 12% tax refund.

If you intend to get a branded item, I personally don’t think it would be hard to hit this amount.

Do note that the United Kingdom is the only European country not to offer VAT-free shopping for foreigners (because of Brexit).

State Sales Tax in the US

Contrary to Europe, the US has a state sales tax which varies across states.

However, there are outlet malls that generally sell products at a cheaper rate, as compared to the same products in other countries.

If you’re travelling during sales periods such as Black Friday, things are really much cheaper. I myself have recently acquired a friend’s help to get an item that’s retailed for SGD150+ in Singapore, but SGD70 after conversion in the US.

There is no standard sales tax rate, some states may not even offer tax refunds and the refund processes vary too.

To ensure you receive a tax return, you should research the state’s sales tax and tax refund policies before you shop. You might be able to earn a tax refund if you plan ahead.

The general rule of thumb when shopping for luxury goods in Europe and the US is if the brand has its headquarters in either place, it is cheaper there.

Just don’t forget to pay your GST where applicable!

Optimise Your Overseas Spending

Now, we know that you intend to splurge on branded/luxury items, but if you can save on things like flight and hotel bookings using credit cards, why not?

If you want to save some pesky conversion fees or don’t wish to bring so much cash overseas, you can also consider using a Multi-Currency Card.

After all, we want to stay on top of our finances but still get the most bang for the buck.

Related Articles

- The Best Desaru Resorts From S$46/Night For Your Next Weekend Vacation

- Best Money Changers In Singapore With The Best Exchange Rates

- KTM Train Singapore Guide: How To Travel to JB & Back via the KTM Train & Avoid Jams

- Touch ‘n Go Card: Where To Buy, How To Buy, How to Reload & Scams

- Best Credit Cards for Complimentary Airport Lounge Access

Advertisement