Singapore Income Tax 2024 Guide: Singapore Income Tax Rates & How to File Your YA2024 Taxes

If you’re working in Singapore, chances are, you probably need to pay income tax.

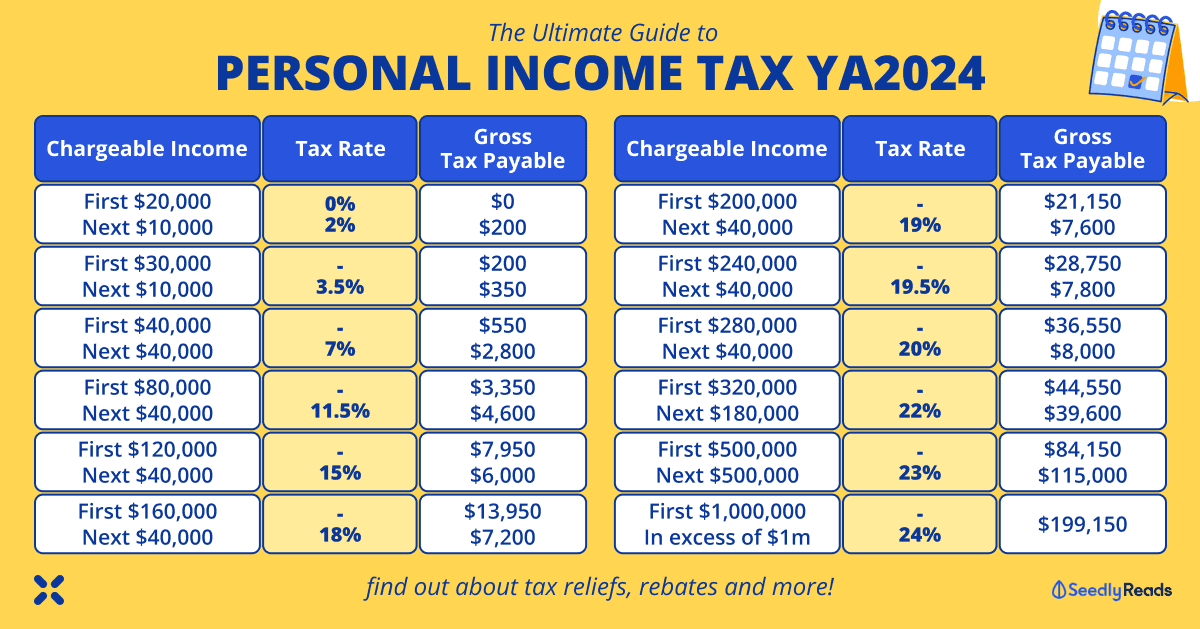

Here in Singapore, we follow a progressive personal income tax rate structure and for YA2024, the tax rate starts at 0% and maxes out at 24% for chargeable income above $1,000,000.

Thankfully, there are no capital gains or inheritance tax.

Think that this is all too cheem (Hokkien: complex)?

Fret not!

This really simple and essential guide should help you figure out your personal income tax in no time!

This guide is written for Year of Assessment (YA) 2024, the next tax year in which income tax is calculated and charged. The assessment is for the income you have earned in the preceding calendar year.

For YA 2024, the assessment is on the income you earned from 1 January 2023 to 31 December 2023. The deadline for personal income tax submission will be by 18 April 2024 (Thursday) if you e-file. Use the filing checker to find out if you need to file an income tax form.

Here’s all you need to know!

TL;DR: Singapore Personal Income Tax Guide 2024 — Year of Assessment (YA) 2024 Singapore Tax Guide

Paying your taxes is mandatory as it helps to fund Government spendings on common resources (e.g. infrastructure like roads, education, and security like the Singapore Armed Forces and the Singapore Police Force).

It’s pretty straightforward as you can do it online via myTax Portal or by paper filing.

To pay lesser tax, you can do so through various (legal) ways like donating to an approved Institution of Public Character (IPC), contributing to the Supplementary Retirement Scheme, and topping up your Central Provident Fund (CPF), etc. Do note that you can only claim up to $80,000 of personal income tax relief for YA2024.

If you want to know exactly how much income you have to pay…

You can use the IRAS Personal Tax Calculator to find out!

Jump to:

- How Do I Know If I’m A Tax Resident?

- Singapore Tax Resident Categories

- Do I Need to Declare in my Income Tax for 2023?

- Personal Income Tax Rates for Residents in Singapore 2023

- FAQs

Do I Need to File My Income Tax?

Before you get started on filing your income tax, it’s important to understand whether you need to file your income tax or not.

First, let’s clarify tax residency in Singapore.

How Do I Know If I’m A Tax Resident?

You will be treated as a tax resident for a particular YA if you are a Singapore Citizen or a Singapore Permanent Resident (SPR) who normally resides in Singapore except for temporary absences.

Singapore Income Tax for Foreigners

Also, there is the Singapore income tax for foreigners.

You will be treated as a Singapore tax resident if you are a:

- Foreigner who has stayed or worked in Singapore:

-

- For at least 183 days in the previous calendar year; or

- Continuously for 3 consecutive years, even if the period of stay in Singapore may be less than 183 days in the first year and/or third year;

- Foreigner who has worked in Singapore for a continuous period straddling 2 calendar years and the total period of stay* is at least 183 days. This applies to foreign employees who entered Singapore but excludes directors of a company, public entertainers or professionals.

*including your physical presence immediately before and after your employment.

If you do not meet the conditions stated above, you will be treated as a non-resident of Singapore for tax purposes.

Singapore Tax Residents Categories

If you are a Singapore tax resident you would receive either a letter or SMS from IRAS about your income tax.

IRAS groups tax residents into three categories:

1) You Receive a Letter, Form, or SMS From IRAS Telling You That You NEED to File Your Income Tax

Pretty straightforward.

This means that you’ll need to file your income tax return via myTax Portal between 1 March to 18 April 2024.

If your employer applied for the Auto-Inclusion Scheme (AIS) for Employment Income, any information about your salary will be pre-filled.

You can also check if your employer is participating in the AIS here.

If you’re a self-employed commission agent whose commission-paying organisation or if you are a private hire car driver whose transport service operator is submitting your income information to IRAS, your income information will also be pre-filled. More details can be found at Pre-filling of income for self-employed persons initiative.

But, you’ll still need to complete the other relevant fields, such as other sources of income, in your tax return before submitting it.

2) You Receive a Letter or SMS From IRAS Telling You That You DO NOT Need to File Your Income Tax — No-Filing Service (NFS)

If you receive a letter or an SMS telling you that you do not need to file your income tax for the year.

FYI: the SMS is sent from late February to early March of each year.

If you have been selected for No-Filing Service (NFS), you are not required to file a tax return.

But, you will need to CHECK and verify the information in your tax return is correct.

Also, if you wish to make any adjustments (e.g. verify your income details or relief claims) you can log in to myTax Portal to file it.

The next thing you’ll need to look out for would be your Notice of Assessment (NOA) or tax bill which will be sent to you around end-April.

This will tell you how much income tax is payable.

Please note that you are responsible for ensuring that your tax bill is accurate. If you have any other income that is not shown in the tax bill, or if your relief claims in the tax bill are incorrect, you need to inform IRAS through the “Object to Assessment” e-Service in myTax Portal within 30 days from the date of your tax bill.

3) You DO NOT Receive Any Notification From IRAS

This DOES NOT mean that you don’t have to file your income tax.

You will still need to file a tax return if your:

- Annual self-employed income exceeded $6,000, OR

- Annual income (inclusive of rental income) was more than $22,000 last year

Just be a good citizen and head over to myTax Portal to file your tax return.

Starting in 2022, about 120,000 selected taxpayers on the No-Filing Service will receive a Direct Notice of Assessment (D-NOA).

This means that they will not receive a notification from IRAS during tax filing season but will receive their tax bill directly from May onwards.

The D-NOA initiative will be extended to more taxpayers progressively over the next few years.

IRAS Income Tax Filing Checker

Alternatively, you can use this income tax filing checker from IRAS:

Do I Need to Declare in my Income Tax for 2024?

It’s really simple.

There are three components to filing your personal income tax.

1) Singapore Taxable Income

You will need to pay income tax on income earned in or derived from Singapore. Generally, overseas income received in Singapore is not taxable, except in some circumstances.

When it comes to income, there is taxable income and non-taxable income. You can refer to the IRAS website for a full list of what’s taxable and what’s not.

Taxable Income Singapore

Here are some examples of taxable income in Singapore:

| Type of Income | Details |

|---|---|

| Income From Employment | |

| Employment income | -Salary, bonus, director's fee, commission and others -Gains from the exercise of stock options |

| Income From Trade, Business, Profession or Vocation | |

| Income received from overseas | You have a trade/business in Singapore and you are carrying on a trade/business overseas which is incidental to your trade carried out in Singapore. You can refer to the IRAS website for more details. |

| Income received in the form of Government Grants | Find out from the IRAS website if these payouts will be auto-included in your tax return -Wage Credit Payout -Jobs Support Scheme -COVID-19 related payouts |

| Income received in the form of virtual currencies | Businesses that accept digital tokens for their revenue or that trade in digital tokens are subject to normal Income Tax rules. You can refer to the IRAS website for more details. |

| Income From Property or Investments and Other Sources | |

| Rent from property | Report rental income and claim rental expenses |

| Dividends | Generally not taxable, except for: - Dividends paid by co-operatives; - Foreign-sourced dividends derived by individuals through a partnership in Singapore. (Note: Such dividends may qualify for tax exemption if certain conditions are met. For more details, please refer to Tax Exemption for Foreign-Sourced Income); - Income distribution from Real Estate Investment Trusts (REITs) derived by individuals through a partnership in Singapore, or from the carrying on of a trade, business or profession in REITs. |

| Interest | Generally not taxable, except for interest income from: must be reported in your tax return - Deposits with non-approved banks in Singapore; - Deposits with finance companies not licensed in Singapore; - Pawnshops in Singapore; - Loans to companies, persons, etc.; - Interest from the refund of excess employee's CPF contributions - Debt securities (e.g. bonds) that are (i) owned by a partnership or (ii) inventory of a trading business |

| Gains from sale of property, shares and financial instruments | Generally not taxable, except for gains from the sales of shares, property, and financial instrument: - with a profit-seeking motive - deemed to be trading in such financial assets. |

| Income From Other Sources | |

| Annuity (recurring annual payments) | Annuities from: - Carrying on of a trade, business or profession, or through a partnership in Singapore - Supplementary Retirement Scheme (SRS) upon withdrawal - Annuity policy bought by your employer, in place of a pension or other employment benefits which are payable to you during employment or upon retirement. |

| Estate/Trust income | Estate/trust income received in Singapore from an estate under administration or a trust is taxable |

| Royalty | Royalties earned in Singapore are taxable even though tax concessions are available |

| Withdrawals from Supplementary Retirement Scheme (SRS) | Different tax rates will apply, depending on whether you withdraw after the statutory retirement age (prevailing at the time of contribution) and the circumstances in which you withdraw the funds |

Source: IRAS

Non-Taxable Income Singapore

Example of non-taxable income includes:

- Capital gains from sales of shares and property investments

- Central Provident Fund (CPF) Life Payouts

- Winnings from 4D, TOTO, horse betting, and soccer betting

- Interest income from approved banks and finance company licensed in Singapore2) Singapore Tax Deductions

Deductions refer to any allowable expenses you incurred or approved donations you made during the year.

Some examples of deductions include:

- Deductions on rental expenses

- Claim tax deductions on certain allowable expenses related to rental income derived in Singapore. Instead of claiming deduction on actual expenses, you may choose to claim deduction on deemed expenses based on 15% of the gross rent + mortgage interest on the loan taken to purchase the tenanted property.

- Deductions on donations to approved IPCs

- Tax deductions of 2.5 times the qualifying donation amount

- Deductions for employees

- Claim work from home (WFH) and other allowable employment expenses not reimbursed by your employer.

- Deductions for self-employed persons:

- Claim allowable business expenses incurred in the course of running the business. Qualifying self-employed persons (i.e. commission agents, private hire car/ taxi drivers and delivery workers) can claim a deemed amount of business expense based on a prescribed percentage of the gross income earned.

3) Singapore Tax Reliefs and Rebates

Tax relief and rebates are usually given if you support certain Government initiatives “to promote specific social and economic objectives.

You can refer to this IRAS table for a full list of qualifying reliefs, expenses, and donations to make sure you don’t miss out on any!

Some common ones that most of you might qualify for include:

| General Reliefs Available to ALL Taxpayers | Amount of Tax Relief Each Year | Additional Reliefs Available to Married/ Divorced/ Widowed Taxpayers | |

|---|---|---|---|

| Note: Eligibility is dependent on individual meeting the qualifying criteria | Available to Male and Female Taxpayers | Available to Female Taxpayers | |

| Course Fees Relief | Up to $5,500 | Qualifying/ Handicapped Child Relief Spouse/ Handicapped Spouse Relief | Foreign Domestic Worker Levy Relief Grandparent Caregiver Relief Working Mother's Child Relief |

| CPF Cash Top Up for Special/Retirement/MediSave accounts (not allowed by CPF Board if the recipient is a self-employed person (SEP) with outstanding MediSave liabilities) (You and your family member) | Up to $16,000 ($8,000 for self, $8,000 for family members) |

||

| CPF Relief for Self-Employed | Tax relief for your compulsory Medisave and voluntary CPF contributions will be capped at the lowest of: -37% of your net trade income assessed for YA 2023 -CPF annual limit of $37,740 -Actual amount contributed by you in 2022 |

||

| Earned Income Relief | Below 55: $1,000 55 to 59: $6,000 60 and above: $8,000 |

||

| Earn Income Relief (for handicapped person) | Below 55: $4,000 55 to 59: $10,000 60 and above: $12,000 |

||

| Handicapped Brother/Sister Relief | $5,500 for each handicapped sibling or sibling-in-law | ||

| Foreign Domestic Worker Levy (FDWL) Relief | Normal: $7,200 or $10,800 Concessionary: $1,440 |

||

| Life Insurance Relief (Your total contributions for the following in 2022 was less than $5,000: a. compulsory employee’s CPF contribution b. compulsory Medisave/voluntary CPF contribution as a self-employed individual) | The lower of the: Difference between $5,000 and your CPF contribution OR Up to 7% of the insured value of your own/your wife's life or the amount of insurance premiums paid |

||

| NSman Relief | Self: $1,500 - $5,000 Wife: $750 Parent With NSman child: $750 |

||

| Parent Relief | Taxpayer stays with dependant: $9,000 per dependant Taxpayer does not stay with dependant: $5,500 per dependant |

||

| Handicapped Parent Relief | Taxpayer stays with dependant: $14,000 per dependant Taxpayer does not stay with dependant: $10,000 per dependant |

||

| Supplementary Retirement Scheme (SRS) Relief | Singapore Citizens/Permanent Residents: lower of actual contribution or $15,300 Foreigners: lower of actual contribution or $35,700 |

||

Source: IRAS

Married couples and families will also enjoy tax reliefs and rebates like the Parenthood Tax Rebate (PTR) which can be shared based on an apportionment agreed by both of you.

You can also refer to this IRAS table for a full list of qualifying reliefs, expenses, and donations to make sure you don’t miss out on any!

Singapore Income Tax Relief Ceiling 2024

Do note that there is a limit to the amount of tax relief that you can receive.

The income tax relief ceiling for YA 2024 is currently $80,000.

Personal Income Tax Rates for Residents in Singapore 2024

Once you’ve figured out that you need to pay income tax, you’ll want to see how much you’re getting taxed.

As mentioned earlier, tax residents are taxed at progressive tax rates.

Singapore Tax Resident Tax Rates From YA 2024 Onwards

The tax rate for high income individuals will increase to make Singapore’s individual income tax regime more progressive. Here is what it looks like:

| Chargeable Income | Income Tax Rate (%) | Gross Tax Payable ($) |

| First $20,000

Next $10,000 |

0

2 |

0

200 |

| First $30,000

Next $10,000 |

–

3.5 |

200

350 |

| First $40,000

Next $40,000 |

–

7 |

550

2,800 |

| First $80,000

Next $40,000 |

–

11.5 |

3,350

4,600 |

| First $120,000

Next $40,000 |

–

15 |

7,950

6,000 |

| First $160,000

Next $40,000 |

–

18 |

13,950

7,200 |

| First $200,000

Next $40,000 |

–

19 |

21,150

7,600 |

| First $240,000

Next $40,000 |

–

19.5 |

28,750

7,800 |

| First $280,000

Next $40,000 |

–

20 |

36,550

8,000 |

| First $320,000

Next $180,000 |

–

22 |

44,550

39,600 |

| First $500,000

Next $500,000 |

–

23 |

84,150

115,000 |

| First $1,000,000

In excess of $1,000,000 |

–

24 |

199,150 |

Source: IRAS

As you can see from the Singapore tax brackets, the more you earn, the more you’re taxed.

Non-Resident Tax Rates for YA 2023 and YA 2024

The tax rate for non-resident individuals is 22% for YA 2023 for all income except employment income (which is taxed at a flat rate of 15% or the progressive resident tax rates, whichever is higher), and certain income taxable at reduced withholding tax rate (see next table).

Note that from YA 2024 (2023 income assessment period), the income tax rate for non-resident individuals (except on employment income and certain income taxable at reduced withholding rates) will be raised from 22% to 24%. This is to maintain parity between the income tax rate of non-resident individuals and the top marginal income tax rate of resident individuals.

Here is what it looks like:

| Type of Income | Withholding tax rate |

| From YA 2024 onwards | |

| 1. Remuneration including director’s fees received by non-resident directors | 24% |

| 2. Income received by non-resident professionals (e.g. consultants, trainers and coaches) for services performed in Singapore | 15% of gross income or 24% of net income |

| 3. Income received by non-resident public entertainers for services performed in Singapore | 15% concessionary rate |

| 4. SRS withdrawals received by non-Singapore SRS account holders* | 24% |

| 5. Interest, commission, fee or other payment in connection with any loan or indebtedness** | 15% reduced final withholding tax rate (subject to conditions) or 24% if reduced withholding tax rate is not applicable |

| 6. Royalty or other lump sum payments for the use of movable properties** | 10% reduced final withholding tax rate (subject to conditions) or 24% if reduced withholding tax rate is not applicable |

Source: IRAS

^The same withholding tax rates also apply to the income derived by a Hindu Joint Family that is registered outside Singapore.

*With effect from 1 Jul 2014, the concessionary withholding tax rate of 15% will apply if the following conditions are met:

- Cumulative amount withdrawn by the SRS account holder in the calendar year does not exceed $200,000; and

- The SRS account holder does not have any other income besides the SRS withdrawal(s) during the calendar year when the withdrawal(s) are made.

To enjoy this concession, the SRS account holder must declare that he fulfils the two conditions above using Form IR37B(1). The Form IR37B91) is obtainable from the SRS operator.

**The reduced withholding tax rate applies if the income is not derived from any trade, business, profession or vocation carried on or exercised by the non-resident individual in Singapore. If the income is derived from any trade, business, profession or vocation carried on or exercised by the non-resident individual in Singapore, then the withholding tax rate is 24% from YA 2024.

Income Tax in Singapore FAQs (Frequently Asked Questions)

If this is your first time paying income tax, you probably have a lot of questions.

Here are some commonly asked ones.

Who is Subjected to Income Tax?

Generally, income tax applies to both Singapore tax resident and non-Singapore tax resident who earns and derives income in Singapore from:

- Employment (Salary or Bonuses)

- Trade, Business, Profession, or Vocation (e.g. social media influencers)

- Property or Investments

- Other Sources (e.g. annuities, royalties, winnings, or estate or trust income)

Are My Investment Dividends Taxable?

This is a very common question that we always get from members of the Seedly community.

Non-Taxable Dividends

Advertisement