Travelling overseas and want to maximise your spending with credit cards?

What if I told you that you can “hack” the system and change your overseas spending into local spending for more credit card rewards and avoid pesky foreign currency conversion (FCY) fees?

Enter the Amaze card by Instarem, a “Virtual Private Network (VPN)” card that lets you link up to five MasterCards!

Here’s why every finance-savvy Singaporean should have the Amaze card and how it works!

Disclaimer: This is a non-sponsored article. The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice.

Update: Changes From 1 August 2023

There are two main changes from 1 August you need to know:

- Amaze Card-linked transactions are nerfed. From 1 August 2023, cardholders will only earn 0.5 InstaPoint instead of 1 InstaPoint for every S$1 (or equivalent) spent, which essentially reduces the cashback to no more than 0.5%;

- Instarem has removed its minimum spending requirement (S$1,500 or foreign currency equivalent) per calendar quarter to earn InstaPoint cashback. It now allows users to earn unlimited InstaPoints on foreign currency transactions but is capped at 500 InstaPoints per spend.

There is no change to the InstaPoints one can earn for transactions funded by the Amaze Wallet. Card users are encouraged to continue earning InstaPoints on all eligible foreign currency spends and redeem the points as cashback or money transfer discounts.

Using the Amaze Card for air miles is still worth it, though.

(P.S. You can now earn 6 miles per dollar on the UOB Lady’s Card, which men can finally apply for)

There are also some changes that took place that you might not be aware of:

- In June 2022, DBS excluded Instarem Amaze transactions from its DBS rewards programme

- From February 2023, Amaze implemented a 2% fee on GrabPay and e-wallet top-ups, then to Amaze Wallet on 5 July 2023.

TL;DR: Amaze Card by Instarem

Features:

- Zero margin fx rates from Mastercard, i.e. no weekend mark-ups.

- Link up to five Mastercard debit or credit cards (and mask foreign spending as local spending)

- No-top ups required

- 0.5%

1%cashback on foreign spending

Jump to:

- How Does the Amaze Card Work?

- How to Use the Amaze Card Overseas?

- Amaze Card Cashback

- What Is The Amaze Wallet?

- What Are The Best Cards to Pair With the Amaze Card?

- Should You Use the Amaze Card by Instarem?

How Does the Amaze Card Work?

With the Amaze card, you can link up to five Singapore-issued Mastercard credit or debit cards to it and set one to be used when you are paying with your Amaze card.

When payment is made with the Amaze card, your chosen underlying Mastercard will be charged.

Suppose you pay in foreign currency with the Amaze card. In that case, it will convert the foreign currency into Singapore dollars based on the prevailing Mastercard exchange rate before charging the Singapore dollar amount to the underlying Mastercard.

That’s why it is considered the “VPN” of cards, as it converts any foreign spending into local spending as if you were buying a product locally.

The best part is that you are not charged any FCY fees (banks usually charge about 3% to 3.5%) and can continue earning credit card rewards for your chosen credit card.

However, there is an implicit FX spread loss of about 2% now (according to online forums). So technically, the amazing card is just making it about 1% – 1.5% cheaper when you can use it overseas compared to just using the bank’s credit cards itself.

When you make a purchase with your Amaze card, the underlying credit card will have a transaction processed:

- As an online transaction

- With AMAZE* added to the description

- With the same Merchant Category Code (MCC) as the original merchant

This is awesome for credit cards that grant bonuses for online transactions, such as the Citi Rewards card, as it turns your regular tap and pay (offline) at retail outlets into online transactions.

Unlike VPNs (which are a grey area), using the Amaze card in this method is completely legal as Instarem, the company behind the Amaze card, is regulated by the Monetary Authority of Singapore (MAS).

Note that you won’t be able to earn Krisflyer miles using your UOB cards for public transport,

How to Use the Amaze Card Overseas?

Now that we know that the Amaze card changes our offline transactions into online ones and charges the underlying credit card in Singapore dollars, we can simply tap and pay overseas with our Amaze card just like we would in Singapore and still get our credit card rewards!

You can use either the physical card or use the digital version of the Amaze card with your NFC feature turned on. Both ways will work, and any transactions will be charged to your underlying credit card.

Amaze Card Cashback

Aside from being a “VPN” and avoiding FCY fees, using the Amaze card also awards you some cashback, albeit rather restrictive when redeeming it.

Since July 2022, Amaze has replaced cashback with its InstaPoint rewards programme where cardholders earn 1 InstaPoint for every S$1 (or foreign currency equivalent) spent.

Here are the details:

1%0.5% cashback for transactions processed in any foreign currency (i.e. non-SGD) from 1 Aug 2023- Cashback criteria:

- Minimum spend of S$10 (or currency equivalent) for each transaction

Minimum spend of S$1,500 (or currency equivalent) per quarter- Earn unlimited InstaPoints on foreign currency transactions but is capped at 500 InstaPoints per spend (New)

- Maximum S$50 maximum cashback per quarter

- Redeemable in blocks of 2,000 InstaPoints ($20, or 1% cashback). Your InstaPoints will expire within a year of being issued.

- The cashback is credited by Instarem to your Amaze wallet on the 15 of the month after every quarter. For example, you will receive the cashback on 15 April for Amaze transactions from January to March.

With such stringent criteria, you’ll have to spend as much as $2,000 overseas to get the cashback.

Similarly, you will only earn 0.5 InstaPoint instead of 1 InstaPoint for every S$1 spent in foreign currency, which essentially reduces the cashback to up to 0.5%, down from up to 1%.

While this is quite a downer for those who love cashback, the card is still amaze-ing. Why did I say so?

Because you can continue to rack up rewards earned on your credit card spends. Before the multiple rounds of nerfing, the cashback one can earn from foreign transactions is on top of local transactions, making it ‘free’ cashback somehow, which is still a good thing, although it’s not as awesome as it used to be.

You can also redeem your InstaPoints for cashback in blocks of 2,000 InstaPoints for S$20, or 1% cashback, and these points will expire within a year of being issued.

That said, the earn rates for Amaze Card transactions funded by the Amaze Wallet (see below) remain at 1 InstaPoint per S$1.

| amaze payment source | InstaPoints earned before 1 Aug 2023 | InstaPoints earned after 1 Aug 2023 |

|---|---|---|

| Wallet | 100 | 100 |

| Linked bank credit | 100 | 50 |

What Is The Amaze Wallet?

Briefly, the Amaze wallet is a multi-currency account similar to the ones you have with YouTrip, Revolut, and Wise.

Should you earn enough InstaPoints to redeem for cashback, it will be transferred here. To use the amount in your Amaze wallet, all you have to do is use your Amaze card and switch the funding source to your Amaze wallet instead.

For more information on the Amaze wallet, read this article.

Instarem Amaze Card MCC (Merchant Category Codes) Exclusions

You can earn unlimited InstaPoints on FX spends made on Amaze at all other merchants. It allows users to earn unlimited InstaPoints on foreign currency transactions, capped at 500 InstaPoints per spend.

Here’s the list of MCCs excluded from Amaze Rewards from 20 February 2023 onwards:

| MCC | Description |

|---|---|

| 4111 | Railroads, Transportation Services |

| 4784 | Tolls and Bridge Fees |

| 4900 | Utilities: Electric, Gas, Water, and Sanitary |

| 5047 | Medical, Dental, Ophthalmic and Hospital Equipment and Supplies |

| 5199 | Nondurable Goods (Not elsewhere classified) |

| 5960 | Direct Marketing: Insurance Services |

| 5993 | Cigar Stores and Stands |

| 6012 | Financial Institutions: Merchandise, Services, and debt Repayment |

| 6211 | Security Brokers/Dealers |

| 6300 | Insurance Sales, Underwritting, and Premiums |

| 6513 | Real Estate Agents and Managers: Rentals |

| 6540 | Non-Financial Institutions – Stored Value Card Purchase/Load |

| 7299 | Other Services (Not elsewhere classified) |

| 7349 | Cleaning, Maintenance and Janitorial Services |

| 7523 | Parking Lots, Parking Meters and Garages |

| 8062 | Hospitals |

| 8211 | Elementary and Secondary Schools |

| 8220 | Colleges, Universities, Professional Schools, and Junior Colleges |

| 8241 | Correspondence Schools |

| 8244 | Business and Secretarial Schools |

| 8249 | Vocational and Trade Schools |

| 8299 | Schools and Educational Services |

| 8398 | Charitable Social Service Organisations |

| 8661 | Religious Organisations |

| 8675 | Automobile Associations |

| 8699 | Membership Organisations |

| 9211 | Court Costs, including Alimony and Child Support |

| 9222 | Fines |

| 9223 | Bail and Bond Payments |

| 9311 | Tax Payments |

| 9399 | Government Services |

| 9402 | Postal Services |

Please note: MCCs are assigned by payment card organisations (e.g. Visa, MasterCard). Instarem does not have a say in the assignation of these codes. A merchant’s registered MCC may not always correspond with its nature of business.

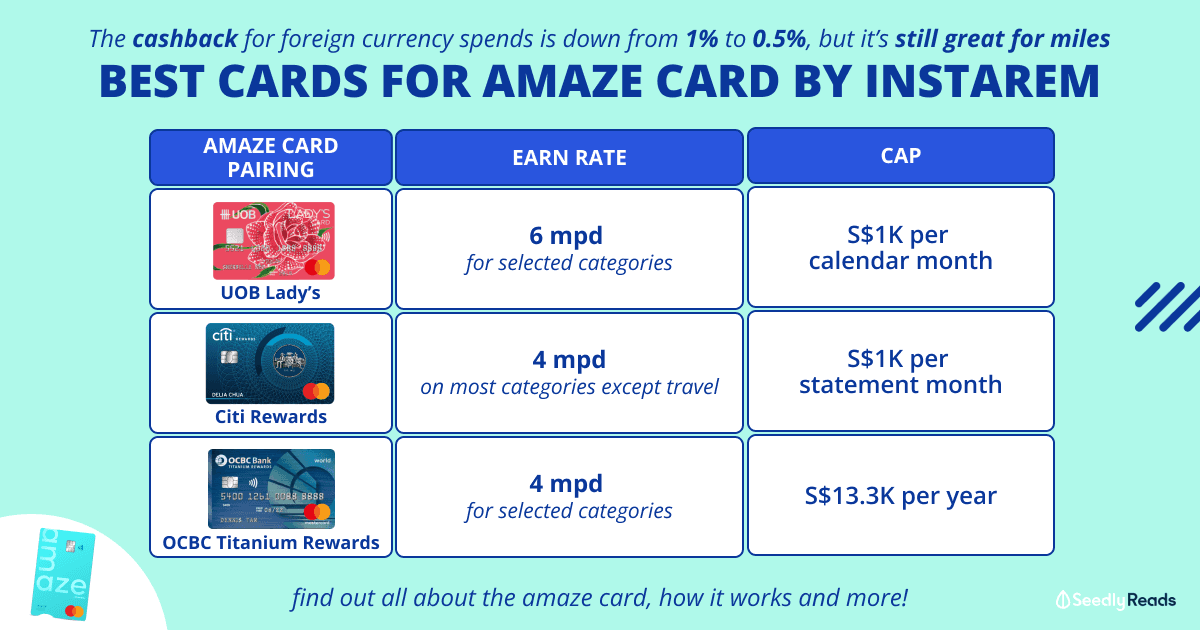

What Are The Best Cards to Pair With the Amaze Card?

Using the Amaze Card for air miles is still great.

If you were fans of the Amaze card like we were way back in 2019 when Instarem unveiled it to us, you’d know of the multiple nerfs over the years.

Sadly, DBS cards no longer earn any credit card rewards with Amaze transactions. Some cards, such as the Maybank Family & Friends card that awards bonuses based on transaction description, are also ineligible to pair with the Amaze card for credit card rewards.

On the bright side, there are still a number of credit cards that we highly recommend to pair with Amaze:

| amaze Card Pairing | Earn Rate | Cap | Remarks |

|---|---|---|---|

| UOB Lady's Card | 6 mpd | S$1K per calendar month | Selected MCCs |

| UOB Lady's Solitaire | 6 mpd | S$3K per calendar month | Selected MCCs |

| Citi Rewards Card Apply Now | 4 mpd or 2.27% cashback | S$1K per statement month | Except travel |

| OCBC Rewards Card Apply Now | 4 mpd or 2.78% cashback | S$1.1k limit per calendar month | Selected MCCs |

| KrisFlyer UOB Credit Card Apply Now | 3 mpd (min. S$500 SIA Group spend per year) | None | Selected MCCs |

| UOB PRVI Miles Mastercard Apply Now | 1.4 mpd | None | 1.4 mpd as spend is counted as local spend. |

Should You Use the Amaze Card by Instarem?

It is a definite yes if you want to earn credit card rewards overseas with the cards recommended above!

Even if you aren’t a miles chaser, the Amaze card is a great way to reduce the bulk in your wallet and has nifty features such as:

- The option to combine selected transactions from various cards into one listing for corporate claims

- Ability to view transactions with the transaction tracking feature, with transactions being automatically categorised

Plus, it’s completely free to sign up for. So why not?

Related Articles:

Advertisement