A Foreign Expat's Go-to Guide to Working in Singapore: Work Pass, Visa, Housing & More

Imagine this: You’ve just been offered a job in Singapore, an opportunity that has you excited about settling down in this beautiful city-state.

Singapore has a long history of welcoming foreign expats and has successfully attracted immigrants from various countries to make it their home

To give you a better understanding of the scale, as of December 2022, the total foreign workforce in Singapore amounted to a staggering 1,424,200 individuals, out of a population of approximately 5.6 million.

That’s an impressive number!

So whether you’re still contemplating finding a job in Singapore or have already secured one, this ‘onboarding’ guide is a must-read.

We’ve got you covered in most areas of concern before you make the move to Singapore ✈️

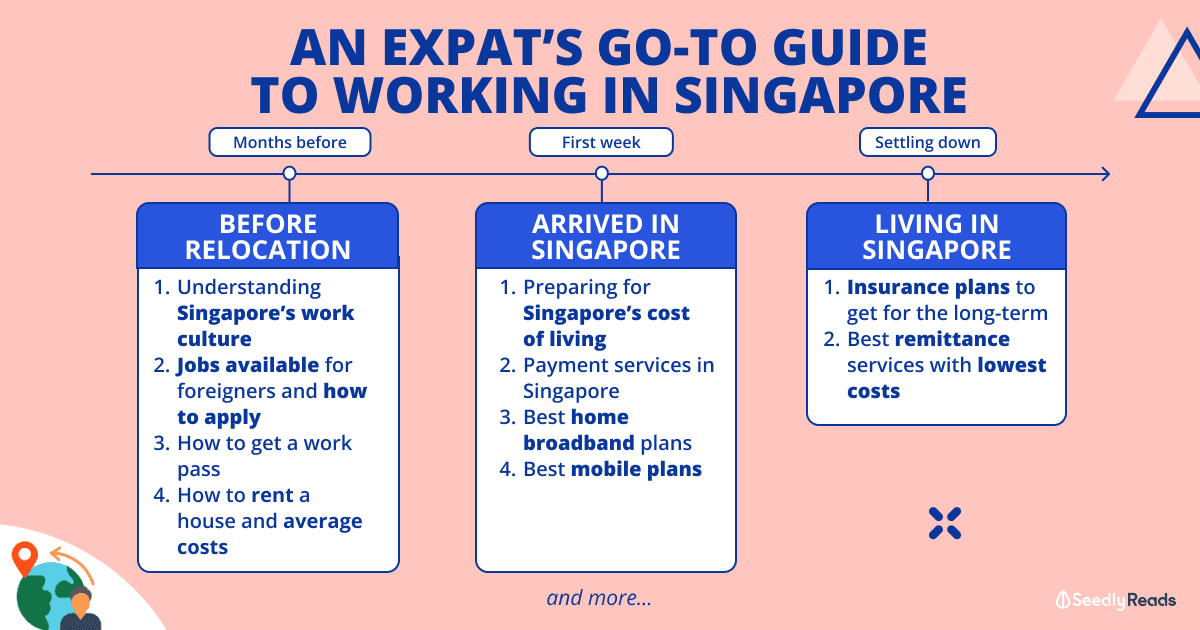

TL;DR: The Simplest Guide You Need Before Moving to Singapore

This guide is going to be very in-depth and hence, long. So to make it easier for you to navigate, we have split this article into three parts (click to jump).

Stage 1: Before Arriving in Singapore

- Working culture in Singapore

- Getting a Job in Singapore as a Foreigner: Salary Guides, job requirements, and academic qualifications

- Renting in Singapore

Stage 2: Arriving in Singapore

Stage 1: Before Arriving in Singapore

Understanding Singapore’s Work Culture

If you’re looking for a highly organised workplace that’s efficient and has many skilled workers, there should be tons of such places in Singapore.

While we may have a blended work culture where the East meets the West: Fast-paced, hardworking, collectivist (or group-thinking), and at times, hierarchical if it’s not a Western multinational company, just to name a few.

Also, the concept of “face” holds significance. “Face” generally refers to a person’s reputation, dignity, and social standing, and maintaining it is highly valued.

In Singapore’s work context, being mindful of others’ reputations and avoiding actions that may cause embarrassment or loss of face are highly valued in a workplace.

Next, there is also growing recognition of the importance of work-life balance, with many companies implementing initiatives to promote employee well-being and provide flexibility in working arrangements.

I would like to caveat that work cultures can vary between organizations and industries in Singapore, so it’s always beneficial to research and understand the specific work culture of the company you may be joining.

Read more:

- Mental Health Leave in Singapore: This Company Gives Employees up to 6 Months Leave To Recover From Their Mental Health Ailments

- Which Industry Has The Longest Working Hours in Singapore?

- Employees Want A 4-Day Work Week in Singapore: How Feasible Is It?.

Jobs in Singapore for Foreigners

2022 was filled with news of retrenchments and a bad year for job hunting, since the reopening of Singapore’s borders, the job market has picked up and from December 2022 to March 2023, the number of unemployed residents fell from 67,100 to 61,500, of whom 54,900 are citizens

As Singapore’s business hub continues to thrive, the job market in this Asian city has been steadily expanding, with an increasing number of organisations establishing their presence.

To enhance your prospects of finding employment in Singapore, you can focus your search on industries with high demand and growth.

For starters, these are the top three industries that the Singapore government is looking to grow:

Compare Salaries Across Industries

Next, you should also zoom into the salary guides across industries to assess if the move is reasonable as you might be earning more in your home country:

- Salary Guide Singapore Across Industries (2022): Are You Paid Enough?

- Teacher Salary Singapore Guide: How Much Do Teachers Earn in Singapore?

- Nurse Salary Guide (2022): Are Nurses in Singapore Paid Enough?

- Singapore Tech Salary Guide For Software Engineers and More: NodeFlair Report

- Cabin Crew Salary Guide: How Much Does an Air Stewardess/Steward in Singapore Make?

- Latest Singapore Uni Fresh Graduate Salary Guide Based on Graduate Employment Survey (GES) 2022.

Can Foreigners Work in Singapore Government?

Yes, non-Singaporeans can apply and be considered for jobs in the Public Service. Generally, you can be hired for non-sensitive positions that are operational in nature or where the skills required are in shortage.

If you’re looking to work in Singapore, you will need a work pass before you begin employment (which we will talk about below).

How to Get a Job in Singapore for Foreigners?

Before going into an intense job search, you can check your eligibility on the Singapore Ministry of Manpower’s Self-Assessment Tool.

This tool enables you to evaluate your educational background and work experience to determine your eligibility to work in Singapore, which may increase your chances of securing employment and applying for a work pass.

As with any job, ensuring that you check all boxes listed in the job description is only the first step.

This means that you will need to stand out in your resume and ensure that your skillsets are useful for the job.

Can You Get a Job in Singapore Without a Visa: Work Pass, Work Permit & Work Visa Are Mandatory

Next, you will need a valid work pass (commonly known as a work permit or work visa) in order to work in Singapore! This step cannot be missed.

As a prospective employee, you need to check which pass you’re applying for:

| Types of Passes | Who | Check eligibility and apply |

|---|---|---|

| Employment Pass (EP) | For foreign professionals, managers and executives. Candidates need to earn at least $5,000 a month. | Here |

| Personalised Employment Pass (PEP) | For high-earning existing Employment Pass holders or overseas foreign professionals. From 1 Sept 2023, the fixed monthly salary criteria for both existing EP holders and overseas foreign professionals will be raised to $22,500. The PEP offers greater flexibility than an Employment Pass. | Here |

| EntrePass | For foreign entrepreneurs who are keen to start and operate a business in Singapore that is venture-backed or possesses innovative technologies. | Here |

| Overseas Networks & Expertise Pass | For top talent in business, arts and culture, sports, as well as academia and research. | Here |

| S Pass | For skilled workers whoearn at least $3,000 a month. | Here |

| Work Permit for migrant worker | For semi-skilled migrant workers in the construction, manufacturing, marine shipyard, process or services sector. | Here |

| Work Permit for migrant domestic worker | For foreign domestic workers to work in Singapore. | Here |

| Work Permit for confinement nanny | For Malaysian confinement nannies to work in Singapore for up to 16 weeks starting from the birth of the employer's child. | Here |

| Work Permit for performing artiste | For foreign performers working in public entertainment outlets such as bars, hotels and nightclubs. | Here |

| Training Employment Pass | For foreign professionals undergoing practical training. Candidates must earn at least $3,000 a month. | Here |

| Work Holiday Pass (under Work Holiday Programme) | For students and graduates aged 18 to 25 who want to work and holiday in Singapore for 6 months. | Here |

| Work Holiday Pass (under Work and Holiday Visa Programme) | For Australian students and graduates aged 18 to 30 who want to work and holiday in Singapore for 1 year. | Here |

| Training Work Permit | For semi-skilled foreign trainees or students undergoing practical training in Singapore for up to 6 months. | Here |

| Work passes for holders of Long-Term Visit Passes issued by ICA | For foreigners married to a Singaporean or permanent resident, or parents accompanying a child who is studying in Singapore. | Here |

The table excludes:

- Exemptions and working while on a visit pass

- Passes for family members (which you are required to apply separately)

When in doubt, you can also refer to MOM’s requirements.

Is It Easy to Work in Singapore as a Foreigner?

It can be difficult to get a job anywhere, but it’s not impossible.

Every company has a designated quota for hiring foreigners based on the number of Singaporeans they employ. However, information regarding these quotas is typically limited to the employers and employees within the organisation. Therefore, this aspect is beyond your control and influence.

For my two cents, you might want to consider applying for a job between March to May as most companies would be charting and projecting hiring budgets in January and February at the start of the year which might also be the best time to scout around.

Renting in Singapore

Unless you plan to buy a private unit for which you will need to pay stamp duties, you will have to rent your accommodation.

Important: Make sure to book your accommodation before arriving in Singapore!

In the latest report by the Home Attainability Index by the Urban Land Institute (ULI) Asia Pacific Centre for Housing, Singapore is ranked the most expensive Asia-Pacific city to own or rent a private home.

Essentially, you will often see two types of private housing: Condominiums (non-landed properties) and Landed properties.

The average rental fee for a 4-room condominium costs about S$6,000 to S$11,650 depending on the location and region of the condominium, which is split into the Core Central Region (CCR), Rest of the Central Region (RCR), and Outside of Central Region (OCR).

Naturally, being the most central and where it’s most accessible, private homes in the CCR tend to be more expensive, and so do the rental.

Furthermore, rentals of private residential properties increased by 7.2 per cent in Q1 2023, with rents for landed properties surging 14.5 per cent, and non-landed properties rising by 6.1 to 6.4 per cent.

So, the key here is to plan your budget properly if you intend to rent a private home in Singapore.

Types of Properties Foreigners Can Rent in Singapore

Fortunately, besides renting a private unit, you can also consider renting public housing, which are Housing Development Board (HDB) flats built by the Singapore government and owned by residents under leasehold agreements.

About 80 percent of Singapore’s citizens live in an HDB flat and HDB estates are equipped with essential amenities such as children’s playgrounds, community centres, and wet markets.

They are conveniently located in proximity to neighborhood banks and shopping malls and are well-connected to nearby bus and MRT stations.

When it comes to affordability, renting an HDB flat in Singapore generally costs around 20% to 25% less than a condominium in a similar nearby location.

HDB flats range from studio apartments to five-bedroom units exceeding 1,500 square feet in size. In addition to the standard flats, there are also executive flats and Design, Build and Sell Scheme (DBSS) flats available.

That said, only 3-room HDBs and above are available for rent. A typical HDB flat follows this structure:

- 3-room: 2 bedrooms, 1 living or common room, 1 kitchen, 2 bathrooms (60 – 68 sqm / 646 – 732 sq ft)

- 4-room: 3 bedrooms, 1 living or common room, 1 kitchen, 2 bathrooms (85 – 93 sqm / 915 – 1,001 sq ft)

- 5-room: 3 bedrooms, 1 living or common room, 1 kitchen, 2 bathrooms (107 – 113 sqm / 1,152 – 1,216 sq ft)

- Executive: 4 bedrooms, 1 living or common room, 2 bathrooms (130sqm / 1,507 sq ft – 1,615 sq ft)

- Maisonette: 1,527 – 1,700 sq ft

- Jumbo flat: 1,442 sq ft – 2,000 sq ft

- 3-Gen flat: 1,238 sq ft

These are important things you need to take note of:

- If you are a non-Malaysian non-citizen (Singapore Permanent Resident or foreigner) renting the HDB flat, you will be subject to the Non-Citizen Quota for Renting Out of Flat.

- There is also a minimum rental period for HDB flats and/or bedrooms of 6 months. Owners can apply to rent out flats or bedrooms for a maximum period of 3 years per application if their tenants are all Singaporeans or Malaysians.

- For applications involving non-Malaysian non-citizens, the maximum rental period per approval is 2 years.

| Renting of Flat | Renting of Bedroom(s) | ||

|---|---|---|---|

| Flat Type | Maximum Number of tenants Allowed in Each Flat | Maximum Number of Bedroom(s) Allowed | Maximum Number of Occupants* Allowed in Each Flat^ |

| 1-room and 2-room | 4 | Owners are not allowed to rent out the bedroom | |

| 3-room | 6 | 1 | 6 |

| 4-room and bigger | 6 | 2 | 6 |

| * Include flat owners, authorised occupiers, and tenants ^ Only bedrooms originally constructed by HDB can be rented out. All other parts of the flat (including partitioned rooms) cannot be used as bedrooms for tenants. |

|||

Source: HDB

Stage 2: Arriving in Singapore

Cost of Living in Singapore

According to a 2021 study entitled “What People Need in Singapore: A Household Budget Study (2021)”, Singaporean households in general think they need these amounts for their basic standard of living:

- Two parents with two children (Aged 7-12 and 13-18) need $6,426 a month

- Single parent with one child (Aged 2-6) needs $3,218 a month

- Based on the above assumptions, the average household member in Singapore needs about $1,600 a month

- A single elderly person needs $1,421 a month.

Do bear in mind this was in 2021 and the core inflation rate then was 2.3%. With core inflation at around ~5% as of April 2023, one can imagine that monthly expenses above would’ve gone up too.

Payment Methods in Singapore

According to the 2023 Smart City Index, Singapore has been ranked as the top smart city in Asia and holds the seventh position globally in terms of intelligence and technological advancement.

You will find digital payment options available in most retail and eateries, with contactless and e-wallet payments like Apple Pay and Google Pay™.

To give you a better understanding, e-wallets are broken down into:

| Bank-Based Mobile Wallet | What You Need to Sign Up? | Where Can It Be Used? | |

|---|---|---|---|

| DBS PayLah! | DBS/POSB digibank account or MyInfo account; Singapore registered mobile number; smartphone with iOS 10 and above or Android version 4.4 and above | Make payments at participating merchants by scanning the NETS, SG and/or PayNow QR codes using your DBS PayLah! app | |

| OCBC Pay Anyone | OCBC online banking account, OCBC savings or current account; smartphone with iOS 10 and above or Android version 4.1 and above | Scan the NETS QR or PayNow QR codes to pay at participating merchants | |

| UOB Mighty | UOB accounts such as current or savings accounts, etc (details below); devices with iOS 10 and above or Android version 6.0 and above | Make payments at participating merchants by scanning the QR code or tapping your phone on the payment terminal | |

| NETSPay | DBS, POSB, OCBC and UOB NETS bank cards; NETSPay app works with certain iPhones and Android phones only (details below) | Scan the NETS QR code to pay at participating merchants or tap on NETS terminal (for certain Android phones; details below) | |

| Non-Bank-Based Mobile Wallet | What You Need to Use? | Where Can It Be Used? | |

| Alipay | Chinese bank account, credit card, stored value card, and local bank card | ComfortDelGro and Prime taxis, Resorts World Sentosa, Singapore Zoo, Universal Studios, Metro, etc | |

| EZ-Link Wallet | Local bank card (Visa and Mastercard-issued only) | Selected merchants in Singapore with SG QR code; Alipay Connect-enabled merchant in Japan | |

| FavePay | Credit card, debit card, or GrabPay | Selected merchants with the FavePay QR code | |

| Google Pay | Credit card, debit card, or PayNow (DBS/POSB, OCBC, Standard Chartered) to transfer money to friends | In-store at more than 80,000 checkout counters eg. 7-Eleven, Cheers, Cold Storage, NTUC, McDonald's, Uniqlo, etc | |

| GrabPay | Credit card, debit card, or PayNow to transfer money in | Selected merchants with GrabPay QR code; pay for Grab rides and GrabFood deliveries; use with GrabPay Card where Mastercard is accepted | |

| Singtel Dash | Top up using a local bank account, credit/debit card, or OCBC Pay Anyone; to use Dash Visa virtual card, you need a compatible Apple device or Near Field Communication (NFC)-enabled Android phone | Selected merchants with Dash QR code; pay via Dash Visa virtual card wherever Visa contactless is accepted | |

| WeChat Pay | Chinese bank account, credit card or stored value card | ComfortDelGro taxis, 7-Eleven, Cold Storage, Giant, Guardian, etc | |

| Gadget-Based Mobile Wallet | What You Need to Use? | Participating Banks and Issuers | Where Can It Be Used? |

| Apple Pay | Apple products (iPhone, iPad, Apple Watch, Mac) | American Express, Citibank, DBS/POSB, HSBC, OCBC, Revolut, Singtel, Standard Chartered, and UOB | 7-Eleven, Best, Breadtalk, Fairprice, Giant, Sheng Siong, Uniqlo, etc |

| Huawei Pay | Available on selected Huawei smartphones (refer to list below) | ICBC Singapore | Huawei Pay supports Near Field Communication (NFC) payment in retail stores |

| Samsung Pay | Available on selected Samsung devices (refer to list below) | American Express, Citibank, DBS/POSB, Fevo, Grab, Maybank, OCBC, Standard Chartered, and UOB | Samsung Pay supports NFC and Magnetic Secure Transmission (MST) payment in retail stores |

There are also Buy Now Pay Later (BNPL) services which allow you to delay your payments and split them up into weekly or monthly installments.

Multi-Currency Accounts And Cards

Well, if you’ve just arrived in Singapore, you will need to settle down before opening a savings account or signing up for a credit card. It might also be too risky to carry too much cash on hand.

In such situations, it might be wise to set up a digital multi-currency account such as Amaze by Instarem and Revolut before coming to Singapore.

Here are some accounts you may consider:

| Account / Card | Promotion |

|---|---|

| Amaze by Instarem Apply Now | - |

| Crypto.com | - |

| GrabPay Card | - |

| Revolut Apply Now | Get 3 months of the Premium plan for free when you apply now Valid till 31 Dec 2023. T&Cs apply. |

| RHB TravelFX Multi Currency Card | - |

| Singlife Card | - |

| TenX Card | - |

| Wirex | - |

| Wise Platinum Mastercard | - |

| YouTrip | - |

Under the Payment Services Act, these digital multi-currency accounts have a wallet limit of S$5,000 and an annual spending limit of S$30,000.

That said, there might still be places where only cash payment is available, so always have some cash on hand.

Broadband and Mobile Plans For Expats in Singapore

Singapore prides itself on having one of the highest Internet penetration rates worldwide.

In recent years, virtual operators have emerged and successfully established their presence by providing similar services at competitive rates from established players like Singtel, M1, and StarHub.

No-contract SIM-Only plans are also quickly becoming the go-to choice of most people as there is no longer a need to stay with one operator over a period of time.

These are some of the popular choices:

| SIM-Only Plans |

|---|

| Circles.Life |

| CMLink |

| GOMO |

| Giga! |

| Gorilla Mobile |

| Grid Mobile |

| redONE |

| MyRepublic Mobile |

| M1 |

| SIMBA (previously known as TPG) |

| Singtel |

| StarHub |

| VIVIFI |

| Zero1 |

| Zero Mobile |

If you’re checking out an operator, make sure you read their reviews before signing up!

Home Fibre Broadband Plans in Singapore 2023

Choices are aplenty if you’re looking for the best Internet home fiber broadband package too.

| Home Fibre Broadband Plans |

|---|

| MyRepublic Broadband |

| M1 Broadband |

| Singtel Broadband |

| StarHub Broadband |

| ViewQwest Broadband |

| WhizComms Broadband |

Their reviews are also readily available on Seedly Reviews.

Stage 3: Living in Singapore

Remitting Money Back Home

In the past, telegraphic transfer was the only way to transfer funds internationally. Today, remittance leverages money transfer services to transfer money across borders in a much more convenient and simplified manner.

Fortunately, we have many such services available in Singapore:

| Provider | Promotion |

|---|---|

| CurrencyFair Money Transfer | - |

| eRemit Money Transfer | - |

| OFX Money Transfer | - |

| Revolut Money Transfer Apply Now | Get 3 months of the Premium plan for free when you apply now Valid till 31 Dec 2023. T&Cs apply. |

| MoneyGram Money Transfer | - |

| Instarem Money Transfer Apply Now | - |

| SENTBE Money Transfer | - |

| SingX Money Transfer | - |

| TorFX Money Transfer | - |

| Western Union Money Transfer | - |

| WorldRemit Money Transfer | - |

| WorldFirst Money Transfer | - |

| ZhongGuo Remittance Money Transfer | - |

For specific product reviews, you can zoom into them one by one.

Insurance Plans For Foreign Expats

Medical bills in Singapore can get quite exorbitant, insuring yourself with health insurance is one way you can reduce your expenses.

There is no one-size-fits-all solution to them. But there is one main thing that is essential to protect yourself from, especially when you are relocating to an entire new place.

In short, you will need coverage for the following:

- Hospitalisation

- Outpatient Coverage

- Dental Check-Ups

- Maternity Coverage

Are You Moving to Singapore Anytime Soon?

I’m barely scratching the surface but that was already a chunk of information to unpack!

But the most important of all is actually being aware of both financial and non-financial costs that you take in moving to Singapore.

There are still topics such as how to thrive in Singapore as an expat, and the best places to have affordable meals by locals that I’ve not covered.

So bookmark this article for future reference as we will be updating this mega guide soon!

In the meantime, what are your thoughts on moving to Singapore? Share with us in the community!

Related Articles:

- The Ultimate Expat Guide to Getting the Best Prepaid SIM Card in Singapore

- Health Insurance for Expats in Singapore Made Easy

- Bank Account in Singapore for Expats: Convenience First or Interest First?

- What Are The Key Insurance Policies You Should Get in Singapore?

- Which International Money Transfer Platform Is The Cheapest?

Advertisement