I was having ma la xiang guo for lunch with an old friend from BMT when the conversation invariably turned to one of three things:

- How is work?

- How is married life?

- What is it like to have my own place?

He was particularly interested in the last point because, according to him, my place is aesthetic AF:

Also, he’s at the age where he would really like to have a place to call his own.

But the problem is, he’s single and not 35 years old yet (more on this in a bit).

And unfortunately, a condominium is out of his budget.

Which got me thinking…

What if I were single and younger than 35?

What kind of HDB housing options would be available for me?

TL;DR: What Type of HDB Flats Can Single Singaporeans Buy?

If You Are a Single Singapore Citizen

As a single, 35-year-old Singapore citizen, you can buy the following:

- a 2-Room Flexi Housing Development Board Built-to-Order flat in a non-mature estate, or

- an HDB Resale flat on the open market

If You Are a Single Permanent Resident

You cannot buy an HDB BTO flat or an HDB Resale flat.

The latter is only possible if you form a family nucleus or are legally married.

So your only option is private housing.

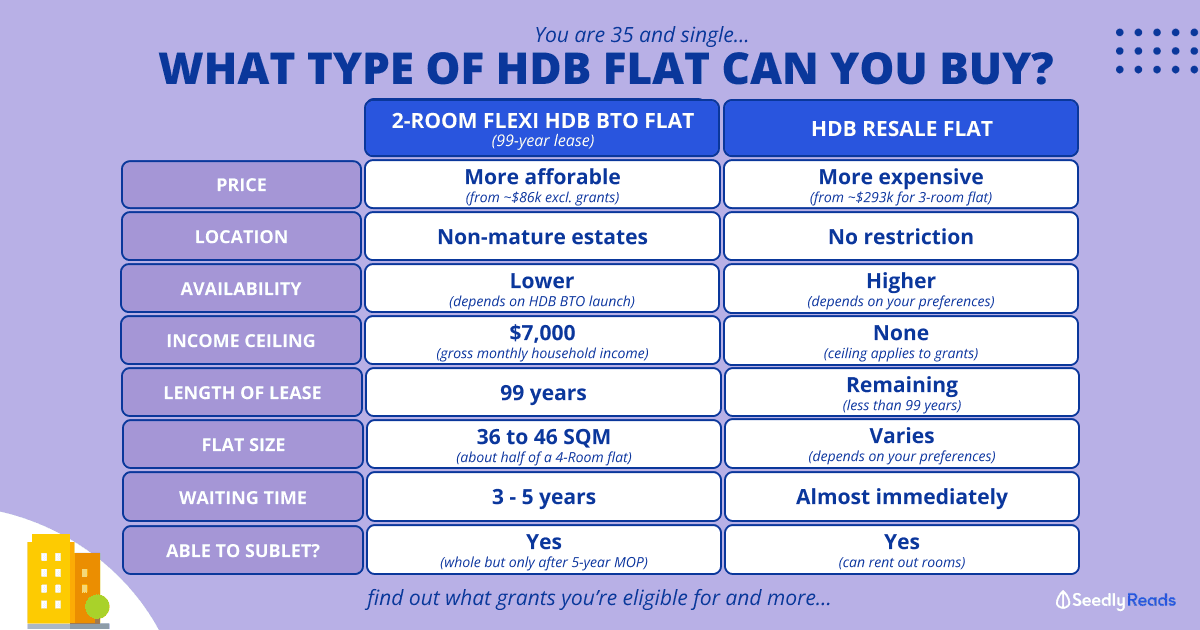

Here’s a quick summary of the pros and cons of both options:

HDB Flat Options for Singles | 2-Room Flexi HDB BTO Flat (99-Year Lease) | HDB Resale Flat |

|---|---|---|

| Price | More affordable (from $86,000 excluding grants) | More expensive (from $293,900, median prices for a 3-Room flat in Geylang, Q4 2021) |

| Location | Non-mature estates only | No restriction |

| Availability | Lower (depends on HDB BTO launch) | Higher (depends on your preference) |

| Income Ceiling | $7,000 (per month) | None (but ceilings apply to grants) |

| Lease | 99-Year | Remaining (less than 99 years) |

| Size of flat | 36 to 38 sqm (Type 1) 45 to 46 sqm (Type 2) Note: 45sqm is about half the size of a 4-Room HDB flat | Varies (2 to 5-Room) |

| Waiting Time | Longer (about 3 to 5 years) | Shorter (almost immediately) |

| Able to Sub-let? | Yes (whole apartment; but only after 5-Year MOP) | Yes (can rent out rooms) |

If you’re looking for an affordable option, the 2-Room Flexi HDB BTO is a clear choice.

But if you need something quick and in an area of your choice, then an HDB Resale flat is the way to go.

Jump to:

- What type of HDB flats can singles buy

- Eligibility requirements for singles

- How much is the CPF grant for singles

- Executive condominiums for singles

- FAQs of HDB Flats for Singles

Why Do We Need HDB Housing Options for Singles?

Simple.

Because increasingly, Singaporeans are comfortable with singlehood or are putting off marriage until they’re older.

In fact, according to the Department of Statistics’ Populations Trends Report for 2022.

The proportion of singles amongst the resident population aged below 50 years rose between 2010 and 2021.

Among those aged 30 to 34, 41.9 per cent of males and 32.8 per cent of females were single in 2020, compared to males and 35.4 per cent of females in 2021.

This is up from 37.1 per cent and 25.1 per cent, respectively, in 2010.

And there’re many reasons why this is happening.

From putting their careers first to singlehood becoming an acceptable lifestyle…

Or, in my friend’s case, the fact that he can’t marry his partner legally despite Singaporeans becoming more liberal towards gay marriages.

In fact, Section 377A, which criminalises gay sex, was repealed in 2022 without any changes to current family and housing policies. This means that the LGBTQ+ community do not qualify for most HDB schemes that would otherwise allow heterosexual couples — who are married or are eligible to marry — to purchase an HDB flat.

Indeed, the absence of legalised marriage calls for more cautious preparation and legal measures to protect the interests of both parties.

Without legal marriage, same-sex couples cannot access certain benefits, such as Additional Buyer’s Stamp Duty* tax remission for foreign or Permanent Resident (PR) spouses and purchase a second matrimonial home before selling the first one.

This has proven to be a significant obstacle for numerous LGBTQ+ couples with cross-national backgrounds.

*The Additional Buyer’s Stamp Duty (ABSD) is a tax imposed on certain property transactions, particularly on individuals who are purchasing additional residential properties. The ABSD tax rates vary depending on factors such as the buyer’s residency status and the number of properties they own. Currently, Singapore provides certain exemptions or reductions to ease the financial burden on eligible individuals. Specifically, when a Singapore citizen or Permanent Resident (PR) purchases property jointly with a foreign spouse or PR spouse, they may be entitled to ABSD tax remission. This remission helps alleviate the higher tax liability that would typically be imposed on such transactions.

What Type of HDB Flats Can Singles Buy?

Assuming you’re a single, 35 years old Singapore citizen, you can buy a 2-Room Flexi HDB BTO flat in a non-mature estate.

Or an HDB Resale flat on the open market.

Here are some pros and cons of both options:

HDB Flat Options for Singles | 2-Room Flexi HDB BTO Flat (99-Year Lease) | HDB Resale Flat |

|---|---|---|

| Price | More affordable (from $86,000 excluding grants) | More expensive (from $293,900, median prices for a 3-Room flat in Geylang, Q4 2021) |

| Location | Non-mature estates only | No restriction |

| Availability | Lower (depends on HDB BTO launch) | Higher (depends on your preference) |

| Income Ceiling | $7,000 (per month) | None (but ceilings apply to grants) |

| Lease | 99-Year | Remaining (less than 99 years) |

| Size of flat | 36 to 38 sqm (Type 1) 45 to 46 sqm (Type 2) Note: 45sqm is about half the size of a 4-Room HDB flat | Varies (2 to 5-Room) |

| Waiting Time | Longer (about 3 to 5 years) | Shorter (almost immediately) |

| Able to Sub-let? | Yes (whole apartment; but only after 5-Year MOP) | Yes (can rent out rooms) |

What Are the HDB Eligibility Requirements for Singles?

Since we’re talking about HDB flats, it’s a no-brainer that they are only available to Singaporeans or PRs.

And even then, PRs are only eligible to purchase an HDB BTO flat if their spouse is a Singapore citizen.

So if you’re a single PR, an HDB flat is out of the question.

For Singapore citizens, you have to be at least 35 years old to apply as an unmarried or divorced individual.

Unless you’re an orphan with no siblings, you may apply for your own flat under the Orphan’s Scheme when you turn 21.

Besides that, you’ll also need to deal with the Ethnic Integration Policy (EIP) and Singapore Permanent Resident (SPR) quota, which is a housing policy to ensure a balanced mix of various ethnic communities in our HDB towns, preserves our multicultural identity and promotes racial integration and harmony.

To be honest, the EIP and SPR won’t be a huge problem.

But it’ll probably affect your flat’s location, depending on the quota.

Eligibility to Buy HDB BTO For Singles

If cost is a major concern, a 2-Room Flexi HDB BTO flat is the most affordable option.

But it’ll definitely be smaller in size.

There is also an income ceiling of $7,000 for this flat type. These are the requirements you need to fulfil to apply for one:

| Criteria | |

|---|---|

| Flat type | 2-room Flexi flat in the non-mature estates |

| Citizenship | Singapore Citizen (SC) or at least 1 other co-applicant is an SC |

| Age | 35 years old and above |

| Monthly household income ceiling | 2-room Flexi flat (99-year lease): $7,000 The total income of all persons listed in the Housing Flat Eligibility (HFE) letter application. |

| Previous housing subsidies | Only first-timer core applicants may qualify. If you and/ or your core applicants have taken a housing subsidy, you are a second-timer and will not be eligible. A subsidised housing unit refers to: - A flat bought from HDB - A resale flat bought on the open market with CPF housing grant - A Design Build and Sell Scheme (DBSS) flat bought from a property developer - An EC unit bought from a property developer - Other forms of housing subsidy (e.g. enjoyed benefits under the Selective En bloc Redevelopment Scheme (SERS), privatisation of HUDC estate, etc.) |

| Ownership/ interest in HDB flat | If you or any person listed in the application owns or has an interest in any HDB flat, you must dispose of the flat within 6 months of the completion of the flat purchase. |

| Ownership/ interest in property in Singapore or overseas other than HDB flat (Private Residential Property) | All applicants and occupiers listed in the flat application must not own or have an interest in any local or overseas private property; and must not have disposed of any private residential property in the following time period: - At least 30 months before HFE letter application when applying to buy a HDB flat, a resale flat with CPF housing grant(s) and applying for a housing loan HDB - At least 15 months before HFE letter application when you're applying to buy a non-subsidised resale flat (including Proximity House Grant) |

| Ownership/ interest in property in Singapore or overseas other than HDB flat (Non-residential Property) | All persons listed in the HFE letter application can, as a household, own up to 1 non-residential property at HFE letter application and up to 30 months before HFE letter application. Non-residential property is a property under a non-residential land zoning and/ or the permitted use does not include housing. |

| Available Grants | Enhanced CPF Housing Grants (Singles) |

To give you an idea of what kind of living arrangements you’re looking at, this is what a 2-Room Flexi (Type 1) will look like:

And this is the floorplan for a 2-Room Flexi (Type 2), which is slightly bigger than Type 1:

You’re also limited to applying for a 2-Room Flexi in a non-mature estate.

So that limits your choices, and you might not be able to live in an estate that’s your first choice.

For the uninitiated, non-mature estates are residential areas that are not more than 20 years old.

Typically, they have fewer amenities and less developed public transport infrastructure than mature estates.

On the upside, these estates are usually more peaceful and have the potential for appreciation in the long term.

Source: Renonation

Another thing to consider would be the limited availability of 2-Room Flexi flats.

Because not all BTO projects will have 2-Room Flexi flats.

And even if they do, at least 40 per cent of 2-Room Flexi units in a project will be made available to the elderly.

One last bugbear is the waiting time.

After booking your flat, you’ll still have to wait about 3 to 5 years for your flat to be built.

So if you applied when you’re 35, you might be moving into your new flat when you’re celebrating your 40th birthday.

Eligibility to Buy HDB Resale Flat For Singles

If you want to get your own place ASAP, you’ll probably want to explore your options on the resale market.

Here, you can purchase almost any type of HDB Resale flat as long as you can afford it, as there is no income ceiling in place.

But doing so also means that it’ll definitely be more expensive.

Even if you went with the smallest HDB Resale flat currently available: a 3-Room HDB Resale flat.

Note: 2-Room Flexi flats were only introduced in 2015, so we’ll probably only see them on the market in 2025 when the first 2-Room Flexi flats have been completed and have fulfilled their 5-year Minimum Occupation Period

You’d still be looking at coughing up at least $330,000 — this is a median resale price of a 2-room flat in Punggol based on HDB resale statistics correct as of the first quarter (Q1) of 2023.

One more thing.

If your resale flat has less than 60 years remaining on its lease, the amount of CPF that you can use to pay for your home will be pro-rated.

So as your mortgage matures, you might find that you’ll need to fork out more cash to service it.

You’ll also want to factor in renovation costs, so if you’re going for a resale flat, purchase a flat you can really afford.

That said, these are the criteria:

| Criteria | |

|---|---|

| Flat type | All flat types (excluding 3Gen flats) |

| Citizenship | Singapore Citizen (SC) or at least 1 other co-applicant is an SC |

| Age | 35 years old or above if unmarried or divorced 21 years old or above if widowed or an orphan (At least 1 of your deceased parents was an SC or Singapore Permanent Resident) |

| Monthly household income ceiling | No income ceiling Note: Income ceiling applies to qualify for CPF housing grants (excluding Proximity Housing Grant) and HDB housing loan |

| Previous housing subsidies | Any previous housing subsidy taken does not affect the eligibility to buy a resale flat. Note: If you have taken any housing subsidies, you are not eligible to apply for CPF housing grants (excluding Proximity Housing Grant). |

| Ownership/ interest in HDB flat | If you or any person listed in the application owns or has an interest in any HDB flat, you must dispose of the flat within 6 months of the completion of the flat purchase. |

| Ownership/ interest in property in Singapore or overseas other than HDB flat (Private Residential Property) | All applicants and occupiers listed in the flat application must not own or have an interest in any local or overseas private property; and must not have disposed of any private residential property in the following time period: - At least 30 months before HFE letter application when applying to buy a HDB flat, a resale flat with CPF housing grant(s) and applying for a housing loan HDB - At least 15 months before HFE letter application when you're applying to buy a non-subsidised resale flat (including Proximity House Grant) |

| Ownership/ interest in property in Singapore or overseas other than HDB flat (Non-residential Property) | All persons listed in the HFE letter application can, as a household, own up to 1 non-residential property at HFE letter application and up to 30 months before HFE letter application. Non-residential property is a property under a non-residential land zoning and/ or the permitted use does not include housing. |

| Available Grants | Enhanced CPF Housing Grants (Singles) CPF Housing Grant (Singles)/Singles Grant Proximity Housing Grant (Single) |

What Types of Housing Grants Are Available for Singles?

Thankfully, singles also have access to housing grants to help them finance their purchase.

The type of CPF housing grants that are applicable depends on what type of HDB flat you choose as a single.

HDB Grants for Singles: HDB BTO

Currently, there are three schemes for single Singaporeans to apply for.

Single Singapore Citizen Scheme

If you’re applying for a 2-Room Flexi HDB BTO flat as a single applicant.

You may apply for the Enhanced CPF Housing Grant (EHG) (Singles) of up to $40,000, with monthly household income capped at $4,500

Two or More Singles Scheme

Single Singaporean Citizens who want to buy a 2-Room Flexi HDB BTO with other first-timer single(s) can apply for this scheme.

You may apply for the Enhanced CPF Housing Grant (EHG) (Singles) of up to $80,000, with monthly household income capped at $9,000.

Orphans Scheme

If you’re applying for an HDB BTO flat (no restrictions on flat type) with a sibling who is a Singapore Citizen or PR and your parents are deceased.

- Enhanced CPF Housing Grant (EHG) (Singles) up to $80,000, with monthly household income capped at $9,000

HDB Grants for Singles: HDB Resale

Single Singapore Citizen Scheme

If you’re buying an HDB Resale flat (no restrictions on flat type) as a single applicant.

You may apply for the following:

- CPF Housing Grant for Resale Flats (Singles) or Singles Grant up to $40,000 (for 2- to 4-Room flat); $25,000 (for 5-Room flat or bigger), with monthly household income capped at $7,000

- Enhanced CPF Housing Grant (EHG) (Singles) up to $40,000, with monthly household income capped at $4,500

And if you live with your parents (meaning parents listed as occupants)

- Proximity Housing Grant of $15,000, with no income ceiling

And if you live near your parents (within a 4km radius of your parent’s home)

- Proximity Housing Grant of $10,000, with no income ceiling

Two or More Scheme or Orphans Scheme

If you’re buying an HDB Resale flat (no restrictions on flat type) with one or three other Singapore Citizen singles.

OR if you’re buying an HDB Resale flat (no restrictions on flat type) with a sibling who is a Singapore Citizen or PR, and your parents are deceased.

- Singles Grant up to $50,000 (for 2- to 4-Room flat, i.e. up to $80,000 for 2 Singles); $25,000 (for 5-Room flat or bigger, i.e. up to $50,000 for 2 Singles), with monthly household income, capped at $14,000

- Enhanced CPF Housing Grant (EHG) (Singles) up to $80,000, with monthly household income capped at $9,000

FYI: if 2 singles apply, each applicant will receive half of the full grant; even if more than 2 singles apply, a maximum of 2 applicants will receive the grant

Executive Condominiums, What About Those?

Are there any alternatives?

Yes! Don’t forget about Executive Condominiums (ECs).

Simply put, ECs are a hybrid of private and public housing, i.e. your unit will be privatised after fulfilling the 10 years Minimum Occupation Period. You can actually buy a brand new EC under the Joint Singles Scheme, but you won’t be eligible for grants.

Similarly, if you have the money, you can purchase a resale EC even when you’re below 35.

FAQs About HDB Flats For Singles

What Is the Age Limit for HDB’s Single Schemes?

There is no age limit, but you should at least have a lease that covers you to 95 years old. Why?

Because you will need to use that house for pledging for your Central Provident Fund (CPF) Retirement Account when you reach 55 years old, and any property that doesn’t cover you to 95 years old can’t be used as collateral.

Can Singles Buy 4 or 5-room HDB Flats?

That is if you’re purchasing a resale HDB flat.

Why Do Singles Buying an HDB Flat Have to Pay a Premium of $15,000?

I will leave a reply by an HDB spokesman below for your reference.

All new HDB flats are sold at a subsidised price with the subsidies intended to benefit a couple.

Essentially, the $15,000 premium is so that there is parity in treatment. As HDB flats are already subsidised and subsidies are intended to support a couple or at least two occupants, some might question why singles who live alone could enjoy the same subsidies as two or more occupants.

Therefore, when single Singaporeans buy a flat through the Single Singapore Citizen Scheme, the price difference accounts for the fact that they are the sole beneficiaries of the subsidies.

If you have previously purchased a home and then married either a citizen or a permanent resident of Singapore, you can apply for the CPF Housing Top-Up Grant.

Doing so will enable you to receive the same subsidy as a family, and as a result, you can reclaim the $15,000 subsidy, which will be reimbursed into their CPF Ordinary Accounts.

What if You Buy Under the HDB Singles Scheme but Get Married in the Future?

There are a few options:

- Keep the Existing Flat: You and your spouse may choose to keep the existing flat under your name. In this case, you will not be eligible for any additional housing subsidies as a married couple. The flat will continue to be considered a single-ownership property.

- Apply for a New Flat: Alternatively, you and your spouse can apply for a new flat together as a married couple. This would involve relinquishing the existing flat purchased under the Singles Scheme. As a married couple, you will be eligible for the various housing schemes and subsidies available to families.

- Sell the Existing Flat: If you decide to sell the flat purchased under the Singles Scheme, you can use the proceeds to finance the purchase of a new flat together with your spouse. The availability of housing grants and subsidies will depend on your eligibility criteria as a married couple.

Pro Tip for Same-Sex Couples

For same-sex couples, like my friend, you can apply under either scheme — as long as both of you meet the abovementioned eligibility criteria.

However, when you’re applying under the Single Singapore Citizen Scheme, only ONE of you can be the legal owner of the flat.

This means that the non-owner partner cannot use their CPF monies to pay for the flat or obtain an HDB loan.

They will also not have any legal rights or claim over the flat (e.g. for renovation, rent, or selling of the flat).

So if both parties want to contribute to the payment AND have legal rights to the HDB flat.

You’ll want to apply under the Joint Singles Scheme instead, as both applicants will have their names recorded as co-owners.

So… Which Should You Get?

If you’re looking for an affordable option, the 2-Room Flexi HDB BTO is a clear choice.

If you need something quick and in an area of your choice, then an HDB Resale flat is the way to go.

Another interesting aspect of choosing a resale flat is that it allows you to rent rooms to generate additional income.

But with the 2-Room Flexi flat on a 99-year lease, you can only choose to rent out your whole apartment.

And that’s only after you meet the minimum occupation period of 5 years.

Apart from the pros and cons of sharing your home with renters, this definitely opens up a possible passive income stream.

Still need help deciding?

Why not check out Seedly and get your questions answered by our friendly community of professionals and everyday Singaporeans?

Related Articles:

- HDB Sale of Balance (SBF) Flat May 2023: A Step-By-Step Guide

- The Ultimate HDB Grants Guide: CPF Housing Grants for BTO, Resale & SBF Flats

- How To Increase Your HDB BTO Ballot Chances: Application Rate & Priority Schemes Matter More Than You Think

- Ultimate HDB Open Booking of Flats 2023 Guide: All You Need To Know

- HDB Flat Eligibility (HFE) Letter and HFE Application: A Singaporean’s Guide

Advertisement