Thinking of buying your first property?

You’re probably looking at HDB flats and wondering how in the world you are going to afford something that expensive.

Thankfully, there are various HDB grants aka CPF Housing Grants which you can apply for to help you offset the cost of buying a new home.

But what grants are you actually eligible for? And how much?

Let’s find out!

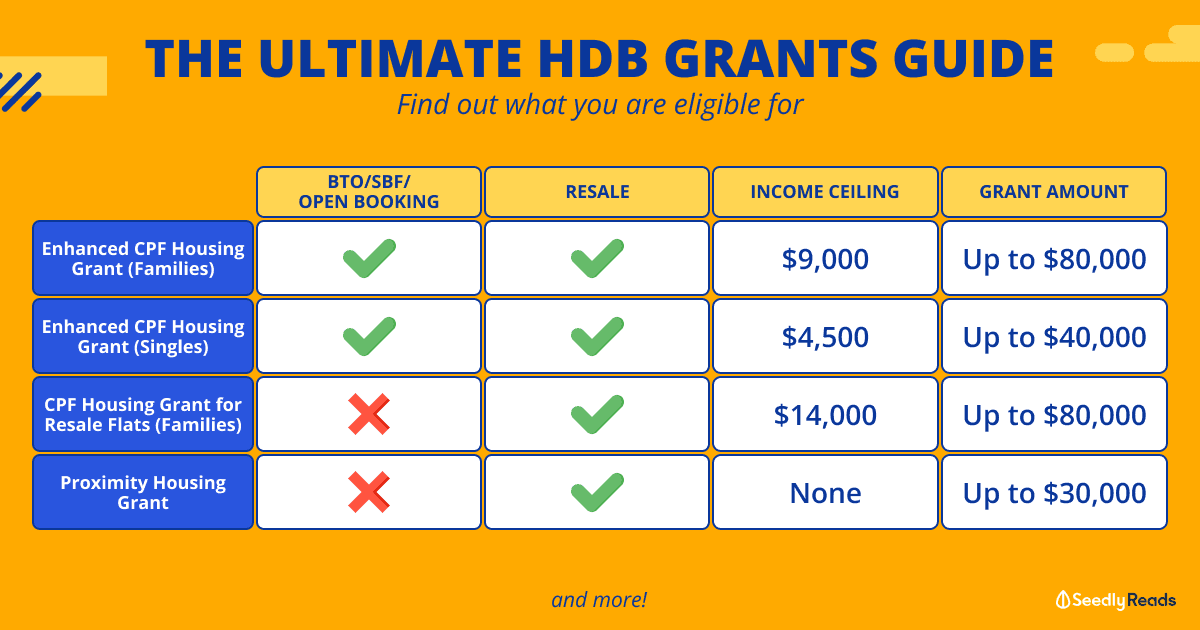

TL;DR: The Ultimate HDB Grant Guide – CPF Housing Grants for BTO, Resale & SBF Flats

HDB grants (aka CPF housing grants) are meant to help Singaporeans make their home purchases a little more affordable.

Depending on various factors such as your household income and citizenship, the amount that you can get will vary.

Here’s a look at the various HDB grants available:

| HDB Housing Grant | Eligible for HDB BTO and Sale of Balance Flats? | Eligible for HDB Resale Flats? | Income Ceiling | Grant Amount | For? |

|---|---|---|---|---|---|

| Enhanced CPF Housing Grant (Families) | Yes | Yes | $9,000 | $5,000 to $80,000 (depending on household income) | Both HDB BTO and SBF, as well as Resale HDB flats |

| Enhanced CPF Housing Grant (Singles) | Yes | Yes | $4,500 if you are buying a flat on your own or with a non-resident spouse $9,000 if you are buying a flat with other singles or a resale flat with your parents | $2,500 to $40,000 (depending on household income) | First-timer and second-timer couple applicants Non-Citizen Spouse Scheme Singles under Single Singaporean Citizen Scheme or Joint Singles Scheme or Orphan Scheme |

| CPF Housing Grant for Resale Flats (Families) Aka Family Grant | No | Yes | $14,000 $21,000 if purchasing with an extended or multi-generation family | 2- to 4-room flat: $40,000 to $80,000 (increased by $30,000) 5-room or bigger flat: $30,000 to $50,000 (increased by $10,000) | First-timer couple applicants buying HDB Resale |

| CPF Housing Grant for Resale Flats (Singles) Aka Singles Grant | No | Yes | $7,000 if purchasing a flat on your own $14,000 if purchasing a flat with your family or other singles | 2- to 4-room flat: $40,000 (increased by $15,000) 5-room or bigger flat: $25,000 (increased by $5,000) | First-timer Singapore Citizen (SC) and buying a resale flat on your own or with your non-resident spouse |

| Step-Up CPF Housing Grant | Yes Applies only to a 2-Room Flexi or 3-Room flat in a non-mature estate | Yes | $7,000 | $15,000 | Second-timer applicants applying for a second subsidised HDB flat |

| Proximity Housing Grant (Families) | No | Yes | None | $30,000 to live with your parents/child $20,000 to live near your parents/child (within 4km) | HDB Resale buyers |

| Proximity Housing Grant (Singles) | No | Yes | None | $15,000 to live with your parents/child $10,000 to live near your parents/child (within 4km) |

HDB Grants Available Based on Your Profile

At first glance, this can be quite overwhelming, so I’ve broken it down based on various profiles and the respective grants available:

For First-Timer Couples/Families Going For:

- BTO/SBF/Open Booking Flats

- Resale Flats

For First-Timer Singles Going For:

- BTO/SBF/Open Booking Flats

- Resale Flats

For Second-Timer Couples/Families Going For:

- BTO/SBF/Open Booking Flats

- Enhanced CPF Housing Grant (Singles) if either applicant is a second-timer

- Resale Flats

- Enhanced CPF Housing Grant (Singles) if either applicant is a second-timer

- Proximity Housing Grant (Singles)

- Next Flat Purchase (in a Non-Mature Estate)

For Second-Timer Singles Going For:

- BTO/SBF/Open Booking Flats

- No grants available

- Resale Flats

For Couples Where One Applicant is Not a Singapore Citizen Going For:

- BTO/SBF/Open Booking Flats

Once you know what grants are available to you based on your profile, check your eligibility and the grant amount available to you here:

- Enhanced CPF Housing Grant (Families)

- Enhanced CPF Housing Grant (Singles)

- CPF Housing Grant for Resale Flats (Families) aka Family Grant

- CPF Housing Grant for Resale Flats (Singles) aka Singles Grant

- Step-Up CPF Housing Grant

- Proximity Housing Grant (Families)

- Proximity Housing Grant (Singles)

Enhanced CPF Housing Grant (Families)

Enhanced CPF Housing Grant (Families) Amount

| Average monthly household income | Grant amount |

|---|---|

| Not more than S$1,500 | S$80,000 |

| S$1,501 – S$2,000 | S$75,000 |

| S$2,001 – S$2,500 | S$70,000 |

| S$2,501 – S$3,000 | S$65,000 |

| S$3,001 – S$3,500 | S$60,000 |

| S$3,501 – S$4,000 | S$55,000 |

| S$4,001 – S$4,500 | S$50,000 |

| S$4,501 – S$5,000 | S$45,000 |

| S$5,001 – S$5,500 | S$40,000 |

| S$5,501 – S$6,000 | S$35,000 |

| S$6,001 – S$6,500 | S$30,000 |

| S$6,501 – S$7,000 | S$25,000 |

| S$7,001 – S$7,500 | S$20,000 |

| S$7,501 – S$8,000 | S$15,000 |

| S$8,001 – S$8,500 | S$10,000 |

| S$8,501 – S$9,000 | S$5,000 |

| More than S$9,000 | NA |

Enhanced CPF Housing Grant (Singles)

Enhanced CPF Housing Grant (Singles) Amount

| Average monthly income | Grant amount |

|---|---|

| Not more than S$750 | S$40,000 |

| S$751 – S$1,000 | S$37,500 |

| S$1,001 – S$1,250 | S$35,000 |

| S$1,251 – S$1,500 | S$32,500 |

| S$1,501 – S$1,750 | S$30,000 |

| S$1,751 – S$2,000 | S$27,500 |

| S$2,001 – S$2,250 | S$25,000 |

| S$2,251 – S$2,500 | S$22,500 |

| S$2,501 – S$2,750 | S$20,000 |

| S$2,751 – S$3,000 | S$17,500 |

| S$3,001 – S$3,250 | S$15,000 |

| S$3,251 – S$3,500 | S$12,500 |

| S$3,501 – S$3,750 | S$10,000 |

| S$3,751 – S$4,000 | S$7,500 |

| S$4,001 – S$4,250 | S$5,000 |

| S$4,251 – S$4,500 | S$2,500 |

| More than S$4,500 | NA |

CPF Housing Grant for Resale Flats (Families) aka Family Grant

CPF Housing Grant for Resale Flats (Families) Amount

Buying a 2- to 4-room resale flat:

- Singapore Citizen (SC) / SC: $80,000

- SC / Singapore Permanent ResidentSPR: $40,000

Buying a 5-room or bigger resale flat:

- SC / SC: $50,000

- SC / SPR: $30,000

CPF Housing Grant for Resale Flats (Singles) aka Singles Grant

CPF Housing Grant for Resale Flats (Singles) Amount

Buying a 2- to 4-room resale flat: $40,000

Buying a 5-room or bigger resale flat: $25,000

Step-Up CPF Housing Grant

Step-Up CPF Housing Grant Amount

$15,000 (Applies only to a 2-Room Flexi or 3-Room flat in a non-mature estate)

Proximity Housing Grant (Families)

Proximity Housing Grant (Families) Amount

$30,000 to live with your parents/child OR

$20,000 to live near your parents/child (within 4km)

Proximity Housing Grant (Singles)

Proximity Housing Grant (Singles) Amount

$15,000 to live with your parents/child OR

$10,000 to live near your parents/child (within 4km)

Related Articles

Advertisement