We’ve talked a lot about how to apply for an HDB BTO flat.

But what if you didn’t get your HDB BTO of choice because it was oversubscribed? And you couldn’t get what you wanted during the HDB Sale of Balance Flat exercise either?

Are you resigned to an HDB Resale flat or an Executive Condominium (EC)?

Fret not! You can still get an HDB BTO Flat through the Open Booking of Flat exercise.

Best of all? You can book a flat as early as the next working day!

Note: You can apply online starting 28 March 2023, Tuesday, 8 pm. Applicants will receive a queue number for flat booking on a first-come-first-served basis and can book a flat as early as the next working day. Applications will close on 29 March 2023, Wednesday, 7:59pm.

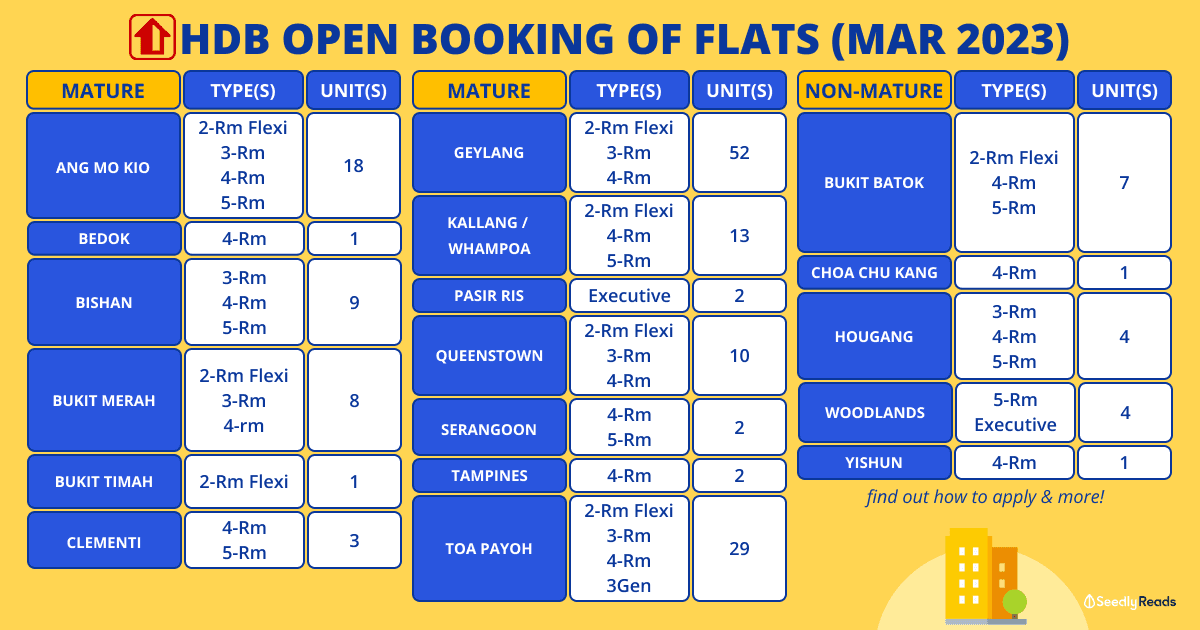

TL;DR: HDB Open Booking of Flats Mar 2023

Jump to:

- Flats Available

- What is Open Booking of Flats?

- Should I apply for an Open Booking Flat?

- How to Apply for Open Booking of Flats?

Flats in Non-Mature Towns or Estates Available for Open Booking

| Town/ Estate | Flat Type | Flat Supply | Starting Price From | Block | Street Name | Level | Available Ethnic Quota (Malay) | Available Ethnic Quota (Chinese) | Available Ethnic Quota (Indian & Other Races) |

|---|---|---|---|---|---|---|---|---|---|

| Bukit Batok | 5-room | 2 | $424,000 | 470B | Bukit Batok West Avenue 5 | #02 | 2 | 2 | 2 |

| 2-room Flexi (short lease) | 1 | $63,000 | 471A | Bukit Batok West Avenue 5 | #07 | 1 | 1 | 1 | |

| 2-room Flexi (99-year lease) | $110,000 | ||||||||

| 4-room | 1 | $291,000 | 471B | Bukit Batok West Avenue 5 | #02 | 0 | 1 | 1 | |

| 4-room | 2 | $291,000 | 472A | Bukit Batok West Avenue 5 | #02 to #03 | 1 | 2 | 2 | |

| 4-room | 1 | $315,000 | 472B | Bukit Batok West Avenue 5 | #04 | 1 | 1 | 1 | |

| Choa Chu Kang | 4-room | 1 | $265,000 | 11 | Teck Whye Lane | #07 | 1 | 1 | 1 |

| Hougang | 4-room | 1 | $244,000 | 15 | Hougang Avenue 3 | #14 | 1 | 0 | 1 |

| 5-room | 1 | $415,000 | 601 | Hougang Avenue 4 | #02 | 1 | 1 | 1 | |

| 5-room | 1 | $415,000 | 624 | Hougang Avenue 8 | #02 | 1 | 1 | 1 | |

| 3-room (income ceiling $7,000) | 1 | $208,000 | 642 | Hougang Avenue 8 | #04 | 1 | 0 | 1 | |

| Woodlands | 5-room | 1 | $285,000 | 35 | Marsiling Drive | #02 | 0 | 1 | 0 |

| 5-room | 1 | $300,000 | 137 | Marsiling Road | #03 | 0 | 1 | 0 | |

| Executive | 1 | $530,000 | 204 | Marsiling Drive | #07 | 0 | 1 | 0 | |

| 5-room | 1 | $273,000 | 5A | Marsiling Drive | #02 | 0 | 1 | 0 | |

| Yishun | 4-room | 1 | $267,000 | 475B | Yishun Street 44 | #02 | 1 | 1 | 1 |

Flats in Mature Towns or Estates Available for Open Booking

| Town/ Estate | Flat Type | Flat Supply | Starting Price From | Block | Street Name | Level | Available Ethnic Quota (Malay) | Available Ethnic Quota (Chinese) | Available Ethnic Quota (Indian & Other Races) |

|---|---|---|---|---|---|---|---|---|---|

| Ang Mo Kio | 4-room | 2 | $307,000 | 179 | Ang Mo Kio Avenue 5 | #02 to #03 | 2 | 0 | 2 |

| 5-room | 1 | $580,000 | 259 | Ang Mo Kio Avenue 2 | #19 | 1 | 0 | 1 | |

| 4-room | 1 | $379,000 | 301 | Ang Mo Kio Avenue 3 | #08 | 1 | 1 | 1 | |

| 4-room | 1 | $379,000 | 305 | Ang Mo Kio Avenue 1 | #15 | 1 | 1 | 1 | |

| 3-room (income ceiling $14,000) | 1 | $222,000 | 471 | Ang Mo Kio Avenue 10 | #07 | 1 | 1 | 1 | |

| 4-room | 1 | $293,000 | 472 | Ang Mo Kio Avenue 10 | #02 | 1 | 0 | 1 | |

| 3-room (income ceiling $14,000) | 1 | $227,000 | 506 | Ang Mo Kio Avenue 8 | #04 | 1 | 1 | 1 | |

| 4-room | 2 | $312,000 | 537 | Ang Mo Kio Avenue 5 | #04 to #11 | 2 | 0 | 2 | |

| 3-room (income ceiling $14,000) | 1 | $222,000 | 538 | Ang Mo Kio Avenue 5 | #02 | 1 | 1 | 1 | |

| 4-room | 1 | $312,000 | 612 | Ang Mo Kio Avenue 4 | #11 | 1 | 0 | 1 | |

| 5-room | 1 | $793,000 | 246A | Ang Mo Kio Street 21 | #29 | 1 | 0 | 1 | |

| 2-room Flexi (short lease) | 2 | $151,000 | 307C | Ang Mo Kio Avenue 1 | #08 to #19 | 2 | 2 | 1 | |

| 4-room | 1 | $502,000 | 309A | Ang Mo Kio Street 31 | #08 | 1 | 1 | 1 | |

| 4-room | 1 | $520,000 | 591A | Ang Mo Kio Street 51 | #02 | 1 | 1 | 1 | |

| 4-room | 1 | $550,000 | 651B | Ang Mo Kio Avenue 9 | #10 | 1 | 1 | 1 | |

| Bedok | 4-room | 1 | $256,000 | 36 | Bedok South Avenue 2 | #05 | 1 | 1 | 1 |

| Bishan | 4-room | 1 | $374,000 | 113 | Bishan Street 12 | #03 | 1 | 0 | 1 |

| 4-room | 1 | $355,000 | 145 | Bishan Street 11 | #07 | 1 | 0 | 1 | |

| 4-room | 1 | $326,000 | 150 | Bishan Street 11 | #03 | 1 | 0 | 1 | |

| 4-room | 1 | $483,000 | 264 | Bishan Street 24 | #07 | 1 | 0 | 1 | |

| 5-room | 1 | $675,000 | 266 | Bishan Street 24 | #05 | 1 | 0 | 0 | |

| 3-room (income ceiling $14,000) | 1 | $314,000 | 156B | Bishan Street 11 | #02 | 1 | 0 | 1 | |

| 4-room | 1 | $667,000 | 532A | Bishan Street 14 | #19 | 1 | 1 | 1 | |

| 3-room (income ceiling $14,000) | 1 | $473,000 | 535C | Bishan Street 13 | #29 | 1 | 0 | 1 | |

| 4-room | 1 | $622,000 | #07 | 1 | 1 | 1 | |||

| Bukit Merah | 2-room Flexi (short lease) | 1 | NA | 45 | Telok Blangah Drive | #10 | 1 | 0 | 1 |

| 2-room Flexi (balance lease) | $166,000 | ||||||||

| 2-room Flexi (short lease) | 1 | $150,000 | 58 | Havelock Road | #18 | 1 | 0 | 1 | |

| 3-room (income ceiling $14,000) | 1 | $260,000 | 103 | Bukit Purmei Road | #11 | 1 | 0 | 1 | |

| 4-room | 1 | $622,000 | 78C | Telok Blangah Drive | #04 | 1 | 1 | 1 | |

| 2-room Flexi (short lease) | 2 | $126,000 | 80B | Telok Blangah Street 31 | #04 to #07 | 2 | 0 | 2 | |

| 3-room (income ceiling $14,000) | 1 | $386,000 | 92A | Telok Blangah Street 31 | #02 | 1 | 0 | 1 | |

| 2-room Flexi (short lease) | 1 | $140,000 | 92B | Telok Blangah Street 31 | #14 | 1 | 0 | 1 | |

| Bukit Timah | 2-room Flexi (short lease) | 1 | $120,000 | 21 | Toh Yi Drive | #09 | 1 | 0 | 1 |

| Clementi | 5-room | 1 | $475,000 | 338 | Clementi Avenue 2 | #02 | 1 | 0 | 1 |

| 4-room | 1 | $328,000 | 612 | Clementi West Street 1 | #03 | 1 | 1 | 1 | |

| 4-room | 1 | $298,000 | 710 | Clementi West Street 2 | #02 | 1 | 1 | 1 | |

| Geylang | 2-room Flexi (short lease) | 5 | $146,000 | 95A | Circuit Road | #02 to #04 | 5 | 0 | 5 |

| 2-room Flexi (99-year lease) | $255,000 | ||||||||

| 3-room (income ceiling $14,000) | 3 | $375,000 | #02 | 3 | 1 | 3 | |||

| 4-room | 1 | $552,000 | #02 | 1 | 1 | 1 | |||

| 2-room Flexi (short lease) | 10 | $111,000 | 95B | Circuit Road | #02 to #13 | 10 | 1 | 10 | |

| 2-room Flexi (99-year lease) | $193,000 | ||||||||

| 3-room (income ceiling $14,000) | 2 | $383,000 | #02 to #03 | 2 | 1 | 2 | |||

| 4-room | 2 | $552,000 | #02 | 2 | 1 | 2 | |||

| 4-room | 7 | $515,000 | 95C | Circuit Road | #02 to #04 | 7 | 1 | 7 | |

| 4-room | 3 | $515,000 | 97A | Circuit Road | #02 | 3 | 1 | 3 | |

| 4-room | 9 | $545,000 | 97B | Circuit Road | #02 | 9 | 1 | 9 | |

| 4-room | 8 | $533,000 | 99A | Circuit Road | #02 to #03 | 8 | 1 | 8 | |

| 4-room | 2 | $545,000 | 99B | Circuit Road | #02 | 2 | 1 | 2 | |

| Kallang Whampoa | 4-room | 4 | $535,000 | 141A | Mcnair Road | #02 to #03 | 4 | 1 | 4 |

| 2-room Flexi (short lease) | 1 | $139,000 | 141B | Mcnair Road | #02 | 1 | 1 | 1 | |

| 2-room Flexi (short lease) | 7 | $118,000 | 141C | Mcnair Road | #02 to #16 | 7 | 1 | 7 | |

| 5-room | 1 | $635,000 | 3C | Upper Boon Keng Road | #03 | 1 | 0 | 1 | |

| Pasir Ris | Executive | 1 | $620,000 | 111 | Pasir Ris Street 11 | #01 | 0 | 1 | 1 |

| Executive | 1 | $550,000 | 137 | Pasir Ris Street 11 | #02 | 0 | 1 | 1 | |

| Queenstown | 4-room | 1 | $331,000 | 8 | Holland Avenue | #10 | 1 | 0 | 1 |

| 2-room Flexi (short lease) | 1 | $167,000 | 27 | Ghim Moh Link | #15 | 1 | 1 | 1 | |

| 2-room Flexi (balance lease) | $287,000 | ||||||||

| 2-room Flexi (short lease) | 1 | NA | 89 | Commonwealth Drive | #01 | 1 | 0 | 1 | |

| 2-room Flexi (balance lease) | $132,000 | ||||||||

| 2-room Flexi (short lease) | 1 | $180,000 | 90 | Tanglin Halt Road | #10 | 1 | 0 | 1 | |

| 2-room Flexi (short lease) | 1 | $177,000 | 91 | Tanglin Halt Road | #06 | 1 | 0 | 1 | |

| 3-room (income ceiling $14,000) | 1 | $174,000 | 169 | Stirling Road | #14 | 1 | 0 | 1 | |

| 4-room | 1 | $588,000 | 28B | Dover Crescent | #06 | 1 | 0 | 1 | |

| 2-room Flexi (short lease) | 1 | $163,000 | 61A | Strathmore Avenue | #06 | 1 | 0 | 0 | |

| 2-room Flexi (short lease) | 2 | $163,000 | 62B | Strathmore Avenue | #06 to #08 | 2 | 0 | 1 | |

| Serangoon | 4-room | 1 | $350,000 | 236 | Serangoon Avenue 3 | #03 | 1 | 0 | 0 |

| 5-room | 1 | $532,000 | 312 | Serangoon Avenue 2 | #02 | 1 | 0 | 1 | |

| Tampines | 4-room | 1 | $328,000 | 258 | Tampines Street 21 | #04 | 0 | 1 | 1 |

| 4-room | 1 | $348,000 | 277 | Tampines Street 22 | #06 | 0 | 1 | 0 | |

| Toa Payoh | 4-room | 1 | $551,000 | 119B | Alkaff Crescent | #02 | 1 | 0 | 1 |

| 3-room (income ceiling $14,000) | 1 | $362,000 | 216A | Bidadari Park Drive | #03 | 1 | 1 | 1 | |

| 4-room | 2 | $541,000 | #03 | 2 | 0 | 2 | |||

| 4-room | 4 | $538,000 | 216B | Bidadari Park Drive | #02 | 4 | 0 | 4 | |

| 4-room | 1 | $534,000 | 226A | Bartley Walk | #02 | 1 | 1 | 1 | |

| 5-room | 2 | $651,000 | #02 | 2 | 1 | 2 | |||

| 4-room | 6 | $518,000 | 226B | Bartley Walk | #02 | 6 | 1 | 6 | |

| 5-room | 2 | $644,000 | #02 | 2 | 0 | 2 | |||

| 4-room | 1 | $529,000 | 227A | Bartley Walk | #02 | 1 | 0 | 1 | |

| 5-room | 1 | $657,000 | 227B | Bartley Walk | #02 | 1 | 0 | 1 | |

| 4-room | 2 | $484,000 | 268A | Toa Payoh East | #05 to #16 | 2 | 2 | 2 | |

| 2-room Flexi (short lease) | 2 | $112,000 | 270A | Toa Payoh East | #09 to #14 | 2 | 2 | 2 | |

| 4-room | 1 | $511,000 | #12 | 1 | 1 | 1 | |||

| 2-room Flexi (short lease) | 2 | $126,000 | 402A | Lorong 1 Toa Payoh | #05 to #35 | 2 | 2 | 2 | |

| 4-room | 1 | $527,000 | 79E | Toa Payoh Central | #02 | 1 | 0 | 1 |

The Ethnic Quota Available quoted is based on the balance Ethnic Quota from previous exercises (read: some of these flats cannot be sold to buyers of certain ethnic groups).

Also, remember that the flats available are on a first-come, first-served basis. So decide fast and act quick!

Note: for the latest flat availability — once application commences — and the exact street names, please check HDB’s Open Booking of Flat listings!

What Is Open Booking of Flats?

If you’ve missed out on a successful application for a particular BTO project and subsequently the Sale of Balance Flats (SBF) exercise, the Open Booking of Flats exercise is an HDB Flat buyer’s final opportunity to get a unit in that elusive BTO project.

After all, the third time’s the charm, right?

First Try

You apply for a particular BTO project.

Unfortunately, it was oversubscribed and you didn’t get it.

Second Try

A couple of months later during the SBF exercise.

You realise that there are flats within the same BTO project you wanted, which are up for sale again. Now, you won’t have the whole range to choose from but you’ve got a pretty good pick.

You apply for the balance flats within the same BTO project.

But sadly… you didn’t get balloted. Or the ethnic quota is maxed out.

Third Try

After the SBF, HDB rounds up all of the remaining flats and pools them together with completed flats which were repossessed or sold back to HDB.

Finally, HDB puts them up for sale via the Open Booking of Flats.

Should I Apply For an Open Booking Flat?

If you’re really picky about the floor and unit, then Open Booking of Flats is NOT for you.

Because when it comes to the flats available, you can only choose whatever is left.

More often than not, your only choice is one unit in an entire block. Also, even if the flat you’re choosing is a completed unit, HDB does not allow any viewing of the flat in person.

But if you’re only concerned about getting a flat ASAP, then the Open Booking of Flats is perfect for you.

Also, the best thing about getting an Open Booking Flat is that unlike BTO launches (which only happen four times a year), you can apply anytime you want.

Just take note that you might be limited by the Ethnic Quota restrictions.

So… Since They Are “Left Over”, Are Open Booking Flats Cheaper?

ERM… NO.

You wish sia…

Unlike your supermarket sushi which is reduced to half-price (or more) close to closing time. Open Booking Flats aren’t priced that way.

Step-by-Step Guide: How to Apply for Open Booking of Flats?

The HDB Open Booking of Flats process is really short and simple.

1) Check Your Eligibility

You wouldn’t order chicken rice from the Chicken Rice Uncle before checking if you’ve got enough money on you, right?

The same applies to an HDB flat.

If you’re already familiar with our Seedly BTO Guide, then you’ll be glad to know that the:

- Eligibility criteria

- Income ceilings

- Housing schemes

which applies to BTOs also applies to HDB flats available for Open Booking.

2) Figure Out How You Want to Finance Your Flat Purchase

Since the HDB Open Booking of Flats is a really quick process.

You should obtain an HDB Loan Eligibility (HLE) letter or an Approval in Principle (AIP) loan letter from your bank in advance as you’ll need it for Registration and Selection.

So if you have a hard time deciding between using a bank loan or an HDB loan to pay for your new HDB flat…

You’ll want to figure that out NOW.

Before the online application opens.

Alternatively, you could ask the friendly SeedlyCommunity for advice!

3) Submit Your Application Online

Instead of going down personally to HDB Hub, you can apply online using your:

- Mobile phone

- Tablet

- Computer

After submitting your application, you will receive:

- Queue number

- Selection appointment date and time to book a flat

Gentle reminder: this is given out on a first-come, first-served basis

Depending on when you submit your online application, this is when you can expect to book your flat:

| If You Applied Online | Earliest Time You Can Book A Flat... |

|---|---|

| After midnight and before noon (Mon – Fri) | In the afternoon of the same day |

| After noon and before midnight (Mon – Thu) | In the morning of the following day |

| After noon and before midnight (Fri) | In the morning of the following Mon |

| Sat and Sun | In the afternoon of the following Mon |

You’ll notice that your booking appointment can be as early as the same day of your application.

For example, if you applied for an HDB flat on Wednesday morning at 10am…

Your booking appointment might be as early as 1pm on the same day.

Word of advice?

Make sure you apply leave (whispers: or geng MC) on application day!

4) Registration and Selection (aka Booking Your Flat)

There are a couple of things which you’ll need to bring along during this appointment:

- Identity cards (if you’re in the SAF, SCDF or SPF, you’ll need to provide a certified true copy of your NRIC from your Personnel Department)

- Passport for non-citizens

- Doctor’s certification of pregnancy or birth certificates of your children (if you apply under Parenthood Priority Scheme)

- Your birth certificate and your parents’ marriage certificate (if you’re buying the flat under the Multi Generation Priority Scheme or Married Child Priority Scheme)

- Marriage certificate (if you’re married)

- Divorce certificate (if you’re divorced)

- Death certificate of your spouse (if your spouse is deceased)

- Student Pass or Letter from School or College or Institute of Learning for persons who are >18 years

- Income documents for assessment of income ceiling to buy or take CPF housing grant(s)

If you’re opting for an HDB loan, you’ll also need to submit your HLE letter at this point.

(See? That’s why you need to have it ready.)

Oh, to book your flat, you’ll also need to pay the option fee.

| Flat Type | Option Fee Payable |

|---|---|

| 2-room Flexi Flat | $500 |

| 3-room Flat | $1,000 |

| 4-/5-room/3Gen/Executive Flat | $2,000 |

Which you can pay through:

- Cash

- Cashier’s order, or

- Cheque

5) Sign the Agreement for Lease

The next HDB Appointment is when you’ll sign the Agreement for Lease.

You’ll need to bring the original copy of the following:

- Identity cards

- Receipt of booking fee

- Bank passbook and photocopy of the page stating your name and bank account number

- Approval in Principle of loan letter from bank or financial institution

- Power of Attorney (if unable to attend the appointment personally)

- Latest CPF statements

You’ll also need to make a downpayment for your flat:

- 15% of your flat if you’re taking an HDB loan

- 25% of your flat if you’re paying via a bank loan

as well as any other legal fees and stamp duties.

If you intend to use your CPF to pay for your flat, you’ll need to set-up the 2-Factor Authentication for your SingPass.

FYI: this registration takes up to 10 working days to be activated.

#dontsayneversay

6) Collect Your Keys

If the flat you booked is already completed, you can collect your keys on the same day you sign the Agreement of Lease!

(Toldja it would be fast.)

If it’s not ready yet, you’ll just need to wait till it’s done.

To collect your keys, you’ll need the original copy of the following:

- Identity cards

- Certificate of Fire Insurance (different from Home Insurance)

- Power of Attorney (if unable to attend the appointment personally)

- Latest CPF statements

- Completed GIRO form (if you’re paying monthly loan instalments partially or fully by cash)

Related Articles:

Advertisement