If you’re a Singaporean looking to buy a new HDB BTO or HDB resale flat, you’ll most likely be looking at a housing loan.

But even with the lower downpayment from an HDB loan, you’re still looking at a staggering 20% downpayment, which translates to about $100,000 for a $500,000 4-room HDB flat.

Unless you and your partner have been working for a few years or are simply rich, you’re unlikely to have $100,000 in cash or CPF.

Thankfully, there is something called the Staggered Downpayment Scheme, where you can pay a much smaller amount first and pay off the rest of the downpayment at a later date! For eligible young couples who are still studying or are National Servicemen (NSFs), the government has also announced that you can pay even less upfront come June 2024!

So here’s all you need to know about the HDB Staggered Downpayment Scheme!

TL;DR: HDB Staggered Downpayment Scheme

- What is the HDB Staggered Downpayment Scheme?

- HDB Staggered Downpayment Scheme Eligibility

- Deferred Income Assessment Eligibility

- Why the HDB Staggered Downpayment Scheme Is Good

What is the HDB Staggered Downpayment Scheme?

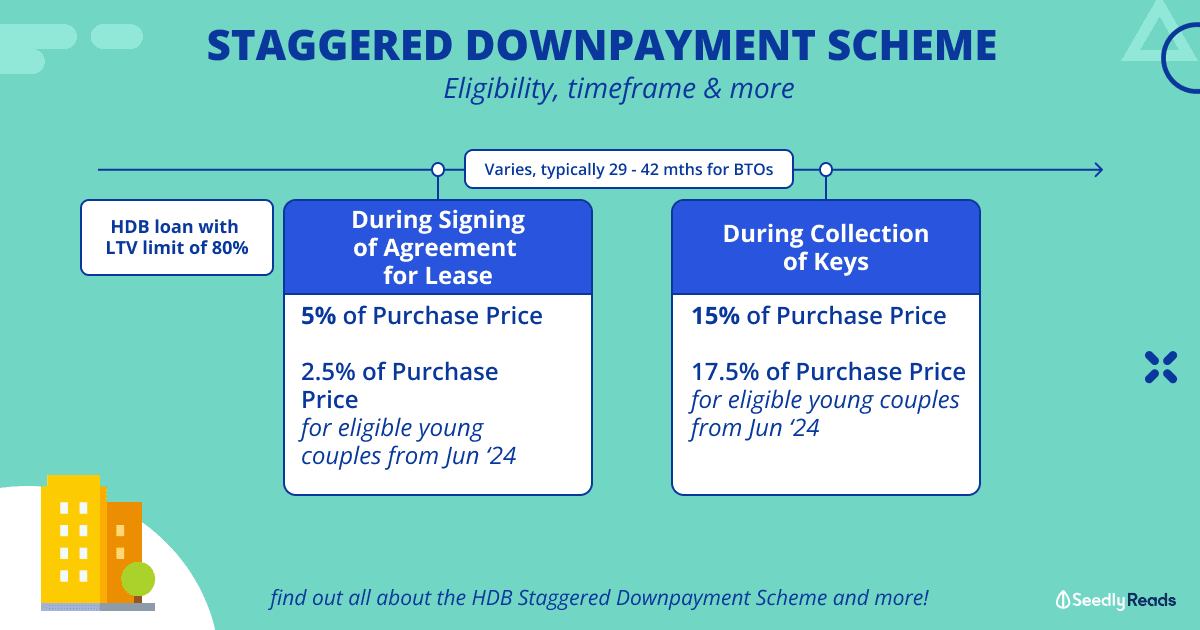

In simple terms, the Staggered Downpayment Scheme is a two-part “instalment” for your HDB downpayment.

Assuming you take an HDB housing loan with a Loan-To-Value (LTV) limit of 80%, you’ll need to pay a 20% downpayment of the flat’s purchase price upfront. However, if you are eligible for the Staggered Downpayment Scheme, you can pay 5% first during the signing of agreement for lease and then 15% later on during key collection.

Recently, the government has also announced an enhancement to this scheme effective June 2024 where eligible young couples can pay 2.5% first instead of 5%, before paying the remaining during key collection. This is a great move financially if you play your cards right! But more on that later.

The above scenario only applies if you are taking an HDB housing loan with an LTV limit of 80% though, so here’s the full breakdown depending on whether you are taking a HDB loan, bank loan or no loan at all:

| Type of loan | Standard Staggered Downpayment Scheme | For young couples eligible for deferred income assessment from the Jun 2024 sales exercise | ||

|---|---|---|---|---|

| Payment to be made during signing of lease (of purchase price) | Payment to be made during key collection (of purchase price) | Payment to be made during signing of lease (of purchase price) | Payment to be made during key collection (of purchase price) | |

| Not taking housing loan | 5.0% | 95.0% | 2.5% | 97.5% |

| HDB housing loan: LTV limit of 80% | 5.0% | 15.0% | 17.5% | |

| Bank loan: LTV limit at 75% | 10.0% | 15.0% | 22.5% | |

| Bank loan: LTV limit at 55% | 10.0% | 35.0% | 42.5% | |

Read more

You might be wondering, how long does it take between the signing of agreement for lease and key collection?

Well, if you are applying for the HDB BTO launch in February 2024, for example, the waiting time will be between 29 to 42 months (assuming you wait the full 9 months between booking a flat and signing the agreement for lease). So you have a good 2.5 to 3.5 years to save up for the remaining downpayment.

For flats in the midst of construction or completed flats, wait times will vary depending on when your key collection is.

HDB Staggered Downpayment Scheme Eligibility

To be eligible for the HDB Staggered Downpayment Scheme, here are the conditions:

First-timer couples

- Both are first-timer applicants, or a couple comprising a first-timer applicant and a second-timer applicant

- Obtained a valid HFE letter on or before the younger applicant’s 30th birthday

- Booked an uncompleted 5-room or smaller flat in any of HDB’s sales exercises

Flat owners who right-size to a 3-room or smaller flat in non-mature estates

- Have not sold or completed the sale of their existing flat at the time of their HFE letter application

- Booked an uncompleted 3-room or smaller flat in a non-mature estate in any HDB sales exercises

You will be informed during the flat booking appointment if you are eligible.

Deferred Income Assessment Eligibility

For young couples who want to enjoy the lower 2.5% initial downpayment, you’ll need to fulfil some additional criteria under the Deferred Income Assessment.

First off, you need to be a student or NSF:

Both parties of a couple must:

- Be full-time students or National Servicemen (NSF); and/ or

- Have completed full-time studies or National Service (NS) within the last 12 months before the HFE letter application.

Additionally, you need to provide supporting documents:

| Status | Documents Required |

|---|---|

| Full-time student | Document from Education Institution confirming enrolment in a full-time programme |

| Completed studies within the last 12 months before the HFE letter application | Graduation certificate |

| Full-time National Serviceman | National Service ID card or letter from the relevant ministry |

| ORD within the last 12 months before the HFE letter application | ORD Certificate of Service |

There are also these requirements:

Age limit

- At the point of the HFE letter application, at least one party must be aged 30 or below.

Marital status

- The couple must be married or are applying for a flat under the Fiancé/ Fiancée Scheme.

Household status

- One party must be a first-timer.

Income assessment

- If you are eligible, the income assessment for EHG and HDB housing loan will be carried out at the following points:

-

For the Purchase of: Income Assessment Completed flat During the flat booking appointment Uncompleted flat Approximately 3 months before flat completion

Why the HDB Staggered Downpayment Scheme Is Good

If you qualify for the HDB Staggered Downpayment Scheme, congratulations!

Remember when I mentioned that this is a great move financially?

You’ll earn money in the long run if you play your cards right! Let me explain.

Assuming an HDB Housing loan with an LTV limit of 80%, you will need to pay 5% of the purchase price initially and the remaining 15% during key collection.

Let’s also assume that the purchase price is $500,000, and the wait time between the signing and key collection is 36 months (3 years).

So, you will pay $25,000 upfront and the remaining $75,000 later.

Even if you don’t have the $75,000 now, you can invest your downpayment savings for some good interest. (You can do this with CPF too!)

But for convenience, let’s just say you have the $75,000 now and put it into a “risk-free” product such as the Singapore Savings Bond.

Based on the latest interest rate of 2.95% for the first 3 years, you will earn a sweet $11,835.23 in interest, and the remaining downpayment will stay the same at $75,000!

This is compared to paying the full $100,000 upfront, where you won’t have that $75,000 to help you generate interest on your money.

THAT SAID, you have to invest in “risk-free” products, or low-risk ones at least. You don’t want to lose such a large sum of money and then fail to make your remaining downpayment.

Advertisement