Health Insurance for Expats in Singapore Made Easy

You are moving to an entire new place, for some of you, it might even be your first time away from home! We understand that you can get extremely excited but hold your horses! Before you board that plane to Singapore…

What kind of coverage would you require?

Likewise for Singaporeans, when it comes to planning your insurance portfolio, there is no one-size-fits-all solution to them. But there is one main thing that is essential to protect yourself from, especially when you are relocating to an entire new place.

That is when health insurance comes in, health insurance helps cover the cost of medical care.

TL;DR: Health Insurance For Expats And Foreigners In Singapore

The Different Types Of Health insurance You Need:

- Hospitalisation

- Outpatient Coverage

- Dental Check Ups

- Maternity Coverage

The average cost of health insurance:

- ~$132 ( Integrated Shield Plan covering a B1 ward for non-smoking 45-year-old men and women in Singapore)

Is health insurance mandatory in Singapore?

Do you need health insurance?

Besides the “greener-pastures” here in Singapore, you need to know that medical bills in Singapore are exorbitant. Instead of extending your journey to financial independence by spending your savings on hospital bills, it would be wise to insure yourself instead.

We understand that you must be handling a lot of things at once (like Spongebob, above) with your move here to Singapore. But we have broken them down for you the Seedly way. Hehe.

Yes, you NEED health insurance if…

- You feel that the insurance coverage that your company provides is inadequate.

- Your company does not provide insurance coverage.

- You started your own business here in Singapore.

- You are a dependant here in Singapore, where your spouse is working but you are not.

No, you DO NOT NEED health insurance if…

- You are contented with the insurance coverage that your company provides.

- You have an existing health insurance at your home country that covers you for your stay in Singapore.

General Check List For Health Insurance For Singapore Expats

I have listed the general things that you should look out for in your health insurance. Base on your needs and existing coverage, you may opt for a specific plan that offers a higher coverage if you need so. Vice versa.

- Hospitalisation

- Outpatient Coverage

- Dental Check-ups

- Maternity

Remember! Check with your human resource department if you company has insurance coverage for these, it is not necessary to have 2 insurance policies that covers the same thing!

1. Hospitalisation Coverage

This is pretty straight forward, you would like your health insurance to cover hospital bills ranging from,

- Hospital Accommodations, drugs and dressings, surgeon and anaesthetists fees, theatre charges, intensive care unit, and pathology.

2. Outpatient Coverage

You want to cover your expenses on your medical consultations that did not require you to be hospitalised. Such medical consultations can range from:

- Routined medical checkups

- General Practitioner visits

- Outpatient treatment and tests

- Diagnostic and surgical procedures

3. Dental Check-ups

You want to cover your visits to the dentist.

- Routine/ Emergency Dental

4. Maternity Coverage

You want to cover while in maternity.

- Maternity care

- Childbirth coverage

- Pregnancy complications

What is the average cost of health insurance for Expats?

Generally, the average cost of an Integrated Shield Plan covering a B1 ward for non-smoking 45-year-old men and women in Singapore is S$132. This does not include MediShield Life premiums or Medisave contributions. The average cost varies and can go from as low as $69 before MediSave contributions, to as high as $1,063 for 75-year-olds. This cost may also vary depending on whether or not you get a rider with your Integrated Shield Plan package.

Health Insurance For Expats And Foreigners: Available Here in Singapore

| Company | Coverage* |

|---|---|

| NTUC Income | Locally |

| AIA Singapore | Local and Global |

| Great Eastern Life | Locally |

| Aviva | Locally |

| Prudential | Locally |

| Liberty Insurance | Globally |

| AXA Singapore | Globally |

| FWD Singapore | Globally |

| MSIG | Globally |

- Local coverage only covers you for your stay in Singapore

- Global coverage might exclude some countries

Health Insurance For Expats and Foreigners: Coverage in Singapore ONLY

This plan is commonly known to Singaporeans as the integrated shield plan. Integrated shield plans are health insurance with a co-payment system of 5% of which you can limit the co-payment with an add-on.

This is an affordable option if you are looking to stay in Singapore for a long time.

Health Insurance For Expats and Foreigners: GLOBAL Coverage

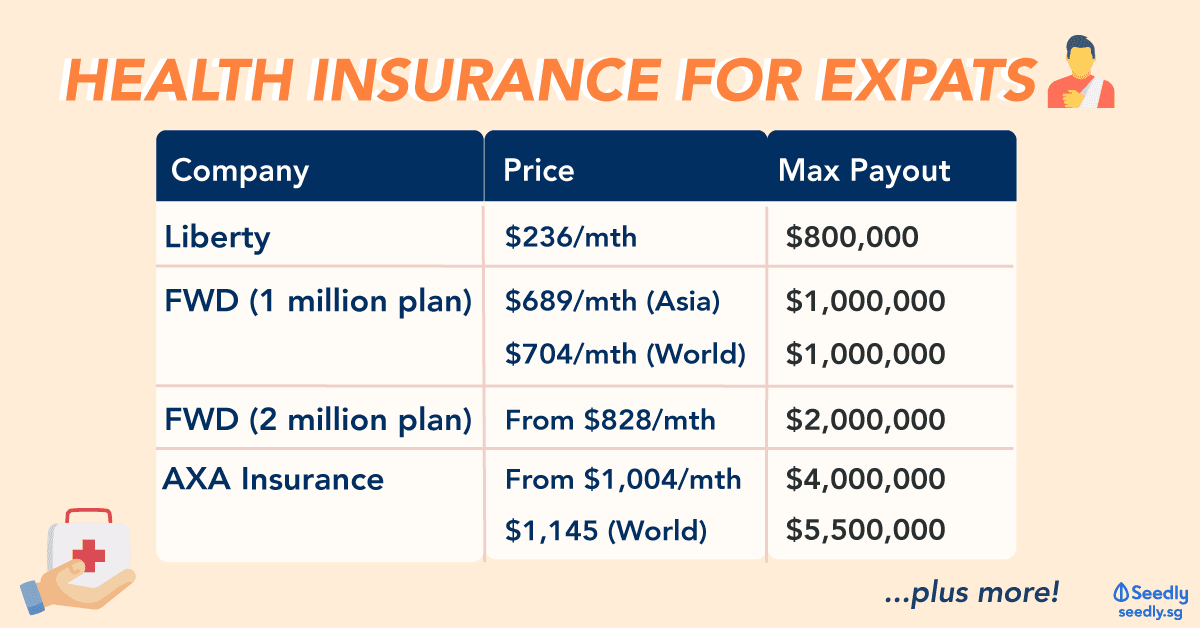

The following quotation is based off a 35-year-old, female, only looking for hospitalization, outpatient coverage, and maternity coverage not only in Singapore.

| Company | Lowest Price Range (per month) | Where? | Maximum Payout |

|---|---|---|---|

| Liberty | $236 | Worldwide | S$ 800,000 |

| FWD Singapore (1 mil plan) | $689 | ASEAN | $1,000,000 |

| $695 | Asia Pacific excl HK and Macau | $1,000,000 | |

| $704 | Worldwide excl USA | $1,000,000 | |

| $1,007 | Worldwide | $1,000,000 | |

| FWD Singapore (2 mil plan) | $828 | ASEAN | $2,000,000 |

| $835 | Asia Pacific excl HK, Macau | $2,000,000 | |

| $846 | Worldwide excl. USA | $2,000,000 | |

| AXA Insurance (International Exclusive Plan A) | $1,004 | Asia | $4,000,000 |

| $1,073 | Worldwide excl. USA | $4,000,000 | |

| AXA Insurance (Global Core Plan A2) | $1,145 | Worldwide excl USA | $5,500,000 |

Source: GoBear

Some of these providers allow you to select plans according to your needs. If you feel a lot of the coverage is redundant, you are able to opt for an option of the lower price range. The higher the coverage, the higher the price. It is this simple!

You can use comparison sites such as GoBear to help you compare premium prices, you can filter the search in accordance to your needs as well. Don’t need a financial advisor for that anymore, GUYS, this is the future!

Disclaimer: We are not sponsored, all opinions here are of our own.

Coming to a foreign land away from home, having to face adulthood on your own can be pretty daunting. Especially if you have relocated here on your own. We have a close-knitted community here at Seedly where you can share your financial woes and learn from each other with tips and hacks to get by in Singapore.

Coming to a foreign land away from home, having to face adulthood on your own can be pretty daunting. Especially if you have relocated here on your own. We have a close-knitted community here at Seedly where you can share your financial woes and learn from each other with tips and hacks to get by in Singapore.

With that, Seedly extends their arms to welcome you to Singapore. We hope you will enjoy your stay here!