Best Home Insurance Singapore (2024) Guide: Lessons Learnt When My Wife Tried to Set Me On Fire

●

One day, while I was relaxing in the living room, reading the investment discussions on the Seedly Community — and learning from the pros there.

I smelt something burning.

Instinctively, I ran to the kitchen and noticed that there was an empty pan on the stove.

And it was smoking.

I picked it up and started dousing it with water in the sink.

Looking at the hob, I quickly put together what happened.

When we cook our eggs, we usually lower the flame to keep it from overcooking the yolk.

This time, however, my wife forgot that the burner was still lit and attempted to burn me alive and decided to take a shower after she was done with cooking.

After I explained what happened, she apologised and asked, “Eh, by the way, we have fire insurance, right?”

Which got me thinking…

DO WE?!

Information is accurate as of 25 April 2023. Do note that prices and promotions are subject to change without prior notice.

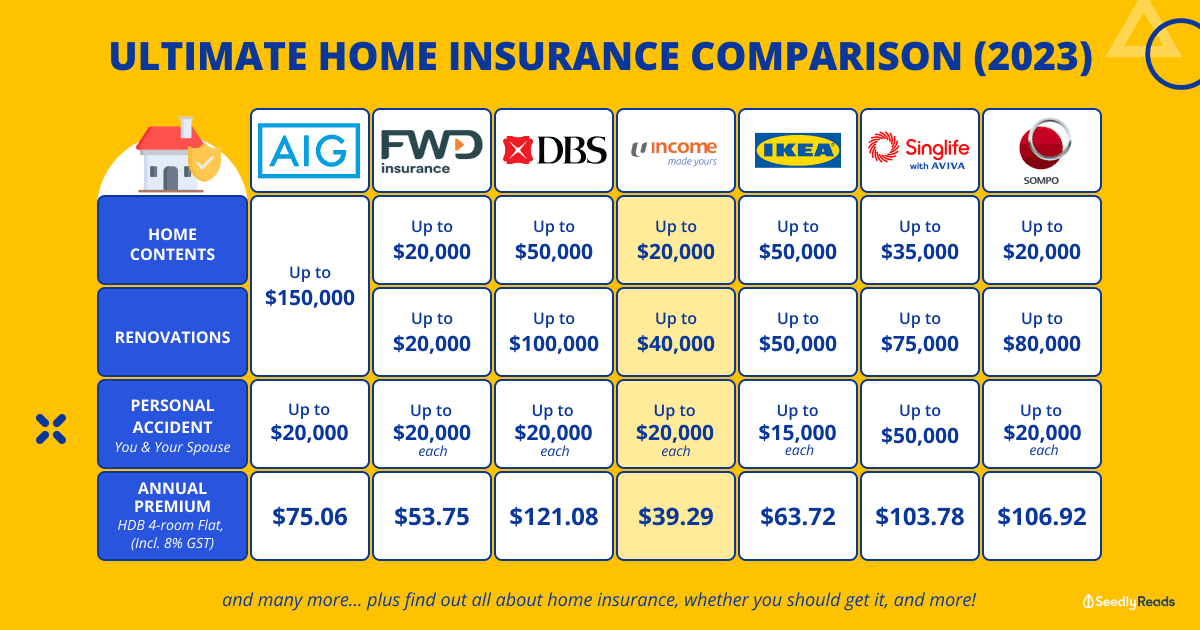

TL;DR: Best Home Insurance Singapore (2023) Guide — Your Comprehensive Home Insurance Comparison

Home insurance protects your home and valuables against unexpected dangers like fire, flood, or theft.

| Home Insurance Plan | 1-Year Premium (Inclusive 8% GST for 2023) | Home Contents | Renovations, Fixtures & Fittings | Personal Liability | Accident at Home (You & Spouse) | Accident at Home (Children) |

|---|---|---|---|---|---|---|

| AIA Elite Home Care Standard | $170.73 | Up to $16,000 | Up to $80,000 | Up to $500,000 | Up to $20,000 total (Extended to spouse and children) |

|

| AIG Home Insurance Enhanced Public Housing Contents Insurance Apply Now | $75.06 | Up to $150,000 | Up to $400,000 | Up to $20,000 total (Insured/Partner aged <65) |

||

| DBS myHome Protect II Classic (underwritten by Chubb) | $121.08 | Up to $50,000 | Up to $100,000 | Up to $1,000,000 | Up to $20,000 each (Insured/Partner) | Up to $5,000 each |

| FWD Home Insurance | $53.75 - $177.47 (customisable) | Up to $20,000 - $100,000 | Up to $20,000 - $100,000 | Up to $500,000 | Up to $20,000 per household member |

|

| Hong Leong Home Protect360 Silver | $259.20 | Up to $100,000 | Up to $100,000 | Up to $500,000 | Up to $10,000 each (Insured/Partner) | Up to $3,000 each |

| IKEA HEMSÄKER Home Insurance (underwritten by Etiqa) | $63.72 (Regardless of flat or housing type) | Up to $50,000 | Up to $50,000 | Up to $500,000 | Up to $15,000 each (Insured/Partner) | Up to $10,000 each |

| MSIG Enhanced Home Plus Standard Apply Now | $119.88 | Up to $50,000 | Up to $75,000 | Up to $1,000,000 | Up to $20,000 each (Insured/Partner) | Up to $10,000 per child |

| NTUC Income Enhanced Home Insurance | From $39.29 (customisable) | $20,000 - $200,000 | $40,000 - $500,000 | $500,000 | $20,000 each (Insured/Partner) | $10,000 per child |

| Singlife Home Lite | $103.78 | Up to $35,000 | Up to $75,000 | Up to $250,000 | Up to $50,000 total | |

| Sompo HomeBliss Insurance Cosy | $106.9 | Up to $20,000 | Up to $80,000 | Up to $750,000 | Up to $20,000 each (Insured/Partner) | Up to $5,000 each (Unlimited number of children) |

| Tiq Home Insurance Apply Now Use Promo Code TIQSEEDLY to get 25% off when you apply | $101.44 - $174.07 (customisable) | Up to $45,000 - $105,000 | Up to $80,000 - $160,000 | Up to $500,000 | Up to $15,000 each (Insured/Partner) | Up to $10,000 each |

Note: Quote based on 4-room HDB flat.

If you live in an HDB flat, you’ll definitely have to buy HDB Fire Insurance.

However, this fire insurance only covers the cost of reinstating damaged internal structures, fixtures, as well as areas built and provided by HDB.

If you want to be protected against damage (like from a fire or flood) and theft to home contents, alternative accommodation, compensation for damage to your neighbour’s home and more.

You’ll need to buy home insurance!

Is Fire Insurance in Singapore Mandatory?

As long as you’re financing your home with some kind of loan.

You’ll definitely need to fire insurance coverage.

HDB Home Insurance If You Own an HDB Flat: Is Mortgage Insurance Compulsory for HDB?

Under the mandatory HDB Fire Insurance Scheme, all HDB occupants have to purchase fire insurance that is currently undertaken by FWD Singapore Ptd Ltd.

“Why is this mandatory,” you ask?

According to HDB, all “flat owners with HDB loans commencing on or after 1 September 1994 must buy and renew the HDB fire insurance for your homes, for as long as you have an outstanding HDB loan”.

This fire insurance is only valid for 5 years and has to be renewed.

Here’s how much the 5-year premium (including 7% GST) costs for the various HDB flat types:

| Flat Type | 5-Year Premium (Including 8% GST for 2023) | Sum Insured |

|---|---|---|

| 1-Room | $1.63 | $29,000 |

| 2-Room/ 2-Room Flexi | $2.73 | $48,700 |

| 3-Room | $4.91 | $60,400 |

| 4-Room/ S1 | $5.99 | $82,000 |

| 5-Room/ S2/ 3Gen | $7.19 | $97,300 |

| Executive/ Multi-Generation Flats | $8.18 | $106,200 |

| Studio Apartment (Type A/B) | $2.73 | $48,700 |

Since my place is a 4-room HDB BTO…

It costs a grand total of ~$6 for 5 years.

If you’re going, “Wah… So cheap sia…”

That’s because this fire insurance only covers the cost of reinstating damaged internal structures, fixtures, as well as areas built and provided by HDB.

Yeah… So all of the wife’s beloved plants and that LED TV that I love so much?

They’re not covered by HDB Fire Insurance if that frying pan, and I went up in flames.

If you’re paying for your flat with a bank loan, your bank will definitely need you to take out a Mortgagee Interest Policy.

Basically, it’s a fire insurance policy which you pay for, but it names the bank as the beneficiary (read: if anything happens, the payouts go to the bank).

Fire insurance is no longer compulsory if you’ve paid off your home loans or you (gasp) choose to pay for your property in cash.

If You Own a Private Property

Since you’re taking a bank loan, you’ll need to get a Mortgagee Interest Policy.

If you’re living in a condominium, your Management Corporation Strata Title (MCST) will confirm maintain a fire insurance policy on behalf of the entire estate.

Again, fire insurance is no longer compulsory if you’ve paid off your home loan or are baller enough to pay for your private property in cash.

Home Insurance vs Fire Insurance: What’s the Difference?

I’ve established earlier that most HDB owners, like you and I, have HDB Fire Insurance.

However, HDB Fire Insurance does NOT protect the contents of my home, such as:

- Furniture (like my comfortable grey sofa)

- Appliances (like my beloved LED TV)

- Personal belongings (like my collection of Power Range… erm… I mean, MY book collection of rare First Editions).

So if you want protection for all of that, that’s where home insurance comes in.

Oh, and just in case you’re wondering.

I also found out that because the majority of Singaporean HDB dwellers already have fire insurance, home insurance policies are designed to complement instead of overlap with your existing fire insurance coverage.

So you don’t have to worry about overpaying for the same coverage.

What Types of Home Insurance Are Available, and What Does It Cover?

Convinced that I needed to look at getting home insurance on top of my mandatory HDB Fire Insurance, I did a little digging and found out that typical home insurance will cover:

Building Fixtures, Fittings, and Renovation Insurance Singapore

If your entire home or HDB flat is destroyed.

HDB Fire Insurance will cover you for the original building, fixtures, and fittings.

For anything else, like renovations, additional fixtures and fittings installed.

Like my wife’s custom-made walk-in wardrobe.

Your home insurance will take care of that.

Home Content Insurance Singapore

This means stuff like your 500 pots of plants, fridge, TV, home PC setup, washing machine, etc.

If you get home insurance, you’ll be able to replace your home contents if they’re damaged or stolen.

.

.

.

Now, if you’re an art collector or keep all of your money in a biscuit tin at home.

Do You Need To Buy Home Insurance in Singapore?

You’ll need more comprehensive home insurance (read: more expensive) to cover stuff like:

Alternative Accommodation

In the case of a fire or flood, it’s unlikely that your home is liveable.

But you’ll still need a place to stay.

This coverage pays you a daily benefit to pay for alternative accommodation (usually capped to a certain number of days).

Personal Accident

To pay for medical expenses, payouts for accidental death and disability and etc., for you and your family.

Or even your domestic helper — if you hire one.

This is usually offered as an optional add-on, as some people would already have personal accident coverage.

Personal Effects

Such as the loss of money and valuables in the event of theft or a break-in.

However, there’s usually a limit as to how much you can claim.

Personal Liability

This protects you from situations which you might be legally held responsible for.

For example, it protects you as a renter if your landlord holds you accountable because your cat broke one of her expensive ceramic vases.

Pets

Speaking of pets.

Some policies will cover the loss of a pet.

Usually dogs or cats, and are limited to certain breeds or pedigree.

This coverage is usually offered as a separate option.

Insured Peril vs All-Risk

Some home insurance plans offer an “Insured Peril” and an “All-Risk” option.

Insured Peril policies offer you protection provide coverage against losses from specified incidents such as fire, explosion, theft, and natural disasters.

An All-Risk policy covers you for a much wider range of scenarios.

The latter is more expensive and probably only recommended if you’re the kiasi (Hokkien: afraid of dying) type.

Best Home Insurance Plans In Singapore

So which is the best home insurance plan to get?

I approached a couple of insurers to look for a one-year plan for a 4-room HDB apartment.

Where possible, it will be Basic, Standard, or Insured Peril policies only.

For the sake of consistency, I’ve also included personal accident coverage for all plans.

And here’s what I got:

| Home Insurance Plan | 1-Year Premium (Inclusive 8% GST for 2023) | Home Contents | Renovations, Fixtures & Fittings | Personal Liability | Accident at Home (You & Spouse) | Accident at Home (Children) |

|---|---|---|---|---|---|---|

| AIA Elite Home Care Standard | $170.73 | Up to $16,000 | Up to $80,000 | Up to $500,000 | Up to $20,000 total (Extended to spouse and children) |

|

| AIG Home Insurance Enhanced Public Housing Contents Insurance Apply Now | $75.06 | Up to $150,000 | Up to $400,000 | Up to $20,000 total (Insured/Partner aged <65) |

||

| DBS myHome Protect II Classic (underwritten by Chubb) | $121.08 | Up to $50,000 | Up to $100,000 | Up to $1,000,000 | Up to $20,000 each (Insured/Partner) | Up to $5,000 each |

| FWD Home Insurance | $53.75 - $177.47 (customisable) | Up to $20,000 - $100,000 | Up to $20,000 - $100,000 | Up to $500,000 | Up to $20,000 per household member |

|

| Hong Leong Home Protect360 Silver | $259.20 | Up to $100,000 | Up to $100,000 | Up to $500,000 | Up to $10,000 each (Insured/Partner) | Up to $3,000 each |

| IKEA HEMSÄKER Home Insurance (underwritten by Etiqa) | $63.72 (Regardless of flat or housing type) | Up to $50,000 | Up to $50,000 | Up to $500,000 | Up to $15,000 each (Insured/Partner) | Up to $10,000 each |

| MSIG Enhanced Home Plus Standard Apply Now | $119.88 | Up to $50,000 | Up to $75,000 | Up to $1,000,000 | Up to $20,000 each (Insured/Partner) | Up to $10,000 per child |

| NTUC Income Enhanced Home Insurance | From $39.29 (customisable) | $20,000 - $200,000 | $40,000 - $500,000 | $500,000 | $20,000 each (Insured/Partner) | $10,000 per child |

| Singlife Home Lite | $103.78 | Up to $35,000 | Up to $75,000 | Up to $250,000 | Up to $50,000 total | |

| Sompo HomeBliss Insurance Cosy | $106.9 | Up to $20,000 | Up to $80,000 | Up to $750,000 | Up to $20,000 each (Insured/Partner) | Up to $5,000 each (Unlimited number of children) |

| Tiq Home Insurance Apply Now Use Promo Code TIQSEEDLY to get 25% off when you apply | $101.44 - $174.07 (customisable) | Up to $45,000 - $105,000 | Up to $80,000 - $160,000 | Up to $500,000 | Up to $15,000 each (Insured/Partner) | Up to $10,000 each |

*prices rounded up

What To Look Out for When Buying Home Insurance in Singapore?

When it comes to choosing a home insurance policy, it’s important to first understand your needs so that you don’t over or under-insure yourself.

You shouldn’t just go for the cheapest home insurance plan.

And neither should you splurge on the most comprehensive one available.

You should probably focus on two aspects: Renovation and Home Content coverage.

Renovations, Fixtures & Fittings

If you’re living in a 4-room HDB flat that you renovated for next to nothing.

Then you probably wouldn’t need a costly plan with extensive coverage for this.

Conversely, if you have a custom wardrobe or an island bar in the living room, then you’ll probably want to consider getting more insurance for this.

To get a good agaration of this, use your total renovation cost (not inclusive of furniture and appliances) as a guide.

What Is Content Coverage on Home Insurance?

Depending on how large you live (read: how atas your taste is)…

How much coverage you require for your home content will also vary widely.

If you have an extensive art collection at home that’s worth four times the GDP of a small developing nation, then you BETTER have sufficient home content coverage.

Getting Adequately Insured

Once you have a ballpark range of how much you need to cover the above two aspects.

The next step is identifying the best home insurance policy which covers all bases — it’s a bonus if the coverage extends to other aspects as well.

If you find a policy which you like, but it does not cover everything you’re looking for, you can usually opt for add-on protection.

Most insurers allow this flexibility (read: comes at additional cost).

Oh, and you should also look out for discounts on policies.

While looking at 1-year premiums, I realised that insurers usually offer a nice discount if you sign up for a longer duration — usually between three to five years.

Home Insurance Promotion

Some insurers will also have special promo codes or certain days where you can get a sizeable discount on your home insurance premium.

Once you’ve purchased your home insurance plan, you should make it a habit to review your coverage on a yearly basis.

When you’ve just moved into your newly-renovated HDB BTO, you probably spent $30,000 on renovations.

But a year later, you’d probably have filled that same home with an expensive 65″ OLED TV, a top-of-the-range sound system, along with a home bar that you stocked with an expensive collection of gin or whiskey.

Yep.

Your 1-year old home insurance policy might need to be upgraded in order to adequately protect your new purchases..

Can I Buy More Than One Home Insurance?

Also, if you were wondering, it is actually possible to purchase more than one type of home insurance policy in case you discover that one policy does not offer enough coverage. But you’ll probably get a better deal by opting for an upgraded version of your home insurance policy with more coverage when you pay more premiums.

Closing Thoughts

Personally, I’m getting a basic, insured peril policy with no add-ons first.

Okay, I’ll probably look at adding personal accident coverage.

And just in case, I’m locking away all the matches and banning the wife from our kitchen.

Because reasons…

Read More:

Advertisement