Looking to Diversify Your Portfolio Towards Asia? Here Are The Popular ETFs on The Stock Exchange of Hong Kong (SEHK) to Consider

●

Despite the troubles and turbulence facing the Chinese special administrative region of Hong Kong, the Stock Exchange of Hong Kong (SEHK) still remains the fourth largest stock exchange in the world based on its market capitalisation of $4.8 trillion in 2019.

Many Singaporean investors are drawn to Chinese and Hong Kong companies as they would like to tap on China’s growth potential.

Through the SEHK, you can invest in many blue-chip mainland Chinese companies like Alibaba, Tencent, Xiaomi, Bank of China, Ping An Insurance and more.

At the core of it, Singaporean investors want exposure to China and Hong Kong due to China’s ascension to the position of the world’s second-largest economic superpower.

As China continues to mature as an economic superpower, many of its citizens will become richer and drive growth across the country’s sectors as well as Chinse companies going overseas to expand.

Similarly, China’s stock market has grown tremendously along with its economy, growing to a total market capitalisation of S$11.73 trillion in 2019.

With such a huge economy and stock market, China is hard to ignore for investors looking to diversify globally.

Although the Coronavirus has put a dampener on this growth, China still has a lot of potential to grow.

Not to mention that Singaporean investors will have to pay low fees when buying stocks on the SEHK.

However, do note that you will still have to pay commission to brokers. Check out our guide to the cheapest brokerages in Singapore if you would like to save on that.

A good way to get this exposure to China and Hong Kong will be to invest in the right exchange-traded funds (ETFs) as it would give them broad exposure to large companies at a low cost.

Personally, as I am more risk-averse I would limit my exposure to China and Hong Kong due to the volatility with the Hang Seng Index falling 19% since 1st Jan (as of 27 May).

Furthermore, the political unrest surrounding Hong Kong is also another cause for concern not to mention the fraud investigations involving US-listed Chinese firms.

If you would still like to add Hong Kong and Chinese securities to your portfolio, here are some of the popular physical ETFs you can buy on the SEHK to gain exposure to China and Hong Kong in your portfolio.

We are only including physical ETFs as they hold all, or most, of the underlying assets of the index. This makes them comparatively less volatile than the synthetic ETFs.

With synthetic ETFs, it is also a lot more complex and there’s a higher risk that a large proportion of the underlying index’s performance can’t be captured along with other risks.

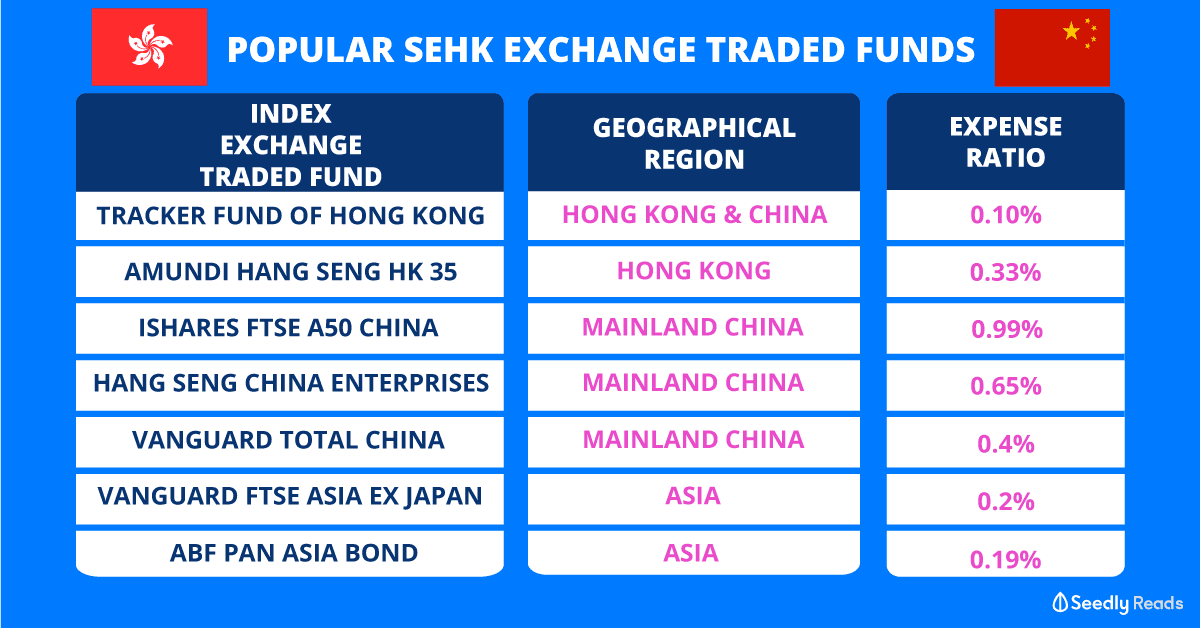

TL;DR Popular ETFs Listed on The SEHK to Consider

If you would still like to add Hong Kong, Chinese and some Asian securities to your portfolio, here are some of the popular physical ETFs you can buy on the SEHK!

Fund Geographical Region Expense Ratio

Tracker Fund of Hong Kong ETF Hong Kong & Mainland China 0.10%

Amundi Hang Seng HK 35 Index ETF Hong Kong 0.33%

iShares FTSE A50 China Index ETF (A-shares) Mainland China 0.99%

Hang Seng China Enterprises Index ETF (H-shares) Mainland China 0.65%

Vanguard Total China Index ETF Worldwide 0.4%

Vanguard FTSE Asia ex Japan Index ETF Asia 0.2%

ABF Pan Asia Bond Index Fund Asia 0.19%

Chinese Share Classes

But first, you will need to understand the different type of classifications when trading Chinese stocks.

Also, according to IndexUniverse, these are all the different share classes:

Share Class Description

A-shares Chinese companies incorporated on the mainland and traded in Shanghai or Shenzhen, quoted in RMB.

B-shares Chinese companies incorporated on the mainland and traded in Shanghai and quoted in USD or traded in Shenzhen and quoted in HKD (open to foreign ownership).

H-shares Chinese companies incorporated on the mainland and traded in Hong Kong.

Red chips State-owned Chinese companies incorporated outside the mainland (mostly in Hong Kong) and traded in Hong Kong.

P-chips Nonstate-owned Chinese companies incorporated outside the mainland, most often in certain foreign jurisdictions (Cayman Islands, Bermuda, etc.) and traded in Hong Kong.

N-shares Chinese companies incorporated outside the mainland, most often in certain foreign jurisdictions, and U.S.-listed on the NYSE or Nasdaq

(ADRs of H-shares and red chips are also sometimes referred to as N-shares).

What Are Exchange-Traded Funds?

Secondly, before you start buying up ETFs listed on the SEHK, here are some important things to consider.

When you are investing in ETFs you are not actually buying a company’s stock or bonds directly. Rather you are investing money into a fund that buys a basket of stocks and bonds for you.

Naturally, holding multiple stocks or assets in one fund reduces volatility in comparison to just buying a few individual stocks.

Do note that when investing in ETFs, be sure that you would buy the underlying assets that the fund invests in.

As diversified as ETFs are, they are still an investment. And as with all investments, ETFs come with risk.

Risks of Buying ETFs

Even though you are buying an ETF with several underlying positions, the risk still applies. Some investments might give higher returns but are a lot riskier and ETFs are no exception.

In other words, less risk ≠ no risk.

Also, be sure that you would buy the underlying assets that the fund invests in and remember that past performance, which is no guarantee of future results.

Hong Kong SEHK Exchange Traded Fund Fees

SEHK Fees

| Fee | Percentage |

|---|---|

| Stamp Duty | 0.1% (Round up to the nearest dollar) |

| CCASS fee | 0.002% (Minimum HKD2.00, Maximum HKD100) |

| Transaction Levy | 0.0027% |

| Trading fee | 0.005% |

Expense Ratio

Expense ratio (or management expense ratio) is the expense incurred to pay the managers for managing the fund.

Choosing an actively managed fund will naturally cost more per year and eat into your returns. So as an investor, you want to find an ETF with a low expense ratio.

Foreign Currency Risk

Since these ETFs are denominated in a currency outside Singapore dollars (SGD), investors need to be aware of the risk of currency fluctuations, during transactions and translations.

On top of this, brokerages also charge conversion fees. When you too up SGD to your brokerage account and buy securties denominated in HKD, your broker will charge a currency conversion fee which will eat into your returns.

When You have any currency conversion always consider multi-currency accounts like YouTrip, Revolut, InstaReM or TransferWise as they generally charge lower fees.

Check out our multi-currency account comparison if you would like to save more!

1) Tracker Fund of Hong Kong ETF (SEHK:2800) – Tracking The Hang Seng Index (HSI)

First up we have the Tracker Fund of Hong Kong (TraHK), an ETF designed to track the Hang Seng Index (HSI).

This ETF was established in 1999 which makes it one of the oldest on the list. It also has net assets of HK$83.15 billion (S$15.23 billion).

The HSI is a free float-adjusted market capitalisation index of the 50 biggest companies (by market cap) that trade on the SEHK.

The index has four sub-sectors:

- Industry

- Finance

- Real Estate Investment Trusts

- Utilities

Like the Stratis Time Index (STI) and the S&P 500, the HSI is often used as a proxy for the overall stock market in Hong Kong.

Unlike the S&P 500 which tracks 500 companies, the HSI is narrower and has been including more and more Chinese companies over the years.

On 18 May 2020, the Hang Seng index announced that it will now allow companies with primary listings overseas and companies with dual-class shares to be included in the index.

This means that three Chinese technology companies Alibaba, Meituan and Xiaomi will soon be included in the index.

The top 10 companies (61.63% of total assets) represented in the TraHK ETF include:

Company Portfolio Weight (%)

Tencent Holdings Ltd 11.24%

AIA Group Ltd 10.12%

China Construction Bank Corp Class H 8.36%

HSBC Holdings PLC 8.14%

Ping An Insurance (Group) Co. of China Ltd Class H 5.81%

Industrial And Commercial Bank Of China Ltd Class H 4.76%

China Mobile Ltd 4.69%

Hong Kong Exchanges and Clearing Ltd 3.70%

Bank Of China Ltd Class H 2.89%

CNOOC Ltd 1.92%

As you can see this portfolio allocation is heavily weighted to mainland Chinese companies that are classified under the H-share classification.

Over the last 5 years, the ETF has produced annualised returns of 0.66% (as of 27 May 2020).

This fund also charges an expense ratio (net) of just 0.10%.

Do note that past performance is no guarantee of future results.

2) Amundi Hang Seng HK 35 Index ETF (SEHK:3012) — Mainly Hong Kong Companies

However, if you want to avoid mainland Chinese companies, the Amundi Hang Seng HK35 is a better bet.

This ETF was established in 2016 and has total net assets of HK$36.06 million (S$6.06 million).

For those who are pessimistic about mainland China, investing in this ETF will give you exposure to a wide range of local and international companies Hong Kong companies based in Hong Kong.

The fund holds stocks of companies that derive the majority of their revenue from areas outside of mainland China.

The majority of the companies tracked by this index are from the Financial Services, Real Estate, Utilities and Industrials industries. However, the fund is heavily weighted toward the financial sector.

The top 10 companies (61.63% of total assets) represented in the Amunidi HK35 ETF include:

Comapny Portfolio Weight (%)

AIA Group Ltd 10.30%

Hong Kong Exchanges and Clearing Ltd 10.08%

HSBC Holdings PLC 8.28%

CLP Holdings Ltd 5.25%

CK Hutchison Holdings Ltd 5.17%

Link Real Estate Investment Trust 4.86%

Hong Kong and China Gas Co Ltd 4.71%

CK Asset Holdings Ltd 4.23%

Sun Hung Kai Properties Ltd 4.10%

Galaxy Entertainment Group Ltd 3.63%

Over the last 3 years, the ETF has produced annualised returns of -0.662% (as of 27 May 2020).

This fund also charges an expense ratio (net) of just 0.33%.

Do note that although this is a smaller fund, we’ve included this in this list as it is one of the few indexes that strictly track mainly Hong Kong companies.

3) iShares FTSE A50 China Index ETF (SEHK:2823) — Tracking The FTSE A50 Index

Now to the more mainland China-focused ETFs.

This ETF tracks the FTSE China A50 index the benchmark for investors to invest in the Chinese domestic market through A-shares.

A-shares are actually shares of the publicly listed mainland Chinese companies that trade on the Shenzen and Shanghai stock exchanges with the stocks trading in yuan. Normally foreigners cannot readily buy A-shares

But, due to a unique collaboration between the SEHK, Shanghai and Shenzhen Stock Exchanges, called the Stock Connect initiative, A-shares can be traded on the SEHK.

Thus the iShares FTSE A50 China Index consists of the 50 largest A-share companies listed on the Shanghai Stock Exchange and Shenzhen Stock Exchange.

It is also a free-float adjusted index that is screened to ensure liquidity with the index acting as a proxy for the underlying China market.

This iShares FTSE A50 China Index ETF was established back in 2003 and has total net assets of HK$16.91 billion (S$3.1 billion).

The majority of the companies tracked by this index are from the Financial Services, Consumer Defensive, Technology, Real Estate and Healthcare industries. However, the fund is heavily weighted toward the financial sector.

The top 10 companies (54.32% of total assets) represented in the iShares FTSE A50 China Index ETF include:

Company Portfolio Weight (%)

Ping An Insurance (Group) Co. of China Ltd 11.52%

Kweichow Moutai Co Ltd 10.64%

China Merchants Bank Co Ltd 6.97%

Wuliangye Yibin Co Ltd 4.61%

Gree Electric Appliances Inc of Zhuhai 4.29%

Industrial Bank Co Ltd 3.90%

Jiangsu Hengrui Medicine Co Ltd 3.53%

CITIC Securities Co Ltd 3.10%

China Vanke Co Ltd 2.96%

China Minsheng Banking Corp Ltd 2.80%

Over the last 5 years, the ETF has produced annualised returns of 0.91% (as of 27 May 2020).

This fund also charges an expense ratio (net) of a hefty 0.99%.

4) Hang Seng China Enterprises Index ETF (SEHK:2828)

Like the name suggests, the ETF tracks the Hang Seng China Enterprises Index.

This index tracks the mainland China incorporated companies that issue H-shares, a class of ordinary shares that are traded outside mainland China.

The Hang Seng China Enterprises Index ETF was established back in 2003 and has total net assets of HK$21.03 billion (S$3.85 billion).

The majority of these companies are in the Financial Services, Communication Services, Energy, Real Estate and Consumer Cyclical industries. However, the fund is heavily weighted toward the financial sector.

The top 10 companies (60.29% of total assets) represented in the Hang Seng China Enterprises Index ETF include:

Company Portfolio Weight (%)

China Construction Bank Corp Class H 10.45%

Ping An Insurance (Group) Co. of China Ltd Class H 9.38%

Tencent Holdings Ltd 9.26%

Industrial And Commercial Bank Of China Ltd Class H 7.70%

China Mobile Ltd 7.25%

Bank Of China Ltd Class H 4.72%

CNOOC Ltd 4.72%

China Life Insurance Co Ltd Class H 3.89%

China Life Insurance Co Ltd Class H 2.81%

China Petroleum & Chemical Corp Class H 2.12%

Over the last 5 years, the ETF has produced annualised returns of -4.34% (as of 27 May 2020).

This fund also charges an expense ratio (net) of a hefty 0.65%.

5) Vanguard Total China Index ETF (SEHK:3169)

Want to invest in Chinese companies and get comprehensive exposure to all the share classes? Check out the Vanguard Total China Index ETF.

This fund has 9000 holdings across the various share classes and lets you invest in Chinese companies that list their shares in the SEHK, mainland China and countries all over the world.

Unlike the other ETFs on this list that is more weighted towards the finance industry, the Vanguard Total China Index is more diversified which reduces concentration risk.

The Vanguard Total China Index was listed back in 2018 and has total net assets of ¥182.63 million (S$36.13 million).

The majority of these companies are in the Financial Services, Consumer Services, Technology, Consumer Goods and Industrials. However, even though the Financial Services sector is the heaviest weighted, it is not as skewed towards that sector compared to the other ETFs.

The top 10 companies (37.7% of total assets) represented in the Vanguard Total China Index ETF include:

Company Portfolio Allocation (%)

Alibaba Group Holding Ltd. 11.97%

Tencent Holdings Ltd. 10.12%

China Construction Bank Corp. Class H 2.53%

Kweichow Moutai Co. Ltd. Class A 2.10%

Ping An Insurance Group Co. 1.85%

Industrial & Commercial Bank of China Ltd. Class H 1.78%

Meituan Dianping Class B 1.52%

China Mobile Ltd. 1.40%

JD.com Inc. ADR 1.14%

Bank of China 0.98%

Over the last year, the Vanguard Total China Index ETF produced annualised returns of 2.9% (as of 27 May 2020).

This fund also charges an expense ratio (net) of just 0.4%.

6) Vanguard FTSE Asia ex Japan Index ETF (SEHK:9805)

If you want a really diversified portfolio, you can consider the Vanguard FTSE Asia ex Japan Index ETF.

Investing in this ETF will give you exposure to the stock markets of China, Hong Kong, India, South Korea, Malaysia, Indonesia, South Korea, Malaysia, Pakistan, Philippines, Singapore, Taiwan and Thailand.

Out of these countries. the top market allocation exposure are in China, Taiwan, Korea, Hong Kong and India equity markets with 88.9% of net assets assigned to these markets.

This is done by tracking the FTSE Asia Pacific ex Japan, Australia and New Zealand Index.

This index is a market capitalisation index that consists of stocks of 700 plus companies in 11 developed and emerging markets in Asia. However, it leaves out common stocks in Australia, New Zealand and Japan.

This ETF was established back in 2013 and has a total net asset value of HK$429 million (S$78.49 million).

The majority of these companies are in the Financial Services, Technology, Consumer Services, Consumer Goods and Industrials. However, even though the Financial Services sector is the heaviest weighted, it is not as skewed towards that sector compared to the other ETFs.

The top 10 companies (32.4% of total assets) represented in the Vanguard FTSE Asia ex Japan Index ETF include:

Company Portfolio Allocation (%)

Alibaba Group Holding Ltd. ADR 7.54%

Tencent Holdings Ltd. 6.37%

Taiwan Semiconductor Manufacturing Co. Ltd. 5.03%

Samsung Electronics Co. Ltd. 3.98%

AIA Group Ltd. 2.33%

China Construction Bank Corp. Class H 1.48%

Ping An Insurance Group Co. of China Ltd. 1.23%

Reliance Industries Ltd. 1.18%

Industrial & Commercial Bank of China Ltd. Class H 1.12%

Meituan Dianping Class B 0.96%

Over the last 5 years, the ETF has produced annualised returns of 0.8%.

This fund also charges an expense ratio (net) of just 0.2%.

7) ABF Pan Asia Bond Index Fund (SEHK:2821)

Last but not least we have the ABF Pan Asia Bond Index Fund an exchange-traded bond fund that tracks the Markit iBoxx ABF Pan-Asia Index.

The fund consists of government bonds and municipal bonds issued by governments and quasi-government institutions in:

- China

- Hong Kong

- Indonesia

- Korea

- Malaysia

- Philippines

- Singapore

- Thailand.

These bonds are issued in their local currencies but you buy them in USD on the SEHK while it is domiciled in Singapore.

The exchange-traded bond fund was established back in 2005 and has total net assets of US$3.57 billion (S$5.07 billion).

The top 10 holdings represented in this bond fund include:

Country Bond Portfolio Allocation (%)

Republic of Singapore 2.75% 1.27%

Republic of Singapore 2.75% 1.25%

Republic of Singapore 3.5% 1.21%

China (People's Republic Of) 3.52% 1.18%

Republic of Singapore 2.25% 1.12%

Republic of Singapore 3.25% 1.02%

China (People's Republic Of) 3.25% 0.99%

Republic of Singapore 3.38% 0.98%

Philippines (Republic Of) 8% 0.94%

China (People's Republic Of) 2.95% 0.91%

Although the fund consists of many Singapore bonds, there is still quite a bit of diversification in other Asian countries when you buy this exchange-traded bond fund.

Over the last 5 years, the exchange-traded bond fund has produced annualised returns of 2.09%.

This fund also charges an expense ratio (net) of just 0.19%.

There you have it. Seven popular ETFs for you to consider investing in on the SEHK.

This serves as an introduction to these funds. I can’t stress this enough but do remember to do your homework on them before doing any investing.

And as with ETFs be sure that you would buy the underlying assets that the fund invests in. Also, be mindful of the industry weightage of these funds.

Do also note that past performance is no guarantee of future results.

Have Burning Questions Surrounding The Stock Market?

Why not check out our friendly SeedlyCommunity and jump in the discussion about stocks!

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any stock.

Advertisement