When my mum had me, she only got me covered with a life insurance. Not only till I am older that she got me covered with hospitalisation insurance.

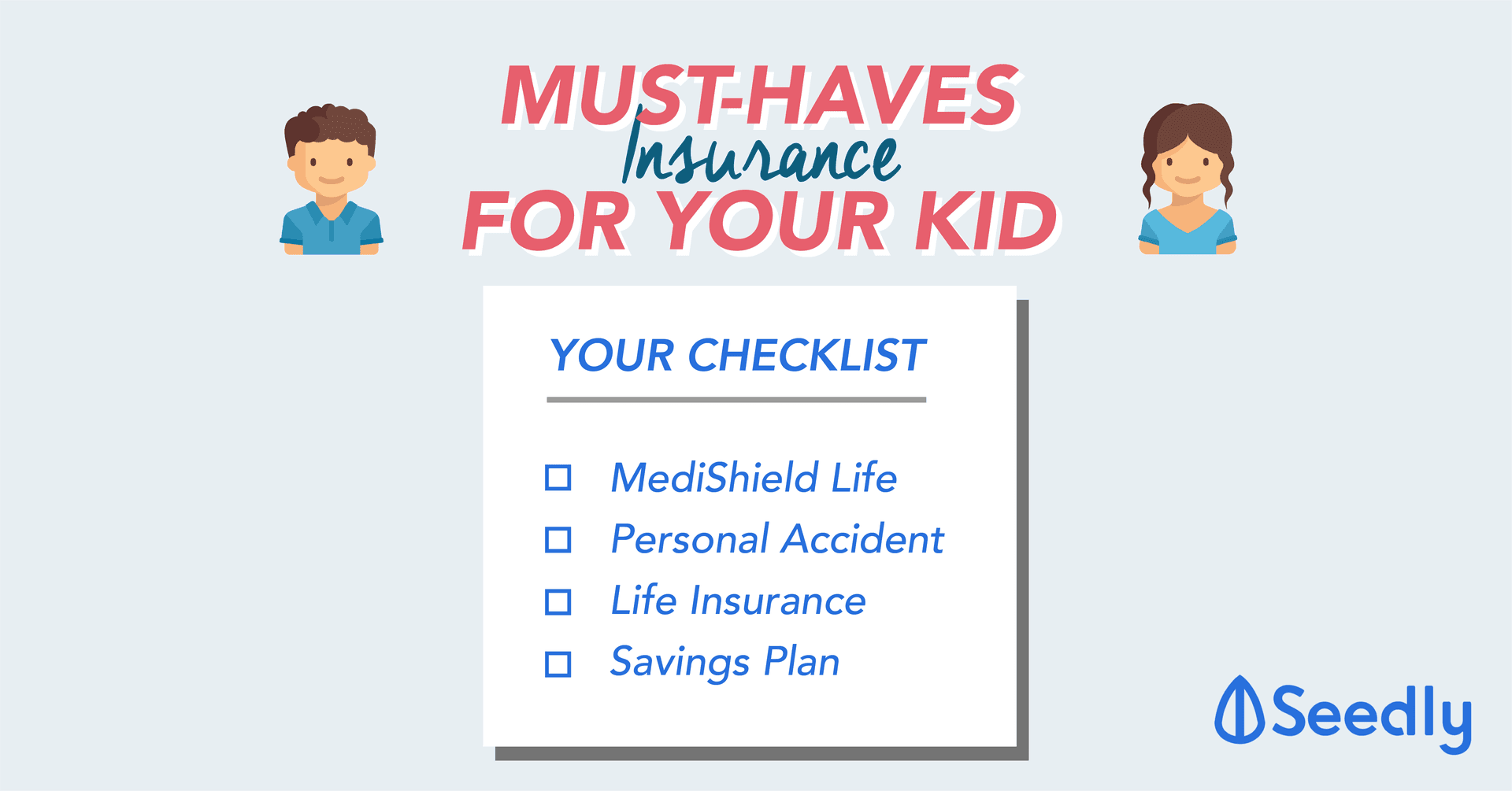

What I am saying is, this is not a one-size fit all for every parent in Singapore, but it serves as a guide for young parents like yourself to see what are the available products that you feel deem fit to cover your child with.

So with that, here are some of the child insurance available. The way it is ordered might not correlate with importance. ?

1. MediShield Life & Integrated Shield Plans with Riders

This is most important and I would even say almost-compulsory to protect your child from unforeseen circumstances that would lead to hospital-stays or even treatment. Touch wood, really! But better to be safe than never.

MediShield Life

What does it protect your child from?

- Hospital Bills

MediShield Life covers every Singaporean and Singapore Permanent Residence (PR), MediShield Life will pay a portion of the hospital bill if anything were to happen to your child.

One may want to consider buying a private integrated shield plan for their newborn. This allows coverage for the child at higher-class wards in public and private hospitals.

With newborns having a tendency to fall sick easily, a private integrated shield plan will cover a large part of the cost should there be a need to be admitted to the hospital.

Integrated Shield Plan and their Riders

Integrated Shield Plan covers another portion of the hospital bill. Adding on to an Integrated Shield Plan Rider will provide your child with more comprehensive coverage in case of hospitalisation.

As of 7 March 2018, there are 4 entities responsible for your hospital bill,

- MediShield Life

- Integrated Shield Plan

- Integrated Shield Plan Rider

- 5% Co-Payment covered by yourself

Integrated Shield Plan and their Riders

There are a total of seven insurers in Singapore that provides integrated shield plans.

A clearer breakdown of the hospital bill illustrated can be found here.

Here is the list of integrated shield plans to choose from:

2. Personal Accident Child Insurance

Knowing that your child would not be aware of what is clean and what isn’t. Especially with the mentality of “if it fits in my mouth, I will place it in my mouth”, or not having the habit of washing their hands before their meals.

Children tend to be more accident-prone, not because they are clumsy but they are just not aware of the danger. When I was younger, my mum allowed me to touch the boiling kettle for me to learn that it’s ‘hot’!

What does Personal Accident protect your child from?

- Injuries

- Accidents

- Food Poisoning

- Hand Foot Mouth Disease (HFMD)

Different insurers provide different coverage for personal accident child insurance, so do check with your financial advisor to find one that fits your needs.

3. Life Insurance for Your Child

Having aife insurance for your child receives mixed feelings from our Community, allow me to explain.

Life Insurance for your child allows the parent to receive a payout if anything were to happen to the child, be it death, total permanent disability, or critical illness.

Why Should You Get a Whole Life Insurance for Your Child?

- You are able to lock in their insurability when they’re young.

- If your policy is limited-pay, meaning you only pay your premiums for X amount of years. You get to sort of “clear” your premium earlier and your child gets to enjoy insurance coverage till age 99.

- If the premiums to your plan are the same throughout the years, you get to lock-in at a lower rate because it is cheaper when one buys insurance at a younger age.

Optional: Additional Early Critical Illness Coverage

- If your child falls sick, one parent would most likely stop working to take care of the child. This will result in the loss of income especially if its a dual-income family.

Term Life Insurance Plan for Your Child Instead

This is another option if you are unable to afford whole life insurance for your child at the moment.

Some term life insurance will allow you to convert to a whole life insurance plan but do check with your financial advisor for insurers that provide this convertibility feature.

Wei Quan Soh – “If you think that whole life is too expensive for you now, maybe can consider to take up term life first when they are young because it can be converted to a whole life without medical underwriting in the future if you wish or when they reach adulthood.”

However, Some might feel it is unnecessary, the reason being:

- “Why buy whole life plan when they have no dependents?”

- “I grew up without life insurance and I turn out fine after all!”

At the end of it all, to each its own I guess. After all, insurance is to pay for the ease of mind.

4. Increase Coverage for Yourselves

Don’t forget to relook into your coverage for you and your spouse now that you have an additional person that is dependant on you.

One way to do it:

- Get a Term Life Insurance coverage for 25 years or till you think they are able to sufficiently support themselves whichever is longer.

Hariz Arthur Maloy – “Do make sure that you and your partner are adequately covered first. Because they depend on you to have a solid future for themselves.”

5. Savings Plan

This is not a child insurance neither it is mandatory but it is something good to have. It is easier to progressively save for your child’s future education than to take up a tuition loan or fork out that bulk of money when you need it.

There are several alternative forms of savings plans that help you invest monthly with minimally $100/month:

- Regular Savings Plans with STI ETF or Blue-Chip Investment

- Robo-Advisors

- Singapore Savings Bonds (min. $500 per issuance)

It would be even better if your child is able to clinch a scholarship for their education, you get to keep your money (kinda)!

Know Your Means

Most importantly, you should understand your situation and only commit to something if you are able to. Do speak with your financial advisor with regard to your needs to find sa olution to work around your situation.

Lee Jiahui – “If there’s a need for money, one should not spend too much on insurance.”

If you don’t have a financial advisor, speak to many, speak to all! Until you find one that understands your needs. Read up more on personal finance to learn more and understand your needs better before speaking to them.

Advertisement