The Power of Compound Interest

We often hear that compound interest is the eighth wonder of the world.

But how powerful is it, really?

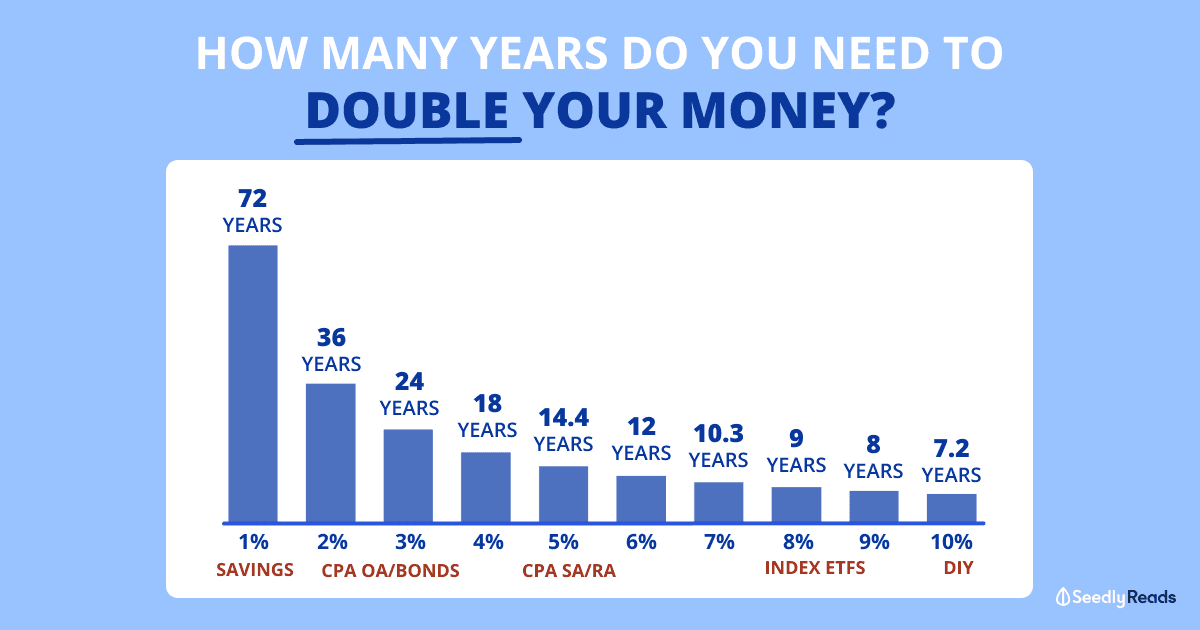

In this article, we see how a higher interest % rate per year would mean the requirement of fewer years to double your money.

In Singapore particularly, there are unique products like the Central Provident Fund (CPF) which also help to support each individual’s endeavour to grow his or her retirement savings.

TL;DR: How Many Years Do You Need to Double Your Money in Singapore?

The Beautiful Rule of 72

You can see in the chart illustrated above, where the black numbers on top represent the number of years, and the interest rate represents the rate of return generated from different financial instruments.

Take 72 divided by the rate of return to determine the time required

It is compressed into this simple formula you can see here:

Simply divide 72 by a constant rate of return, one will be able to derive the amount of time required for their investment money to double.

| Rate Of Return | Number Of Years For Investment Money To Double | Examples |

|---|---|---|

| 1% | 72 | Savings |

| 2% | 36 | CPF OA/ Bonds |

| 3% | 24 | |

| 4% | 18 | CPF SA/RA |

| 5% | 14.4 | |

| 6% | 12 | |

| 7% | 10.3 | Index ETF/ DIY/ Stock Picking |

| 8% | 9 | |

| 9% | 8 | |

| 10% | 7.2 |

An Example: What Strategy to Double $10,000?

Joe, 25 just graduated recently and has been working for over a year now. He has been reading up and is looking for ways to make his money work for him.

Step 1: Determine Your Investible Cash

He has saved up $10,000 excess cash (apart from his emergency funds) and aims to invest all of this $10,000 into the market today.

Step 2: Determine Your Investment Timeframe

- How many years?

For Joe, as he is younger, he has plans to set aside this $10,000 for a period of around 20 to 25 years.

Step 3: Understand Which Products Meet His Time Requirements

We have the full list of investment products here for you to understand.

These are some common places for Singaporeans to consider putting their money:

- Savings accounts

- CPF Ordinary Account

- Bonds, like Singapore Savings Bonds (SSB)

- CPF Special Account

- Exchange-Traded Funds (ETFs)

- DIY stock-picking

| Financial Product | Risk Level | Interest Rate Per Year (Return) | Time to double capital |

|---|---|---|---|

| Savings Account | Lowest | 1% | 72 Years |

| CPF OA | Lowest | 2.5% | 28.8 Years |

| Bonds | Low | 3% | 24 Years |

| CPF SA | Lowest | 4% | 18 Years |

| Index ETFs | High | 8% | 9 Years |

| DIY Stock picking | Highest | 10% | 7.2 Years |

Conclusion: This Is the Foundation of Investing

At the end of the day, this is probably one of the easiest approaches to understand the compounding effect of money and also what products meet your timeframe.

Do your own due diligence and if you are keen to learn more, you can find out more about when you should look at investing, and what portion of your monthly income you should set aside for investments.

And if you’re looking to get started… Here’s all you need to know about investing!

Advertisement