I don’t know if you realised but…

Personal finance is something that we have been taught since young.

You might be thinking, “What personal finance? All I have to do is to wait for my parents to give me money, not enough, then ask for more.”

But the thing is, learning how to manage what tiny amounts of money we have is actually one way to learn personal finance!

Especially for young kids, this can be an excellent way to teach them the importance of budgeting their expenditure.

Giving them too much money can result in them developing bad spending habits.

However, it is crucial to balance out the amount of money we give to our children, so they have enough for their basic needs at the very least.

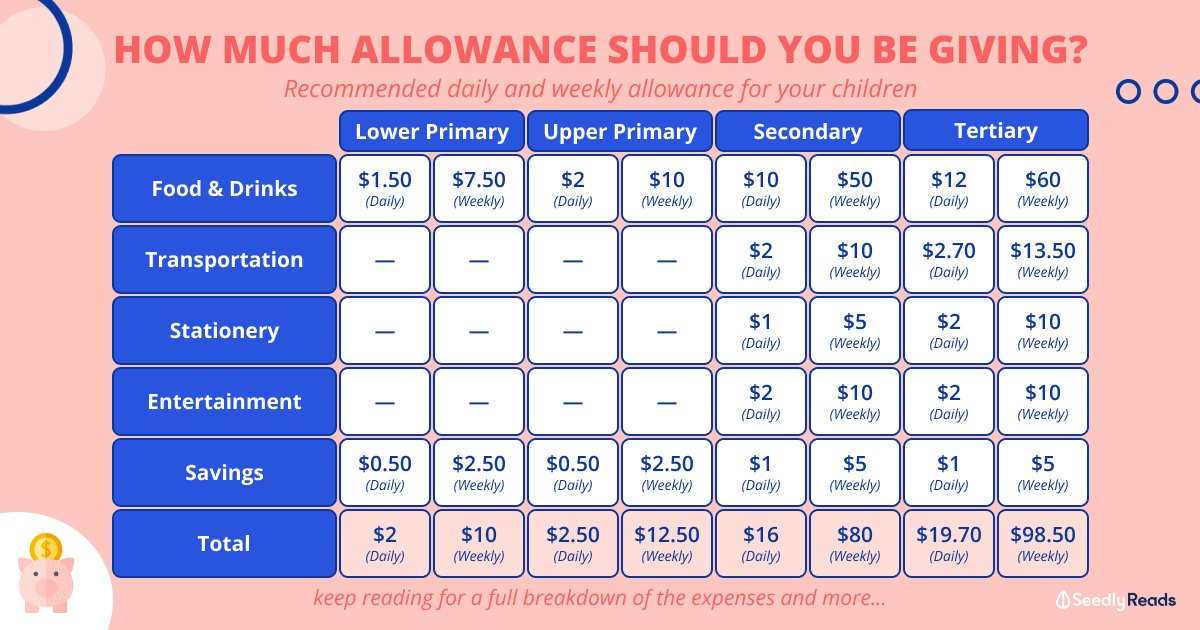

TL;DR: How Much Money Should You Be Giving Your Children?

Do note that this is just a rough estimate of the expenses for the children, and the amounts can be adjusted to suit the child’s actual costs in school or changed based on parenting styles.

The weekly allowance is calculated by the five days the children will be in school and not the full seven days of the week.

Things to Take Note When Giving Children An Allowance

As mentioned earlier, we want to balance when planning an allowance.

Not too much, so the child starts to spend without thinking, nor too little that they do not have enough for expenses.

Important things to consider for your children will be what expenses they will incur.

So let’s break this down into different stages in the lives of the children.

Primary School

At the Primary School level, the children do not have a lot of expenses to worry about, mostly just food expenses since you will most likely take care of their other expenses such as stationery.

One important aspect to consider will be the child’s age.

While they are in lower primary, they might not eat a lot, so you can give them a little less for food expenses.

However, as they grow into upper primary, they might need a little more for their food expenses since the child is growing.

Another thing to note is that the children might take their lunch in school when they stay back in school for extracurricular activities or remedial.

Transport costs will be another essential consideration, especially if you are not fetching your children back and forth from school.

But even so, helping them top up money into their ez-link card should be sufficient for their transport costs, so all you really need to think about is food expenses.

Secondary School

Once your children start Secondary School, besides food costs, it’s a good time to start letting the children have more control over their own money.

You can start allocating part of their allowance for the stationery they use and their transportation costs.

Since they won’t be spending on stationery all the time, any extra money can be put into their savings as well!

In Secondary School, the children will definitely have extracurricular activities, so you will need to include lunch expenses into the allowance.

Take note, the children might even go to food places outside of the school for their lunch with their friends, so don’t be afraid to give a little extra for their lunch expenses.

You can start giving your children some money for their entertainment expenses at this age too.

After all, they are at the age when they want to spend more time with their friends!

Plus, if they don’t spend their entertainment money for the week, this could be an excellent opportunity to help them develop a habit of saving!

Tertiary Education (JC/Polytechnic/ITE)

When your children start their Tertiary education, they will begin to incur more transportation costs, especially if you live further away from where they are studying.

The next thing to note will be that your children might need to stay back for projects or assignments. The canteen stalls would most likely be closed by then, so ensure they have enough money for dinner outside.

Besides food and transportation costs, the allowance will also have to accommodate the costs of printing lecture notes or assignments.

This is also the age where the children will start to socialise more, so you might need to give a heftier sum for their entertainment costs compared to when they were in Secondary School.

Why Is It Important to Teach Your Kids Financial Management at a Young Age?

Now picture yourself as a kid, and you see all sorts of toys, erasers, and snacks on display in the shops at school.

Tempting, isn’t it?

But when you’re given a fixed allowance, you need to worry whether or not you have enough money for food after you buy what you want.

By ensuring that the child has to make such decisions, you can teach them self-control at a young age, preventing them from developing a habit of making impulse purchases in the future.

Of course, it can be argued that the child can ask for more money from their parents.

But we can use that as an opportunity to teach them about whether or not their purchases are needs or wants.

This can also be an excellent chance to say no to your kids when they ask for more money.

After all, do you ask your boss for more money when you overspent for the month?

Especially when the children finally get their own allowance, many opportunities to teach them how to better manage their finances will present themselves.

Furthermore, inculcating a habit of smart finance management early while they are still young and impressionable will help them in the future, when they eventually need to learn these things.

When Should You Stop Giving Your Children An Allowance?

As your children grow older, you will start to think, “when is the right time to stop giving them a monthly allowance?”

Generally, most parents would stop giving their children an allowance when they can support themselves by working part-time during the holidays.

Some parents wait until their children have found a full-time job before stopping.

Ultimately, it’s up to the parents to decide when to stop giving their children a monthly allowance.

A good gauge would be their ability to support their own expenses outside since they do not need to contribute to bills and can choose to eat at home to save money.

With that said, how much are you giving your children as an allowance?

Feel free to hop on to Seedly’s Community to discuss this and other parenting finance queries you might have!

Advertisement