Being a (relatively) young person, I’m always intrigued by the numbers of our Central Provident Fund (CPF).

Knowing that I still have a relatively long runway, I always enjoy trying to figure out how my CPF account can fit into my financial planning and goals.

When it comes to retirement, the presence of CPF reminds me that there’s always a safety net around to fund my future needs.

For the uninitiated, CPF is a mandatory social security savings scheme that consists of CPF LIFE, a life annuity that provides lifetime payouts for eligible individuals.

Now, we should ideally have different income streams that would help fund our retirement needs in the future.

However, if we only want to depend on CPF as our only source of retirement income…

How much do we actually need in our CPF accounts to meet our basic living needs?

(Psst… Are you a Seedly member yet? Sign up for your FREE membership before it’s too late!)

TL;DR: How Much CPF Do You Need For Your Desired Retirement Income?

How Many Retirement Years Do I Have?

According to Singstat, Singaporeans have an average life expectancy of 83.6 years old (based on 2019 data).

Males have an average life expectancy of 81.4 years old, while females have an average life expectancy of 85.7 years old.

A simple explanation as to why women generally live longer than men:

While the statutory retirement age is 63, let’s assume that we will start depending on our retirement income at 65 years old since that is when CPF LIFE starts its monthly payouts.

This translates to about 16 retirement years for men and 21 retirement years for women.

How Much Do I Need In My CPF To Retire At 65?

According to a study done by Lee Kuan Yew School of Public Policy, here’s how much a household needs to meet their basic needs:

| Demographic of household | How much you need for basic needs |

|---|---|

| Single elderly household | $1,379 per month |

| Coupled elderly household | $2,351 per month |

| Single person (aged 55 - 64 years old) | $1,721 per month |

According to the researchers, this sum not only covers basic expenses such as food, transportation, and accommodation.

It also includes money required beyond subsistence, such as money for a mobile phone or an annual holiday.

This is because basic needs should go beyond just surviving, and should also ensure a quality of life.

And this includes having a budget to allow for independence and autonomy for the elderly to be independent of their loved ones.

How about the expenses of different households?

According to the Household Expenditure Survey (HES) 2017/18, the retiree households from the 21st to 40th percentile spend about $600 per month, while households from the 61st to 80th percentile spend about $1,130 per month.

Another popular method to plan for our retirement expenses would be 70% of our pre-retirement income.

Taking the current median income of $4,534 (including employer’s CPF), this translates to about $2,700.

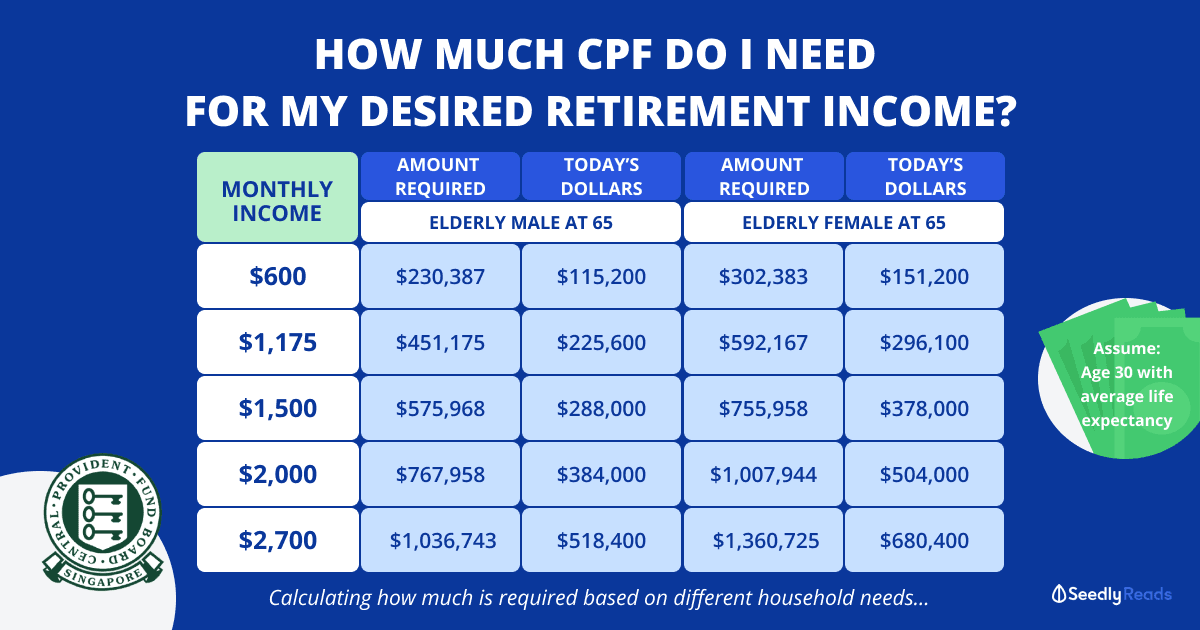

Taking these numbers, we used the nifty CPF Retirement Estimator tool to see how much is required for these monthly expenses.

Assumptions:

- Current age of 30 years old

- Inflation of 2%, investment returns after retirement able to beat inflation every year

- Desired retirement age of 65 years old

With the life expectancy of men and women at 81.4 years old and 85.7 years old respectively, here are some numbers we got:

| Desired Monthly Retirement Income | Amount Required To Retire At 65 (2056) | Equivalent Amount in Today's Dollars (2021) | Amount Required To Retire At 65 (2056) | Equivalent Amount in Today's Dollars (2021) |

|---|---|---|---|---|

| Elderly (Male) at age 65 | Elderly (Female) at age 65 | |||

| No. of retirement years: 16 years | No. of retirement years: 21 years | |||

| $600 | $230,387 | $115,200 | $302,383 | $151,200 |

| $1,175 | $451,175 | $225,600 | $592,167 | $296,100 |

| $1,500 | $575,968 | $288,000 | $755,958 | $378,000 |

| $1,700 | $652,764 | $326,400 | $856,753 | $428,400 |

| $2,000 | $767,958 | $384,000 | $1,007,944 | $504,000 |

| $2,500 | $959,947 | $480,000 | $1,259,930 | $630,000 |

| $2,700 | $1,036,743 | $518,400 | $1,360,725 | $680,400 |

Is Achieving That CPF Amount Even Possible?

Now… if you’re intimidated by the huge numbers above, don’t worry because they are actually attainable!

Especially if you still have many years ahead of you to maximise your CPF accounts.

If that’s something that interests you, we previously covered a couple of CPF hacks and tips which include:

- Keeping $20,000 in your Ordinary Account instead of wiping it out for home purchase

- Transfer Money from OA to SA

- Top up SA with cash

- Invest your OA with CPFIS (CPF Investment Scheme)

Or even actions you can take at the end of each year to grow your retirement savings and reduce your income tax at the same time!

Also, the 1M65 (or rather, the recently updated 4M65) movement proves that being a millionaire via CPF is totally possible.

As long as you keep working, don’t touch your CPF funds, and make significant top-ups to your CPF SA and MA in your 20s and 30s.

That being said, there are definitely pros and cons to this method as well, so only do it if it is something that suits your needs!

What if I Want To Start Drawing My Money at an Earlier Age?

Some of us might find 65 years old to be a little late.

For those looking to withdraw some of these funds earlier, you can withdraw your CPF savings at 55 years old after setting aside your Full Retirement Sum (FRS) in your Retirement Account.

Do note that top-ups done to SA will be placed aside for CPF LIFE. You can only withdraw money beyond FRS that are not top-ups, government grants and interest earned.

The FRS is currently at $186,000 for those age 55 in 2021.

If you have an amount more than the FRS, you can choose to withdraw the excess, or choose to leave it in the accounts to continue earning risk-free interest.

However, being at 55 years old means that the ability to take risks decreases significantly.

Therefore, having guaranteed risk-free 2.5 to 4% returns is not something that can be found easily elsewhere.

My own take is to let the interest keep rolling even further, for as long as you can afford to.

(And if you haven’t learnt about this CPF Special Account Hack… you probably should.)

Should We Solely Depend On CPF for Our Retirement Annuity?

Our calculations above assume that CPF would be our sole source of retirement income.

While some might plan to depend on just CPF LIFE to support their retirement needs, it could be useful to have different streams of retirement income to address different needs during retirement years.

Also, while it might be difficult to predict how much we truly need by then, it is important to safeguard ourselves from potential financial expenditure, which might be caused by situations like health issues.

Medical costs could be one reason that might cause an unexpected spike in expenses.

Which is why it would be important to also have the necessary coverage in place to cushion these unexpected needs, such as health insurance coverage.

Read Real User Reviews On Health Insurance

Start Planning For Your Retirement Today

These numbers today are not supposed to be here to scare you.

If anything, they should be here to motivate you to start your retirement planning process!

And yes, you’re never too young to start planning for that.

The earlier we start looking at it, the more well-prepared we will be.

And your future self will definitely be thanking you for starting this journey early. 😉

Advertisement