Put aside all the “propaganda” you see online today on investing, trading and fanciful financial products. The first step towards financial freedom should always start with savings.

- If you are someone with a great level of discipline to save, great! Kick-off your savings routine today!

- On the other hand, if you are someone who lacks the discipline to save, try setting up your own system to set aside a portion of your money before it reaches the “leaky bucket”.

Your leaky bucket refers to all the costs that will be incurred to pay for all your wants, expenses, temptations and inflations.

How Much Savings Should You Have Accumulated?

To answer this question, allow us to visualise your life in front of you.

With each life stage comes a different savings rate:

- At the early stage of our lives, we tend to experience lower savings rate.

This is due to the various financial commitments such as school loan, marriage, family planning and housing loan. - As we approach the years nearing retirement, we tend to have a higher savings rate.

This is based on the assumption that we cleared off most of our financial commitments. - When it comes to retirement, it will mainly be pure expense on our end due to the lack of income.

With that, instead of coming out with an absolute amount of savings, we base the savings amount on your individual yearly expense.

This amount varies for each individual depending on the lifestyle which one chooses to lead.

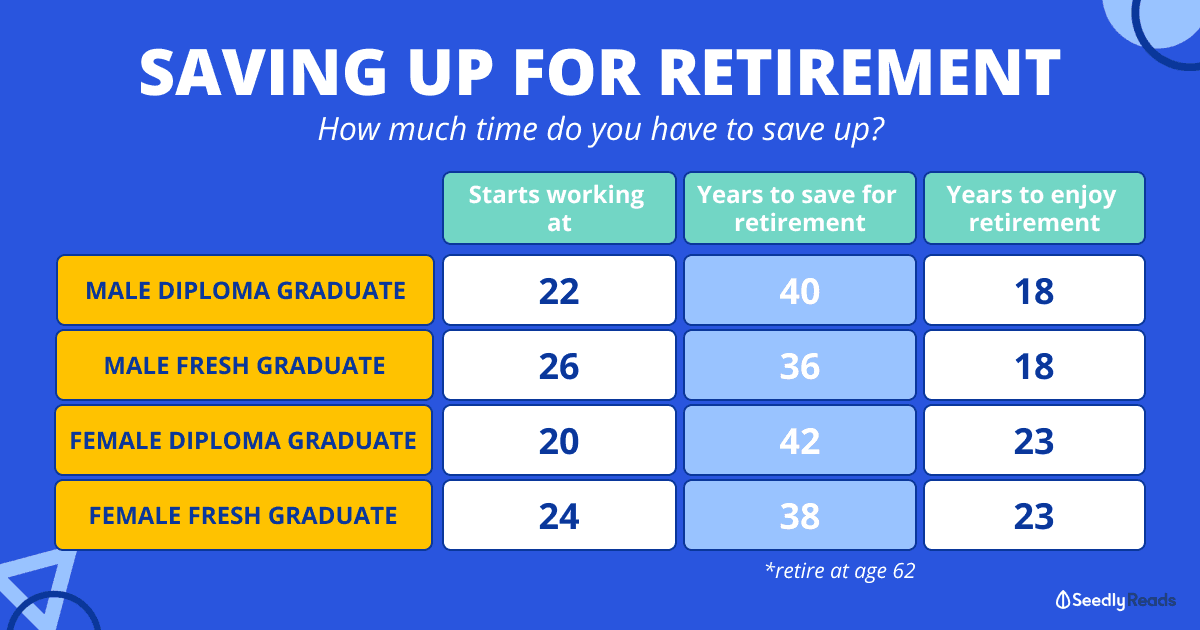

To give a good projection of how much one needs to save, we took into account these factors:

- Singaporean male to go through 2 years of National Service (NS)

- The lower savings rate for an early stage in life (lower pay, higher financial commitments such as student loan, marriage and housing loans)

- Higher savings rate closer to retirement

- Retirement is at age 62

- The life expectancy of Singaporean males is 80 and females at 85 years old

| The age that one starts working | Years to save up for retirement (retire at 62) | Years to enjoy retirement | |

|---|---|---|---|

| Male Diploma Graduate (after NS) | 22 | 40 | 18 |

| Male Fresh Graduate | 26 | 36 | 18 |

| Female Diploma Graduate | 20 | 42 | 23 |

| Female Fresh Graduate | 24 | 38 | 23 |

The Savings Rate of a Male Fresh Graduate

Using a male fresh graduate as an example. A male fresh graduate will have the least time to save (36 years to save up 18 years worth of expense).

From there, we work backwards to give a projection of how much you should have saved by a certain age.

To get an exact number, simply use:

(How much you need to survive per year) X (Number of years)

| Age (Male Fresh Graduate) | Savings Rate | Annual Expenses Saved |

|---|---|---|

| 26-30 | Low Salary Clearing Loans (Very Low) | At least 6 Months |

| 31-35 | Marriage Housing Loan (Low) | At least 1 Year |

| 36-40 | Kids Education Housing Loan (Low) | 3-6 Years |

| 41-45 | Kids Education (Low) | 4-8 Years |

| 46-50 | Realised you need to SAVE for retirement! (High) | 6-10 Years |

| 51-55 | Debt free (High) | 7-12 Years |

| 56-62 | Retirement Planning (High) | At least 18 Years |

| Target at age 62: | At least 18 | |

The Savings Rate of a Female Fresh Graduate

Taking life expectancy into account, females tend to live longer than their male counterparts.

With this, females face a steeper saving slope due to the need to save an additional 5 more years worth of expense.

| Age (Female Fresh Graduate) | Savings Rate | Annual Expenses Saved |

|---|---|---|

| 22-25 | Low Salary Student Loans (Very Low) | At least 6 Months |

| 26-30 | Low Salary Student Loans (Very Low) | At least 2 Years |

| 31-35 | Marriage Housing Loan (Low) | At least 6 Years |

| 36-40 | Kids Education Housing Loan (Low) | 8-11 Years |

| 41-45 | Kids Education (Low) | 9-13 Years |

| 46-50 | Realised you need to SAVE for retirement! (High) | 11-15 Years |

| 51-55 | Debt free (High) | 12-17 Years |

| 56-62 | Retirement Planning (High) | At least 23 Years |

| Target at age 62: | At least 23 | |

Further Reading: Are You Saving More Than an Average Singaporean?

Do take note if you fall within the below demographic:

- Monthly income of $4,056 (inclusive of employer CPF contributions) and above

- 25 years old and above

97% of middle to high-income earners above the age of 25 years old are saving between 30% to up to 49% of their salary.

How much of your salary are you saving?

Seedly’s Tips: How to Determine My Best Savings Rate?

Assuming your determination to save up brought you down so “far” this article, here’s a simple exercise to determine your saving rates.

Taking into account that different individual has different

- salary

- financial commitments (housing loans, student loans)

A good exercise to determine your best saving rate is

- Start off by saving 10-15% of your salary.

- Challenge yourself and increase that savings percentage by 1% every month

- Keep doing so till it hurts if you were to increase it by another percentage.

- That will be your best savings rate

A simple rule of thumb will be: As your income increases, your savings rate should increase too. This is possible if one’s total expense increases at a slower rate than his income increment.

Advertisement