How Much Do You Need To Earn To Reach CPF Basic Retirement Sum (BRS)?

●

Every now and then, I’d hear news or see articles talking about CPF.

If there’s a topic that would always pique the interest of Singaporeans, this is would be it.

I’ve seen the numbers of CPF retirement sums floating around, but since retirement feels like something that’s quite distant from me, I never really took notice of the actual numbers.

However, a recent chat with my friends got me very intimidated by how much we need when we retire.

So I got pretty excited when I was reminded that we might receive monthly payouts via the CPF LIFE scheme.

Which was why I decided to face these intimidating CPF retirement numbers for the very first time.

We’ve previously seen how much we need to earn in order to achieve Full Retirement Sum (FRS) when we turn 55.

TL;DR: To reach FRS, we would need:

- Starting salary of $3,500 at 25 years old

- Yearly salary increment of $110

- Maintain salary of $6,000 from 48 years old

And also take a housing loan of $360,000 or less.

While these figures might not seem like much to some, it might still be intimidating to others.

So in this article, we will be tabulating how much we need to earn to reach the Basic Retirement Sum (BRS), which TBH is already pretty intimidating.

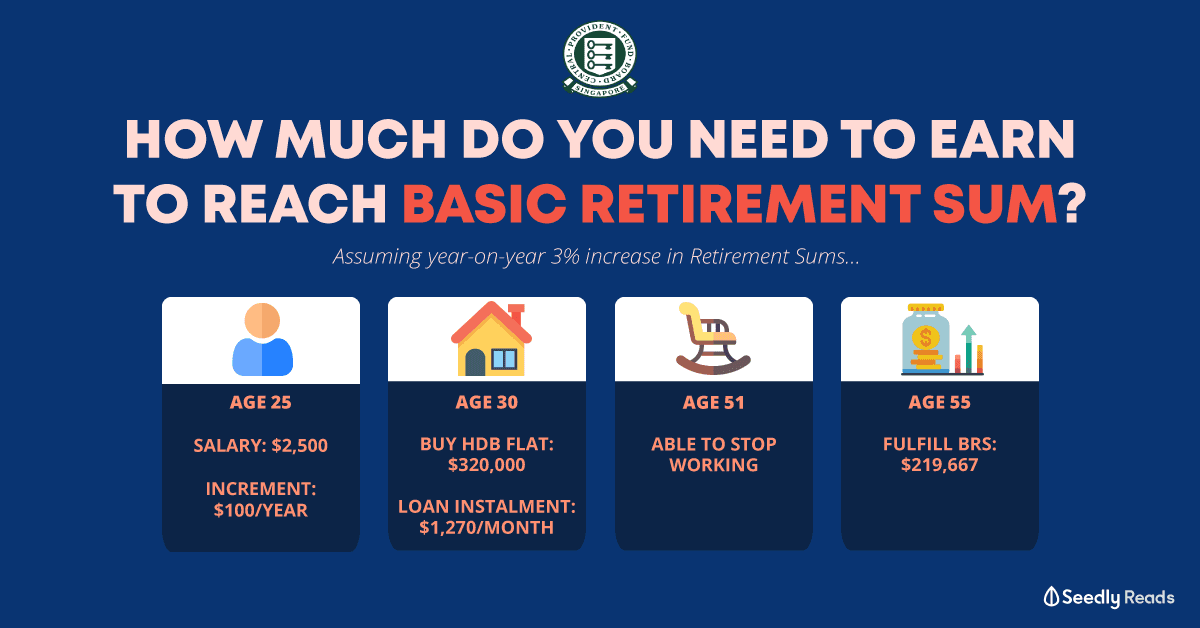

TL;DR: How Much Do I Need To Earn To Hit CPF Basic Retirement Sum?

Assuming you’re 25 years old in 2020 (just started work after graduation), this is the projected Retirement Sums that might be required when you turn 55 years old (assuming 3% year-on-year increment, based on current trends).

| Retirement Sum | Amount (S$) |

|---|---|

| Basic Retirement Sum | $219,667 |

| Full Retirement Sum | $439,335 |

| Enhanced Retirement Sum | $659,002 |

Now, let’s dive right into the BRS of $219,667.

Let’s make some assumptions here:

You’re 25 this year, and your goal is to achieve the BRS of $219,667 by 55 years old.

Given that:

- Your starting salary is $2,500 (Current SGUnited traineeship salary but with CPF contributions)

- Salary increment of $100 per year

- Assuming no bonuses

- Buying a flat that costs $320,000, costs split equally with your partner

To simplify these calculations, do note that we are not factoring in the 1% extra interest for the first $60,000 in your CPF accounts, as well as any excess of your MediSave that would flow into your Special Account, upon reaching the Basic Healthcare Sum. These will definitely increase the amounts that we see in our calculations, and aid in reaching the Retirement Sums.

How Do We Calculate the Basic Retirement Sum Required in 2050?

Most of us are still a couple of years away from 55 years old.

Given that we’ve seen how the Retirement Sums have been increasing every year, what we have today would be entirely different from what is required 30 years later.

Looking at the recent year-on-year difference, we took a projected 3% return and extrapolated these figures for the next 30 years:

| 55th Birthday in | Basic Retirement Sum (BRS) | Percentage Increase | Full Retirement Sum (FRS) | Percentage Increase | Enhanced Retirement Sum (3 x BRS) |

|---|---|---|---|---|---|

| 2017 | $83,000 | 3.11% | $166,000 | 3.11% | $249,000 |

| 2018 | $85,500 | 3.01% | $171,000 | 3.01% | $256,500 |

| 2019 | $88,000 | 2.92% | $176,000 | 2.92% | $264,000 |

| 2020 | $90,500 | 2.84% | $181,000 | 2.84% | $271,500 |

| 2021 | $93,000 | 2.76% | $186,000 | 2.76% | $279,000 |

| 2022 | $96,000 | 3.22% | $192,000 | 3.22% | $288,000 |

| 2023 | $98,880 | Projected 3% Increase p.a. | $197,760 | Projected 3% Increase p.a. | $296,640 |

| 2024 | $101,859 | $203,717 | $305,576 | ||

| 2025 | $104,914 | $209,829 | $314,743 | ||

| 2026 | $108,062 | $216,123 | $324,185 | ||

| 2027 | $111,304 | $222,607 | $333,911 | ||

| 2028 | $114,643 | $229,285 | $343,928 | ||

| 2029 | $118,082 | $236,164 | $354,246 | ||

| 2030 | $121,624 | $243,249 | $364,873 | ||

| 2031 | $125,273 | $250,546 | $375,819 | ||

| 2032 | $129,031 | $258,063 | $387,094 | ||

| 2033 | $132,902 | $265,805 | $398,707 | ||

| 2034 | $136,889 | $273,779 | $410,668 | ||

| 2035 | $140,996 | $281,992 | $422,988 | ||

| 2036 | $145,226 | $290,452 | $435,678 | ||

| 2037 | $149,583 | $299,165 | $448,748 | ||

| 2038 | $154,070 | $308,140 | $462,211 | ||

| 2039 | $158,692 | $317,385 | $476,077 | ||

| 2040 | $163,453 | $326,906 | $490,359 | ||

| 2041 | $168,357 | $336,713 | $505,070 | ||

| 2042 | $173,407 | $346,815 | $520,222 | ||

| 2043 | $178,610 | $357,219 | $535,829 | ||

| 2044 | $183,968 | $367,936 | $551,904 | ||

| 2045 | $189,487 | $378,974 | $568,461 | ||

| 2046 | $195,172 | $390,343 | $585,515 | ||

| 2047 | $201,027 | $402,053 | $603,080 | ||

| 2048 | $207,057 | $414,115 | $621,172 | ||

| 2049 | $213,269 | $426,538 | $639,808 | ||

| 2050 | $219,667 | $439,335 | $659,002 |

Things We Will Spend With Our CPF Accounts

Apart from being a hardworking fresh graduate at 25, you also meet the love of your life at that age.

You two dated for five years before deciding to take your relationship to the next level.

We acknowledge the complex nature of CPF’s interest being accrued monthly but compounded annually.

In this scenario, we will be assuming regular yearly compound interest, where the actual amount would differ slightly.

Based on our previous assumptions:

Seems like we’ll have about $50,0532 in both OA and SA accounts before spending any on an HDB flat.

Now, assuming that you will be purchasing your HDB flat with your partner when you’re 30 years old.

You managed to secure a flat that costs $320,000.

We assume that both you and your partner have the exact same amount in your CPF accounts, and hope to retain $20,000 in your OA instead of wiping it clean after the flat purchase.

You’ll be making a downpayment of $20,081.57 each, both of you will be taking up a 25-year HDB housing loan of $279.837.

An estimated monthly instalment would be $1,270, which means $635 each.

We see a dip in our OA balance to $21,177.68, assuming we start paying for the house in the first year of purchase.

Will We Hit BRS With This Salary at 55 Years Old?

Now for the important question.

Will we hit BRS with a starting salary of $2,500 and an increment of $100 per year?

Since CPF contributions are capped at $6,000 a month and your salary is at $5,500 at 55, there is no worry about this cap.

We can see that there’ll be $304,818.19 in your Retirement Account.

Let’s take a look at the required BRS again.

| Retirement Sum | Amount (S$) |

|---|---|

| Basic Retirement Sum | $219,667 |

| Full Retirement Sum | $439,335 |

| Enhanced Retirement Sum | $659,002 |

It’ll be approximately $219,667.

So yes!

You’ll be hitting the BRS at 55 years old.

What if I Don’t Want To Work Till 55?

Maybe retiring earlier might be your goal.

Assuming all factors remain the same, we ran the numbers to see what’s the earliest age to stop working and still be able to hit BRS.

It seems like we can only stop work after 51 years old.

Are These Numbers Achievable?

For our assumptions in the scenario above, there are a few things that we did not include that would help boost our CPF savings.

This includes our additional 1% interest on the first $60,000 of our CPF balance.

Also, our yearly bonuses are not factored into the calculations as well, which would also provide a good addition to your savings.

There are also other ways to increase your salary beyond the yearly $100, or you can reach your goals earlier by doing a top-up to your CPF accounts.

However, everyone’s situation is different, and numbers here mainly serve as a general guide.

But breaking it down makes it all seem less intimidating and more achievable, right?

Closing Thoughts

Retirement planning might seem far-fetched to some of us.

It’s like we just started working and now we are planning the end of our work life.

But the magic of compound interest is something all of us would want to tap on before it’s all too late.

If you’re looking for more ideas and tips on retirement planning, you know where to go!

Advertisement