Step-By-Step Guide To Analysing REITs: Mapletree Commercial Trust

Who here is still using their POSB Kids Savings Account?

… Nobody?

Well… I am.

And if you’re like me, rather than getting the 0.0000001%* interest, how about putting it into some REITs? (*just kidding, it’s actually 0.050% p.a.)

If you haven’t heard, REITs are popular for their attractive distributions. More than 5% per year, who is in?

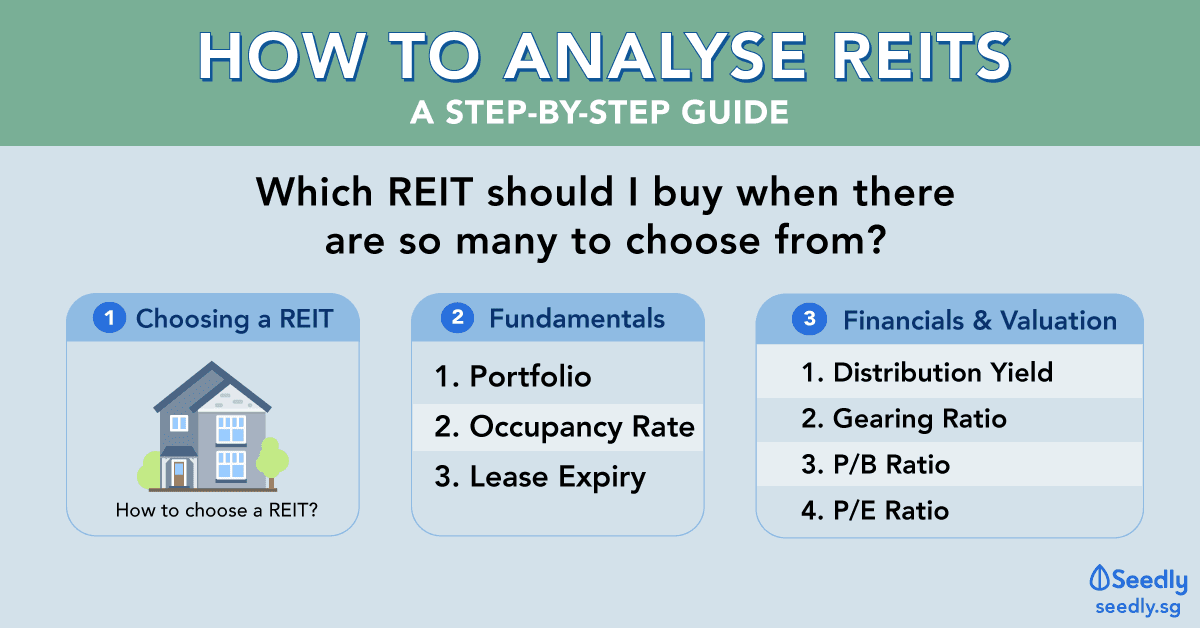

So just tell me already… How do I analyse a REIT?

Disclaimer: This post will be looking at 8 factors to analyse REITs, with explanations. It may get pretty technical, but we will try to break it down into digestible pieces!

1. Industry

First step: Choose a REIT first lah, obviously.

If you do not have a REIT in mind, you can start by deciding on an industry you are interested in.

I just went to one of my favourite malls, Vivocity the other day. So I’m going to look at Mapletree Commercial Trust (SGX: N2IU), which owns Vivocity.

Source: Mapletree

You can choose from a variety of other REITs in retail, office, logistics and industrial sectors.

2. Portfolio of Properties

You can proceed to look at the portfolio of properties and see whether they are good. “Good” can mean various factors, like location, occupancy rate, etc. More will be explained below.

Mapletree Commercial Trust (MCT)’s portfolio consists of 5 properties.

VivoCity

Singapore’s largest mall, located in the HarbourFront Precinct. One of the malls I quite enjoy going because of the shops (tenants) there and how spacious the mall is.

Good crowd = Tenants staying = Income for MCT. I noticed many tourists there, who were passing by Vivocity to go to Sentosa. Harbourfront Ferry Terminal also connects tourists coming from Indonesia.

Mapletree Business City I

An office and business park complex with Grade-A building specifications, located in the Alexandra Precinct.

PSA Building

A 40-storey office block and a three-storey retail centre known as the Alexandra Retail Centre (“ARC”), located in the Alexandra Precinct.

Mapletree Anson

A 19-storey premium office building located in Singapore’s Central Business District (“CBD”).

Bank of America Merrill Lynch HarbourFront

A premium office building located in the HarbourFront Precinct.

MCT is a pretty diversified REIT itself, with retail, business hub and office buildings.

On the surface, it looks nice. Let’s move on to analyse the other factors.

3. Occupancy Rate and Lease Expiry

- Any unoccupied spaces will be revenue lost that you can never get back. It’s not like inventory that you may still be able to sell in the future.

- Ideally, you want the portfolio properties to have near 100% occupancy.

- Lease expiry will show you how stable their income will be in the near future. With more leases expiring, the less stable their income will be.

- Their occupancy rate is 99.5% overall, which is very high! This is good as it means efficient use of spaces.

- However, their property leases expiring in the near future are pretty high. This will mean high leasing risks, because if leases are not renewed for another term, they will have to find new tenants. And finding new tenants will take time, including doing checks after checks.

As of 31 March 2018, the weighted average lease expiry (“WALE”) is 2.7 years. The typical retail lease term is 3 years, the WALE for the retail leases in their portfolio was 2.1 years. The office/business park WALE was healthy at 3.2 years.

The MCT management is seeking to maintain high occupancy levels and stable rental income through their strategy of active asset management.

4. Distribution Per Unit

REITs are required to pay out 90% of their taxable income. You will want to find REITs with a good track record of steady (or even better, increasing) distributions and growth earnings.

*based on the current price of $2.02

*based on the current price of $2.02

5. Share Price

A high distribution yield shouldn’t be the only thing you see.

On top of distributions, you should hope for a steadily moving share price. It doesn’t make sense if the distributions are 10 cents per year but share price declines 50 cents, right?

Take a look at this.

This is steadily moving, but in the wrong direction. Sabana Shariah Compliant REIT (SGX: M1GU), y’all.

What you should hope for rather, is something like this.

Mapletree Commercial Trust (SGX: N2IU). Some ups and downs, but an overall increase in the share price.

6. Gearing Ratio

This shows you the financial leverage, or the percentage of the mode of financing of the company (debt vs. equity).

Having a high gearing ratio means high leverage (high debts to equity), and is riskier than having a lower gearing ratio. A high D/E ratio bring about the concerns that the company may not pay off its debts in time.

In this case, debt-to-equity of 34.5% is a healthy ratio.

7. P/B and P/E Ratios

The P/B and P/E ratios can tell you how the REIT compares with its industry peers.

Data correct as at the time of writing (21 June 2019).

You can learn how to read and understand the meaning of P/E and P/B ratios here.

8. Management and News

Take the case of Sabana Shariah Compliant REIT (SGX: M1GU). Why did its share price drop so much?

The whole saga revolved around the underperformance of the industrial REIT, which led to a distribution per unit (DPU) decrease. The REIT manager wanted to buy another industrial building from their sponsor even though the industrial sector not doing well at that time. Unhappy investors then wanted to remove the REIT manager, but failed.

Another thing was the 42-for-100 rights issue to obtain funding, which shareholders didn’t think was a good deal.

TL;DR: Overall, the management is important – see whether the performance (you can look at it by the DPU) improved under them. Do take note of management changes and stock splits in the future, or any news that may dilute your shareholdings.

In Summary

Remember that within your portfolio of REITs, it can do you good to diversify into different industries – retail, office, logistics and industrial sectors. Distributions are not the only factor that you should look at. And as always, please do your own due diligence!

Advertisement