Here's Why You Shouldn't Play It Too Safe as a Long-Term Investor

●

Just the other day, I was conversing with my colleague about their investing strategy.

I was intrigued to hear that his/her played it really safe when it came to their investments even though they had a long investing horizon of 30 – 40 years. This colleague told me that they only rolled over his/her fixed deposits, bought savings bonds or insurance, and consistently made top-ups to their Central Provident Fund (CPF) accounts.

And judging by the recent popularity of our Fixed Deposit, Treasury Bills and Singapore Savings Bonds (SSB) articles, I would guess that he/she is not alone in doing this.

Although nothing is wrong with doing this if you have short-term financial goals, this safe investment strategy might not be best in the long term.

Why is this the case?

Read on to find out.

TL;DR:

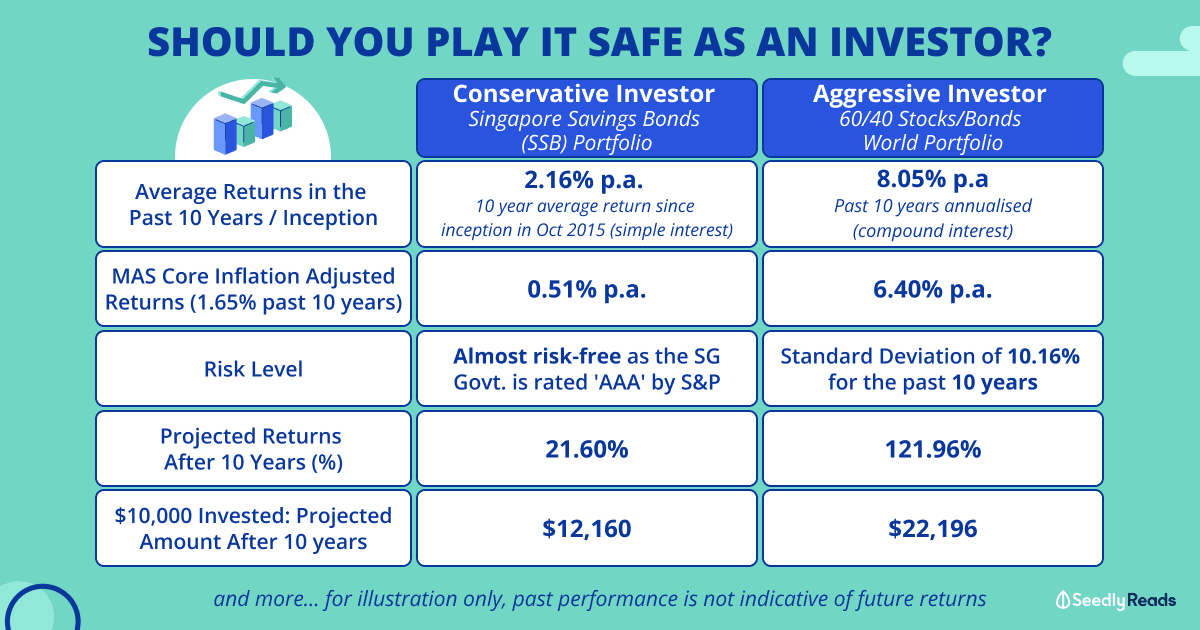

| Conservative Investor (SSB) | Aggresive Investor (60/40 Stocks/Bonds World Portfolio) | |

|---|---|---|

| Average Yield in the Past 10 Years / Inception | 2.16% p.a. in simple interest (Since Inception in Oct 2015) | 8.05% p.a. in compounded interest (Past 10 Years) |

| Inflation Adjusted (MAS Core Inflation: 1.65% p.a. past 10 years) | 0.51% p.a. | 6.40% p.a. |

| Risk Level | Almost risk-free as the Singapore Government is rated 'AAA' by S&P | Standard Deviation of 10.16% for past 10 years |

| Projected Returns After 10 Years Percentage | 21.60% | 121.96% |

| Projected Returns After 10 Years ($10,000 Portfolio) | $12,160 | $22,196 |

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice to buy or sell any investment product. Readers should always do their own due diligence and consider their financial goals before investing. Past performance is not

Loss Aversion

To understand why people like to play it safe when it comes to investing, let’s play a simple game.

In this first scenario, you have two options:

- Option A is that you can either walk away with a guaranteed win of $75

- Option B is that you have a 75% chance of winning $150 and a 25% chance of winning $0.

If you are like most people, you would have preferred Option A over Option B.

In other words, you prefer a sure gain of $75 over a potential chance of winning $150. From a rational point of view, this seems inconsistent.

The explanation psychologists give is that we are averse to losses.

This means that our degree of pain when we lose money is much more significant than the degree of happiness when we win money:

This makes us want to take less risk when it comes to gains and more risk when it comes to losses.

How Does This Relate To Investing?

This can relate to investing in several ways.

First, when it comes to potential gains, we may prefer low-risk or risk-free investments over more risky ones, even if the more risky strategies may promise a lot higher returns.

Second, if the investments we are holding have increased in price, we may be tempted to sell them off and lock in the gains, even if there is a high chance that they will continue to perform.

These two examples show that we are more afraid of taking risks when potential gains are at stake. However, the reverse is true when we are dealing with potential losses.

We may be reluctant to sell an investment that has performed poorly, holding on to the hope that this investment will improve over time, even if there is a good chance that losses may continue. In other words, we don’t want to lock in our losses.

There could also be the scenario where we want to hold on to a losing stock until it has rebounded back to our entry price, such that we neither make nor lose any money from this investment. This is also loss aversion, but the sunk cost fallacy is at play, too.

This could be why people stick to low-risk or risk-free investments over more risky ones.

Increasing Your Income Is Not Easy

In a vacuum, this low-risk investing strategy may work.

But, we have to contend with a little thing called inflation.

With rising costs, our hard-earned cash is losing value over time.

In Singapore, inflation measures the rate at which the price levels of goods and services in the economy increase over time. This causes a decrease in purchasing power of the currency as more money is needed to buy the same product now compared to the past.

Here’s how this works. For example, in the 90s, chicken rice used to cost only $1 per plate, and $10 could buy you 10 plates of chicken rice.

Fast forward to today, chicken rice now costs about $4.00 per plate. This means the same $10 can only buy you slightly less than three plates of chicken rice today.

How it relates to our investments is this concept called inflation-adjusted returns. According to Investopedia:

‘The inflation-adjusted return is the measure of return that considers the time period’s inflation rate. The inflation-adjusted return metric aims to reveal the return on an investment after removing the effects of inflation.

Average Inflation in Singapore (2024)

To understand inflation-adjusted returns, we need to look at the inflation rate in Singapore, which is measured by the Singapore Consumer Price Index (CPI) and the Monetary Authority of Singapore (MAS) Core Inflation rate.

Singapore (CPI) Consumer Price Index (February 2024)

The CPI measures general price levels in Singapore and is released monthly by the Singapore Department of Statistics (DOS).

According to MAS, here is how the CPI is calculated:

For longer periods, the CPI is derived by averaging the monthly indices.

For example, the yearly CPI is derived by taking a simple average of the 12 months’ indices for the year. To compute month-on-month change, the difference between the CPI for the specific month and that for the preceding month expressed in percentage term is used.This measures the change in average prices between the two months and serves as a useful short-term indicator of price movement.

To measure the year-on-year change, the CPI for the specific month is compared with that for the same month of preceding year. Likewise, the annual inflation rate for a specific year is computed by comparing the average for the 12 monthly indices with that for the preceding year.

For example the CPI for Feburary 2024 is benchmarked agasinst the CPI for Feburary 2023:

Consumer Price Index (CPI) Categories: What Causes Inflation in Singapore?

It mainly measures consumption expenditure.

Precisely, the CPI measures the weighted average price of a fixed basket of goods and services consumed by an average household in Singapore headed by Singapore Citizens or Permanent Residents (PRs).

The basket is broken down into 10 expenditure categories based largely on the Classification of Individual Consumption According to Purpose (COICOP), while the weights of these items are determined by the expenditure pattern of an average household in Singapore:

The data source is quite comprehensive as the prices for about 6,800 brands/varieties of goods and services across 4,200 outlets around Singapore are surveyed for the computation of the CPI basket.

However, non-consumption expenditures like buying housing, loan repayments, income taxes, stocks, and other financial instruments are not included.

Although, the cost of consuming services from housing is included in the computation of CPI. This is estimated through a rental price survey.

Another way to look at this will be through the lens of the purchasing power of the Singapore dollar.

Monetary Authority of Singapore (MAS) Core Inflation Rate Singapore

In addition, the Monetary Authority of Singapore (MAS), like many central banks around the world, monitors the core inflation rate, which is a measure of persistent and generalised price movements instead of one-off price movements in specific categories.

In Singapore, the MAS core inflation rate considers the CPI minus the categories of owning private transportation (e.g. car) and accommodation (i.e. rental). These categories are excluded as they are volatile and significantly affected by Government policies (i.e. Certificate of Entitlement (COE) prices for the private transport category).

As such, here is the CPI and MAS Core Inflation data for the past 30 years:

| Average Headline Inflation Rate (CPI All-Items) | Average Core Inflation Rate (MAS Core Inflation) |

|

|---|---|---|

| Over the last 10 years (2013 to 2023) | 1.44% | 1.65% |

| Over the last 20 years (2003 to 2023) | 2.08% | 1.86% |

| Over the last 30 years (1993 to 2023) | 1.73% | 1.67% |

Source: SmartWealth Singapore

Conservative Investor vs Aggressive Investor Returns

Now that we’ve established what inflation-adjusted returns and what inflation is in Singapore let’s compare the returns of a conservative investor who only invests in Singapore Savings Bonds (SSB) and a more aggressive risk-taking investor who invested their money in a more aggressive medium risk 60/40 stocks and bonds portfolio for the past 10 years or inception. These returns will then be adjusted for MAS Core inflation in Singapore, which has been 1.65% for the past 10 years.

But even though past performance is not indicative of future returns, we can analyse historical data to get an idea of what kind of returns your portfolio might deliver.

Conservative Investor Returns (Portfolio of Only SSB)

I have chosen SSBs due to the high liquidity (I can withdraw anytime with a wait time of just one month) and longer time frame (I can lock in the rate for 10 years).

Also, SSBs are almost risk-free.

The amount you invest in the SSB is completely backed by the Singapore Government.

Whatever your political views might be, it IS a fact that the Singapore Government received a “AAA” credit rating from Standard and Poor (S&P).

Singapore is one of only 11 countries that enjoy the “AAA” credit rating by Standard and Poor (S&P), as in the folks behind the S&P 500 index! Some other countries include Switzerland, Australia, and Finland:

This reduces the risks of investing in the SSB to the bare minimum (read: there are still risks).

Switzerland and cities like Hong Kong are the only other countries that enjoy the same “AAA” credit rating.

Having such a strong rating arguably makes the SSB one of the safest products in the market.

From inception in October 2015 to April 2024, SSBs had a median 10-year average return rate of 2.16% p.a. (Note that this is simple interest and does not compound).

If you adjusted for MAS Core Inflation for the past 10 years (i.e. 1.65%).

When dealing with simple interest, you don’t need to use the same formula as for compound interest. Instead, you can directly subtract the inflation rate from the nominal return rate to find the real return rate.

Given: Nominal Return (Singapore Savings Bond) = 2.16% p.a. Inflation Rate = 1.65% p.a.

Real Return = Nominal Return – Inflation

Real Return = 2.16% – 1.65%

Real Return = 0.51% per annum

So, the inflation-adjusted return of the Singapore Savings Bond with a simple interest return of 2.16% p.a. and inflation of 1.65% p.a. is approximately 0.51% per annum.

Based on this assumption, this rate of return on a $10,000 portfolio that is re-invested every ten years will only increase by 21.60% to $12,160 some 10 years later.

Aggressive Investor Returns

Whereas if you were an aggressive investor who invested in a globally diversified 60/40 stocks portfolio with the following asset allocation:

60/40 Portfolio Returns

| Return (%) as of 31 March 31 2024 | |||||||||

| 1M | 6M | 1Y | 5Y | 10Y | 30Y | MAX (~153Y) |

|||

| Stocks/Bonds 60/40 Portfolio | 2.12 | 16.12 | 17.74 | 8.77 | 8.05 | 8.42 | 7.69 | ||

| Components | |||||||||

| VTI | USD | Vanguard Total Stock Market | 2.9 | 22.88 | 28.85 | 14.15 | 12.23 | 10.49 | 9.16 |

| BND | USD | Vanguard Total Bond Market | 0.85 | 5.87 | 1.62 | 0.32 | 1.49 | 4.3 | 4.49 |

In this case, if a stock performs well in the market above its expected or historical mean, the standard deviation of the stock increases.

Hence, there is a greater opportunity for investors to benefit from the above-expected results.

Of course, “danger” also exists in the sense that the stock’s performance can be much worse than expected.

For the past 10 years (31 March 2014 to 31 March 2024), this World 60/40 portfolio delivered annualised returns of 8.05% p.a. (note this interest compounds).

If you adjusted for inflation in Singapore, the inflation-adjusted returns for this portfolio would be 6.40% p.a. That is about 5.89% higher than SSB returns.

Based on this assumption, this rate of return on a $10,000 portfolio will only increase by 121.96% to ~$22,196 some 10 years later.

Here’s how it compares to the conservative investor’s returns in table form:

| Conservative Investor (SSB) | Aggresive Investor (60/40 Stocks/Bonds World Portfolio) | |

|---|---|---|

| Average Yield in the Past 10 Years / Inception | 2.16% p.a. in simple interest (Since Inception in Oct 2015) | 8.05% p.a. in compounded interest (Past 10 Years) |

| Inflation Adjusted (MAS Core Inflation: 1.65% p.a. past 10 years) | 0.51% p.a. | 6.40% p.a. |

| Risk Level | Almost risk-free as the Singapore Government is rated 'AAA' by S&P | Standard Deviation of 10.16% for past 10 years |

| Projected Returns After 10 Years Percentage | 21.60% | 121.96% |

| Projected Returns After 10 Years ($10,000 Portfolio) | $12,160 | $22,196 |

Granted, a big caveat is the risk that you take. You must be prepared for deviation of a stock’s returns from its expected returns of up to 10.16% if you opt for the 60/40 portfolio compared to the almost risk-free SSB portfolio.

Conclusion

But the point I’m trying to drive across is this.

To get ahead in life, taking calculated risks is essential for success.

Unless you were getting pay raises that comfortably beat inflation every year, you could possibly not take much investing risk over the long term.

The reliability provided by cash lies solely in its face value. The $100 today will still be considered $100 in the coming years. However, there is no guarantee that its purchasing power will remain intact. In cases of low inflation, the money will retain some of its purchasing power, but if inflation is high, its value will rapidly diminish.

The crucial factor here is time. In the short term, cash will likely hold up better against inflation. However, cash performs poorly over extended periods, even when inflation is relatively low.

An analysis of historical returns on cash and stock market investments over various timeframes and 96 years of data have been compiled by Schroders into the chart that is displayed below. Additionally, it contrasts these returns with the associated inflation rates for the same time periods:

The findings are striking. The chart clearly illustrates that over extremely brief periods, such as three months or less, there hasn’t been a significant disparity in the probability of cash or shares outperforming inflation. However, as the time frame lengthens, the gap between them becomes decisively wider.

For most periods examined, cash savings have had approximately a 60 per cent chance of surpassing inflation. On the other hand, stock market investments have achieved a 100 per cent success rate in beating inflation when held for 20 years. In simpler terms, equities have consistently delivered returns that outpaced inflation throughout every 20-year period in the past 96 years.

Therefore, although stock market investments may carry short-term risks when evaluated in relation to inflation, they have provided significantly greater certainty and reliability over the long term.

So if you would like to get started with investing, check out our Ultimate Beginner’s Guide to Investing:

Read More:

Advertisement