Introduction to mutual fund investing

For busy Singaporeans who spend most of their time at work, unit trust, also known as mutual fund provides a very hands-off approach to investing.

Here are some quick pointers on what a mutual fund is:

- It pools money from a large number of investors to invest

- The money is managed by a paid Fund Manager, which determines the day to day investment decisions and operations of it.

- The fund is then used to invest in various investment instruments such as stocks, bonds or other assets.

- By investing in a mutual fund, an investor purchases “units” of the fund. The price of each unit is influenced by the total net asset value (NAV) of the fund, the liabilities that the fund holds and the number of units it issues.

- Investors have zero control over the decision of the Fund Managers on the fund. These decisions, however, are made known to investors through a legal document known as the Prospectus.

- Investors usually have access to the Prospectus, Semi-Annual or Annual Report, Product Highlights Sheet and Fund Factsheet of a fund to help them make a decision.

Fun Fact: “Fund Manager” can also be an algorithm running on the computer.

How to read a Fund Factsheet?

With the whole lot of information available for investors to find a suitable fund, chances are, it may end up confusing investors when little guidance is provided.

For that, the fund factsheet will be a good piece of information to kick-start your fund investing journey.

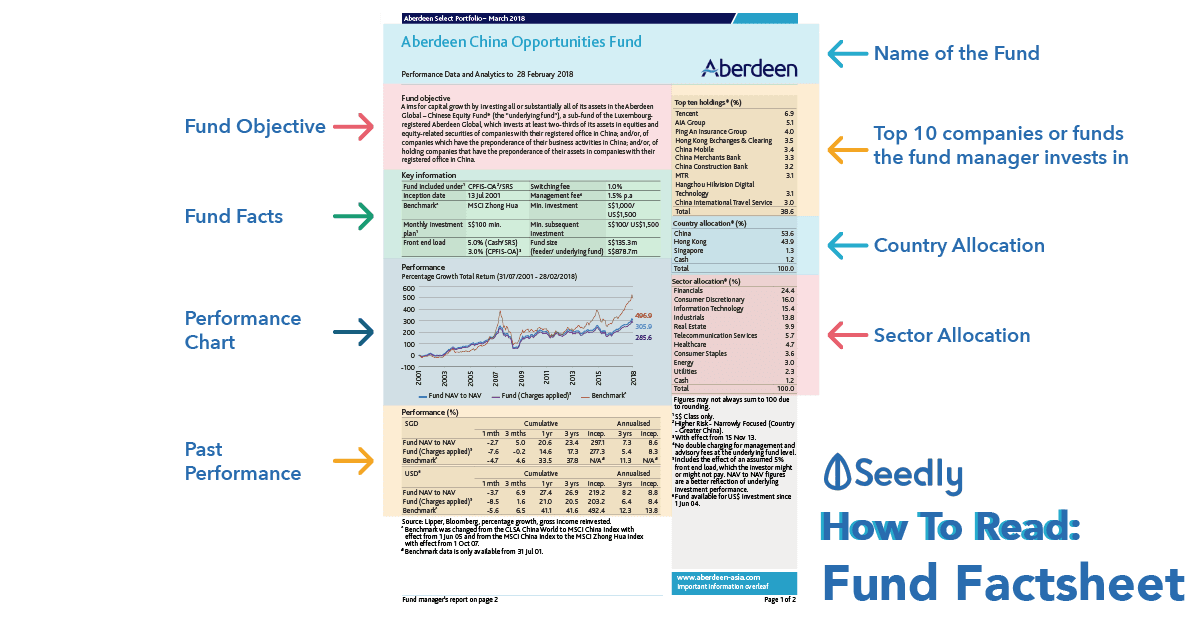

In this article, we will break down some of the key components in a fund factsheet, and what to make of them. We will be using Aberdeen China Opportunities Fund’s March 2018 Factsheet.

Key terms found in a Fund Factsheet:

Readers can download it here for a better learning experience:

Aberdeen China Opportunities Fund – March 2018

Name of the Fund

The fund name can usually be broken down into the Fund Manager, Geographical Region covered and an indication that it is a passive fund.

In the above example:

- Fund Manager: Aberdeen

- Region: China

- Indicator: Opportunities Fund

Fund Objective

- A growth fund focuses on stocks that grow fast and have high potential in share price gains

- A value-oriented fund invests in stocks that appear undervalued or dividend-paying stocks

Read also: Should I Pick Dividend or Growth Investing?

Fund Facts

When it comes to fund facts, there are a few things investors might wish to take note of.

- Inception date: The starting date of the fund

- Benchmark: What does the fund peg its performance against?

- Management fees: What are the charges implemented, this is regardless of whether the fund makes money or not.

- Fund size: Total amount of money in the fund

- Switching fee: Charges by the management group should an investor moves money from one fund to another within the same group.

- The amount you need, to invest

Top 10 Holdings (%)

This section usually includes a list of the top 10 companies or funds the fund manager invests the fund’s money in. The percentage of the total fund in each holding is reflected too.

The choice of investing in blue-chips or high-growth companies depends on the fund’s objective.

Country Allocation

The percentage of the fund invested in different geographical locations.

Sector Allocation

How are the funds allocated in terms of the various sector?

Performance Chart

A picture speaks a thousand words. When going through the performance chart in the fund factsheet, it is important to take note of some of these:

- Sometimes charts can be misleading. Always look carefully at what the chart is telling you.

- Newer funds may present “back-tested returns” or simulated data instead.

Past Performance

- The table shows how the fund has performed year on year over a certain period of time against the benchmark.

- Investors can observe how the funds did when subjected to various economic conditions

- It is a good practice to look at a longer timeframe when investing

- Do take note that past performance is not an indication of future performance.

- An investor can also look at the annualised return, which represents the average return an investor will receive should he invested in the fund over a certain timeframe.

Codes

- ISIN: The International Securities Identification Number is the best way to identify your tracker across platforms.

- Ticker symbols can vary but as long as you can cross-reference the ISIN number then you’ll know you’re trading the right fund.

- SEDOL: code for the London Stock Exchange

- Bloomberg ticker code for tracking on Bloomberg Terminal

Risk Statistics

Standard Deviation

- A common measure of volatility.

- The higher the standard deviation, the wider the range of performance, the more volatile.

Sharpe Ratio

- Another mean of measuring volatility.

- The higher the Sharpe ratio, the better the fund’s historical risk-adjusted performance.

- Negative Sharpe ratio represents the performance of the fund below risk-free rate or benchmark.

Fund Price

The price of buying a unit in the fund.

In this case, it shows the highest and lowest price over the past 12 months.

That being said, we hope this post had given you some insightful information on the fund factsheet that you may have possibly come by.

If you have more questions, we have an open community for you to get your questions answered and to hear from different perspectives. Check out our blog for more unbiased opinions on your personal finance journey.

Share with us if you have any experience by commenting below! Also, don’t forget to share it with your friends who might need this!

Advertisement