Travel Insurance Gone Wrong: Here’s How Your Insurance Claims Can Be Denied

COVID-19 took the world by storm, and even though travel has seen a resurgence, things are never the same.

In a world where things are all over the place—with wars, tons of COVID-19 subvariants, more elections, and natural disasters on the way—going on a trip can be kinda tricky.

More people are getting travel insurance, which is like a safety net, but it only really helps when something goes wrong.

There are reasons why you might not get paid if you need to use your travel insurance and stuff you might not have thought about.

Who wants to skip unnecessary arguments with the insurer and get your payment quickly? Me, and also you.

So, check out the reasons why a claim might be denied and how to prevent this from happening!

TL;DR: 8 Reasons Why Your Travel Insurance Claims Are Denied

Bottom line: Read the fine print and stay informed to avoid any bumps when you need to cash in on that insurance.

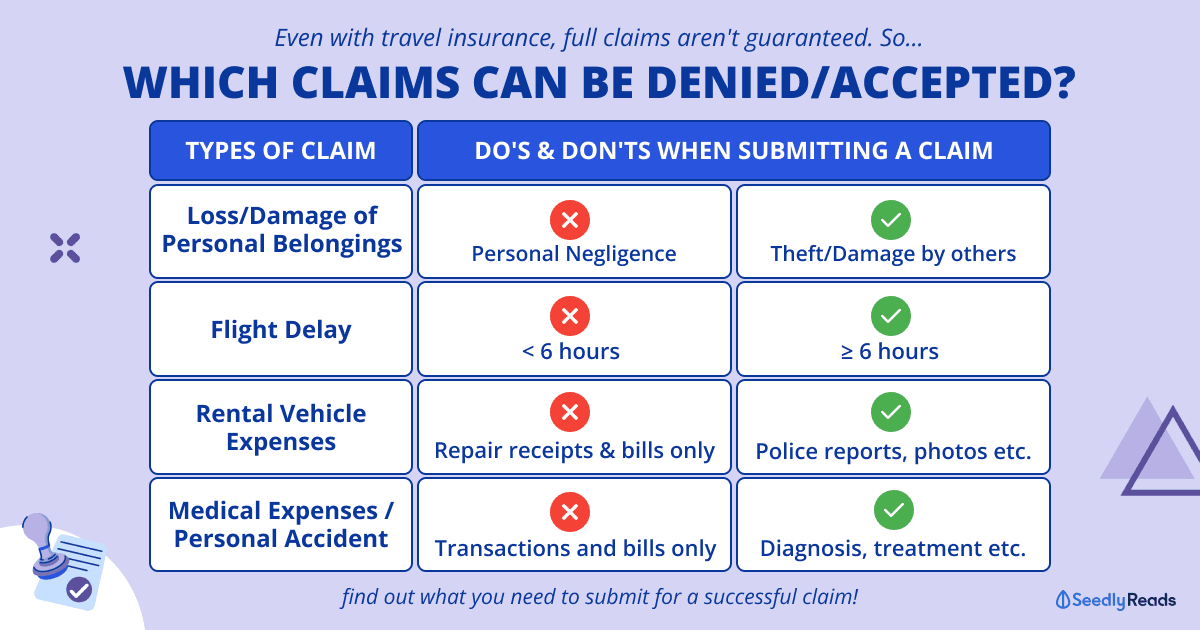

Here’s an itemised checklist for making sure your claims are not denied without a good reason:

| Types of Claim | Supporting Documents |

|---|---|

| Loss of Personal Belongings | - Purchase invoice (best if original) - Property loss irregularity report - Police report of lost items - Warranty card (if any) |

| Damaged Personal Belongings | - Original photo of the belonging (if any) - Photos of the damaged objects - A repairer's diagnostic report outlining the kind and extent of the damage - A repair bill or invoice - Warranty card (if any) |

| Delay of Baggage | Written acknowledgement from the airline or baggage carrier that there was a delay, the delay period and when the baggage was returned |

| Travel Cancellation | Written acknowledgement from the airline or baggage carrier that there was a delay, the delay period, advice on hotel accommodation confirmation or travel deposit receipt |

| Travel Cancellation (if death or sickness is the cause) | Death certificate (if in time), proof of relationship with the affected party, medical diagnosis to prove that the affected person is not suitable to travel |

| Travel Disruptions Including Flight Delays, Overbooking etc. | Written acknowledgements from the airline or carrier, the amount refunded and any additional charges |

| Rental Vehicle-related Expenses | In cases of accidents, provide photographs of the evidence and police report, the excess and repair payment receipt and bills |

| Medical Expenses / Personal Accident | - Medical bills and receipts (best if original) - A discharge statement that includes the date, nature, and cause of the injury or illness - A police report (for accidents) |

| Personal Liability | Third-party letter of claim (also known as Letter of Demand) or documents and documentary proof to show damage made to the third-party's property (e.g. photograph). |

Click here to jump:

- Missing or incomplete documents

- Claiming for baggage damage by the airline

- Claiming for things not covered by travel insurance

- Not checking if a pre-existing medical condition is covered

- Called for emergency rescue or received treatment without informing the travel insurer

- Accidents caused by alcohol consumption

- Bankruptcy or insolvency of travel agency

- Flight delay is under minimum delay duration

- How long do claims take to process?

Disclaimer: The Information provided by Seedly does not constitute an offer or solicitation to buy or sell any insurance product(s). It does not take into account the specific objectives or particular needs of any person. We strongly advise you to seek advice from a licensed insurance professional before purchasing any insurance products and/or services.

Reason #1: Missing or Incomplete Documents

Before taking off, ensure you’ve got all your documents sorted.

Don’t mess up your paperwork. Double-check that you’ve got all the right documents and that they’re spot on. Small mistakes can turn into big headaches.

Make sure you put in the right dates, too! Mixing them up can mess with your claims.

Reason #2: Claiming for Baggage Damage by the Airline or Personal Negligence

If the airline messes up your luggage, snap some pics and report it immediately. Don’t wait till the last minute – airlines need to know ASAP for your claims to go smoothly.

Similarly, losing personal items or travel documents due to personal negligence (i.e. not attending to your belongings) may result in a denied claim.

You can most likely claim for these items only under circumstances such as accidental loss or damage while in the custody of an airline or other carrier and if your baggage or personal belongings are stolen or accidentally damaged.

That said, you can find a comparison of the items covered by some of the popular insurers below:

| Insurer | Covered Items |

|---|---|

| AIG Travel Insurance Apply Now | Money, laptop, jewllery, travel documents, personal belongings in baggage |

| Bubblegum | Mobile phone, laptop and other accessories, personal belongings in baggage, travel documents |

| FWD Travel Insurance Apply Now | Money, mobile phone, laptop, tablet or other electronic devices, personal belongings in baggage, travel documents, jewellery |

| HLAS CovidSafe Travel Protect360 Insurance | Money, mobile phone, laptop, tablet, travel documents, breakage or damage to cameras and tape recorders, sports equipment |

| DBS Chubb TravellerShield Plus Apply Now | Money, mobile phones, tablets, netbooks, laptop/notebook, travel documents |

| Seedly Travel Insurance Apply Now | Money, mobile phone, laptop, tablet, travel documents, breakage or damage to cameras and tape recorders, sports equipment |

| Tiq Travel Insurance Apply Now | Money, mobile phone, laptop, a pair of shoes, a camera and accompanying lens & any accessories, a set of diving gear and any accessories, personal belongings in baggage, travel documents |

Reason #3: Claiming for Things Outside of Your Travel Insurance

Your travel insurance is like a safety net for specific things. Don’t try to claim for stuff not covered. Know your policy inside out so you don’t miss out on anything.

If you’re jetting off to places with travel advisories or getting into high-risk activities, your claim might face a hurdle.

Oh, and if your adventure involves a bit too much partying or some law-breaking, your insurance might not have your back.

Reason #4: Not Checking if Pre-existing Medical Conditions Are Covered

In a world where price is the talk of the town, you might miss this fact if you only look at the cheapest travel insurance available.

How Long Do Claims Take to Process?

The typical claim process is about 14 days or two weeks, and you receive your payments within two to four weeks.

In fact, a survey by Ancileo on Singaporeans’ experiences with travel insurance found that the majority of those surveyed expected two weeks or less waiting time for claims to be resolved and payment to be made.

In reality, some things take time, and 53 per cent of those surveyed were satisfied with their claim experiences, expecting their claims to be resolved within one to two weeks and to receive their payments within two to four weeks.

And before you start wondering which insurer is the best, check out real user reviews below:

How to Make Sure My Claims Are Accepted?

The best piece of advice I can give you is to know your travel insurance policy.

Reading and understanding your policy documents isn’t going to be easy, but they spell out clearly in black and white what’s covered and what isn’t. Who has the time and patience to go through a 50-page document in size 10 font?

Here are some general tips and pointers to put you in a good position to make successful travel insurance claims:

If you’re considering travel insurance, make sure you check out Seedly Travel Insurance!

This travel insurance is ideal for everyone, particularly families, as it automatically includes insurance protection for children without needing additional add-ons!

Built from the ground up based on what users want in a travel insurance plan, Seedly Travel insurance includes COVID-19 coverage, personal accident benefits per child, and all your travel essentials covered!

Sign up now and enjoy 50% off and an additional 7% off with promo code ‘march7‘.

You’ll also receive a FREE 3GB Airalo Travel eSim (worth US$10) and up to S$50 Grab Vouchers! And that’s not the end.

From now till 10 March 2024, you will also get a FREE Apple AirTag (worth S$45)! No min. premium required.

Related Articles:

- 4 Reasons You Should Get Travel Insurance From Insurers Over Airlines

- Best Travel Insurance Promotions (2024): Travel Insurance Promo Codes & Sign-up Gifts Galore

- Seedly Travel Insurance: Perfect for Families & Anyone at an Affordable Price

- Best Japan Travel Insurance For Families

- Credit Cards With Complimentary Travel Insurance And Why It May Not Be Enough!

Advertisement