Income Inequality in Singapore? 6,568 People Made >$1 Million and 184,308 Made <$20,000 in YA2021

●

The other day, I was browsing Reddit when I came across this post by u/kaydenjack in Singapore’s subreddit that caught my eye:

I was a little shocked to discover that there were so many people making more than $1 million a year in Singapore for the Year of Assessment (YA) 2021,

FYI: According to the Inland Revenue Authority of Singapore (IRAS), the basis period for YA 2021 is 1 Jan 2020 to 31 Dec 2020.

Naturally, that got me thinking about the state of income inequality in Singapore.

Here’s what I found.

TL;DR: The State of Income Inequality in Singapore

Taxable Individuals by Assessable Income Group, Annual (YA2021) Total No. of Taxpayers (Tax Resident) Total No. of Taxpayers (Non-Tax Resident) Total No. of Taxpayers (Tax Resident + Non-Tax Resident)

$1,000,001 & above 6,527 41 6,568

$500,001 - $1,000,000 21,858 31 21,889

$400,001 - $500,000 17,263 31 17,294

$300,001 - $400,000 35,486 57 35,543

$200,001 - $300,000 90,428 182 90,610

$150,001 - $200,000 107,344 171 107,515

$100,001 - $150,000 233,556 541 234,097

$80,001 - $100,000 172,984 469 173,453

$70,001 - $80,000 118,839 495 119,334

$60,001 - $70,000 141,897 362 142,259

$50,001 - $60,000 186,634 707 187,341

$40,001 - $50,000 249,771 1,038 250,809

$30,001 - $40,000 335,617 1,782 337,399

$25,001 - $30,000 122,832 1,412 124,244

$20,001 - $25,000 63,658 1,884 65,542

$20,000 & below 167,200 17,108 184,308

Source: SingStat – Taxable Individuals by Assessable Income Group, Annual (YA2021) | Labour Force in Singapore 2021 report

Note:

- *As SingStat did not provide data for the number of taxpayers who earnt less than $20,000 annually in YA2021, I took data from the latest Labour Force in Singapore 2021 report and took the figures of the residents who had a gross monthly income of <$1,500 in 2021 (June).

- The lower income brackets were combined to ensure that the range within the income brackets was as uniform as possible.

- Assessable Income refers to the total income of an individual, less allowable deductions such as CPF top-ups, SRS top-ups, business expenses, employment expenses and donations.

- The chargeable Income of an individual is his/her assessable income less the personal reliefs allowed.

- Net Tax Assessed is the net tax payable or repayable by an individual after taking into account allowable tax credits, tax remission, tax rebates and tax deducted at source.

- Non-Tax Resident refers to an individual who has worked in Singapore for less than 183 days in the preceding year of the Year of Assessment.

Background to This Data

For this data above, there are a few interesting things to take note of.

1. There Could be More People Earning >$1 Million Not Included in This Data Set

Firstly, as this data does not include income from investments, many of the top earners in Singapore might not even be included in this list.

This is because Singapore has no capital gains tax.

More specifically, here are the types of non-taxable income in Singapore (via IRAS).

Types of Non-Taxable Income Singapore

Capital gains are not taxable. These include:

- Gains on the sale of fixed assets

- Gains on foreign exchange on capital transactions.

Certain types of income are also specifically exempted from tax under the Income Tax Act 1947, subject to conditions. These include:

- Certain shipping income derived by a shipping company under Section 13A and Section 13E

- Foreign-sourced dividends, branch profits and service income received by a resident company under Section 13(8)

- Gains derived by a company on the disposal of equity investments under Section 13W.

2. Not All Income is Earnt From Employment

Here’s another interesting stat that I found:

| Income Type | Amount (S$ Thousand) | Percentage |

|---|---|---|

| Employment Income | 197,456,687 | 93.87% |

| Income from Trade and Profession | 7,809,663 | 3.71% |

| Rent | 4,787,662 | 2.28% |

| Other Types | 200,709 | 0.10% |

| Interest | 60,333 | 0.03% |

| Dividends | 21,580 | 0.01% |

| Royalties | 5,512 | 0.003% |

Source: SingStat | Income of Individuals by Income Type, Annual (YA2021)

As you can see from the table above, some people in Singapore are pretty enterprising.

They are diversifying their income sources and building more income streams which have become increasingly important. We might never know when we might lose our jobs when recessions almost inevitably happen.

This would mean that relying on our job as our sole income source could be risky.

Do check out our piece Ways to Build Your Wealth: Types of Income Streams Anyone Can Have if you would like to start mitigating the risk of having a job as your sole source of income.

Income Inequality in Singapore Deep Dive

So here’s the thing.

In modern societies, it is tough to wrap your head around income inequality.

In his 2016 paper Income Inequality, Development, and Dualism: Results from an Unbalanced Cross-National Panel researchers François Nielsen and Arthur S. Alderson argue that this may be due to deep evolutionary reasons:

The human emotional system did not evolve to react to inequality in large stratified societies, as these did not exist prior to the onset of food production 10,000 years ago, so people’s ability to perceive inequality in the structure of today’s largely anonymous societies is poor. … we do not instinctively recoil at the sight of a high Gini. Even a purely academic apprehension of the inequality phenomenon is difficult.”

Whether or not ordinary people can clearly perceive national-level inequality or at least perceive it clearly enough for sensible political debate is an important empirical question. It is not an easy question, in part because conceptions of inequality have a strongly pictorial character suggesting visual images of the relative size and hierarchical position of different classes.

This is where the International Social Survey Programme (ISSP) ‘s ‘type of society’ question comes in:

Although not as mathematically accurate as the Gini coefficient, this model can highlight key information about income distribution in Singapore and worldwide.

FYI: According to Investopedia, the Gini index is a measure of income distribution across a population. A higher Gini index indicates greater inequality, with high-income individuals receiving much larger percentages of the population’s total income.

Generally, the type of societies are ranked in alphabetical order according to how egalitarian they are. Type A societies are most elitist, while Type E societies are more egalitarian.

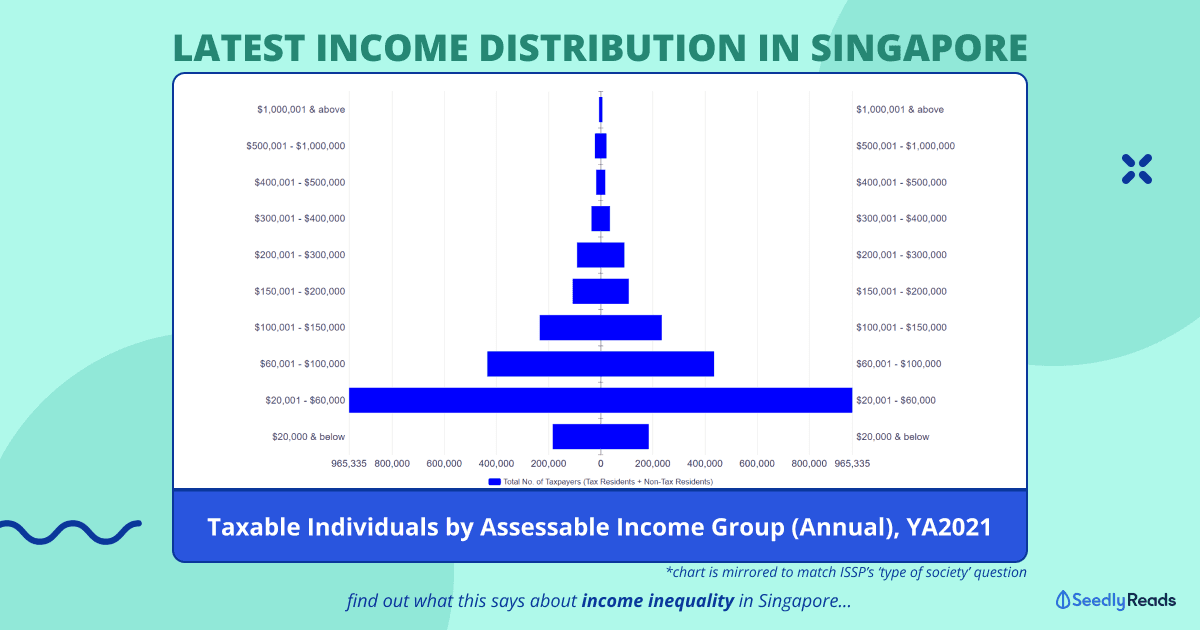

And according to the latest data from SingStat, here is a picture of Singapore’s income distribution:

Based on the model above, Singapore’s income distribution would fall somewhere between Type B and Type C.

More specifically, Singapore’s income distribution is more like a pyramid, with a small elite at the top and most people near the middle and bottom.

What is Being Done About This? Gini Coefficient in Singapore

So clearly, Singapore’s income distribution is more of a Type C pyramid.

The Government is well aware of it and is working to address income inequality in Singapore, which is measured by the Gini coefficient. Singapore’s latest Gini coefficient before accounting for Government transfers and taxes is 0.444, while after accounting for those transfers and taxes, the number drops to 0.386.

Speaking on Channel News Asia (CNA) ‘s Ask The Finance Minister programme in February 2021, former Deputy Prime Minister (DPM) Heng Swee Keat stated:

When we measured inequality last year, it is at a historic low. That came out of massive transfers, because our schemes were tilted towards supporting our lower income group.

Examples of such transfers include the whole Goods and Service Tax (GST) Voucher scheme and other Government support programmes:

But I believe that more needs to be done.

At the National University of Singapore (NUS) Kent Ridge Ministerial Forum, Deputy Prime Minister (DPM) Lawrence Wong addressed the topic of income inequality in Singapore and the importance of uplifting lower-income households.

Income inequality in Singapore, as measured by the Gini coefficient, has been coming down. It’s because of all our efforts to uplift incomes at the lower end, and make sure that lower-income households enjoy good income growth. And that’s very important for Singapore’s cohesion, that everyone continues to have this chance of moving forward together.

And this is why it’s also very important for us to understand that making this work, it’s not going to be possible just through the Government’s efforts alone.

Advertisement