A Singaporean's Guide: How to Claim Income Tax Deduction for Work-Related Expenses

Even though Circuit Breaker has been lifted.

Companies must allow employees to work from home (WFH) as the default option.

That’s great news because that means that we’re saving a LOT on our transportation.

But our utility bills are probably going to explode…

Especially if you have your air conditioning switched on throughout the day.

And have 5,329,452 electronic devices switched on at the same time.

But wait.

Did you know that you can claim personal income tax deductions on employment expenses which are ‘wholly and exclusively’ incurred when earning your income?

TL;DR: Allowable Employment Expense That Are Tax-Deductible

If you’re lucky enough to be reimbursed by your employer for any work-related expenses, then great!

If not, here are some allowable employment expenses, which you can claim income tax deductions for (read: lower income tax).

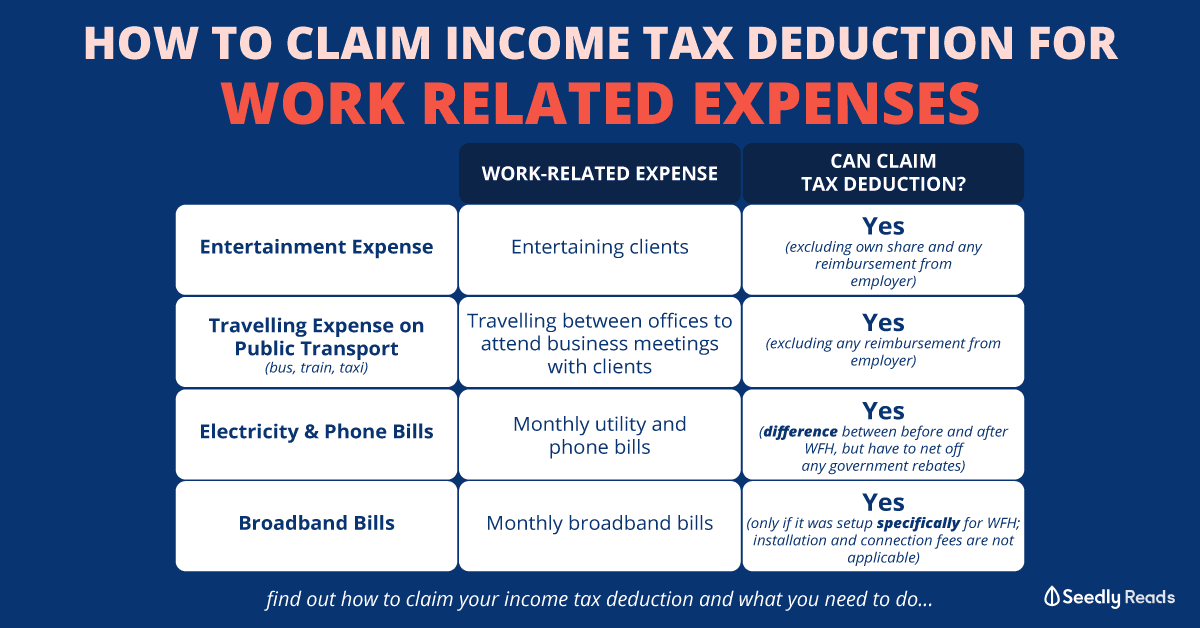

| Work-Related Expense | Can Claim Tax Deduction? | |

|---|---|---|

| Entertainment expenses | Entertaining clients | Yes (Excluding your share of the entertainment and any reimbursement by your employer) |

| Meeting potential clients OR for social purposes and maintaining goodwill | No | |

| Travelling expenses on public transport (bus, train, taxi) | Travelling between your office and your client's office, in order to attend business meetings | Yes (Excluding any reimbursement from your employer) |

| Travelling in own private motor vehicle EVEN if used for business meetings | No | |

| Travelling to and from your home to the office | ||

| Electricity and phone bills | Monthly utility and phone bills | Yes (Using the difference in bills before and after working from home BUT have to net off any government rebates) |

| Home broadband WiFi | Monthly broadband bills | Yes (Only if it was setup specifically for WFH; installation and network connection fees are not applicable) |

| Laptops and mobile phones | To be able to work from home | No (Because it is capital in nature) |

The biggest bugbears are that you can only claim deductions for your income tax assessment when it rolls around next year.

Also, it’s a tax deduction, mind you, NOT an immediate cash payout which you can use to buy bubble tea or whatever tickles your fancy.

You’ll also need to keep a proper record of all of your expenses for at least 5 years.

So… What Is Considered an Allowable Employment Expense?

In simpler English.

This means that you can claim deductions on your income tax by claiming for allowable expenses that are necessary when doing your job.

However, these have to be paid for using your own money and are not reimbursed by your employer.

Oh, and did you know that this is not just for the Circuit Breaker period?

It’s just something that most of us never had to claim for because we’re usually working in an office or workplace somewhere.

.

.

.

As a general guideline, here’re the criteria for what is considered an allowable employment expense:

| Allowable Expenses |

|---|

| Incurred while carrying out official duties |

| Not reimbursed by your employer |

| Not capital or private in nature |

Entertainment Expenses Incurred in Entertaining Clients

Allowable Expense

This excludes your share of the entertainment.

For example, let’s say you’ve incurred a $100 restaurant bill for a business lunch meeting with a client.

Your meal costs $40.

And your employer only reimburses you $40 for the $60 you paid for your client’s meal.

You can only claim the difference of $20 against your employment income.

Non-Deductible Expense

Refers to expenses — for example meals, entertainment, and gifts — incurred for meeting potential clients.

Or for social purposes and maintaining goodwill.

For example, for a meal celebrating a colleague’s birthday celebration.

These cannot be claimed.

Travelling Expenses Incurred on Public Transport

Allowable Expense

This excludes any reimbursement from your employer.

Assuming you incurred $100 in taxi fares for travelling between your office and your client’s office, in order to attend business meetings.

If your employer gives you a transport allowance of $80.

You can only claim the difference of $20 against your employment income.

Non-Deductible Expense

You cannot make claims for deduction against your employment income for transport expenses incurred on your own private motor vehicle (read: car plates starting with “S”).

Even if you used it for business meetings.

In addition, no deduction can be claimed for travelling expenses incurred to and from your home and office.

Electricity, Telephone, and Broadband Bills

Allowable Expense

Since most of us are working from home right now.

The Inland Revenue Authority of Singapore (IRAS) has shared in a statement with The Business Times that employees will be able to claim for deductions against employment income for expenses like electricity and telephone bills.

While it is difficult to calculate the exact amount of allowable expenses incurred as a result of working from home.

The IRAS will accept the difference in electricity and telephone bills before and after working from home.

So if your electricity bills before and after working from home are $60 and $80 respectively.

You can claim the difference of $20 against your employment income.

Pro tip: you could switch to an open electricity market retailer for an overall cheaper electricity bill too…

However, where government rebates have been provided, for example, the $100 Solidarity Utilities Credit.

(This will be credited to your July or August 2020 utility bill, by the way.)

You’ll have to net this rebate off when claiming for electricity expenses incurred for work purposes.

Non-Deductible Expense

While you can claim the monthly broadband fees for a broadband WiFi connection that was set up specifically for work purposes.

You cannot claim for one-time charges such as the installation of a modem or fibre network connection fee as they are capital in nature.

Note: the same applies to laptops or mobile phones purchased for work purposes since they are capital in nature as well.

Oh, and this probably applies to the majority of us.

If your home broadband was set up before you started working from home, no deduction can be claimed for that either.

Mosque Building Fund, Zakat Fitrah or Any Other Religious Dues Authorised by Law

Allowable Expense

You may claim Zakat Fitrah (an obligatory contribution by all Muslims during Ramadan) and mosque building fund contributions other than the following which are automatically allowed in your personal income tax assessment:

- Zakat Fitrah and mosque building fund deducted through your salary if your employer is in the Auto-Inclusion Scheme (AIS) for Employment Income

- Zakat Harta payment if you are a Singapore NRIC/FIN holder and have provided the information to Majlis Ugama Islam Singapura (MUIS)

As well as any other religious dues authorised by law.

Subscriptions Paid to Professional Bodies or Society for Professional Updates, Knowledge, and Networking

Allowable Expense

You will be able to claim for deductions against employment income for such expenses.

How to Claim Tax Deductions for Allowable Employment Expenses?

You’ll have to enter your allowable employment expenses claim under the “Employment” section when filing your Income Tax Return.

If you need help with this, you can refer to our step-by-step income tax guide on how to file and pay your personal income tax.

But you’ll probably be looking at this only around April next year.

On top of that, you’ll have to keep proper records.

Keep Proper Records

You have to keep complete and proper records of ALL allowable employment expenses incurred, for 5 years.

Meaning if you incur any employment expenses between 1 January to 31 December 2020, for Year of Assessment 2021.

You have to keep your records until 31 December 2025.

Examples of records that you have to keep include:

- Forms IR8A

- Business expense receipts (I highly recommend photocopying or scanning your receipts as the ink tends to fade over time)

- Payslips

- CPF statements

- Invoices, receipts, vouchers, and other relevant documents

Note: you only have to submit the supporting documents upon IRAS’ request

On top of that, the IRAS has an Employment Expenses Schedule template which you can download and use to track and record the details of ALL of your employment expenses claims.

My advice?

Do yourself a favour and input any relevant information along the way.

You don’t want to wait till next year and have to sieve through mountains of receipts and invoices.

And because this is an official document, estimates are not acceptable.

So if you incurred $30.95 for a taxi fare to get to a business meeting.

And your transport allowance only covers $15.

You can claim a tax deduction on the $15.95 which came out of your own pocket.

But you’ll have to remember to ask the taxi uncle for the receipt and keep it properly.

And cannot round it up to $16 when making your tax deduction claim.

You never know when IRAS will want to conduct a spot check…

Households With More Than One Person Working From Home

If there is more than one person, who is also living under the same roof, working from home.

IRAS has said that it is prepared to accept “equal apportionment basis among the working individuals in the same household”.

So if your household is claiming a tax deduction of $20 difference in utility costs between 2 family members who are working from home.

Each member can claim $10 in tax deductions.

Advertisement