Latest Inflation Rate in Singapore (2024): Rising Consumer Prices & What You Can Do About It

●

Did you know that you’re already losing money due to inflation?

That’s right.

With rising costs, our hard-earned cash is actually losing its value over time.

As if to add salt to our financial wounds, the latest Goods and Services (GST) hike from 7% to 9% means that we will be paying more for goods and services per dollar than ever before…

So here’s what you need to know about the high levels of inflation and how to hedge against them.

TL;DR: Latest Singapore Inflation Rate Guide (2024) — What Are the Current Inflation Rates in Singapore

According to the Monetary Authority of Singapore (MAS):

Latest CPI Inflation Singapore (Dec 2023)

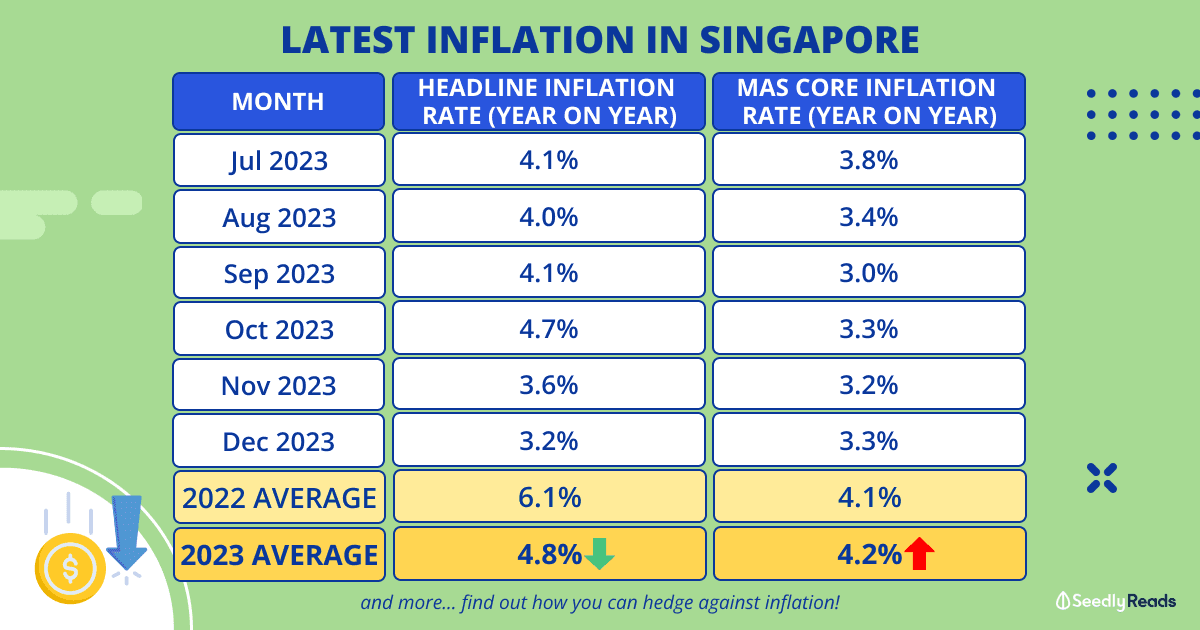

Overall inflation, or the Consumer Price Index (CPI) inflation, went up to 3.7% year on year (y-o-y) in December 2023, up from 3.6% in November. This was due to a jump in private transport costs and services inflation.

CPI-All Items inflation averaged 4.8% in 2023, down from 6.1% in 2022.

Latest MAS Core Inflation Singapore (Dec 2023)

The Monetary Authority of Singapore (MAS) Core Inflation (excludes accommodation and private transport costs) in December 2023 went up slightly to 3.3% y-o-y, up from 3.2% in November.

MAS Core Inflation averaged 4.2% in 2023, compared to 4.1% in 2022.

In 2023, the inflation rates were impacted by the rise in the Goods and Services Tax (GST) rate to 8%.

Jump To:

- What Is Inflation and What Is the Average Inflation Rate in Singapore

- How is Inflation in Singapore Measured?

- MAS Inflation Calculator

- How Does Inflation Affect You?

- What is the Best Hedge Against Inflation?

What Is Inflation and How Does the Global Economy Affect it in Singapore

In Singapore’s context, inflation is a measure of the rate at which the price levels of goods and services in the economy increase over time. This causes a decrease in the purchasing power of the currency as more money is needed to buy the same product now compared to the past.

As Singapore is heavily reliant on imports, consumer prices are affected by shifts in the global economy.

For context, the average CPI inflation in Singapore over the last 30 years (1992 to 2022) was 1.65%, while the average MAS Core Inflation was 1.59%.

Here’s how this works. For example, back in the 90s, chicken rice used to only cost $1 per plate, and $10 could buy you 10 plates of chicken rice.

Fast forward to today, chicken rice now costs about $4.00 per plate. This means that the same $10 can only buy you slightly less than three plates of chicken rice today.

But, price levels of goods and services do not always go up. Sometimes, it may go down. This is called deflation.

When deflation happens, the general price levels of goods and services decrease over time. This causes an increase in the purchasing power of the currency, as less money is needed to buy the same product now compared to the past.

For instance, the price of laptops has fallen steadily over the years. Back in 1991, an Apple Macintosh PowerBook would set you back US$4,247 (S$5,752) (inflation-adjusted price).

Today, you can get a very decent laptop that is much more powerful than the Apple Macintosh PowerBook for about five times less.

There are two main causes of inflation.

- Cost-Push Inflation: Cost-push inflation happens when the prices of all the goods and services increase when production costs (e.g. raw materials, transportation, and salaries) increase.

- Demand-Pull Inflation: There is also demand-pull inflation, which happens when there is a huge increase in demand for certain goods and services. Inflation occurs when people are more than willing to pay a higher price for a product, which increases prices. (E.g. Bak Kwa during Chinese New Year)

Inflation matters when it comes to your personal finances.

You’ll need it to evaluate if your investments are doing well enough to beat inflation and effectively plan how much you need for your retirement in the future.

How is Inflation in Singapore Measured?

Did you know that you’re already losing money due to inflation?

That’s right.

With rising costs, our hard-earned cash is actually losing its value over time.

As if to add salt to our financial wounds, the latest Goods and Services (GST) hike from 7% to 9% means that we will be paying more for goods and services per dollar than ever before…

So here’s what you need to know about the high levels of inflation and how to hedge against them.

TL;DR: Latest Singapore Inflation Rate Guide (2024) — What Are the Current Inflation Rates in Singapore

According to the Monetary Authority of Singapore (MAS):

Latest CPI Inflation Singapore (Dec 2023)

Overall inflation, or the Consumer Price Index (CPI) inflation, went up to 3.7% year on year (y-o-y) in December 2023, up from 3.6% in November. This was due to a jump in private transport costs and services inflation.

CPI-All Items inflation averaged 4.8% in 2023, down from 6.1% in 2022.

Latest MAS Core Inflation Singapore (Dec 2023)

The Monetary Authority of Singapore (MAS) Core Inflation (excludes accommodation and private transport costs) in December 2023 went up slightly to 3.3% y-o-y, up from 3.2% in November.

MAS Core Inflation averaged 4.2% in 2023, compared to 4.1% in 2022.

In 2023, the inflation rates were impacted by the rise in the Goods and Services Tax (GST) rate to 8%.

Jump To:

- What Is Inflation and What Is the Average Inflation Rate in Singapore

- How is Inflation in Singapore Measured?

- MAS Inflation Calculator

- How Does Inflation Affect You?

- What is the Best Hedge Against Inflation?

What Is Inflation and How Does the Global Economy Affect it in Singapore

In Singapore’s context, inflation is a measure of the rate at which the price levels of goods and services in the economy increase over time. This causes a decrease in the purchasing power of the currency as more money is needed to buy the same product now compared to the past.

As Singapore is heavily reliant on imports, consumer prices are affected by shifts in the global economy.

For context, the average CPI inflation in Singapore over the last 30 years (1992 to 2022) was 1.65%, while the average MAS Core Inflation was 1.59%.

Here’s how this works. For example, back in the 90s, chicken rice used to only cost $1 per plate, and $10 could buy you 10 plates of chicken rice.

Fast forward to today, chicken rice now costs about $4.00 per plate. This means that the same $10 can only buy you slightly less than three plates of chicken rice today.

But, price levels of goods and services do not always go up. Sometimes, it may go down. This is called deflation.

When deflation happens, the general price levels of goods and services decrease over time. This causes an increase in the purchasing power of the currency, as less money is needed to buy the same product now compared to the past.

For instance, the price of laptops has fallen steadily over the years. Back in 1991, an Apple Macintosh PowerBook would set you back US$4,247 (S$5,752) (inflation-adjusted price).

Today, you can get a very decent laptop that is much more powerful than the Apple Macintosh PowerBook for about five times less.

There are two main causes of inflation.

- Cost-Push Inflation: Cost-push inflation happens when the prices of all the goods and services increase when production costs (e.g. raw materials, transportation, and salaries) increase.

- Demand-Pull Inflation: There is also demand-pull inflation, which happens when there is a huge increase in demand for certain goods and services. Inflation occurs when people are more than willing to pay a higher price for a product, which increases prices. (E.g. Bak Kwa during Chinese New Year)

Inflation matters when it comes to your personal finances.

You’ll need it to evaluate if your investments are doing well enough to beat inflation and effectively plan how much you need for your retirement in the future.

How is Inflation in Singapore Measured? A Measure of Consumer Prices

In Singapore, inflation is generally measured using the CPI, a measure of overall consumer prices inflation.

Latest Singapore (CPI) Consumer Price Index (December 2023)

The CPI measures general price levels in Singapore and is released monthly by the Singapore Department of Statistics (DOS).

According to MAS, here is how the CPI is calculated:

For longer periods, the CPI is derived by averaging the monthly indices.

For example, the yearly CPI is derived by taking a simple average of the 12 months’ indices for the year. To compute month-on-month change, the difference between the CPI for the specific month and that for the preceding month expressed in percentage term is used.This measures the change in average prices between the two months and serves as a useful short-term indicator of price movement.

To measure the year-on-year change, the CPI for the specific month is compared with that for the same month of preceding year. Likewise, the annual inflation rate for a specific year is computed by comparing the average for the 12 monthly indices with that for the preceding year.

For example the CPI for December 2023 is benchmarked agasinst the CPI for December 2022:

Consumer Price Index (CPI) Categories: What Causes Inflation in Singapore?

It mainly measures consumption expenditure.

Specifically, the CPI measures the weighted average price of a fixed basket of goods and services consumed by an average household in Singapore headed by Singapore Citizens or Permanent Residents (PRs).

The basket is broken down into 10 expenditure categories based largely on the Classification of Individual Consumption According to Purpose (COICOP), while the weights of these items are determined by the expenditure pattern of an average household in Singapore:

The data source is quite comprehensive as the prices for about 6,800 brands/varieties of goods and services across 4,200 outlets around Singapore are surveyed for the computation of the CPI basket.

Non-Consumption Expenditures Like Income Tax

However, non-consumption expenditures like buying housing, loan repayments, income taxes, stocks, and other financial instruments are not included.

Although, the cost of consuming services from housing is included in the computation of CPI. This is estimated through a survey of rental prices.

Another way to look at this will be through the lens of the purchasing power of the Singapore dollar.

MAS Inflation Calculator

To illustrate this, I will use MAS’s Goods & Services Inflation Calculator.

Think of inflation as a reverse interest rate.

For example, a basket of goods and services (CPI overall category) that would cost you S$1,000.00 in 2009 will cost you S$1,176.40 in 2019 (base year).

In other words, the value of your money has ‘shrunk’ by about -17.64% in ten years.

| Basket of Goods & Services (Overall CPI) Cost $1,000 in Year: | Cost in 2019 (Base Year)* | Cumulative Rate of Inflation | Compound Average Annual Rate of Inflation |

|---|---|---|---|

| 1989 | S$1,648.80 | 64.88% | 1.68% |

| 1994 | S$1,429 | 42.90% | 1.44% |

| 1999 | S$1,361.60 | 36.16% | 1.56% |

| 2004 | S$1,306.90 | 30.69% | 1.8% |

| 2009 | S$1,176.40 | 17.64% | 1.64% |

| 2014 | S$1,005.20 | 0.52% | 0.10% |

Monetary Authority of Singapore (MAS) Core Inflation Rate Singapore

In addition, MAS, like many central banks around the world, monitors core inflation, which is a measure of persistent and generalised price movements instead of one-off price movements in specific categories.

In Singapore, MAS core inflation considers the CPI minus the categories of owning private transportation (e.g. car) and accommodation (i.e. rental). These categories are excluded as they are volatile and significantly affected by Government policies (i.e. Certificate of Entitlement (COE) prices and COVID-19 impacting rents).

What Is the Inflation Rate 2024 in Singapore, and How Does It Affect You?

Although the CPI is a good gauge of consumer price inflation in general, it may not be helpful as your spending would most likely differ from the average family in Singapore.

For example, the latest CPI for December 2023 rose 3.70% y-o-y (i.e. compared to December 2022).

But, the increase may feel heavier on you if most of your budget is spent on Recreation, which went up by 6.30%:

When it comes to budgeting for your and your family’s needs or your retirement, the headline inflation rates (CPI) are not what you should focus on.

Rather, you should look at the latest CPI reports and focus on the categories that matter to you.

For example, let’s say you want to plan for your retirement. The Health Care category should have more importance due to the rising costs of healthcare and Singaporeans living longer.

Inflation Rate Over the Years

In case you were wondering, here is the CPI and MAS Core Inflation data for the past 30 years:

| Average Headline Inflation Rate (CPI All-Items) | Average Core Inflation Rate (MAS Core Inflation) |

|

|---|---|---|

| Over the last 10 years (2013 to 2023) | 1.44% | 1.65% |

| Over the last 20 years (2003 to 2023) | 2.08% | 1.86% |

| Over the last 30 years (1993 to 2023) | 1.73% | 1.67% |

Source: SmartWealth Singapore

What is the Best Hedge Against Inflation?

But there are a few things to do to hedge against inflation.

1. Negotiate For a Pay Raise

At the risk of sounding entitled, a good way to hedge against inflation would be to ensure you get a healthy pay raise yearly.

Generally, any increment less than the core inflation for the year would mean that you are technically getting a pay cut as your purchasing power has shrunk due to inflation.

Here’s a detailed step-by-step guide on how to negotiate a pay increase:

2. How to Hedge Against Inflation: Five Practical Tips to Beat Inflation in Singapore

As a country that imports most of our essentials, Singapore will be impacted by price hikes across the globe.

This is something that is hard to avoid and is not within our internal locus of control.

But there are some lifestyle choices you can consider making.

Here are five practical tips to beat inflation in Singapore:

3. Start Investing: Take Note of the Inflation-Adjusted Rate of Return

Another way is to start investing to beat inflation.

Even if you’re a lazy bum who doesn’t want to go too in-depth into stocks, you should consider Robo-advisors such as Endowus, Syfe and Stashaway to help you manage your investments for a small fee.

At the very least, you’ll earn much higher interest rates than having your cash sit in a savings account with a base interest of 0.05%.

But just a disclaimer about investment risks: you might lose your capital when you invest.

You will also have to account for the inflation-adjusted rate of return.

According to Investopedia: ‘The inflation-adjusted return is the measure of return that considers the time period’s rate of inflation. The inflation-adjusted return metric aims to reveal the return on an investment after removing the effects of inflation.

As such, we recommend reading up and fully understanding what you are getting into before investing.

These guides should help:

Read More

- Inflation Rate By Country (2022): How Does Singapore Fare?

- 5 Practical Budgeting Tips to Help You Beat Inflation in Singapore (April 2022)

- Higher Prices & Less Allowance From Loved Ones: Inflation in Singapore is Hitting Seniors Doubly Hard

- Budget 2023 Singapore Summary

- Best Credit Card in Singapore

- Best Travel Insurance in Singapore

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice to buy or sell any investment product. Readers should always do their own due diligence and consider their financial goals before investing.

In Singapore, inflation is generally measured using the CPI, a measure of overall consumer prices inflation.

Latest Singapore (CPI) Consumer Price Index (December 2023)

The CPI measures general price levels in Singapore and is released monthly by the Singapore Department of Statistics (DOS).

According to MAS, here is how the CPI is calculated:

For longer periods, the CPI is derived by averaging the monthly indices.

For example, the yearly CPI is derived by taking a simple average of the 12 months’ indices for the year. To compute month-on-month change, the difference between the CPI for the specific month and that for the preceding month expressed in percentage term is used.This measures the change in average prices between the two months and serves as a useful short-term indicator of price movement.

To measure the year-on-year change, the CPI for the specific month is compared with that for the same month of preceding year. Likewise, the annual inflation rate for a specific year is computed by comparing the average for the 12 monthly indices with that for the preceding year.

For example the CPI for December 2023 is benchmarked agasinst the CPI for December 2022:

Consumer Price Index (CPI) Categories: What Causes Inflation in Singapore?

It mainly measures consumption expenditure.

Specifically, the CPI measures the weighted average price of a fixed basket of goods and services consumed by an average household in Singapore headed by Singapore Citizens or Permanent Residents (PRs).

The basket is broken down into 10 expenditure categories based largely on the Classification of Individual Consumption According to Purpose (COICOP), while the weights of these items are determined by the expenditure pattern of an average household in Singapore:

The data source is quite comprehensive as the prices for about 6,800 brands/varieties of goods and services across 4,200 outlets around Singapore are surveyed for the computation of the CPI basket.

Non-Consumption Expenditures Like Income Tax

However, non-consumption expenditures like buying housing, loan repayments, income taxes, stocks, and other financial instruments are not included.

Although, the cost of consuming services from housing is included in the computation of CPI. This is estimated through a survey of rental prices.

Another way to look at this will be through the lens of the purchasing power of the Singapore dollar.

MAS Inflation Calculator

To illustrate this, I will use MAS’s Goods & Services Inflation Calculator.

Think of inflation as a reverse interest rate.

For example, a basket of goods and services (CPI overall category) that would cost you S$1,000.00 in 2009 will cost you S$1,176.40 in 2019 (base year).

In other words, the value of your money has ‘shrunk’ by about -17.64% in ten years.

| Basket of Goods & Services (Overall CPI) Cost $1,000 in Year: | Cost in 2019 (Base Year)* | Cumulative Rate of Inflation | Compound Average Annual Rate of Inflation |

|---|---|---|---|

| 1989 | S$1,648.80 | 64.88% | 1.68% |

| 1994 | S$1,429 | 42.90% | 1.44% |

| 1999 | S$1,361.60 | 36.16% | 1.56% |

| 2004 | S$1,306.90 | 30.69% | 1.8% |

| 2009 | S$1,176.40 | 17.64% | 1.64% |

| 2014 | S$1,005.20 | 0.52% | 0.10% |

Monetary Authority of Singapore (MAS) Core Inflation Rate Singapore

In addition, MAS, like many central banks around the world, monitors core inflation, which is a measure of persistent and generalised price movements instead of one-off price movements in specific categories.

In Singapore, MAS core inflation considers the CPI minus the categories of owning private transportation (e.g. car) and accommodation (i.e. rental). These categories are excluded as they are volatile and significantly affected by Government policies (i.e. Certificate of Entitlement (COE) prices and COVID-19 impacting rents).

What Is the Inflation Rate 2024 in Singapore, and How Does It Affect You?

Although the CPI is a good gauge of consumer price inflation in general, it may not be helpful as your spending would most likely differ from the average family in Singapore.

For example, the latest CPI for December 2023 rose 3.70% y-o-y (i.e. compared to December 2022).

But, the increase may feel heavier on you if most of your budget is spent on Recreation, which went up by 6.30%:

When it comes to budgeting for your and your family’s needs or your retirement, the headline inflation rates (CPI) are not what you should focus on.

Rather, you should look at the latest CPI reports and focus on the categories that matter to you.

For example, let’s say you want to plan for your retirement. The Health Care category should have more importance due to the rising costs of healthcare and Singaporeans living longer.

Inflation Rate Over the Years

In case you were wondering, here is the CPI and MAS Core Inflation data for the past 30 years:

| Average Headline Inflation Rate (CPI All-Items) | Average Core Inflation Rate (MAS Core Inflation) |

|

|---|---|---|

| Over the last 10 years (2013 to 2023) | 1.44% | 1.65% |

| Over the last 20 years (2003 to 2023) | 2.08% | 1.86% |

| Over the last 30 years (1993 to 2023) | 1.73% | 1.67% |

Source: SmartWealth Singapore

What is the Best Hedge Against Inflation?

But there are a few things to do to hedge against inflation.

1. Negotiate For a Pay Raise

At the risk of sounding entitled, a good way to hedge against inflation would be to ensure you get a healthy pay raise yearly.

Generally, any increment less than the core inflation for the year would mean that you are technically getting a pay cut as your purchasing power has shrunk due to inflation.

Here’s a detailed step-by-step guide on how to negotiate a pay increase:

2. How to Hedge Against Inflation: Five Practical Tips to Beat Inflation in Singapore

As a country that imports most of our essentials, Singapore will be impacted by price hikes across the globe.

This is something that is hard to avoid and is not within our internal locus of control.

But there are some lifestyle choices you can consider making.

Here are five practical tips to beat inflation in Singapore:

3. Start Investing: Take Note of the Inflation-Adjusted Rate of Return

Another way is to start investing to beat inflation.

Even if you’re a lazy bum who doesn’t want to go too in-depth into stocks, you should consider Robo-advisors such as Endowus, Syfe and Stashaway to help you manage your investments for a small fee.

At the very least, you’ll earn much higher interest rates than having your cash sit in a savings account with a base interest of 0.05%.

But just a disclaimer about investment risks: you might lose your capital when you invest.

You will also have to account for the inflation-adjusted rate of return.

According to Investopedia: ‘The inflation-adjusted return is the measure of return that considers the time period’s rate of inflation. The inflation-adjusted return metric aims to reveal the return on an investment after removing the effects of inflation.

As such, we recommend reading up and fully understanding what you are getting into before investing.

These guides should help:

Read More

- Inflation Rate By Country (2022): How Does Singapore Fare?

- 5 Practical Budgeting Tips to Help You Beat Inflation in Singapore (April 2022)

- Higher Prices & Less Allowance From Loved Ones: Inflation in Singapore is Hitting Seniors Doubly Hard

- Budget 2023 Singapore Summary

- Best Credit Card in Singapore

- Best Travel Insurance in Singapore

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice to buy or sell any investment product. Readers should always do their own due diligence and consider their financial goals before investing.

Advertisement