Insurance For Undergraduates: What Are You Covered For?

You know when you start a new internship and the previous intern passes on keys, folders & excel sheets to you? I wish growing up was like that – a simple case of the .zip folder of handover documents. And if there’s one crucial handover document you should have right now, it’s your insurance policy.

Talking about insurance and thinking about the eventual deterioration of our bodies is extremely morbid and terrifying – but let’s get this out of the way. Insurance is important because it can protect you from greater financial burdens in the future.

Losing coverage after graduation

Some of my medical benefits are part of my parents’ employment contract and this might be the case for you as well. Such company benefits may include personal accident coverage (breaking your arm for example).

Bigger companies sometimes extend medical benefits to dependents (i.e. us when we depend on the financial support of our parents, before we can start working full-time on our own). And university students will likely age out of these benefits when we graduate.

Therefore, it would be prudent to consider when your parents plan to retire.

TL;DR: Saving more while you’re still young & healthy

You’re in your prime, in the pink of the health and – to keep it real – probably the healthiest version of yourself you will ever be. This makes you highly insurable, meaning you’re less “risky” to any insurer, hence securing lower premiums for yourself.

Any diagnosis for chronic or long-term conditions, history of smoking or even a history of dengue could be termed as “pre-existing” conditions. This could increase the cost of your premiums or the insurer may not cover you for those conditions.

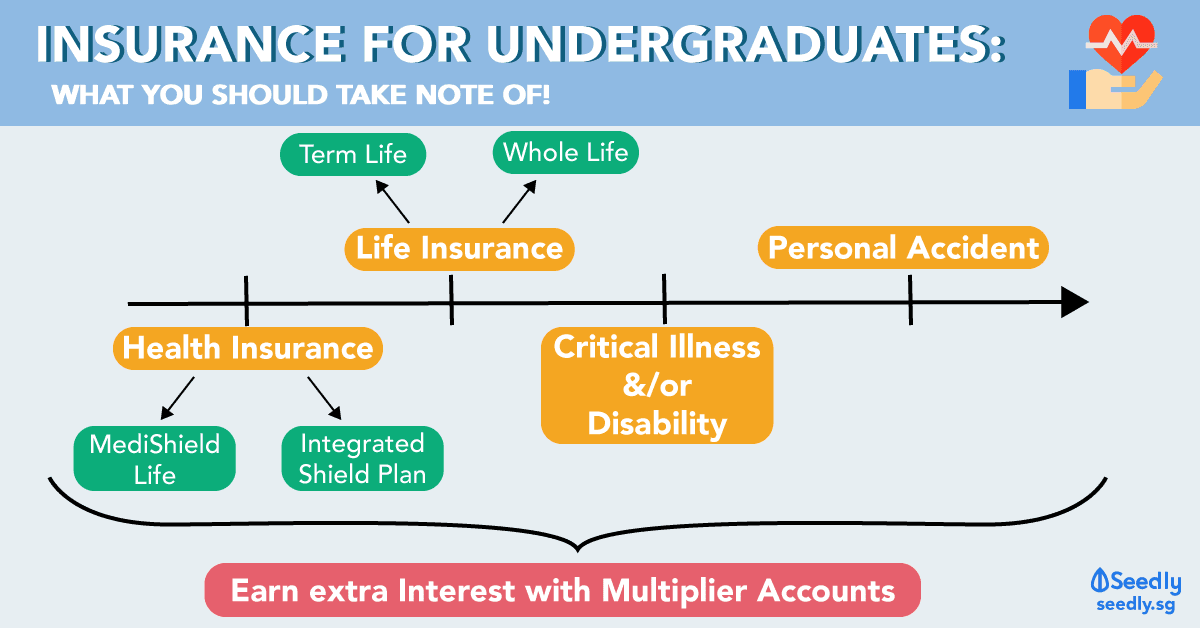

Notably, there are 5 types of insurance policies related to your wellbeing. But we’ll cover Life and Health into further detail today!

Health Insurance

The good news is all Singaporeans and Permanent Residents have health insurance coverage under MediShield Life, paid off by your CPF Medisave Accounts. As MediShield Life is mandatory and cannot be opted-out of, it is likely your parents are paying for yours now if you don’t have money in your Medisave account yet.

The best thing about MediShield Life is you’re covered even if you have serious pre-existing condition like diabetes or HIV/AIDS, which private insurers often do not include. Or worse, these conditions may prevent you from securing a health insurance policy altogether.

It’s important to note that those with these serious pre-existing conditions would have to pay 30% more in premiums.

| Categories | Examples |

|---|---|

| Cancer | Lung cancer, breast cancer, stomach cancer |

| Degenerative Diseases | Parkinson’s Disease, Muscular Dystrophy, Amyotrophic Lateral Sclerosis (ALS) |

| Heart or other circulatory system diseases | Heart attack, Coronary artery disease |

| Liver Diseases | Alcoholic liver disease , Chronic hepatitis |

| Psychiatric conditions | Schizophrenia |

For a full list of broad categories covered, click here.

Integrated Shield Plan (ISP)

You can also upsize this with your private insurer for an (ISP), where you pay higher premiums for the option of hospitalisation and treatment in private hospitals or Class A/B1 wards in public hospitals.

If you fall within these income brackets, you will also be entitled to the following subsidies on your premiums:

(Source: Ministry of Health)

(Source: Ministry of Health)

Until 1 November 2019, the government will also pay 20% of the net increase of subsidies for Singaporeans who have to pay higher premiums in the transition from the original MediShield plan to MediShield Life’s coverage.

But is this enough to keep you at ease? For those who are a little more kiasi, it’s time to look into extending the coverage you have.

Life Insurance

There are generally 2 types of life insurance policies out there: whole life and term life.

- Term life covers you for a specific period, as stipulated in your contract, and payouts are often in one lump sum.

- For whole life policies, payouts may be periodical. Policies often have a cash value tied to it that also helps grow your wealth due to accruing of interest.

Check with your parents what type of policy you have as you’ll have to include the premiums into your monthly budget too.

Tip: Pay your premiums annually (instead of monthly) as some insurers may charge additional admin/transaction fees.

Other types of Insurance Policies you should consider

Critical illness (CI) and Disability insurance may be top-ups to your life insurance policy, so chances are, your parents have gotten this for you as well. These policies protect you in the event that you are unable to work and earn a living, especially after a serious accident or illness.

Do note that critical illness insurance is paid in one lump sum, upon diagnosis or after undergoing treatment of the illness. Of the 37 industry-defined CIs, the types and number of CIs insured will vary from policy to policy.

Personal accident insurance can also be part of medical benefits larger companies have for employees. It may vary from getting the common flu, to a workplace accident like (touch wood) having equipment fall on your foot.

This is an additional policy but something that is worth looking into. Do consider this especially if you are a freelancer, entrepreneur or someone averse to working for large corporations.

Heads up if you see your future in Singapore’s start-up culture. Smaller companies may only be able to offer you some medical benefits (e.g. claims for illnesses or injuries on the job) on top of CPF contribution.

Earning extra interest with your bank account

If you’re thinking of crediting your salary to a multiplier account, insurance plans with your bank’s affiliated insurance agency may also rack up bonus interest on these accounts:

| Bank | Insurance Policy | Type of Insurance | Benefits |

|---|---|---|---|

| DBS Multiplier (ManuLife Policies) | ManuProtect Moneyback | Term Life | From 1.55% interest if your monthly salary credit via GIRO + qualifying insurance policy premiums = at least $2,000. |

| Lifeready | Whole Life | ||

| ManuProtect Term ManuProtect Term Lite | Term Life | ||

| Manulife Global Medical | Health | ||

| ReadyBuilder | Whole Life | ||

| OCBC 360 (Great Eastern Policies) | MaxTerm Value | Term Life | 1.2% interest on your first $35,000 if your salary credit via GIRO is at least $2,000 via GIRO. Additional 0.6%* interest on your first $35,000 if you get a qualifying insurance policy. *subject to a qualifying amount of premiums for the type of policy you take on. For as low as $2,000 for MaxFamily and MaxTerm Value plans to qualify. |

| MaxTerm Value (CI) | Term Life with CI Insurance | ||

| MaxLife Protector 2 | Whole Life | ||

| MaxLife Multiplier | Whole Life | ||

| MaxFamily Protector | Disability Insurance (with option for Critical Illness coverage) | ||

| May Bank Save Up Account (eTiQa Policies) | eSave assue presto with (option) extra cancer waiver | Term Life with CI Insurance | 0.3% on your first $60,000. Additional 0.8% interest for qualifying insurance policies with a min. Premium of $5,000 |

| AmplifyFlex | Term Life with Disability and CI Insurance |

Seedly Contributor: Dollar Scholar Squad

For more about insurance policies, listen to our podcast “Money Bites” on Spotify here. On the train, when you’re pooping, anywhere!

Advertisement