The Ultimate Female Insurance Plans Comparison (With Free Health Checkup)

According to the Singapore Cancer Society,

- 39 Singaporeans are diagnosed with cancer every day;

- 15 people die from cancer every day; and

- 1 in 4 people may develop cancer in their lifetime

As females, we are slightly more prone to diseases than our male counterparts as well.

According to the National Cancer Centre Singapore, a total of 71,265 cancer cases were reported in Singapore between 2013 to 2017, and 51.6% of the incidence of cancers occurred in females.

On the same note, breast cancer holds the highest occurrence among Singaporean women, affecting 29.4% of the women.

Which reminds us how important it is to get sufficient insurance to protect ourselves.

Insurance for Women in Singapore (With FREE Health Checkups)

Disclaimer: This article is not meant to be taken as financial advice, do speak to a licensed advisor who can assist you with your insurance needs.

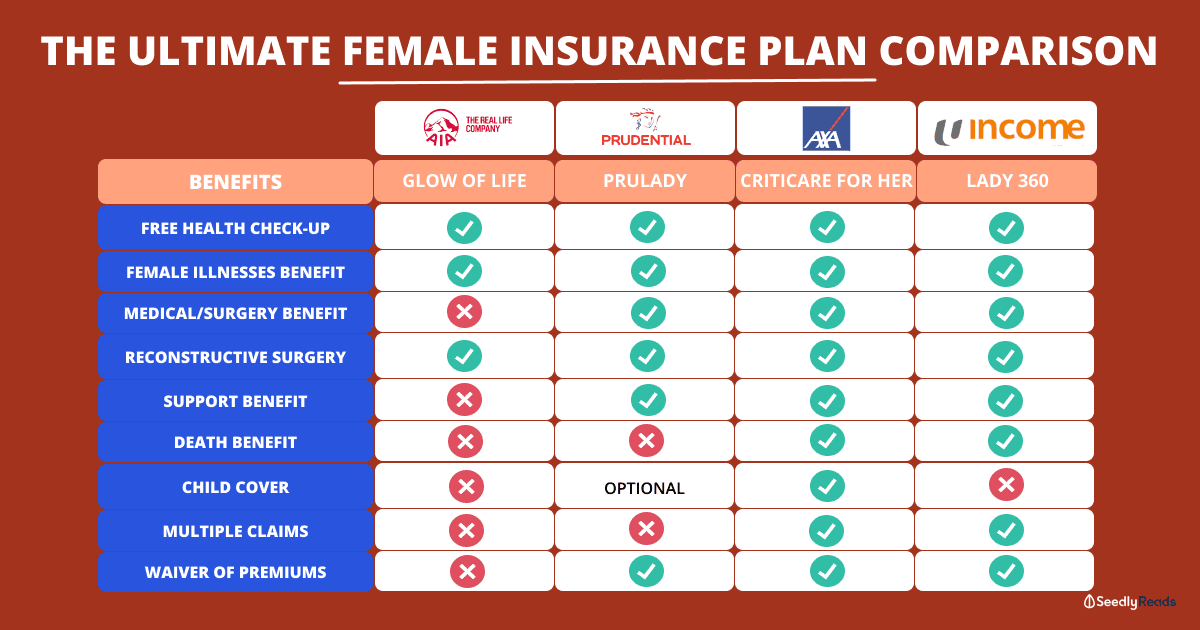

These insurance plans specifically cater to only the needs of women. It provides coverage for a range of critical illnesses that only women are exposed to:

We all know that health checkups are quite costly, even a simple scan.

It’s good if your company provides for your free health checkups.

However, if they don’t, this is one way you can save on those hefty checkup fees.

AIA Glow of Life

Key Benefits

- Receive payouts for a range of conditions

- Enjoy a reimbursement of up to 100% of coverage for reconstructive surgery

- Complimentary medical checkup every 2 years

AIA Glow of Life Sum Assured

AIA Glow of Life has 2 plans, the Standard Plan and the Executive Plan.

| Standard | Executive | |

|---|---|---|

| Coverage (S$) | 25,000 | 50,000 |

| 5% Extra Coverage (S$) - For each renewal for the first 5 years | 26,250 | 52,500 |

What Benefits Do AIA Glow of Life cover?

| AIA Glow of Life Benefit Schedule | % of Sum Assured |

|---|---|

1. Female Dreaded Illness Benefit |

|

| Female cancer (Includes cancers pertaining to the female organs including the breast, cervix uteri, uterus, ovary, fallopian tube and vaginal/vulva) | 100 |

| Systemic lupus erythematosus (S.L.E) with lupus nephritis | |

| Rheumatoid arthritis | |

2. Female Health Benefit |

|

| Osteoporosis | 30 |

| Urinary incontinence requiring surgical repair | 5 |

| Carcinoma-in-situ of the female organs | 20 |

| Reconstructive surgery reimbursement due to accidents or burns | 100 |

PRULady by Prudential

Key Benefits

- Comprehensive coverage specific for women, including female-related medical conditions and procedures and reconstructive or skin grafting surgeries

- Premium waiver for 36 months upon female illnesses claim

- Optional add-on coverage to include: pregnancy complications, congenital illnesses, hospital care

- Complimentary medical checkup every 2 years

PRULady Plans and Sum Assured

| Benefits | Plan A | Plan B | Plan C | Plan D |

|---|---|---|---|---|

| Female Illness benefit | 25,000 | 50,000 | 75,000 | 100,000 |

| Medical Procedures benefit | 25,000 | 50,000 | 75,000 | 100,000 |

| Reconstructive Surgery or Skin Grafting benefit | 25,000 | 50,000 | 75,000 | 100,000 |

| Support benefit | 25,000 | 25,000 | 25,000 | 25,000 |

| Waiver of Premium | Waives premiums for 36 months upon Female Illnesses benefit claim of at least 50% of sum assured | |||

| Biennial Medical Screening | Package 1 (23 tests) | Package 2 (25 tests) | ||

| Loyalty benefit | 15% discount on first year premium (of selected policies purchased upon life event) | |||

Benefits | Maternity Cover Plus Sum Assured (S$) – Optional |

|||

| Pregnancy Complications | 5,000 | 10,000 | 15,000 | 20,000 |

| Congenital Illness | 5,000 | 10,000 | 15,000 | 20,000 |

| Hospital Care | 5,000 | 10,000 | 15,000 | 20,000 |

What Benefits Do PRULady Offer?

| PRUlady Benefits | % of Sum Assured |

|---|---|

1. Female Illnesses benefit |

|

| Systemic Lupus Erythematosus with Lupus Nephritis | 100% |

| Rheumatoid Arthritis | |

| Chronic Auto-Immune Hepatitis | |

| Malignant Cancer of the following: • Breast • Cervix Uteri • Uterus • Fallopian tube • Ovary • Vagina/Vulva |

|

| Osteoporosis requiring surgery or repair | 50% |

| Carcinoma in situ of the Breast | |

| Carcinoma in situ of the Cervix Uteri | |

| Urinary Incontinence requiring Surgical Repair | 10% |

| Uterine Prolapse | |

| Pelvic Relaxation requiring Surgical Repair | |

| Thyroid disorders causing Thyroid Storm | |

| Polycystic Ovarian Syndrome | |

2. Medical Procedures |

|

| Radical Vulvectomy required due to a malignant condition | 50% |

| Wertheim’s Operation required due to a malignant condition | |

| Total Pelvic Exenteration required due to a malignant condition | |

| Hysterectomy required due to a malignant condition | 30% |

| Mastectomy required due to a malignant condition | |

| Complicated repair of a Vaginal Fistula | |

| Bilateral Breast Lumpectomy due to a malignant condition or carcinoma in situ | 20% |

| Unilateral Breast Lumpectomy due to a malignant condition or carcinoma in situ | 15% |

3. Reconstructive Surgery or Skin Grafting |

|

| Breast Reconstructive Surgery following a Mastectomy | 100% |

| Facial Reconstructive Surgery due to an Accident | |

| Skin grafting due to major burns | |

| Skin grafting due to skin cancer | |

4. Support Benefit |

|

| Oocyte Cryopreservation due to covered female cancers | 100% |

| Breast Cancer – Molecular Gene Expression Profiling Test for Treatment Guidance | 40% |

| Hormone Replacement Therapy | 20% |

| Outpatient Psychiatric benefit | $100 per visit (up to 10 visits) |

AXA CritiCare for Her

- Flexible sum assured: S$25,000 (min), S$150,000 (max)

- 3 Coverage Duration (Policy Term): 10 years, 20 years, or up to age 65.

- Maximum Coverage Age: Up to 65 years old

Key Benefits of AXA CritiCare for Her

- Four core benefits: female illness benefit, surgery benefit, reconstructive surgery or skin grafting benefit, support benefit

- Multiple claims up to 3.5 times sum assured

- Free Child Cover: Coverage of $5,000 extends to the child should they be diagnosed with Critical Illness

- Premium waiver for 36 months upon cumulative claim(s) of 50% Sum Assured made under Female Illness Benefit, capped at 2 claims

- Complimentary medical checkup every 2 years

What Benefits Do AXA Criticare for Her Offer?

| AXA CritiCare for Her Benefits Schedule | % of Sum Assured |

|---|---|

1. Female Illness Benefit |

|

| • Systemic lupus erythematosus with lupus nephritis • Rheumatoid arthritis • Chronic autoimmune hepatitis • Malignant cancer of the breast, cervix uteri, uterus, fallopian tube, ovary, vagina/vulva | 100% |

| • Osteoporosis requiring surgery or repair • Carcinoma in situ of the breast • Carcinoma in situ of the cervix uteri | 50% |

| • Urinary incontinence requiring surgical repair • Uterine prolapse • Pelvic relaxation requiring surgical repair • Thyroid disorders causing thyroid storm • Polycystic ovarian syndrome | 10% |

2. Surgery Benefit |

|

| • Radical vulvectomy required due to a malignant condition • Wertheim’s operation required due to a malignant condition • Total pelvic exenteration required due to a malignant condition | 50% |

| • Hysterectomy required due to a malignant condition • Mastectomy required due to a malignant condition • Complicated repair of a vaginal fistula | 30% |

| • Bilateral breast lumpectomy due to a malignant condition or carcinoma in situ | 20% |

| • Unilateral breast lumpectomy due to a malignant condition or carcinoma in situ | 15% |

3. Reconstructive Surgery or Skin Gafting Benefit |

|

| • Facial reconstructive surgery due to an accident • Breast reconstructive surgery following a mastectomy • Skin grafting due to major burns • Skin grafting due to skin cancer | 100% |

4. Support Benefit |

|

| Oocyte cryopreservation due to covered female cancer | S$25,000 |

| Breast cancer – molecular gene expression profiling test for treatment guidance | S$10,000 |

| Hormone replacement therapy | S$5,000 |

| Outpatient psychiatric benefit | S$100 per visit (up to 10 visits) |

| Death Benefit | S$10,000 |

Men, you are not forgotten! AXA has a male version that covers male critical illnesses as well – AXA CritiCare for Him.

Lady 360 by NTUC Income

Key Benefits

- Benefits include: Female Illness benefit, Female Surgeries benefit, Support benefit, Death benefit

- Claim multiple times up to 100% sum assured from each of the benefits

- Premium waiver for 24 months upon diagnosis of a specific female illness covered by the policy

- Complimentary medical checkup every 2 years

What Benefits Do Lady 360 Cover?

| Lady 360 Benefits Schedule | % of Sum Assured |

|---|---|

1. Female Illnesses benefit |

|

| • Chronic autoimmune hepatitis • Malignant cancer of female sites • Rheumatoid arthritis • SLE with lupus nephritis | 100% |

| • Carcinoma in situ of female sites • Osteoporotic fractures of the hip and vertebra requiring surgery or repair | 50% |

2. Female Surgeries Benefit |

|

| • Radical vulvectomy • Wertheim’s operation • Uterus, total pelvic exenteration | 50% |

| • Breast lumpectomy – bilateral • Mastectomy – bilateral or unilateral • Hysterectomy • Complicated repair of fistula | 30% |

| • Breast lumpectomy – unilateral • Urinary incontinence requiring surgery • Uterine prolapse requiring surgery • Thyroid disorders requiring surgery • Polycystic ovarian syndrome requiring surgery | 15% |

3. Support benefit |

|

| Reconstructive surgery benefit due to mastectomy following breast cancer or carcinoma in situ of the breast, malignant skin cancer, accidental burns and accident | 100% |

| Oocyte cryopreservation benefit | 25% |

| Breast cancer – molecular gene expression profiling test for treatment guidance benefit | 15% |

| Outpatient psychiatric benefit | 5% |

| Hormone replacement therapy benefit | 5% |

4. Death Benefit | S$10,000 |

We can see that different plans offered varied types of coverage.

With more benefits and protection, we can expect the premiums to be more expensive.

As with all insurance plans, while we might be tempted to have the maximum level of coverage, it is important to balance between your own needs and the cost of premiums.

Because the last thing we want is to overspend on insurance.

Do speak with a licensed advisor to analyse your needs before deciding on which insurance plan to get for yourself!

Should You Get a Female Critical Illness Insurance Plan?

We know that insurance could be a BIG topic.

As with all insurance coverage, a female-specific insurance plan should be purchased if you would like to increase your coverage for female-specific diseases.

Given that some specific diseases are not included in the prescribed list of 37 critical illnesses, it could be beneficial to receive coverage for them.

In addition, with the free biennial health check-ups as one of the coverage benefits, such regular check-ups could be very useful as a preventive measure.

That being said, do always assess your own insurance needs, and only purchase the ones that suit these needs the best.

In my opinion, such a plan should not replace your critical illness coverage, but could act as a complement to it.

If you’re considering it and wondering what you are already covered by…

Perhaps it’s time to do a quick review of your insurance coverage.

Looking to talk about insurance further? Pick the brains of some of the personal finance gurus at Seedly!

Disclaimer: The Information provided by Seedly does not constitute an offer or solicitation to buy or sell any insurance product(s). It does not take into account the specific objectives or particular needs of any person. We strongly advise you to seek advice from a licensed insurance professional before purchasing any insurance products and/or services.

Advertisement