Insurance can feel like a huge topic to tackle.

Schools never taught us about it, yet we are expected to ace it like a pro after graduation.

With the multitude of options and plans available, it can get intimidating trying to sieve out what insurance policies we truly need.

And with limited knowledge on this topic, one of the worst fears is to buy insurance policies that we don’t actually need.

So… how do we discern what is truly essential for us?

If you’ve attended our recent Seedly Personal Finance Festival, you might have come across the keynote presentation by Mr Christopher Tan, CEO of Providend, a fee-only wealth advisory firm in Singapore.

Christopher has broken down this huge question in our heads into something REALLY digestible for us noobs to understand.

The information that was shared during his session was perfect for beginners who are looking to plan for insurance needs.

So if you’re wondering what type of insurance you REALLY need…

We’ve jotted down the key points which would provide a good basic framework for you to get started!

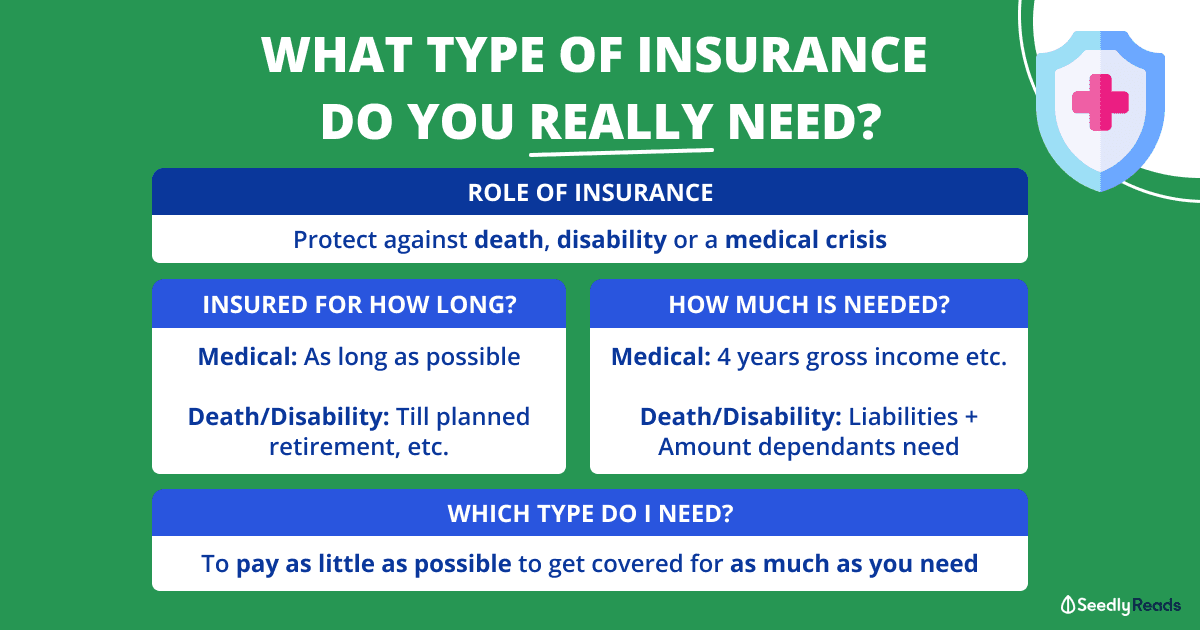

TL;DR: What Types of Insurance Do Young Adults Really Need?

| What's Covered | Details |

|---|---|

| Role of Insurance | Main purpose is protection, not accumulation Protect against premature death, disability or a medical crisis |

| How to Insure Yourself | Think about: - How long do you need insurance for - How much do you need - What type of insurance should you purchase |

| How Long Do I Need Insurance For? | Death/Disability: Till your planned retirement age, or when you do not have any more dependents Medical Crises: Medical expenses to be covered for as long as possible |

| How Much Insurance Do I Actually Need? | For income replacement due to death or disability: Amount required until your dependents become independent + any outstanding liabilities (e.g. loans) |

| Income replacement for medical crisis: Loss of Income: About 4 years of gross income Medical Expenses: H&S based on your own healthcare expectations Alternative Care: ~$100,000 (varies according to individual) |

|

| What Type of Insurance Should I Purchase? | Aim is to pay as little as you can to be covered for as much as you need |

Disclaimer: The Information provided by Seedly does not constitute an offer or solicitation to buy or sell any insurance product(s). It does not take into account the specific objectives or particular needs of any person. We strongly advise you to seek advice from a licensed insurance professional before purchasing any insurance products and/or services.

What Is the Role of Insurance?

Firstly, it is crucial to define the role of insurance in your financial plan.

It is important to know that the main purpose of insurance is for protection and not accumulation.

In fact, according to Oxford Languages, the definition of insurance is:

Something that provides protection against a possible eventuality.

What Do We Need Protection From?

Now that we know that insurance is for protection, what are we protecting then?

The answer is Income.

Our income is the most important financial asset, and we would have to draw from our current assets if our income were to stop.

And there are three factors that would cause your income to stop: premature death, disability or a medical crisis.

In such situations, insurance steps in by providing income replacement to pay for ongoing expenses.

By protecting our income, life can continue for us and our families.

While insurance CAN be used for saving for retirement or any other savings goals, the main role of insurance is protection.

How To Insure Yourself in the Best Possible Way

According to Christopher, there are three main questions to ask yourself to determine your insurance needs:

- How long do you need insurance for

- How much do you need

- What type of insurance should you purchase

We will be focusing on three (unfortunate) outcomes: death, disability and medical crisis.

How Long Do I Need Insurance For?

| For | How Long |

|---|---|

| Replacement of income loss due to death or disability | - Until your planned retirement or - When you have no more dependents |

| Medical crises | For loss of income: Until planned retirement or when you have no more dependents For medical expenses such as hospitalisation & alternative care: As long as possible |

For the replacement of income due to death or disability, it is advised for insurance to cover up till your planned retirement age, or when you do not have any more dependents.

This is because income is no longer a concern at such life stages, and there would be no need for income replacement.

In such cases, we only need insurance for a temporary period.

For medical crises, there are two areas of consideration: Loss of income and medical expenses.

For loss of income, the same logic applies as with income replacement due to death or disability.

For medical expenses such as hospitalisation costs and alternative care, it is advised for us to be covered for as long as possible.

This is because medical expenses can be costly, especially if one were to be hospitalised for a prolonged period of time.

And we would always want to be covered for such costs.

How Much Insurance Do I Actually Need?

The amount of insurance coverage differs for every individual as it is highly dependent on your own lifestyle, including the liabilities and dependents that you have.

To calculate how much insurance coverage is needed, here are a few pointers to note.

| For | Amount |

|---|---|

| Income replacement due to death or disability | Amount required until your dependents become independent + any outstanding liabilities (e.g. loans) |

| Income replacement for medical crisis | Loss of Income: About 4 years of gross income |

| Medical Expenses: H&S based on your own healthcare expectations | |

| Alternative Care: ~$100,000 (varies according to individual) |

For income replacement due to death or disability:

(Calculate number of years before dependents become independent x how much is needed a year) + Liabilities (e.g. loans)

For income replacement due to medical crisis:

About four years of gross income, as it generally takes three to four years before one fully recuperates.

Do note that this is just a general estimate, and individuals can adjust this amount accordingly based on factors such as family history.

For medical expenses, the amount of coverage depends on your own healthcare expectations.

For instance, if you prefer to have the option to stay in a private ward, you should get insured with a policy that offers such coverage.

As for alternative care, coverage of about $100,000 is advised (varies according to individual), if you wish to be insured for areas that are not covered by your hospitalisation plan (e.g. for TCM).

What Type of Insurance Should I Purchase?

It is important to pay as little as you can to be covered for as much as you need.

And one way to do that is to purchase a term life plan for your life insurance needs.

While there are situations where one would need a whole life plan, the purpose of having insurance is to be protected, and not to accumulate wealth – which is one of the goals of a whole life plan as well.

Therefore, a term life plan would be the most cost-efficient method to be sufficiently covered.

Always find the way to pay as little as you can to be insured with as much as you need!

In addition, there is also one point that Christopher has brought up succinctly.

Addressing the popular phrase ‘Buy Term, Invest the Rest’ (BTIR), he mentioned:

You’re not buying term to invest the rest, you’re buying a term plan because it’s the most affordable way to be fully covered.

Insurance Is NOT the Main Cast Of Your Financial Life

Christopher ended his speech with this wonderful reminder:

Insurance should act as the supporting cast of your life, and NOT the main cast.

The main cast should be your accumulation plan, as most of us will live and have to decide on our life goals.

These life goals will determine how much is needed, and how much resources should be set aside to meet these goals.

And to mitigate life risks such as death, disability and medical crises which would cost this plan to fail, insurance acts as a supporting cast in this plan.

Which is why it is important to spend as little as possible on this supporting cast.

To leave some behind for us to live a life.

And to wrap things up, I’ll leave my favourite quote from the session:

“If you buy so much insurance, and you don’t leave enough to accumulate to your retirement, the only way for you to reach your goal is to die. All resources have gone to insurance, and that has been confused as the main plan.’

Insurance Policies: What Do I Need and What Should I Get?

We hope that this sharing has helped you have a clearer idea of how you can start looking into your insurance needs.

If you’re still hoping to read up a little more about insurance, you might be able to find your answers at Seedly!

Or if you need unbiased reviews on various types of insurances, be it health insurance, disability insurance, personal accident insurance or even cancer insurance…

We got it all covered as well! 😉

Advertisement