Best Insurance Savings Plans in Singapore (2024): Dash PET vs Dash PET 2 vs Singlife Account vs Dash EasyEarn vs GIGANTIQ

●

If so, an insurance savings plan should be on your radar!

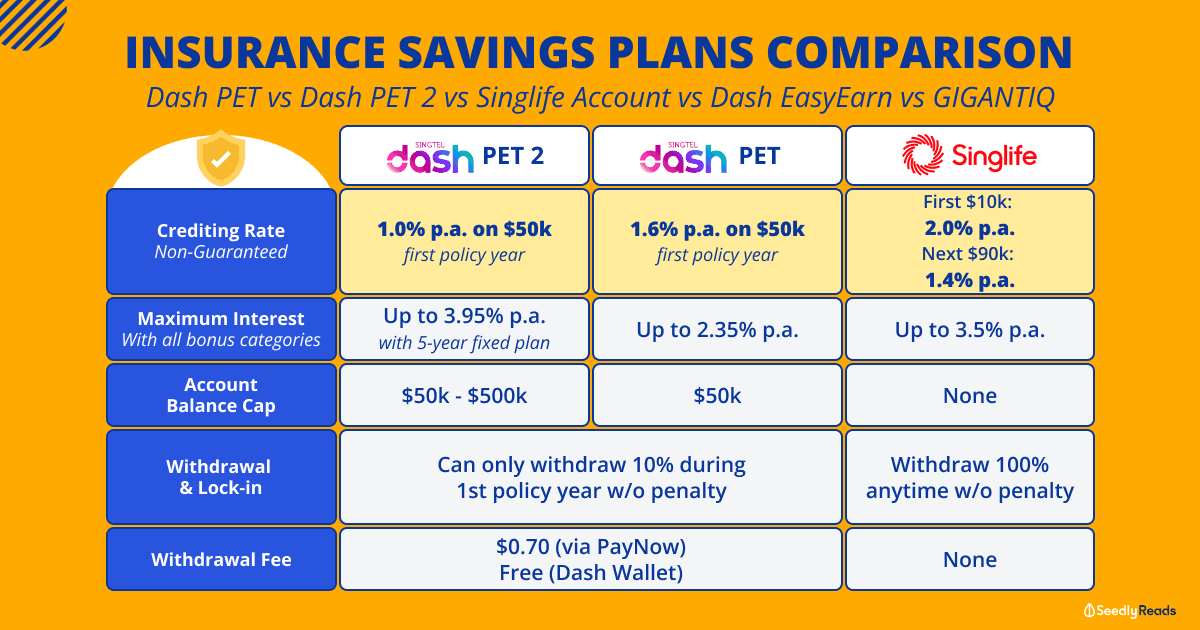

TL;DR: Best Insurance Savings Plan in Singapore — Which Insurance Is Best for Saving?

Trying to find out which insurance savings plan you should go with?

Here’s an overview comparing all insurance savings plans available on the market right now:

Comparison of Insurance Savings Plan | Dash PET 2 (by Etiqa Insurance) | Dash PET (by Etiqa Insurance) | Singlife Account | Dash EasyEarn (by Etiqa Insurance) | GIGANTIQ (by Etiqa Insurance) |

|---|---|---|---|---|---|

| Prevailing Crediting Rate (Non-Guaranteed) | 1.0% p.a. on first $50k (Basic plan) first policy year | 1.6% p.a. on first $50k first policy year | 2.0% p.a. on first $10k 1.4% p.a. on next $90k | 1.8% p.a. on $20k | 1.0% p.a. on $200k for first policy year |

| Add-On Plan Riders (if any) | 1-year fixed plan: Up to 2.80% p.a. 3-year fixed plan: Up to 3.00% p.a. 5-year fixed plan: Up to 3.20% p.a. | - | - | - | - |

| Can New Customers Sign Up? | Yes | No | |||

| Bonus Interest Categories | Up to 0.75% (0.25% for each additional policy: Major Cancer, Death & Total and Permanent Disability, Accidental Death) | 0.5% p.a. on first $10k for $800 net top-up during each Top-up period 0.5% p.a. on first $10k for purchasing Singlife Sure Invest digital ILP Up to $810 if you top up and maintain the following amounts for 12 months to earn a cash bonus: For the following amounts - S$10,000, S$30,000 and S$50,000, you will stand to receive a cash bonus of S$50, S$430 and S$810 respectively. | - | For every optional supplementary riders added, additional prevailing bonus crediting rates of up to 0.25% p.a. will be applicable for the first S$10,000 in the Account value |

|

| Minimum Initial Deposit | $50 (Basic plan) $1,000 per fixed plan | $50 | $100 | $2k | $50 |

| Account Balance Cap | Basic plan: $50k Fixed plans: $200k | $50k | None | $20k | $200k |

| Minimum Account Value to Earn Returns | $50 Note: policy will be de-activated if the average daily account value for the calendar month falls below $1 | $100 Note: policy will be de-activated if the average daily account value for the calendar month falls below $100 | $2k Note: policy will be de-activated if the average daily account value for the calendar month falls below $1 | $50 Note: policy will be de-activated if the average daily account value for the calendar month falls below $50 |

|

| Lock-in & Withdrawal Penalty | Instant top-ups and flexible partial withdrawals of up to 10% of your Single Premium and Top-ups in the first policy year Surrender charges within the first year apply | Instant top-ups and flexible partial withdrawals of up to 10% of your Single Premium and Top-ups in the first policy year Surrender charges within the first year apply | Withdraw 100% of your capital anytime without penalty | ||

| Withdrawal Fee | $0.70 service fee via PayNow Free via Dash Wallet (Can withdraw to bank account from Dash Wallet but limited to $3,000 a month) | None | $0.70 service fee via PayNow Free via Dash Wallet Free via Dash Wallet (Can withdraw to bank account from Dash Wallet but limited to $3,000 a month) | $0.50 service fee via Direct Credit (POSB or DBS) withdrawal $0.70 service fee via PayNow withdrawal |

|

| Withdrawal Requirements | Minimum of $1 in multiples of $1 (up to 10% of your Single Premium and Top-ups) If you wish to make a full withdrawal, you will need to request to surrender your policy. Please note that once your policy is surrendered, the add-on protection tagged to your policy will also be terminated, and you may not make another purchase of this policy within a 3-month period | None | Minimum of $100 in multiples of $100 | No restrictions | |

| Minimum Top Up Requirements | $1 (Dash Wallet/PayNow) $50 (eNETS) | No restrictions | Minimum of $500 in multiples of $500* | Minimum $1 (Up to account balance cap) |

|

| Life Insurance Coverage (For Death) | 105% of the account value | ||||

| Capital Guaranteed? | Capital guaranteed by SDIC under PPF* | ||||

Click to Teleport:

- What are Insurance Savings plans?

- Are Insurance Savings Plans Safe?

- Dash PET

- Dash PET 2

- Singlife

- Dash EasyEarn

- GIGANTIQ

- Are Insurance Saving Plans Good? Which One Should I Pick?

Disclaimer: The Information provided by Seedly does not constitute an offer or solicitation to buy or sell any insurance product(s). It does not take into account the specific objectives or particular needs of any person. We strongly advise you to seek advice from a licensed insurance professional before purchasing any insurance products and/or services.

What Are Insurance Savings Plans?

One of the more new-ish types of investments that you can consider is an insurance savings plan.

It’s basically a financial product that is a combination of a regular savings plan, insurance protection, and a traditional bank account.

More specifically, I’m referring to Dash PET, Dash PET 2, Dash EasyEarn, GIGANTIQ, and the Singlife Account.

All of these are universal life plans that offer an attractive rate of return (crediting rate) on the money you put into the account.

Note that although your capital is guaranteed, the crediting rate is non-guaranteed. Also, the returns are calculated daily and credited to your account on a monthly basis.

And they also provide a bit of insurance coverage too.

If these benefits and features appeal to you, read on for our comparison and find out which is a good fit for your financial goals.

Are Insurance Savings Plans Safe?

Insurance savings plans are protected under the Policy Owners’ Protection (PPF) Scheme, which is administered by the Singapore Deposit Insurance Corporation (SDIC).

This coverage is automatic so you do not need to apply for anything.

According to SDIC, the amount insured (aka amount deposited) has a guaranteed surrender value at the point of failure that is capped at $100,000.

There is also a cap of $500,000 for the aggregated guaranteed sum assured.

Basically, your money’s safe as long as you’re dealing with amounts within what is covered.

If you’d like to find out more about the types of benefits covered under the scheme as well as the limits of coverage.

You can check out the Life Insurance Association (LIA) or SDIC website for more information.

If you’re still unsure about committing to an insurance savings plan, all policies come with a 14-day free look period where you can terminate the policy without any penalties.

Dash PET Review 2023

Dash PET is an insurance savings plan underwritten by Etiqa and offered in partnership with Singtel Dash.

The policy is a capital-guaranteed, single premium, non-participating universal life plan with a lock-in period and penalties for early withdrawal.

Dash PET Crediting Rate

New users who sign up for Dash PET will get to enjoy a crediting rate of 1.60% p.a. on up to $50,000 in their Dash Pet account for the first policy year.

Do note that there is a lock-in period of 12 months.

But, you can still withdraw up to 10% of your Single Premium and Top-ups in the first policy year without penalty. If you would like to withdraw all the money from your Dash PET account within the first year, you will have to pay surrender charges.

In terms of surrender charges, Etiqa’s Dash PET product summary (issued on 12 August 2022) has stated that:

Should You choose to surrender Your policy in full during the first policy year, Your surrender Benefit shall be subject to a surrender charge of 10% of your total Account value less the partial withdrawal limit.

So let’s say you deposited $1,000 in Dash PET and want to surrender the policy in full during the first policy year. You would only get $910 back.

One more thing, once you request for a freelook or surrender on your policy, you will not be able to sign up for Dash PET within a three months’ period.

Past Subscribers of Dash PET

However, if you signed up before 4 August 2022, you can still withdraw your money from Dash PET freely and enjoy these returns:

- 26 April 2021 and before for 1st policy year:

- First $10,000: 1.7% p.a.

- Above $10,000: 1.2% p.a.

- 26 April 2021 – 3 Aug 2022 for 1st policy year:

- First $10,000 – 1.3% p.a.

- Above $10,000 – 0.3% p.a

Dash PET Add-Ons

If you would like to boost the returns on Dash Pet, you can opt to add on any of these three add-on protection plans (riders) for additional returns of up to 0.25% for every activated plan.

Users can get up to $100,000 coverage from just $0.02 a day with these plans:

- Major Cancer

- Accidental Death

- Death & Total and Permanent Disability.

How To Apply for Dash PET?

You’ll need to first create a Dash account and then sign up for the insurance savings plan via the Dash app.

This plan is only open to eligible Singtel Dash users aged 17 to 75 years old, who have a valid Singaporean NRIC or Singapore residency/work pass.

And no matter how much money you’ve got, only one Dash PET policy per individual is allowed at any point in time, regardless of whether your policy is active or inactive.

Once you have your account, you’ll need to make a minimum initial deposit of $50 and maintain an average daily account value of $50 to be entitled to interest crediting. Even though this is considered the first single premium that you will pay for the plan; you can continue making top-ups to the account anytime.

Again, you might be rolling in cash, but there is a maximum cap of $50,000 for your Dash PET account.

How Easy Is It To Make Top-ups and Withdrawals From Dash Pet?

When it comes to top-ups and withdrawals, there are quite a few restrictions.

Top-ups

The minimum top-up amount is as follows:

- At least $1 if you are using Dash Wallet/PayNow

- At least $50 for top-ups using eNETS

- The top-up amount must also be in multiples of $1

- The maximum aggregate amount for all Top-up(s) per policy is S$50,000 less the single premium

paid to Us, plus all partial withdrawal(s) and transaction fee(s).

In addition, you cannot make any more top-ups if you are 76 and older.

Withdrawals

You may request partial withdrawal(s) anytime after the Policy issue date, subject to the following:

- The total withdrawal amount (excluding insurance cover charge of the optional supplementary

riders) for the first policy year cannot exceed 10% of your single premium plus Top-up; and - The withdrawal amount must be at least $1 (or its multiples) per withdrawal; and

- The balance of Account value upon deduction of withdrawal amount and withdrawal charges (if any) must be at least $1.

More importantly, you’ll be charged $0.70 for each partial withdrawal you make to your bank account via PayNow.

Note: this applies to surrender or free look requests into PayNow as well.

But, withdrawals to your Dash Wallet are free. Thus, you should withdraw your money to your Dash Wallet, and then withdraw it from your Dash Wallet to your bank account.

However, there is a $3,000 monthly withdrawal limit from your Dash Wallet to your bank account,

How Much Life Insurance Coverage Do I Get with Dash PET?

Although the Dash EasyEarn is a universal life plan, the coverage is not as comprehensive as compared to traditional universal life plans.

Upon your (unfortunate) demise, Etiqa will pay out 105% of your account value (after subtracting whatever amount you owe them).

Etiqa will also pay out 105% of your account value when the policy matures immediately before you turn 100 years old.

What Else Do I Need to Take Note About Dash PET?

Unlike most bank savings accounts, there is no fall-below fee for the Dash PET.

Another thing to note is that on the Dash PET product summary page there is a line that states:

We reserve the right to delay the payment of the withdrawal amount for up to a period of 6 months from the date of the withdrawal request. We will trigger this right when there is a surge in withdrawals (partial or full) within the Portfolio during a very short period of time.

Dash PET 2 Review 2023

Dash PET 2 differs from Dash PET with a lower crediting rate, but a higher maximum crediting rate if you opt for one of three fixed rider plans.

Dash PET 2 Crediting Rate

The base Dash PET 2 plan has a crediting rate of just 1% p.a. on the first $50,000.

You might be wondering, why choose Dash PET 2 when Dash PET gives a higher rate?

The difference is that Dash PET 2 allows you to choose from three add-on fixed rider plans for up to 3.20% p.a.:

- 1-year fixed plan: Up to 2.80% p.a.

- 3-year fixed plan: Up to 3.00% p.a.

- 5-year fixed plan: Up to 3.20% p.a.

Each of these fixed plans has an account balance cap of $200,000 and the maximum aggregate amount for the Account Value for all Dash PET Policies (excluding Dash PET

Plus) and fixed plan riders issued by Etiqa will be $500,000 per Life Insured.

Moreover, the minimum initial deposits for these fixed plans are $1,000.

Dash PET 2 also enjoys the same add-ons as Dash PET for bonus interest up to 0.75% p.a.

Dash PET 2 vs Dash PET

Aside from the differences mentioned above, all other details for Dash PET 2 such as withdrawal fees and insurance coverage are the same as Dash PET.

Singlife Account Review 2023

Update 2024: The Singlife Account now lets you earn a base 3% p.a. interest and up to 4% p.a. interest!

The Singlife Account is a capital-guaranteed insurance savings plan that gives up to 3.5% p.a. returns, but only if you jump through certain hoops.

Singlife Account Crediting Rate

- 2.0% p.a. on first $10,000

- 1.4% p.a. for the next $90,000.

- 0% p.a. for amounts above $100,000.

But, if you are looking to boost your Singlife account returns to up to 3.5% p.a., you can spend some money on your Singlife card or invest in some Singlife products:

- 0.5% p.a. on first $10k for $800 net top-up during each Top-up period

- 0.5% p.a. on first $10k for purchasing Singlife Sure Invest digital ILP

- Up to $810 if you top up and maintain the following amounts for 12 months to earn a cash bonus:

For the following amounts – $10,000, $30,000, and $50,000, you will stand to receive a cash bonus of $50, $430, and $810 respectively.

How To Apply for Singlife Account?

Similar to Dash PET, Dash EasyEarn, and GIGANTIQ, you’ll need to download Singlife’s app.

You can sign up for an account using MyInfo by logging in with SingPass and confirming your personal details.

Once your Singlife ID is created and your Singlife account is approved, you can get started by transferring a minimum of $100 via FAST transfer.

You’ll need to maintain an average daily account value of $100 to enjoy the return rates.

Note: the Singlife Account is available for Singapore residents who are Singapore citizens, Singapore Permanent Residents or foreigners holding valid passes, and who are between 18 and 75 years old.

How Easy Is It To Make Withdrawals from Singlife Account?

Top-ups and withdrawals can be done over FAST.

There are also no restrictions or service fees incurred, and that makes it more fuss-free as compared to the first three ISPs.

How Much Life Insurance Coverage Do I Get with Singlife Account?

Although the Singlife Account is also a universal life plan, the coverage is slightly more comprehensive than the other policies due to the additional terminal illness coverage it provides.

This policy provides life insurance coverage for death or terminal illness, for up to 105% of your account value at age 60.

Here’s a more detailed explanation of the life insurance coverage in the event of death or terminal illness:

| In Event of Death or Terminal Illness | Death Benefit |

|---|---|

| Before the policy anniversary on which account holder’s age last birthday is 61 | The sum of: - account value AND - 5% of account value or $50,000, (whichever is lower) |

| On or after the policy anniversary on which account holder’s age last birthday is 61 | The sum of: - account value AND - 1% of account value or $50,000 (whichever is lower) |

This means that the additional 5% coverage on top of the 100% is only for policyholders under the age of 61.

Once you’re past 61 years old, that additional coverage is reduced to 101% of the account value.

In addition, Singlife has stated that ‘customers will be eligible for the Death and Terminal Illness Benefit even if the claim event is due to pre-existing conditions’ and that ‘exclusions for the Death Benefit will only apply to suicide within the first policy year, while exclusions for the Terminal Illness Benefit will include infection by the Human Immunodeficiency Virus (HIV). In such cases, Singlife will refund your Account Value.’

What Happened To The Singlife Debit Card?

If you are wondering about the Singlife Visa Debit card, the card has been discontinued since 6 July 2023.

Dash EasyEarn Review 2023

Dash EasyEarn is an insurance savings plan underwritten by Etiqa and offered in partnership with Singtel.

The policy is a capital-guaranteed, single premium, non-participating universal life plan with no lock-in period or penalties for early withdrawal.

Dash EasyEarn Crediting Rate

You can earn 1.8% p.a. on the first $20,000.

How To Apply for Dash EasyEarn?

Unfortunately, Dash EasyEarn is currently fully subscribed.

To sign up for Dash EasyEarn, you’ll need to create a Dash account and then sign up for the insurance savings plan via the Dash app.

This plan is only open to Dash users aged 17 to 75 years old, who has a valid Singaporean NRIC or Singapore residency/workpass.

Once you’ve opened an account, you’ll need to make a minimum initial deposit of $2,000 and maintain an average daily account value of $2,000 to be entitled to interest crediting.

You can make top-ups anytime you want but the maximum cap is $20,000.

How Easy Is It To Make Withdrawals from Dash EasyEarn?

Similar to Dash PET, when it comes to top-ups and withdrawals, there are quite a few restrictions.

The minimum top-up is $500, and can only be done in multiples of $500.

The minimum withdrawal is $100, and can only be done in multiples of $100.

In addition, you’ll be charged $0.70 for each withdrawal you make to your bank account via PayNow.

The alternative?

Yep, you guessed it withdrawals to the Dash Wallet are free.

Thus, you should withdraw your money to your Dash Wallet, and then withdraw it from your Dash Wallet to your bank account.

How Much Life Insurance Coverage Do I Get with Dash EasyEarn?

Although the Dash EasyEarn is a universal life plan, the coverage is not as comprehensive as compared to traditional universal life plans.

Upon your (unfortunate) demise, Etiqa will pay out 105% of your account value (after subtracting whatever amount you owe them).

Etiqa will also pay out 105% of your account value when the policy matures immediately before you turn 100 years old.

What Else Do I Need to Take Note About Dash EasyEarn?

Unlike most bank savings accounts, there is no fall-below fee for the Dash EasyEarn.

You also can top up and withdraw funds anytime, with no lock-in period or penalty.

Again, similar to Dash PET, the Dash EasyEarn product summary page has this one-liner as well:

Please note that Etiqa Insurance reserves the right to delay the payment of the partial withdrawal amount for up to a period of 6 months from the date of your withdrawal application.

GIGANTIQ Review 2023

Next up, we have GIGANTIQ by Etiqa Insurance.

Etiqa is positioning this product as an “all-in-one insurance tool with savings and protection plans to fulfill your life goals”.

In other words, it is yet another capital-guaranteed, single-premium, non-participating universal life plan with no lock-in period or penalties for early withdrawal.

GIGANTIQ Rate of Return

1.0% p.a. on $200k for first policy year.

Besides this, you can also earn up to an additional 0.25% p.a. on the first $10,000 for selected life or general insurance products offered as a supplementary rider under GIGANTIQ.

How To Apply for GIGANTIQ?

GIGANTIQ is currently fully subscribed.

But if applications are open, you’ll need to download the Tiq by Etiqa app in order to register for an account.

You’ll have to meet the following criteria to be eligible:

- You are a Singapore citizen or permanent resident with a valid NRIC; or

- You are a foreigner holding a valid Work Pass/Permit or Long-Term Visit Pass.

- You are between age 17 to 75 (age next birthday).

- You are only allowed to purchase one GIGANTIQ plan at a time.

And provide a photo ID to complete the sign-up.

Once you get that sorted out, you can start growing your savings with as little as $50.

Note: payment can ONLY be done via DBS or POSB bank accounts or via your Etiqa eWallet.

Like the rest of the ISPs so far, you can continue making any amount of top-ups to your GIGANTIQ account anytime.

But there is a maximum cap of $200,000.

How Easy Is It To Make Withdrawals from GIGANTIQ?

With this policy, there is no lock-in period, which means that you can top-up and withdraw money from your GIGANTIQ account anytime.

However, a transaction fee will be charged for each partial withdrawal, surrender, or free look request:

- PayNow: $0.70 per transaction.

- Direct Credit (DBS or POSB) $0.50 per transaction.

However do note that if after withdrawal, the average daily account value for the calendar month cannot fall below $50.

If the average daily account value for the calendar month falls below $50 and the required top-up to keep the policy in force is not paid by the expiry date of the grace period, your policy will be de-activated immediately and Eqtiq will return the account value, less any amounts owed to them.

How Much Life Insurance Coverage Do I Get with GIGANTIQ?

Similar to Dash PET and EasyEarn, GIGANTIQ’s coverage is not as comprehensive as compared to traditional universal life plans.

Upon your (unfortunate) demise, Etiqa will pay out 105% of your account value (after subtracting whatever amount you owe them).

Etiqa will also pay out 105% of your account value when the policy matures immediately before you turn 100 years old.

What Else Do I Need to Take Note About GIGANTIQ?

There’s no fall-below fee levied but your policy will be deactivated if your average daily account value for the calendar month falls below $50.

Oh, FYI: your policy will be automatically renewed for another year unless you write to Etiqa to request a policy termination.

I know I’m repeating myself again, but since GIGANTIQ is ALSO underwritten by Etiqa, here’s the same one-liner in their policy provisions:

Please note that Etiqa Insurance reserves the right to delay the payment of the partial withdrawal amount for up to a period of 6 months from the date of your withdrawal application.

Are Insurance Saving Plans Good? Which One Should I Pick?

In this high-interest-rate environment, these options are half decent if you want to:

- Store your emergency fund

- Park your spare cash, OR

- Earn some interest while waiting to fund an upcoming expense

But, assuming you’re a brand new customer, your only choices are:

- Dash PET

- Dash PET 2

- Singlife Account.

Choosing one over the other really depends on how liquid you want your funds to be (or how easy it is to withdraw without penalties). The Singlife Account offers the most liquidity with a decent base crediting rate of 2.0% p.a. for the first $10,000. So if you have an amount below $10,000 and need it to be fairly liquid, the Singlife Account is a good choice.

On the other hand, for those who have larger sums and can afford to keep their money locked in for longer than a year, Dash PET and Dash PET 2 with fixed plans are a better choice.

Read More:

- NTUC Income Gro Capital Ease: 3-Year Insurance Savings Plan With 3.55% p.a. Guaranteed Returns at Maturity

- Great Eastern Endowment Plan GREAT SP Series 11: 3.5% p.a. Guaranteed Returns at Maturity After 1 Year

- Tiq 3-Year Endowment Plan: Up to 3.50% p.a. Guaranteed Returns if Held to Maturity (2023)

- Best Savings Accounts Singapore: Which Bank Has The Best Interest Rate for Savings Account?

Advertisement