Integrated Shield Plan Rider Comparison: How Can I Cover Myself More?

Integrated Shield Plan (ISP) covers a big part of your hospital expenses (bills), however, you have to pay the deductibles and co-insurance of your hospital bill first.

Integrated Shield Plan Rider:

- Plans provided by Insurance Companies

- Covers deductibles and co-insurance

- Comes with added benefit (sometimes)

The Breakdown of your Hospital Bill

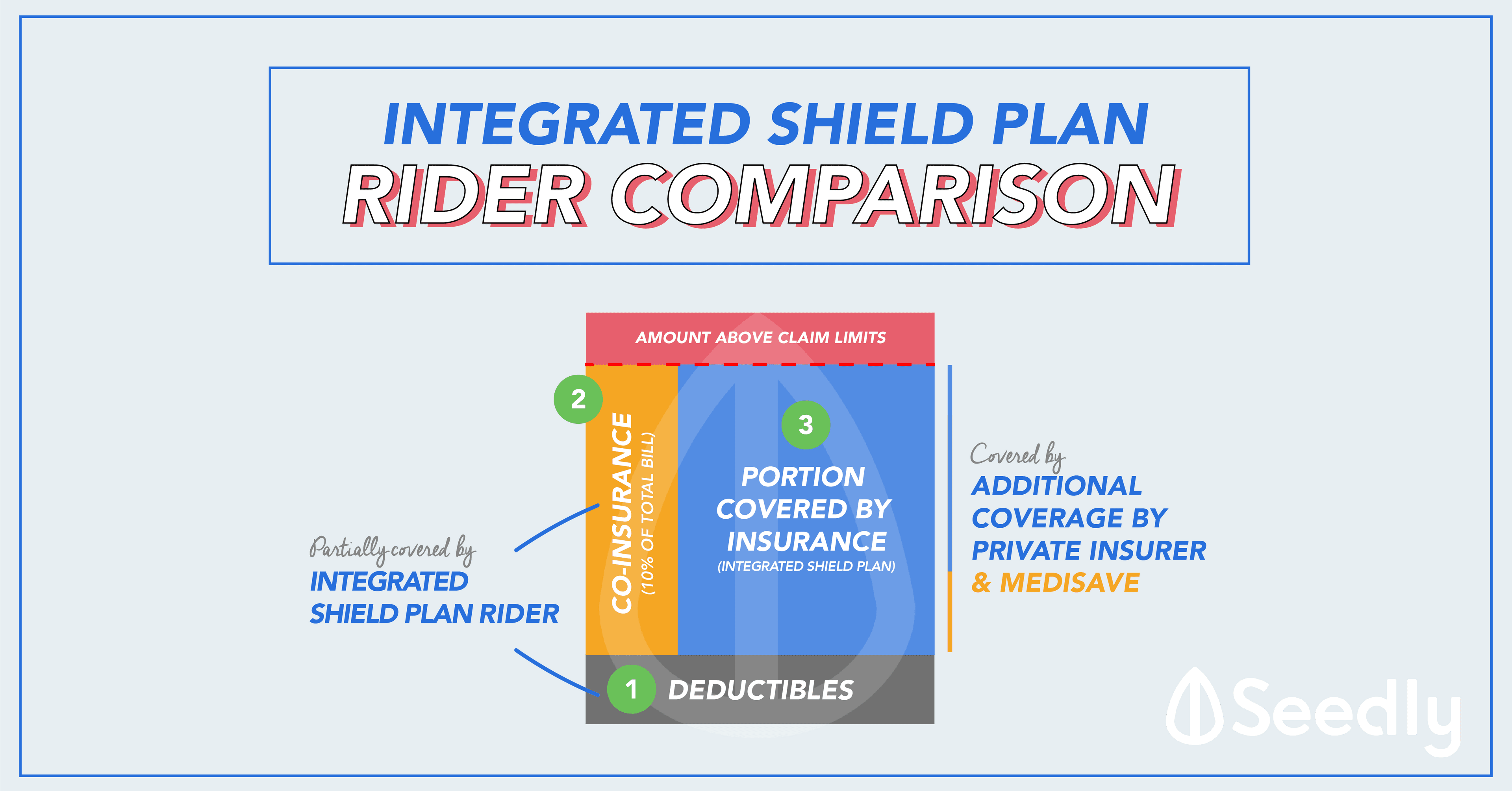

Your hospital bill can be broken up into three parts, sometimes four:

- Deductibles

You are required to pay the first $3,500* of your hospital bill - Co-insurance

You are then required to pay the next 10% of your hospital bill - The rest of the bill

If you have an ISP, this portion will be covered by both Medisave and your private insurer.

It usually ends here, but there will be one more part, if you exceed the insurer’s limit.

- The amount above Claim Limits

For you to reach the claim limit, your hospital bill would have amounted to at least $1 million in that year.

You can read about the respective claim limits each insurance company has, we have done a comprehensive comparison of the benefits that each ISP offers.

Read more: Singaporean’s Ultimate Integrated Shield Plan Comparison, Am I on The Best Plan?

* According to the ISP for Private Hospital.

In that article, we have looked at ISPs and compared them across 6 insurers, have you noticed that you are exposed to the deductibles and co-insurance?

If you are only covered by the main ISP, here are what you are exposed to:

(meaning the amount you have to fork out from your pocket)

- Deductibles (Exposed!)

- Co-insurance (Exposed!)

- The rest of the bill (Covered)

How can we protect ourselves from the “ceilingless” hospital bills?! Answer: Rider.

Integrated Shield Plan Rider

- ISP Rider is an add-on to your Integrated Shield Plan

- Covers your co-insurance and deductibles – well it used to be an ‘as charged’ benefit.

- Most of the time, on a reimbursement basis (you pay first).

After the recent announcement made by the Ministry of Health in March 2018, any new policy for riders will include a new co-payment feature starting from April 2021.

New Co-payment Feature

- At least 5% of your hospital bill from your own pockets

- Capped at $3,000 with conditions set by your insurer

Existing policyholders with ISP rider will still be covered ‘as charged’ for their hospital bill until further notice.

Read More: ZHUN BO? Insurers Want Patients To Pay Part Of Hospital Bills

ISP Riders Offered by Respective Insurers

| INSURERS/ BENEFITS | Covers Deductibles | Covers Co-insurance | Covers Deductibles, Co-insurance, and more |

|---|---|---|---|

| Income | Assist Rider (+ Additional Benefits) | - | Plus Rider |

| AIA Singapore | Max Essential A Saver Covers Deductible* (+ Additional Benefits) | Max Essential A | |

| Great Eastern | Total Health Platinum Select Covers Deductible* (+ Additional Benefits) | Total Health Platinum | |

| Prudential | PRUextra Premier Lite Covers 50% of Deductibles (+ Additional Benefits) PRUextra Premier Saver Deductible: You pay the first $1,000 per policy year Co-insurance: Covered 5% (Private), 10% (Public) | PRUextra Premier | |

| Aviva | - | MyHealthPlus Plan 1 | |

| AXA | Basic Care Covers Co-insurance and Deductibles only | General Care Rider Plan A | |

*Conditions apply

For this article, we will be looking at these riders:

| INSURERS | INTEGRATED SHIELD PLAN RIDERS |

|---|---|

| Income | Plus Rider |

| AIA | Max Essential A |

| Great Eastern | Total Health Platinum |

| Prudential | PRUextra Premier |

| Aviva | MyHealthPlus Plan 1 |

| AXA | General Care Rider Plan A |

Benefits of ISP Riders

A quick breakdown of some of the benefits offered:

- AXA offers personal accident benefits

- Great Eastern offers income benefits

- Prudential offers disability benefits

- Aviva offers dental benefits

- TCM benefits after offered by Great Eastern, Prudential, and AXA.

- Prudential offers the highest premium

- Aviva has the cheapest premium

These are the benefits entails in each of the ISP Rider:

| Benefits | Income | AIA | GE | Pru | Aviva | AXA |

|---|---|---|---|---|---|---|

| Covers Co-insurance and Deductibles | Y | Y | Y | Y | Y | Y |

| Accommodation (additional bed in hospital for family member) | Y | Y | Y | Y | Y | Y |

| Emergency Accident Outpatient Treatment | - | Y | Y | Y | - | Y |

| Post-Hospitalisation Home Nursing | - | Y | Y | - | - | - |

| Post-Hospitalisation Alternative Medicine (for Cancer and Stroke) | - | Y | - | - | - | - |

| Ambulance | - | - | Y | Y | - | Y |

| Traditional Chinese Medicine (TCM) | - | - | Y | Y | - | Y |

| Get Well Benefit (Income to you) | - | - | Y | - | - | - |

| Confinement in a Hospice | - | - | Y | - | - | - |

| Purchase Medical/Mobility Aids | - | - | Y | Y | - | - |

| Disability Waiver Benefit | - | - | - | Y | - | - |

| Extension of Post-hospitalisation treatment & stay in Community Hospital | - | - | - | - | Y | - |

| Accidental inpatient dental treatment | - | - | - | - | Y | - |

| Additional Critical Illness Benefit | - | - | - | - | Y | - |

| Covers Fractures, Dislocations and Sports Injuries (Outpatient) | - | - | - | - | - | Y |

| Coverage for Dengue, Hand Foot Mouth, Food Poisoning (Outpatient) | - | - | - | - | - | Y |

| Planned Overseas Medical Treatment | - | - | - | - | - | Y |

| Premium (Annually) | ||||||

| Ages 21-30 | 428 | 396 | 502 | 573-610 | 124 | 415 |

| Ages 31-40 | 559-567 | 441 | 604 | 619-698 | 129 | 458 |

Welllllllll, that’s a lot of different benefits…

Ultimately, they seem to even out – for the parts the insurer lacks, they tend to offer something else in return.

When the riders are bundled up with the main ISP, the riders sometimes top up the existing coverage the ISP has.

- For example, Aviva extends their post-hospitalisation benefit coverage which makes them as competitive.

But let’s not get overwhelmed by the immense benefits they are offering, the main functionalities of an ISP rider that we should be looking at are:

- To cover the deductibles and co-insurance

Everything else should be a bonus, having more benefits increases the premiums as well, let’s look at Great Eastern and Prudential, they do offer many different benefits in their rider but this leads to their premiums being the highest.

I Don’t Need These Extra Benefits

These are the riders that you should be looking at:

| INSURERS/ BENEFITS | Covers Deductibles | Covers Co-insurance | Premiums (S$) | |

|---|---|---|---|---|

| Income | Assist Rider (+ Additional Benefits) | - | Ages 21-30 | 262 |

| Ages 31-40 | 273-303 | |||

| AIA Singapore | Max Essential A Saver Covers Deductible* (+ Additional Benefits) | Ages 21-30 | 205 | |

| Ages 31-40 | 215 | |||

| Great Eastern | Total Health Platinum Select Covers Deductible* (+ Additional Benefits) | Ages 21-30 | 227 | |

| Ages 31-40 | 260 | |||

| Prudential | PRUextra Premier Saver Deductible: You pay the first $1,000 per policy year Co-insurance: Covered 5% (Private), 10% (Public) | Ages 21-30 | 395 | |

| Ages 31-40 | 447 | |||

| Aviva | - | |||

| AXA | Basic Care Covers Co-insurance and Deductibles only | Ages 21-30 | 322 | |

| Ages 31-40 | ||||

*Conditions apply.

There are conditions set by the insurer for you to fulfill before they cover you, some of these conditions are but not limited to:

- AIA: Using their insurer’s panel of providers

- Prudential: Paying the first S$ X first

- Great Eastern: Getting a pre-authorisation

The plan offers for AXA that offers coverage for deductibles and co-insurance only, although it is not the cheapest, it is very straightforward.

Premium Discounts

Different insurers offer different discount schemes that help reduce your premium, but I did not include in this post at all because I feel they should be an added bonus instead of a driving factor. If you are interested, you can look at their respective website or ask your Financial Advisor for more information!

It was very difficult to compare them to each other as some insurers offer more benefits compared to others. But I have tried my best to break it down for you.

Before you commit to any plan, do check with your trusted Financial Advisor as well. If you do not have a trusted Financial Advisor, speak to everyone possible till you find someone you can trust. We have an open community for you to get your questions answered and to hear from different perspectives as well.

I’ll see you in the next one, till then!

Advertisement