All You Need To Know About Phillip SING Income ETF in 5 mins. Should You Invest?

What is Phillip SING Income ETF (SGX: OVQ)

Phillip SING Income Exchanged Traded Fund (ETF) is Phillip Capital’s Third Exchanged Traded Fund.

The other Exchange Traded Funds by Phillip Capital are:

- Lion- Phillip S-REIT ETF

- Phillip SGX APAC Dividend Leaders REIT ETF

What is an Exchange Traded Fund (ETF)?

- An ETF is a passively managed investment fund which is traded on the stock market

- Passively managed because it just tracks the index (for example, buys the top 30 companies based on a certain allocation) hence lower fees

- Traded on stock market indicates that it has high liquidity of buyers and sellers, which is a good thing for investors

What does Phillip SING Income even mean?

Here is some information on Phillip SING Income:

- Tracks the Morningstar Singapore Yield Focus Index

- Here’s how the Morningstar Singapore Yield Focus Index is constructed:

First:

Selection UniverseSecond:

Factor Scores CalculationForming the Morningstar Singapore Yield Focus Index Securities whose primary listing is on the Singapore Exchange (SGX) is the initial criteria Stocks are assigned scores based on:

- Quantitative Moat

- Distance to Default

- Trailing 12-month Dividend yield

- Compute composite factor score by combining normalized factor scoresTop 30 constituents selected based on composite factor score.

Liquidity-based adjustment to strategy weights to make it investable.

In short, top 30 Singapore stocks that scored well for factors such as Quantitative Moat, Distance to Default and Trailing 12-months dividend yield are included. - Stocks are assigned a composite score based on these indicators, and the top 30 are included in the Morningstar Singapore Yield Focus Index.

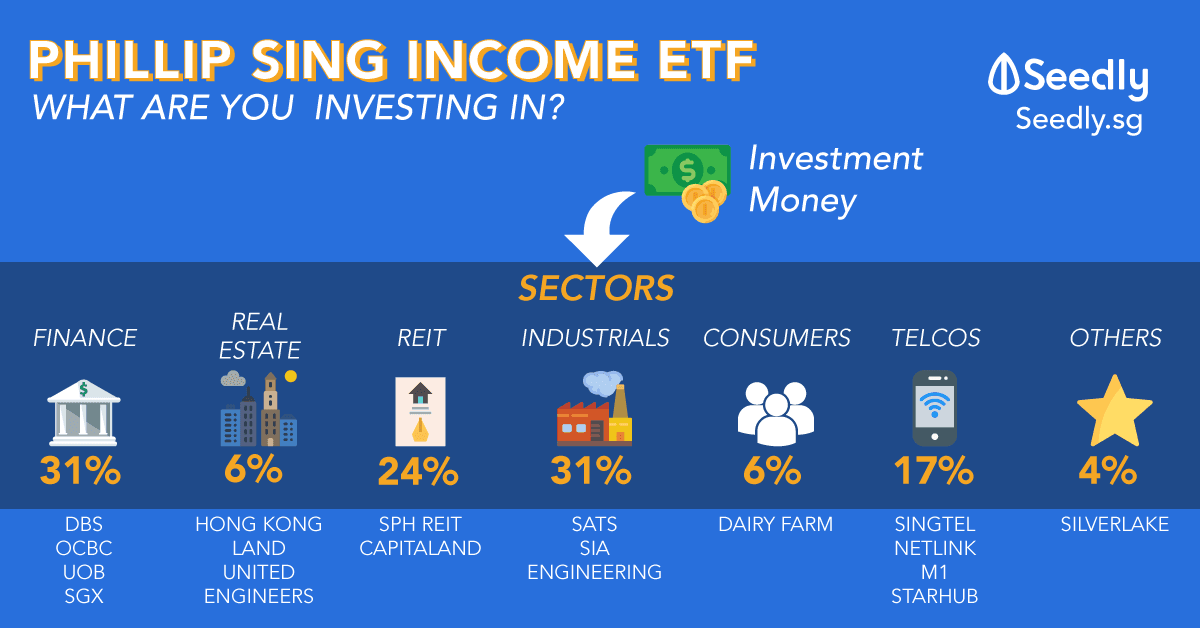

What does Phillip SING Income ETF invest in?

” What am I getting, when I invest into the Phillip SING Income ETF?”

Sector allocation of Phillip SING Income ETF

| Sector | Percentage |

|---|---|

| Real Estate | 6% |

| REIT | 24% |

| Financials | 31% |

| Telcos | 17% |

| Industrials | 13% |

| Consumer | 6% |

| Others | 4% |

What are we exactly investing into, when we invest into the Phillip SING Income ETF?

The Phillip SING Income ETF looks to follow the performance of Morningstar Singapore Yield Focus Index. Imagine it as you trying to copy someone’s portfolio as closely as possible.

The Phillip SING Income ETF will look to imitate these weightings:

| Stocks | Sector | Portfolio Weightage (%) |

|---|---|---|

| Singapore Telecommunications Ltd | Telecommunication Services | 10.2% |

| DBS Group Holdings | Financials | 8.5% |

| Overseas-Chinese Banking | Financials | 7.9% |

| United Overseas Bank | Financials | 7.5% |

| Singapore Exchange Ltd | Financials | 5.8% |

| Singapore Technologies Engineering Ltd | Industrials | 5.2% |

| SATS Ltd | Industrials | 5.1% |

| CapitaLand Commercial Trust | Real Estate | 5.4% |

| Hong Kong Land Holdings Ltd | Real Estate | 4.7% |

| CapitaLand Mall Trust REIT | Real Estate | 5.2% |

| Mapletree Commercial Trust | Real Estate | 4.7% |

| NetLink NBN Trust | Telecommunication Services | 4.1% |

| Dairy Farm Intl Holdings Ltd | Consumer Staples | 3.5% |

| Parkway Life REIT | Real Estate | 2.3% |

| SIA Engineering Co | Industrials | 2.2% |

| Sheng Siong Group Ltd | Consumer Staples | 2.1% |

| M1 Ltd | Telecommunication Services | 1.6% |

| Manulife US Real Estate Investment Trust | Real Estate | 1.6% |

| Keppel Infrastructure Trust | Utilities | 1.6% |

| OUE Hospitality Trust | Real Estate | 1.5% |

| United Engineers Ltd | Real Estate | 1.4% |

| Haw Par Corp Ltd | Health Care | 1.4% |

| Starhub | Telecommunication Services | 1.2% |

| First Real Estate Investment Trust | Real Estate | 1.0% |

| AIMS AMP Capital Industrial | Real Estate | 0.9% |

| Hong Leong Finance Ltd | Financials | 0.9% |

| SPH REIT | Real Estate | 0.9% |

| Raffles Medical Group | Health Care | 0.8% |

| Frasers Hospitality Trust | Real Estate | 0.5% |

| Silverlake Axis Ltd | Information Technology | 0.4% |

What is the difference? Straits Times Index STI ETF vs Phillip SING Income ETF

While most Singaporeans would have heard of the STI ETF, we will draw a comparison between both STI ETF and Phillip SING Income ETF.

First, we draw a comparison between the percentage in each sector:

In this comparison, we compare Nikko AM STI ETF. For Singaporeans investing into the STI ETF using OCBC, POSB or Maybank, Nikko AM STI ETF is the fund that you are investing in.

| Sector | Phillip SING Income ETF | Nikko AM Straits Times Index ETF |

|---|---|---|

| Real Estate | 6% | 14.5% |

| REIT | 24% | 0% |

| Financials | 31% | 42.9% |

| Telcos | 17% | 9.8% |

| Industrials | 13% | 21.5% |

| Consumer | 6% | 9.4% |

| Others | 4% | 1.9% |

Editor’s note: Do note that Phillip SING Income ETF will have a certain degree of tracking error moving forward and it will not be 100% as of mentioned above.

Reasons to consider Phillip SING Income ETF

Diversification across various industry

Phillip SING Income allows investors a diversified investment with lesser capital. Getting 1 lot of Phillip SING Income ETF allows one to invest across 30 stocks.

As it is made up of stocks from different industries, it allows a quick diversification without the hassle of having to build a portfolio on your own.

Familiar local companies

As seen in the list of companies, Phillip SING Income ETF invests in companies which Singaporeans are familiar with.

Companies such as Singtel, DBS, Sheng Siong, Raffles Medical etc are companies Singaporeans see every day.

Phillip SING Income ETF is more defensive than STI ETF

For Singaporeans who want to invest but feels that the STI ETF is still too risky for his liking, he may wish to consider Phillip SING Income ETF as a slightly more defensive alternative.

- Other than Singtel, the rest of the stocks do not hold more than 10% in the portfolio respectively.

- While some argued that the STI ETF is too heavily reliant on the financial industry (43%), Phillip SING Income ETF is doing a better job in diversification in terms of industry-specific risk.

Regional Presence

Another benefit of investing in these companies is that these companies might be doing business outside of Singapore.

By investing in this ETF, one might be investing in companies with a regional presence.

Low effort way to invest

For investors who do not have time to frequently monitor the market.

Investing in ETFs like Phillip SING Income ETF means that there will be an ETF manager that rebalances the ETF every semi-annually.

High liquidity

Given that Phillip SING Income ETF is traded on the Singapore Exchange, this means that one can lock in his profit or cut his loss in the stocks exchange.

How to invest in Phillip SING Income ETF?

Currently, there is only one way to investinto the Phillip SING Income ETF.

Lump sum investment

You can do this by using your brokerage account. Find the one with the lowest fees here.

- Step 1: Have a Bank account with either DBS/POSB, OCBC, UOB or FSM/POEMS and a CDP (central depository) securities account (Free to set up)

- Step 2: Apply for a brokerage account with any of the providers as above

- Step 3: Enter the amount that you are interested to buy for that counter and submit it

- Step 4: A few days later, your stock will be allocated to your CDP account which will be tracked on whichever platform you chose

To invest into the Phillip SING Income ETF, the code will be OVQ.

source: SGX

Contribute or check out what the community has to say about Phillip SING Income ETF!

Further Reading: How to read a fund factsheet?

For those who have now developed an interest in funds after this article, below is a snippet of how to read a fund factsheet.

Advertisement